A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

Associated Articles: A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024). Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024)

The worth of gold, a timeless image of wealth and stability, has skilled a rollercoaster experience over the previous decade. From 2014 to 2024 (projected), the yellow steel’s journey displays the advanced interaction of worldwide financial forces, geopolitical occasions, and investor sentiment. Analyzing a ten-year chart reveals not simply worth fluctuations, however a deeper narrative in regards to the evolving position of gold in a always shifting monetary panorama. This text will delve into an in depth evaluation of this era, exploring the important thing drivers behind gold’s worth actions and providing insights into potential future developments.

The Pre-2014 Panorama: Setting the Stage

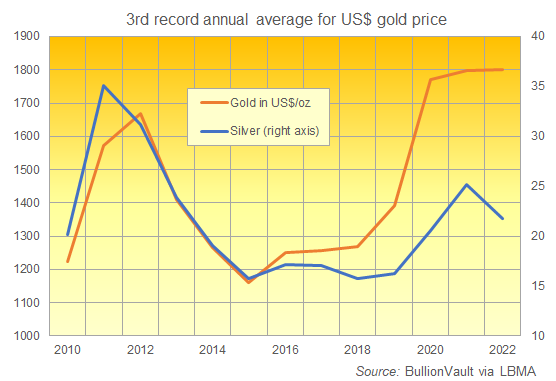

To totally respect the last decade’s trajectory, we should briefly look at the interval main as much as 2014. The gold worth had reached its all-time excessive of round $1,900 per ounce in 2011, fueled by the aftermath of the 2008 monetary disaster, quantitative easing measures by central banks, and escalating geopolitical uncertainties. Nevertheless, by early 2014, a decline had begun. This downward development was influenced by a number of components:

- Strengthening US Greenback: A strengthening US greenback, usually inversely correlated with gold costs (as gold is priced in USD), exerted downward strain. Because the US financial system confirmed indicators of restoration, traders moved in the direction of dollar-denominated property.

- Decreased Worry of Deflation/Recession: The preliminary fears of a protracted international recession and deflation that had propelled gold costs earlier started to subside. This lowered the safe-haven demand for gold.

- Elevated Curiosity Charges (Anticipation): The anticipation of rising rates of interest within the US, signaling a more healthy financial system, additional diminished the attraction of non-yielding property like gold. Greater rates of interest make holding bonds extra enticing, diverting funding away from gold.

2014-2018: A Interval of Consolidation and Decline

The interval from 2014 to 2018 witnessed a basic downward development in gold costs, albeit with durations of volatility. The worth fluctuated inside a spread, typically staying beneath the $1,300 per ounce mark for a lot of this time. A number of components contributed to this consolidation part:

- Continued US Financial Progress: The US financial system continued its restoration, albeit at a reasonable tempo, lowering the necessity for a safe-haven asset.

- World Financial Uncertainty (Muted): Whereas geopolitical dangers remained, they had been much less pronounced than within the previous years. The worldwide financial system skilled comparatively steady, albeit gradual, progress.

- Shifting Investor Sentiment: Buyers, emboldened by the bettering financial outlook, shifted their focus in the direction of riskier property with larger potential returns, equivalent to equities and rising market bonds.

2018-2020: The Resurgence of Secure-Haven Demand

The latter half of the last decade noticed a dramatic shift within the gold market. Beginning in 2018, gold costs started to climb, pushed by a number of key occasions:

- Renewed Commerce Wars: The escalating commerce battle between the US and China created vital international financial uncertainty, boosting safe-haven demand for gold.

- Geopolitical Tensions: Rising geopolitical tensions in varied areas, together with the Center East and Jap Europe, additional fueled investor nervousness and elevated demand for gold as a hedge in opposition to uncertainty.

- Adverse Curiosity Charges: The adoption of damaging rates of interest by a number of central banks in Europe and Japan made gold, a non-yielding asset, a comparatively extra enticing funding in comparison with bonds with damaging yields.

- Weakening US Greenback (Intervals): Whereas the greenback remained comparatively sturdy all through a lot of the last decade, durations of weak point supplied additional assist for gold costs.

2020-2024 (Projected): Navigating a Pandemic and Past

The COVID-19 pandemic in 2020 considerably impacted the gold market. Initially, there was a short sell-off as traders liquidated property to fulfill instant liquidity wants. Nevertheless, the next unprecedented financial and financial stimulus packages applied globally, coupled with continued financial uncertainty, led to a surge in gold costs. The worth soared to over $2,000 per ounce in 2020, pushed by:

- Large Financial Stimulus: Central banks worldwide unleashed huge quantitative easing packages, injecting trillions of {dollars} into the worldwide financial system. This inflationary strain boosted gold’s attraction as an inflation hedge.

- Elevated Uncertainty: The pandemic created immense uncertainty in regards to the international financial system’s future, main traders to hunt refuge in gold.

- Weakening Greenback: The greenback skilled durations of weak point in opposition to different main currencies, benefiting gold costs.

Waiting for 2024 and past, a number of components will probably affect gold costs:

- Inflationary Pressures: Persistent inflation, doubtlessly fueled by provide chain disruptions and elevated authorities spending, may proceed to assist gold costs.

- Curiosity Price Hikes: The tempo of rate of interest hikes by central banks can be essential. Aggressive price hikes may put downward strain on gold costs, whereas slower hikes might be much less impactful.

- Geopolitical Dangers: Ongoing geopolitical dangers, together with the battle in Ukraine and rising tensions between main powers, will proceed to affect investor sentiment and gold demand.

- Technological Developments: Developments within the mining and refining of gold may have an effect on provide and, consequently, costs.

Conclusion: A Complicated and Evolving Market

The ten-year gold worth chart from 2014 to 2024 (projected) reveals a dynamic and complicated market influenced by a mess of interconnected components. Whereas the value has fluctuated considerably, it has demonstrated its resilience as a safe-haven asset and an inflation hedge. Predicting future gold costs with certainty stays inconceivable, because the interaction of financial, geopolitical, and investor sentiment components is inherently unpredictable. Nevertheless, by fastidiously contemplating the varied drivers mentioned above, traders can develop a extra knowledgeable perspective on the potential trajectory of gold costs within the coming years. An intensive understanding of the macroeconomic atmosphere, central financial institution insurance policies, and geopolitical dangers can be essential for navigating this fascinating and ever-evolving market. The last decade’s journey showcases that gold, regardless of its conventional attraction, stays a extremely delicate barometer of worldwide financial well being and investor confidence, making it a vital asset to observe inside a diversified funding portfolio. Additional analysis into particular financial indicators, inflation charges, and geopolitical occasions will present a extra granular understanding of the particular worth actions inside the broader ten-year development.

Closure

Thus, we hope this text has supplied useful insights into A Decade of Glittering Uncertainty: Analyzing the Gold Worth Chart (2014-2024). We hope you discover this text informative and useful. See you in our subsequent article!