A Golden Historical past: Charting the Rise and Fall of Gold Costs

Associated Articles: A Golden Historical past: Charting the Rise and Fall of Gold Costs

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to A Golden Historical past: Charting the Rise and Fall of Gold Costs. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

A Golden Historical past: Charting the Rise and Fall of Gold Costs

Gold. A shimmering image of wealth, energy, and stability for millennia. Its worth, nonetheless, has been something however secure, reflecting a fancy interaction of financial, geopolitical, and psychological elements. Analyzing the historic gold worth chart reveals an interesting narrative, a rollercoaster experience of booms and busts that mirrors the worldwide financial panorama. This text delves into the historic trajectory of gold costs, exploring key intervals of great change and the underlying forces that formed them.

The Pre-Bretton Woods Period: A Comparatively Steady Basis (Pre-1971)

Earlier than 1971, the gold worth was largely fastened underneath the Bretton Woods system. Established after World Warfare II, this technique pegged the US greenback to gold at a charge of $35 per ounce. Different currencies have been then pegged to the greenback, creating a comparatively secure worldwide financial system. Whereas fluctuations existed inside this framework, they have been typically minor in comparison with the volatility witnessed within the post-Bretton Woods period. The gold worth, although fastened, wasn’t totally stagnant. Demand from central banks and industrial customers influenced the general provide and, consequently, exerted delicate strain on the system. Nonetheless, the overarching stability supplied a predictable surroundings for gold funding and commerce. Historic charts from this era present a comparatively flat line, punctuated solely by occasional minor changes reflecting the shifting world financial local weather and occasional devaluations of different currencies.

The Nixon Shock and the Daybreak of Free-Market Gold (1971-1980)

President Nixon’s determination in 1971 to unilaterally finish the convertibility of the US greenback to gold marked a watershed second. This "Nixon Shock" shattered the Bretton Woods system and unleashed gold onto the free market. The speedy aftermath noticed a dramatic surge within the gold worth, as traders sought a secure haven asset amidst rising financial uncertainty. Inflation soared in lots of international locations, additional fueling gold’s attraction as a hedge towards foreign money devaluation. The Seventies witnessed a interval of great worth volatility, with gold reaching document highs, solely to expertise corrections. This era’s chart shows a steep upward development, interrupted by intervals of consolidation and short-term declines. Elements contributing to this volatility included the oil disaster of 1973, geopolitical tensions, and chronic inflation. The last decade culminated in a spectacular worth peak in 1980, reaching almost $850 per ounce – a degree not seen once more for over 20 years.

The Consolidation and Decline (1980-2000)

Following the 1980 peak, gold costs entered a interval of consolidation and decline. A number of elements contributed to this development. The Federal Reserve, underneath Paul Volcker, applied aggressive financial insurance policies geared toward curbing inflation, leading to increased rates of interest. Larger rates of interest made holding non-interest-bearing belongings like gold much less engaging, as traders may earn a return on their capital by interest-bearing devices. The general financial local weather in the course of the Nineteen Eighties and Nineteen Nineties, characterised by relative stability and average progress in lots of developed economies, additionally diminished the perceived want for a secure haven asset like gold. The gold worth chart throughout this era reveals a gradual downward development, punctuated by occasional rallies pushed by particular occasions, such because the Gulf Warfare. The value remained comparatively depressed all through the Nineteen Nineties, hovering across the $300-$400 vary.

The twenty first Century: A New Period of Volatility and Development (2000-Current)

The brand new millennium marked a big turning level within the gold market. A number of interconnected elements contributed to a renewed surge in gold costs. The dot-com bubble burst in 2000, adopted by the 9/11 terrorist assaults and the following "Warfare on Terror," created a local weather of uncertainty and threat aversion. Traders as soon as once more flocked to gold as a secure haven. The weakening US greenback, fueled by persistent commerce deficits and quantitative easing insurance policies applied in response to the 2008 monetary disaster, additional propelled gold’s worth upwards. The worldwide monetary disaster itself acted as a significant catalyst, highlighting the fragility of the worldwide monetary system and reinforcing gold’s position as a retailer of worth throughout instances of financial turmoil.

The chart from 2000 onwards reveals a powerful upward development, with a number of vital worth milestones. Gold surpassed its 1980 peak in 2011, reaching over $1,900 per ounce. Nonetheless, this era additionally witnessed vital volatility. Elements influencing this volatility included adjustments in investor sentiment, shifts in central financial institution insurance policies, and geopolitical occasions. The following years noticed intervals of each worth will increase and corrections, reflecting the dynamic interaction of those elements. The COVID-19 pandemic in 2020 sparked one other vital rally, as traders sought refuge in gold amid widespread financial uncertainty and market volatility.

Influencing Elements: A Complicated Interaction

The historic gold worth chart will not be merely a random fluctuation; it is a reflection of varied intertwined elements:

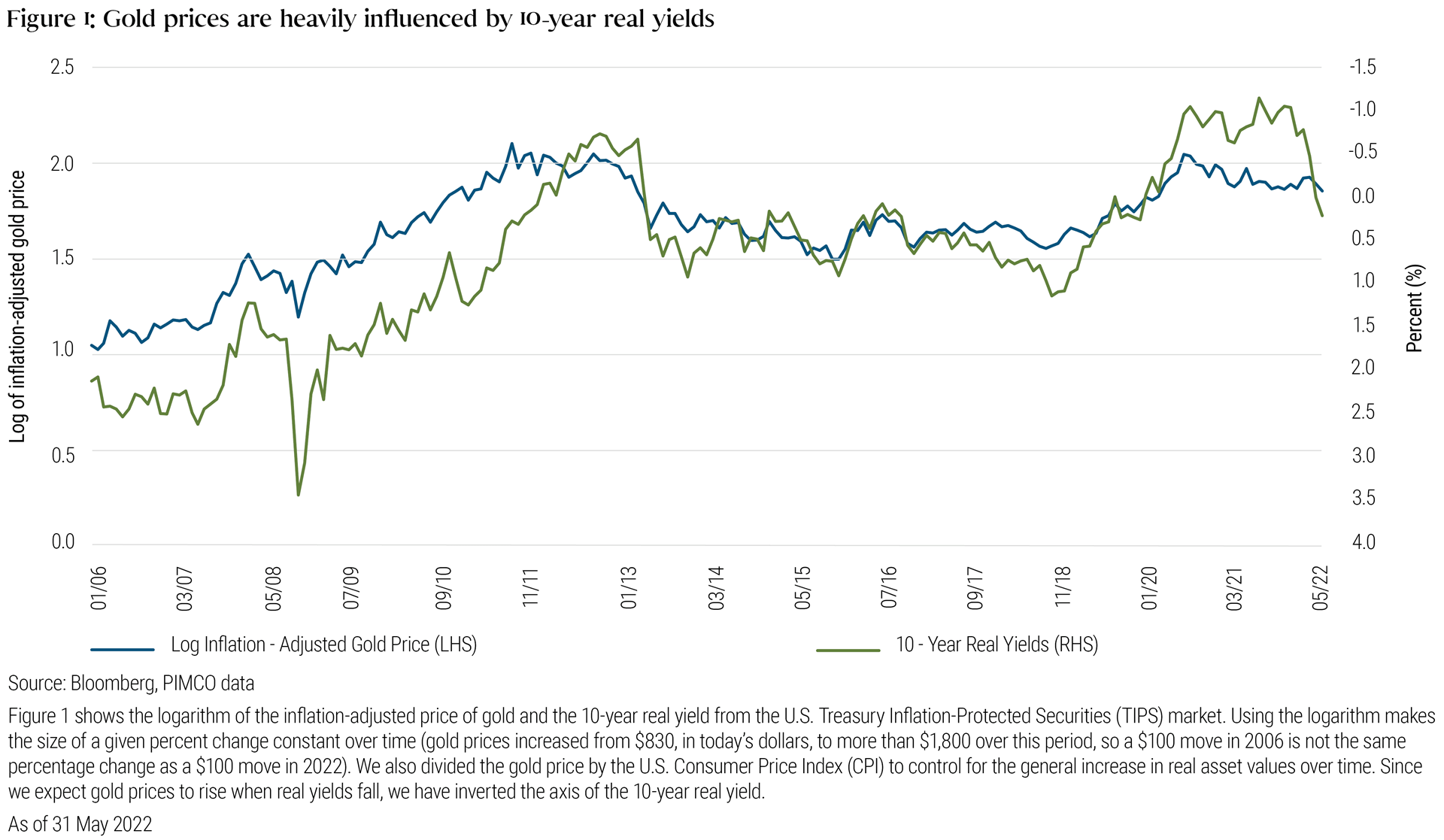

- Inflation: Gold has traditionally served as a hedge towards inflation. When inflation rises, the buying energy of fiat currencies decreases, making gold a extra engaging funding.

- Curiosity Charges: Larger rates of interest are likely to depress gold costs, as traders can earn returns on various investments. Decrease rates of interest, conversely, can enhance gold’s attraction.

- US Greenback: The US greenback and gold costs typically exhibit an inverse relationship. A weaker greenback usually results in increased gold costs, as gold turns into extra reasonably priced for holders of different currencies.

- Geopolitical Occasions: Intervals of geopolitical uncertainty and instability typically drive traders in the direction of gold as a secure haven asset. Wars, political crises, and terrorist assaults can all affect gold costs.

- Investor Sentiment: Market psychology performs a vital position. Intervals of optimism can result in decrease gold costs, whereas concern and uncertainty can drive demand and push costs increased.

- Provide and Demand: Whereas the availability of gold is comparatively inelastic, adjustments in demand considerably influence costs. Central financial institution shopping for, industrial demand, and funding demand all contribute to the general demand equation.

Conclusion: A Persevering with Narrative

The historic gold worth chart tells a compelling story of financial and geopolitical shifts, reflecting the enduring attraction of gold as a retailer of worth and a hedge towards uncertainty. Whereas predicting future gold costs stays an unimaginable activity, understanding the historic developments and the elements that affect them gives invaluable insights into the dynamics of this valuable steel market. The way forward for gold costs will undoubtedly proceed to be formed by the evolving world financial panorama, geopolitical occasions, and the ever-changing sentiment of traders worldwide. The chart will proceed to be written, reflecting a dynamic and interesting narrative for years to return.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has supplied invaluable insights into A Golden Historical past: Charting the Rise and Fall of Gold Costs. We recognize your consideration to our article. See you in our subsequent article!