Assigning Chart of Accounts to Firm Codes: A Complete Information

Associated Articles: Assigning Chart of Accounts to Firm Codes: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Assigning Chart of Accounts to Firm Codes: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Assigning Chart of Accounts to Firm Codes: A Complete Information

On the earth of monetary accounting, notably inside massive organizations working throughout a number of entities, a strong and well-defined chart of accounts (COA) is paramount. The COA serves because the spine of the monetary reporting system, offering a structured framework for classifying and summarizing monetary transactions. Nevertheless, the method of assigning a COA to an organization code inside an ERP system like SAP is a crucial step that requires meticulous planning and execution. This text delves into the intricacies of this course of, exploring its significance, the steps concerned, concerns for various organizational buildings, potential challenges, and finest practices for profitable implementation.

Understanding the Core Ideas:

Earlier than diving into the project course of, let’s make clear the important thing phrases:

-

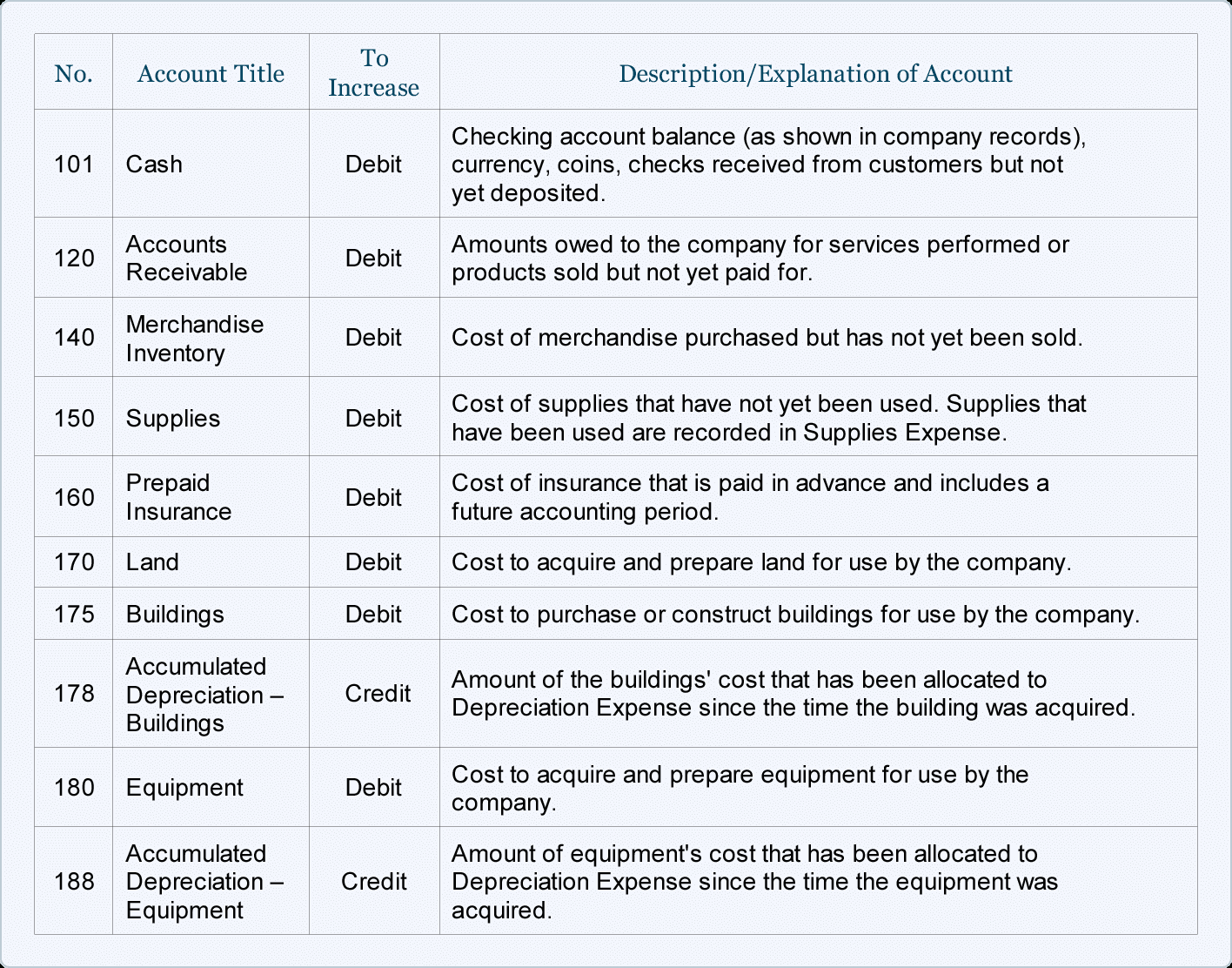

Chart of Accounts (COA): A scientific itemizing of all accounts utilized by a company to report monetary transactions. It outlines the precise accounts for belongings, liabilities, fairness, revenues, and bills. COAs will be extremely custom-made to replicate the precise wants of a enterprise.

-

Firm Code: In an ERP system like SAP, an organization code represents a legally unbiased entity inside a company. Every firm code maintains its personal set of monetary knowledge, together with its personal common ledger. An organization code is usually a subsidiary, a department, a division, or perhaps a separate authorized entity.

-

Project: The method of linking a selected COA to a specific firm code inside the ERP system. This significant step ensures that every one monetary transactions recorded inside an organization code are labeled and reported in line with its designated COA.

Why is Assigning a COA to a Firm Code Essential?

The right project of a COA to an organization code is prime for a number of causes:

-

Correct Monetary Reporting: Every firm code wants its personal COA to precisely replicate its distinctive monetary actions. Utilizing a typical COA throughout vastly completely different entities would result in inaccurate and deceptive monetary statements.

-

Compliance and Auditing: Correct COA project ensures compliance with native accounting requirements and rules. It additionally simplifies the auditing course of by offering a transparent and constant framework for inspecting monetary transactions.

-

Information Integrity: A well-defined COA ensures knowledge integrity by offering a structured method to classifying transactions. This minimizes errors and inconsistencies in monetary reporting.

-

Administration Reporting: Completely different firm codes might require completely different ranges of element of their monetary reporting. Assigning a tailor-made COA to every firm code permits for custom-made administration studies that meet the precise wants of every entity.

-

Consolidation: Correct COA project is crucial for correct consolidation of monetary statements throughout a number of firm codes. A constant COA construction facilitates the aggregation of monetary knowledge from completely different entities right into a single, complete report.

Steps Concerned in Assigning a COA to a Firm Code:

The precise steps concerned in assigning a COA to an organization code might fluctuate relying on the ERP system used (e.g., SAP, Oracle). Nevertheless, the overall course of sometimes consists of:

-

Defining the Chart of Accounts: This entails creating or choosing a COA that precisely displays the precise accounting necessities of the corporate code. This will likely contain defining account numbers, account names, account varieties (asset, legal responsibility, and so on.), and different related attributes.

-

Firm Code Creation: If the corporate code does not exist already, it must be created within the ERP system. This entails defining its organizational construction, authorized info, and different related particulars.

-

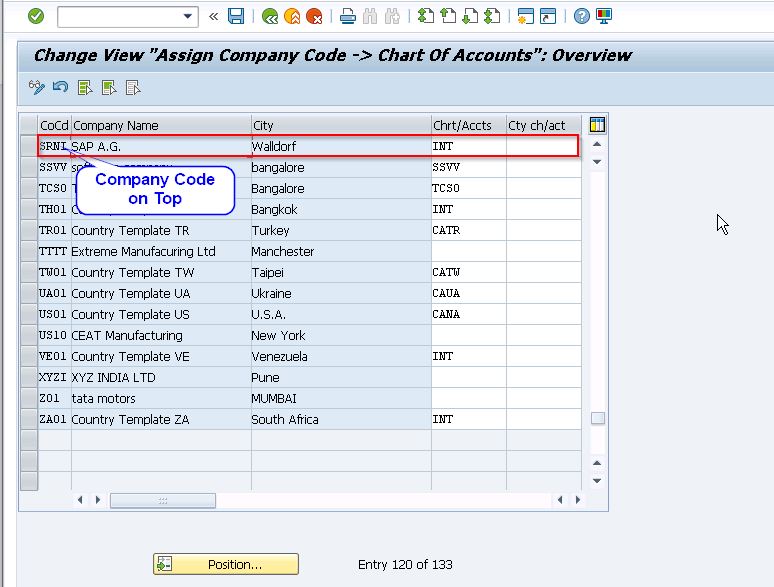

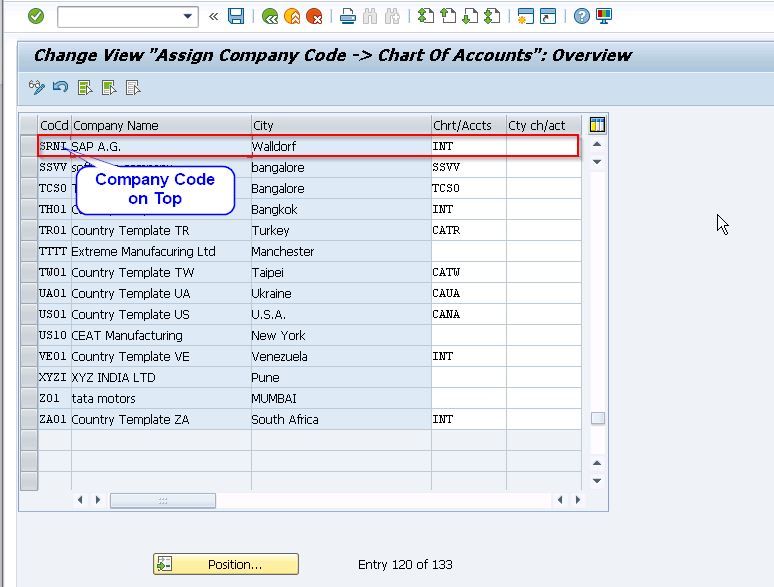

COA Project: That is the core step the place the chosen COA is linked to the newly created or current firm code. This sometimes entails choosing the COA from an inventory of obtainable COAs and assigning it to the precise firm code inside the system’s configuration settings.

-

Testing and Validation: After assigning the COA, thorough testing is essential to make sure that the system is functioning accurately. This entails posting pattern transactions and verifying that they’re accurately labeled and reported in line with the assigned COA.

-

Go-Stay and Monitoring: As soon as testing is full, the system will be deployed to dwell operations. Ongoing monitoring and upkeep are important to make sure the accuracy and integrity of the monetary knowledge.

Issues for Completely different Organizational Buildings:

The method to COA project varies relying on the group’s construction:

-

Easy Construction: A single COA might suffice for a small group with a single authorized entity.

-

Advanced Construction: Giant organizations with a number of subsidiaries, divisions, or authorized entities usually require a number of COAs, every tailor-made to the precise accounting wants of the respective firm code. This necessitates a well-defined chart of accounts construction that permits for consolidation and reporting throughout completely different entities.

-

Worldwide Operations: Organizations working in a number of nations should adjust to numerous native accounting requirements and rules. This usually requires utilizing completely different COAs for various geographic areas.

Potential Challenges and Greatest Practices:

A number of challenges can come up throughout COA project:

-

Information Migration: Migrating current monetary knowledge to a brand new COA will be complicated and time-consuming. Cautious planning and execution are essential to make sure knowledge accuracy and reduce disruption.

-

Integration with Different Techniques: The COA have to be built-in with different methods, akin to payroll, procurement, and buyer relationship administration (CRM) methods, to make sure seamless knowledge circulation.

-

Consumer Coaching: Ample consumer coaching is crucial to make sure that all customers perceive the brand new COA and the best way to use it accurately.

-

Change Administration: Implementing a brand new COA or altering an current one requires efficient change administration to attenuate resistance and guarantee easy adoption by customers.

Greatest practices for profitable COA project embrace:

-

Thorough Planning: Develop an in depth plan that outlines the steps concerned, timelines, tasks, and potential dangers.

-

Standardization: Develop a standardized method to COA design and project to make sure consistency throughout all firm codes.

-

Collaboration: Contain key stakeholders from finance, IT, and different related departments to make sure a collaborative and efficient implementation.

-

Testing and Validation: Conduct thorough testing and validation to make sure the accuracy and integrity of the monetary knowledge.

-

Documentation: Preserve complete documentation of the COA construction, project course of, and any adjustments made.

Conclusion:

Assigning a chart of accounts to an organization code is a crucial course of that considerably impacts the accuracy, reliability, and effectivity of monetary reporting. By understanding the important thing ideas, following finest practices, and addressing potential challenges proactively, organizations can guarantee a profitable implementation that helps their monetary administration wants and contributes to sound decision-making. The funding in cautious planning and execution pays dividends within the type of correct monetary info, improved compliance, and enhanced operational effectivity.

Closure

Thus, we hope this text has supplied priceless insights into Assigning Chart of Accounts to Firm Codes: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!