Backtesting Charts for Foreign exchange: A Deep Dive into Technique Validation and Refinement

Associated Articles: Backtesting Charts for Foreign exchange: A Deep Dive into Technique Validation and Refinement

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Backtesting Charts for Foreign exchange: A Deep Dive into Technique Validation and Refinement. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Backtesting Charts for Foreign exchange: A Deep Dive into Technique Validation and Refinement

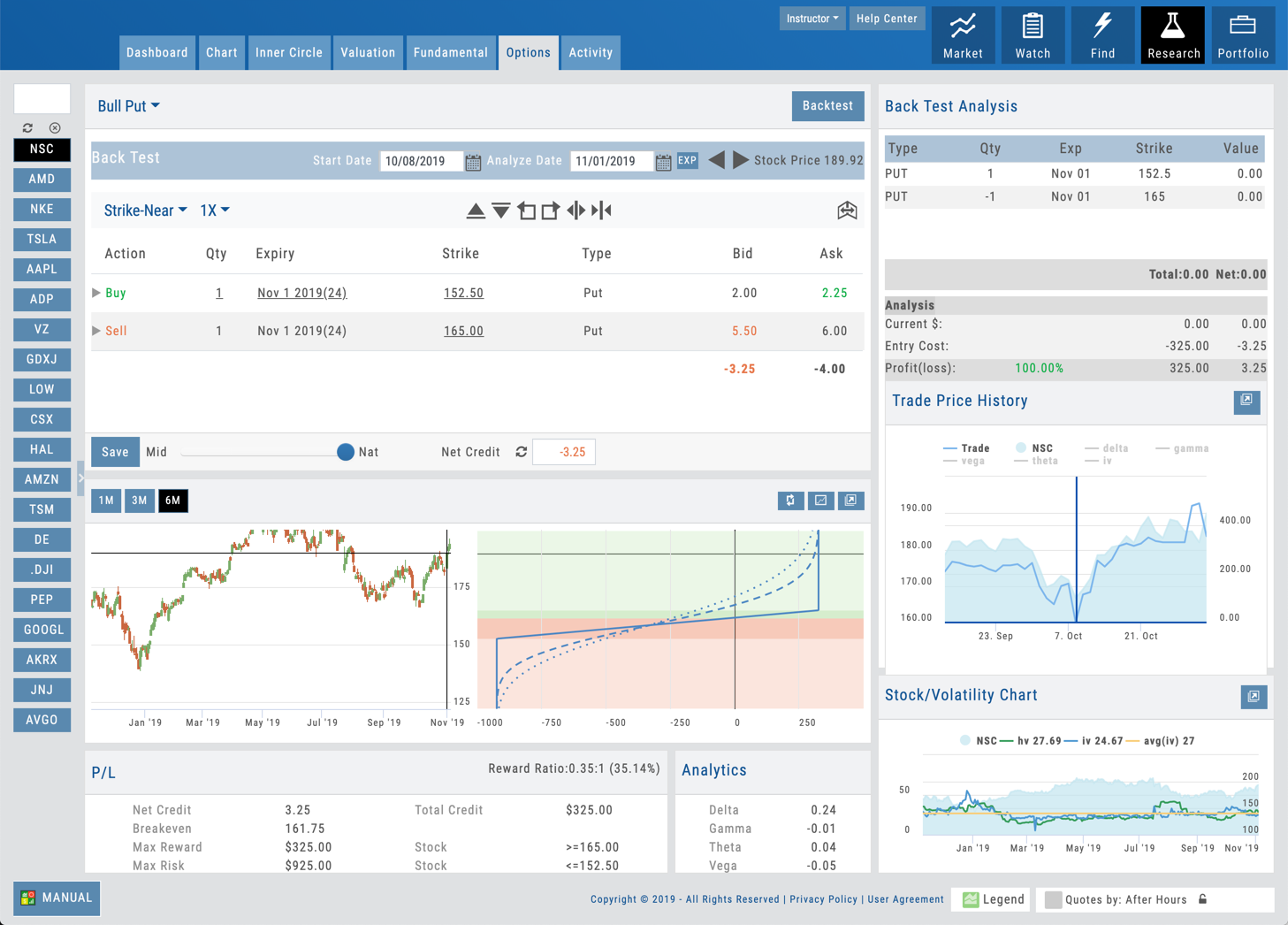

The overseas change (foreign exchange) market, a colossal area of world forex buying and selling, calls for meticulous planning and rigorous testing earlier than deploying any buying and selling technique. Whereas theoretical understanding is essential, the true measure of a technique’s viability lies in its efficiency below real-world circumstances, or as near them as attainable. That is the place backtesting comes into play, and backtesting charts are the indispensable visible instruments that empower merchants to investigate historic knowledge and consider their methods’ effectiveness.

This text delves into the intricacies of backtesting charts for foreign exchange, exploring their function, methodologies, limitations, and the right way to successfully make the most of them for technique validation and refinement.

Understanding the Function of Backtesting Charts

Backtesting, in essence, includes making use of a buying and selling technique to historic worth knowledge to evaluate its potential profitability and threat profile. Backtesting charts are the graphical illustration of this course of, permitting merchants to visually examine the technique’s efficiency over a selected interval. These charts show worth motion alongside alerts generated by the technique, highlighting entry and exit factors, income, and losses. This visible illustration supplies a much more intuitive understanding than merely numerical efficiency metrics alone. The important thing functions of backtesting charts are:

-

Technique Validation: The first purpose is to confirm whether or not a technique, be it primarily based on technical indicators, elementary evaluation, or a mixture of each, performs as anticipated in historic market circumstances. This helps determine potential flaws and biases earlier than risking actual capital.

-

Parameter Optimization: Many buying and selling methods contain adjustable parameters (e.g., transferring common durations, stop-loss ranges, take-profit targets). Backtesting charts permit merchants to experiment with completely different parameter settings and visualize their influence on efficiency, resulting in optimized technique configurations.

-

Danger Administration Evaluation: By observing the distribution of wins and losses, most drawdown, and different threat metrics on the backtesting chart, merchants can acquire insights into their technique’s threat profile. This helps in figuring out applicable place sizing and threat administration methods.

-

Figuring out Market Regime Modifications: Backtesting charts can reveal how a technique performs throughout completely different market regimes (bullish, bearish, sideways). This helps determine potential weaknesses and adapt the technique accordingly.

Methodologies for Creating Backtesting Charts

Creating backtesting charts requires a mixture of historic worth knowledge and a technique implementation. A number of approaches can be found:

-

Guide Backtesting: This includes manually plotting worth knowledge on a chart and making use of the buying and selling guidelines of the technique. It is time-consuming and susceptible to errors, nevertheless it provides a deeper understanding of the technique’s mechanics. It is appropriate for easy methods and smaller datasets.

-

Spreadsheet Software program: Spreadsheet packages like Excel or Google Sheets can be utilized for semi-automated backtesting. Formulation will be employed to calculate indicators and generate buying and selling alerts, however charting normally requires guide plotting or the usage of add-ins.

-

Devoted Backtesting Software program: Quite a few software program platforms are particularly designed for backtesting, providing automated knowledge retrieval, technique implementation, chart era, and efficiency reporting. These platforms considerably streamline the backtesting course of and provide superior options like optimization and Monte Carlo simulations. Examples embrace MetaTrader 4/5, TradingView, NinjaTrader, and others.

-

Programming Languages: Skilled programmers can make the most of languages like Python (with libraries like Pandas and TA-Lib) to create customized backtesting scripts and generate charts utilizing libraries like Matplotlib or Seaborn. This provides most flexibility and management however requires vital programming experience.

Deciphering Backtesting Charts: Key Components

Efficient interpretation of backtesting charts is essential for extracting significant insights. Key components to give attention to embrace:

-

Value Motion: The underlying worth chart serves as the muse, displaying the historic worth actions of the forex pair.

-

Buying and selling Alerts: These are visually represented, usually utilizing arrows, traces, or different markers, indicating the entry and exit factors generated by the technique.

-

Revenue/Loss (P/L): The chart ought to clearly point out the revenue or loss for every commerce, ideally displayed numerically and visually (e.g., utilizing completely different coloured bars or traces).

-

Drawdown: Most drawdown, the biggest peak-to-trough decline within the fairness curve, is a important threat metric that must be clearly seen.

-

Fairness Curve: The fairness curve, a line graph displaying the cumulative revenue or loss over time, supplies a holistic view of the technique’s efficiency.

-

Statistical Metrics: Whereas the chart supplies a visible illustration, accompanying statistical metrics like Sharpe Ratio, Sortino Ratio, most drawdown, win price, common win/loss, and Calmar Ratio present quantitative measures of efficiency and threat.

Limitations of Backtesting Charts and Overcoming Them

Whereas backtesting charts are highly effective instruments, they’ve limitations:

-

Knowledge Limitations: Historic knowledge might not precisely replicate future market circumstances. Previous efficiency shouldn’t be indicative of future outcomes.

-

Survivorship Bias: Backtesting datasets usually exclude failed methods or devices, creating an excessively optimistic view of historic efficiency.

-

Optimization Overfitting: Extreme optimization of parameters to suit historic knowledge can result in overfitting, leading to poor efficiency on new knowledge.

-

Transaction Prices: Backtesting usually neglects transaction prices (spreads, commissions), which might considerably influence profitability.

To mitigate these limitations:

-

Use Sturdy Knowledge: Make use of high-quality, tick-level knowledge from dependable sources.

-

Out-of-Pattern Testing: Check the technique on knowledge not used throughout optimization.

-

Stroll-Ahead Evaluation: Divide the info into a number of durations, optimizing parameters on one interval and testing on subsequent durations.

-

Embrace Transaction Prices: Incorporate practical transaction prices into the backtesting course of.

-

Take into account Market Regime Modifications: Analyze efficiency throughout completely different market circumstances.

Conclusion:

Backtesting charts are invaluable instruments for foreign exchange merchants. They supply a visible and intuitive solution to assess the efficiency of buying and selling methods, optimize parameters, and handle threat. Nonetheless, it is essential to know their limitations and make use of greatest practices to attenuate biases and guarantee practical efficiency assessments. By combining visible evaluation of backtesting charts with rigorous statistical analysis and out-of-sample testing, merchants can considerably enhance their probabilities of growing strong and worthwhile foreign currency trading methods. Bear in mind, backtesting is an important step, nevertheless it’s just one piece of the puzzle in profitable foreign currency trading. Steady studying, adaptation, and threat administration stay paramount.

Closure

Thus, we hope this text has offered helpful insights into Backtesting Charts for Foreign exchange: A Deep Dive into Technique Validation and Refinement. We respect your consideration to our article. See you in our subsequent article!