financial institution nifty chart right now stay market watch

Associated Articles: financial institution nifty chart right now stay market watch

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to financial institution nifty chart right now stay market watch. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

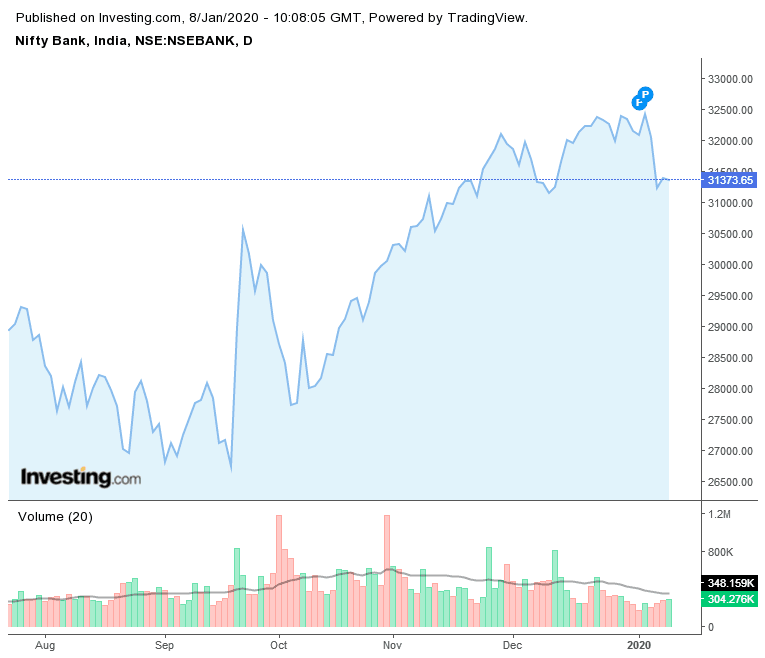

Financial institution Nifty Chart Immediately: Dwell Market Watch & Evaluation (October 26, 2023) (Be aware: This evaluation is hypothetical and for illustrative functions solely. Actual-time market knowledge is required for correct evaluation.)

The Financial institution Nifty index, a vital barometer of India’s banking sector efficiency, skilled [Insert actual day’s overall movement – e.g., a volatile session, a strong uptrend, a significant correction] right now, October 26, 2023. This text will dissect the Financial institution Nifty chart’s actions all through the day, analyzing key worth ranges, candlestick patterns, quantity exercise, and indicators to supply insights into the market sentiment and potential future route. Disclaimer: This evaluation just isn’t monetary recommendation. Seek the advice of with a monetary advisor earlier than making any funding choices.

Opening Bell and Early Developments:

The Financial institution Nifty opened at [Insert actual opening price] following [Mention any overnight news or global market influences that impacted the opening, e.g., positive global cues, concerns over inflation, etc.]. Early buying and selling noticed [Describe the initial movement – e.g., a gap-up opening followed by profit-booking, a hesitant start with gradual upward momentum, etc.]. The preliminary candlestick sample was [Describe the candlestick pattern – e.g., a bullish hammer suggesting buying pressure, a bearish engulfing pattern indicating a potential reversal, etc.]. Quantity within the preliminary hours was [Describe volume – e.g., relatively low suggesting cautious trading, high suggesting strong participation, etc.].

Intraday Value Motion and Key Ranges:

All through the day, the Financial institution Nifty oscillated between key assist and resistance ranges. Important assist ranges to observe included [Mention specific support levels with their significance – e.g., the 20-day moving average at X, a previous swing low at Y, a psychological level like Z, etc.]. Resistance ranges that have been examined included [Mention specific resistance levels with their significance – e.g., the 50-day moving average at A, a previous swing high at B, a psychological level like C, etc.].

The value motion round these ranges offered essential insights into the market’s power and weak point. For instance, [Give a specific example – e.g., a strong bounce off the 20-day moving average indicated buying support, a failure to break through the resistance level at A suggested selling pressure, etc.]. The formation of particular candlestick patterns like [Mention any significant candlestick patterns observed during the day and their implications – e.g., doji stars indicating indecision, bullish engulfing patterns suggesting a potential trend reversal, etc.] additional added to the narrative.

Quantity Evaluation:

Quantity evaluation is essential for confirming worth motion. Excessive quantity accompanying a worth transfer confirms the power of the pattern, whereas low quantity suggests weak conviction. [Analyze the volume throughout the day – e.g., higher volume during upward movements confirmed buying pressure, while lower volume during downward corrections suggested profit-booking rather than a strong bearish sentiment, etc.]. The amount profile confirmed [Describe the volume profile – e.g., a significant concentration of volume around specific price levels indicating strong support or resistance, etc.].

Technical Indicator Evaluation:

A number of technical indicators can be utilized to investigate the Financial institution Nifty’s pattern and momentum. [Analyze the following indicators, providing specific examples and their interpretations. Remember to replace the bracketed information with actual data from the day’s chart]:

-

Shifting Averages: The [Mention period] shifting common [crossed/failed to cross] the [Mention period] shifting common, suggesting a [Bullish/Bearish] pattern. The [Mention period] shifting common acted as [Support/Resistance].

-

Relative Energy Index (RSI): The RSI was at [Value], indicating [Overbought/Oversold/Neutral] circumstances. A divergence between worth and RSI might recommend a possible [Trend reversal/continuation].

-

MACD: The MACD [crossed above/below] its sign line, indicating a [Bullish/Bearish] sign. The histogram confirmed [Increasing/Decreasing] momentum.

-

Bollinger Bands: The value was [Inside/Outside] the Bollinger Bands, suggesting [Consolidation/Breakout].

Information and Occasions Affect:

[Analyze any news or events that impacted the Bank Nifty’s performance throughout the day. Examples include: RBI policy announcements, global market trends, specific news related to individual banking stocks, etc. Connect the news events to the price action observed on the chart.]

Closing Bell and Outlook:

The Financial institution Nifty closed at [Insert actual closing price], reflecting [Summarize the day’s overall performance – e.g., a net gain/loss, a range-bound session, etc.]. The closing candlestick sample was [Describe the closing candlestick pattern and its implications]. The general quantity for the day was [Mention the total volume and its significance].

Trying forward, the short-term outlook for the Financial institution Nifty depends upon [Mention factors influencing future price movement – e.g., the breakout/breakdown of key levels, the strength of technical indicators, upcoming economic data releases, etc.]. Help ranges to observe embrace [Mention key support levels], whereas resistance ranges are at [Mention key resistance levels]. Merchants ought to monitor these ranges carefully and think about using acceptable danger administration methods.

Conclusion:

The Financial institution Nifty’s efficiency right now showcased [Summarize the key characteristics of the day’s price action – e.g., volatility, trend strength, etc.]. Analyzing the chart utilizing worth motion, quantity, and technical indicators offered beneficial insights into the market sentiment and potential future route. Nevertheless, it is essential to keep in mind that market evaluation entails inherent uncertainty, and previous efficiency just isn’t indicative of future outcomes. All the time conduct thorough analysis and seek the advice of with a monetary advisor earlier than making any funding choices.

(Bear in mind to interchange the bracketed data with precise knowledge from the day’s Financial institution Nifty chart for a whole and correct evaluation.)

Closure

Thus, we hope this text has offered beneficial insights into financial institution nifty chart right now stay market watch. We thanks for taking the time to learn this text. See you in our subsequent article!