Financial institution Nifty Dwell Chart TradingView: A Complete Information to Charting, Evaluation, and Buying and selling Methods

Associated Articles: Financial institution Nifty Dwell Chart TradingView: A Complete Information to Charting, Evaluation, and Buying and selling Methods

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Financial institution Nifty Dwell Chart TradingView: A Complete Information to Charting, Evaluation, and Buying and selling Methods. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Financial institution Nifty Dwell Chart TradingView: A Complete Information to Charting, Evaluation, and Buying and selling Methods

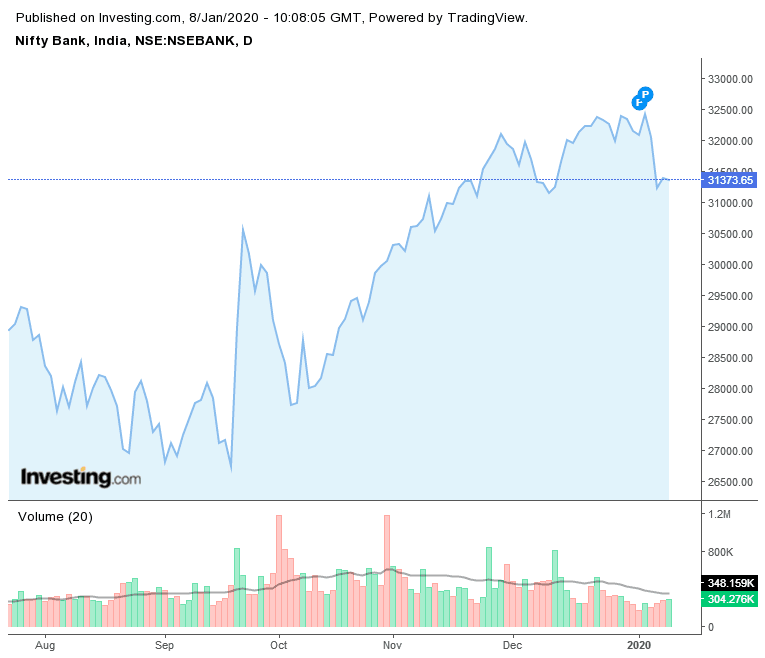

The Financial institution Nifty, an index representing the efficiency of the banking sector in India’s Nationwide Inventory Alternate (NSE), is a extremely liquid and unstable market, attracting each seasoned merchants and newcomers. TradingView, a preferred charting and evaluation platform, affords a strong toolset for analyzing the Financial institution Nifty dwell chart, enabling merchants to make knowledgeable selections. This text delves into the intricacies of utilizing TradingView for Financial institution Nifty buying and selling, masking chart sorts, indicators, methods, threat administration, and extra.

Understanding the Financial institution Nifty and its Volatility:

The Financial institution Nifty’s composition includes essentially the most important banking shares in India, making it a barometer of the nation’s monetary well being. Its volatility stems from varied elements, together with macroeconomic occasions (rate of interest modifications, inflation, international financial traits), authorities insurance policies, and particular person bank-specific information. This volatility presents each alternatives and dangers for merchants. Profitable Financial institution Nifty buying and selling requires a deep understanding of those elements and the power to interpret them by technical evaluation.

TradingView: Your Gateway to Financial institution Nifty Evaluation:

TradingView supplies a user-friendly interface with an unlimited array of instruments for charting and technical evaluation. Its key options related to Financial institution Nifty buying and selling embrace:

- Actual-time information: Entry to dwell Financial institution Nifty worth information, guaranteeing your evaluation is predicated on essentially the most present info.

- A number of chart sorts: Select from varied chart sorts like candlestick, bar, line, Heikin Ashi, and Renko to fit your buying and selling model and evaluation wants.

- In depth indicator library: TradingView boasts a large library of technical indicators, together with shifting averages (SMA, EMA), oscillators (RSI, MACD, Stochastic), quantity indicators (OBV, Chaikin Cash Movement), and plenty of extra. You may add, customise, and mix indicators to create customized evaluation setups.

- Drawing instruments: Make the most of varied drawing instruments like development traces, Fibonacci retracements, assist/resistance ranges, and channels to establish patterns and potential buying and selling alternatives.

- Script improvement: For superior customers, TradingView permits for the creation of customized scripts and indicators, enabling extremely customized evaluation.

- Neighborhood interplay: Interact with a worldwide group of merchants, share concepts, and be taught from others’ experiences.

Analyzing the Financial institution Nifty Dwell Chart on TradingView:

Efficient Financial institution Nifty buying and selling on TradingView entails a multi-faceted method:

1. Chart Choice and Timeframes:

The selection of timeframe depends upon your buying and selling model:

- Quick-term merchants (scalpers and day merchants): Make the most of shorter timeframes like 1-minute, 5-minute, or 15-minute charts to establish fast worth actions and capitalize on short-term traits.

- Swing merchants: Concentrate on intermediate timeframes like 30-minute, hourly, or 4-hour charts to establish swing highs and lows and maintain positions for a number of hours or days.

- Lengthy-term merchants: Analyze every day or weekly charts to establish long-term traits and maintain positions for weeks or months.

2. Technical Indicators:

Combining totally different indicators can present a extra complete image:

- Transferring Averages: Determine traits and potential assist/resistance ranges. A typical technique entails utilizing a fast-moving common (e.g., 20-period EMA) and a slow-moving common (e.g., 50-period EMA) to establish crossover alerts.

- Relative Power Index (RSI): Measure momentum and establish overbought and oversold situations. Divergences between worth and RSI can point out potential development reversals.

- Transferring Common Convergence Divergence (MACD): Determine momentum modifications and potential development reversals. Crossovers of the MACD traces can sign purchase or promote alternatives.

- Bollinger Bands: Measure volatility and establish potential overbought and oversold situations. Value bounces off the bands can present buying and selling alerts.

- Quantity Indicators: Verify worth actions and establish potential breakouts. Excessive quantity throughout worth actions confirms the energy of the development.

3. Value Motion Evaluation:

Understanding worth motion is essential for figuring out potential buying and selling alternatives:

- Assist and Resistance Ranges: Determine key worth ranges the place the value has beforehand bounced or damaged by. These ranges can act as potential entry and exit factors.

- Candlestick Patterns: Acknowledge candlestick patterns like engulfing patterns, hammer, hanging man, and doji to anticipate potential worth reversals or continuations.

- Pattern Traces: Draw development traces to establish the general route of the value motion. Breakouts above or beneath development traces can sign important worth actions.

4. Growing a Buying and selling Technique:

A well-defined buying and selling technique is essential for constant profitability:

- Outline your entry and exit guidelines: Specify exact situations for getting into and exiting trades primarily based in your chosen indicators and worth motion evaluation.

- Set stop-loss orders: Shield your capital by setting stop-loss orders to restrict potential losses.

- Decide your place sizing: Calculate the suitable place measurement to handle threat successfully.

- Backtest your technique: Take a look at your technique on historic information to guage its efficiency earlier than implementing it with actual cash.

Danger Administration in Financial institution Nifty Buying and selling:

Financial institution Nifty buying and selling entails important threat as a result of its volatility. Efficient threat administration is paramount:

- Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different property to scale back threat.

- Place sizing: By no means threat greater than a small proportion of your buying and selling capital on a single commerce. A typical rule is to threat not more than 1-2% per commerce.

- Cease-loss orders: At all times use stop-loss orders to restrict potential losses.

- Emotional self-discipline: Keep away from emotional buying and selling selections. Stick with your buying and selling plan and keep away from impulsive trades primarily based on worry or greed.

Conclusion:

TradingView supplies a strong platform for analyzing the Financial institution Nifty dwell chart and creating efficient buying and selling methods. Nonetheless, success in Financial institution Nifty buying and selling requires a mixture of technical evaluation abilities, threat administration self-discipline, and a deep understanding of the market’s dynamics. Constant follow, steady studying, and adapting to market situations are important for long-term success. Do not forget that previous efficiency shouldn’t be indicative of future outcomes, and buying and selling all the time entails threat. It is essential to completely perceive the dangers concerned earlier than participating in Financial institution Nifty buying and selling. Take into account searching for steerage from skilled merchants or monetary advisors if wanted. At all times prioritize accountable buying and selling practices.

Closure

Thus, we hope this text has offered beneficial insights into Financial institution Nifty Dwell Chart TradingView: A Complete Information to Charting, Evaluation, and Buying and selling Methods. We hope you discover this text informative and helpful. See you in our subsequent article!