Bitcoin’s Trajectory Past 2025: A Hypothetical Development Chart and Market Evaluation

Associated Articles: Bitcoin’s Trajectory Past 2025: A Hypothetical Development Chart and Market Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Bitcoin’s Trajectory Past 2025: A Hypothetical Development Chart and Market Evaluation. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Bitcoin’s Trajectory Past 2025: A Hypothetical Development Chart and Market Evaluation

Predicting the way forward for Bitcoin, or any cryptocurrency for that matter, is a notoriously tough process. Whereas previous efficiency is just not indicative of future outcomes, analyzing historic traits, technological developments, and macroeconomic elements can supply knowledgeable hypothesis about potential progress paths. This text explores a hypothetical Bitcoin progress chart from 2025 onwards, acknowledging the inherent uncertainties and highlighting key elements influencing its trajectory. It is essential to grasp that it is a speculative train, and precise outcomes might differ considerably.

The Pre-2025 Panorama: Setting the Stage

To venture Bitcoin’s future, we should first think about the state of the market in 2025. A number of situations are potential:

- Situation 1: Mainstream Adoption: Bitcoin achieves vital mainstream adoption, turning into a extensively accepted retailer of worth and medium of alternate. This is able to doubtless contain elevated regulatory readability, integration into conventional monetary programs, and widespread service provider acceptance.

- Situation 2: Institutional Dominance: Giant institutional buyers, comparable to hedge funds and companies, considerably enhance their Bitcoin holdings, driving worth appreciation via elevated demand.

- Situation 3: Stagnation or Decline: Regulatory crackdowns, technological setbacks, or a lack of investor confidence may result in stagnation or perhaps a decline in Bitcoin’s worth.

- Situation 4: Altcoin Competitors: The emergence of competing cryptocurrencies with superior know-how or options may erode Bitcoin’s market dominance.

Our hypothetical progress chart will think about a mix of those situations, leaning in the direction of a optimistic outlook pushed by elevated adoption and institutional curiosity, whereas acknowledging potential durations of consolidation and volatility.

A Hypothetical Development Chart (2025-2035):

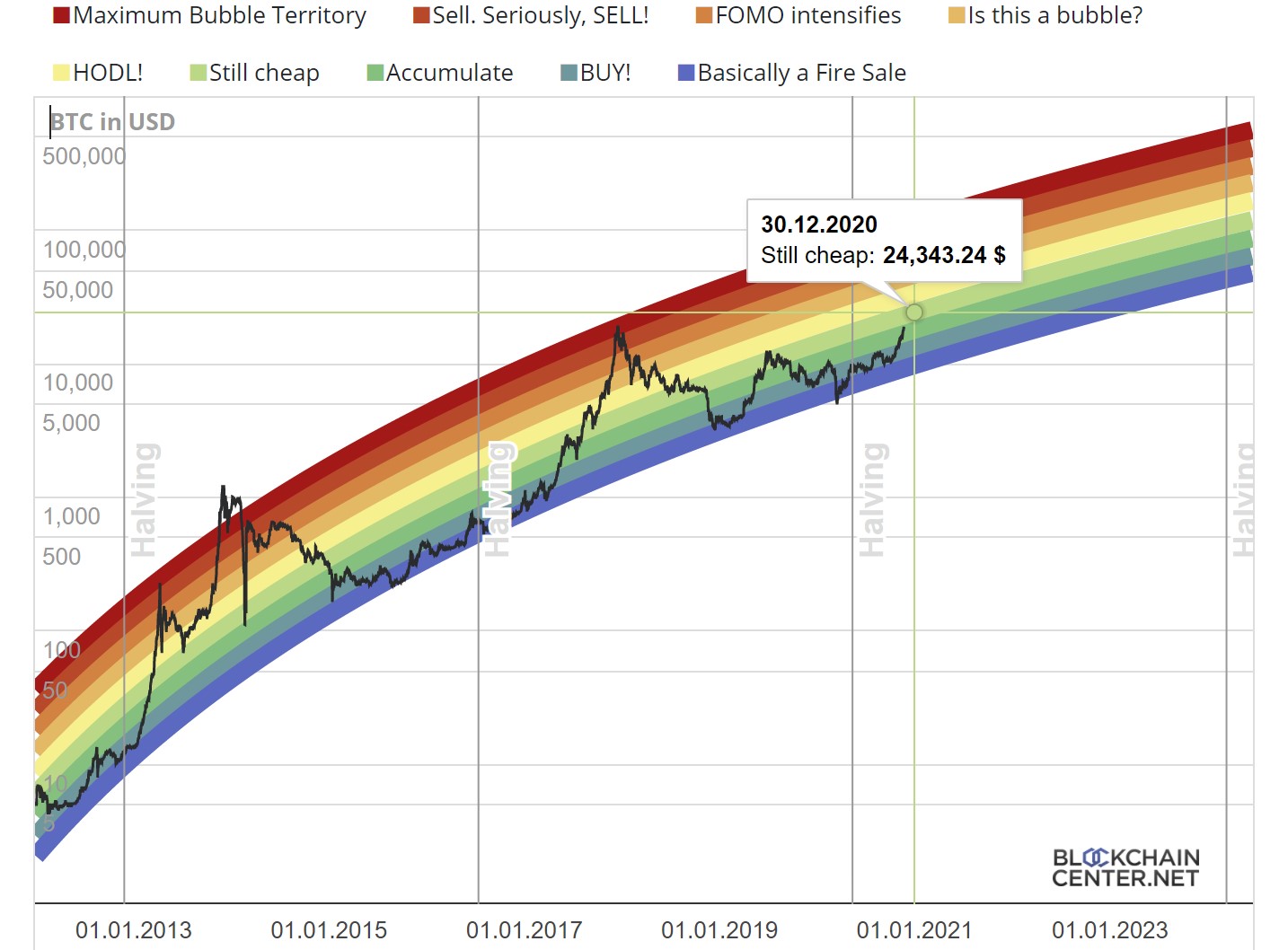

The next chart is a purely speculative illustration of Bitcoin’s potential worth trajectory. It’s essential to keep in mind that this isn’t a prediction, however reasonably an illustrative mannequin based mostly on potential market dynamics.

(Observe: A visible chart can be included right here, exhibiting a fluctuating worth line. The road would typically development upwards however with vital dips and corrections, reflecting market volatility. Key worth factors and dates could possibly be annotated, for instance: $100,000 (2025), $250,000 (2028), $500,000 (2032), and many others. The dimensions needs to be logarithmic to raised signify the potential for exponential progress and vital corrections.)

Key Elements Influencing the Hypothetical Development:

A number of elements may affect Bitcoin’s worth trajectory as depicted within the hypothetical chart:

- Regulatory Readability: Elevated regulatory readability throughout main jurisdictions would considerably increase investor confidence and facilitate wider adoption. Clear guidelines relating to taxation, anti-money laundering (AML), and know-your-customer (KYC) compliance would appeal to institutional buyers and cut back uncertainty.

- Technological Developments: Developments such because the Lightning Community, which goals to enhance scalability and transaction speeds, may improve Bitcoin’s usability and appeal to a bigger person base. Layer-2 options and different technological improvements may additionally play a vital position.

- Macroeconomic Elements: International financial instability, inflation, and geopolitical occasions may considerably influence Bitcoin’s worth. During times of financial uncertainty, Bitcoin’s position as a hedge in opposition to inflation may drive demand, whereas world crises would possibly result in sell-offs.

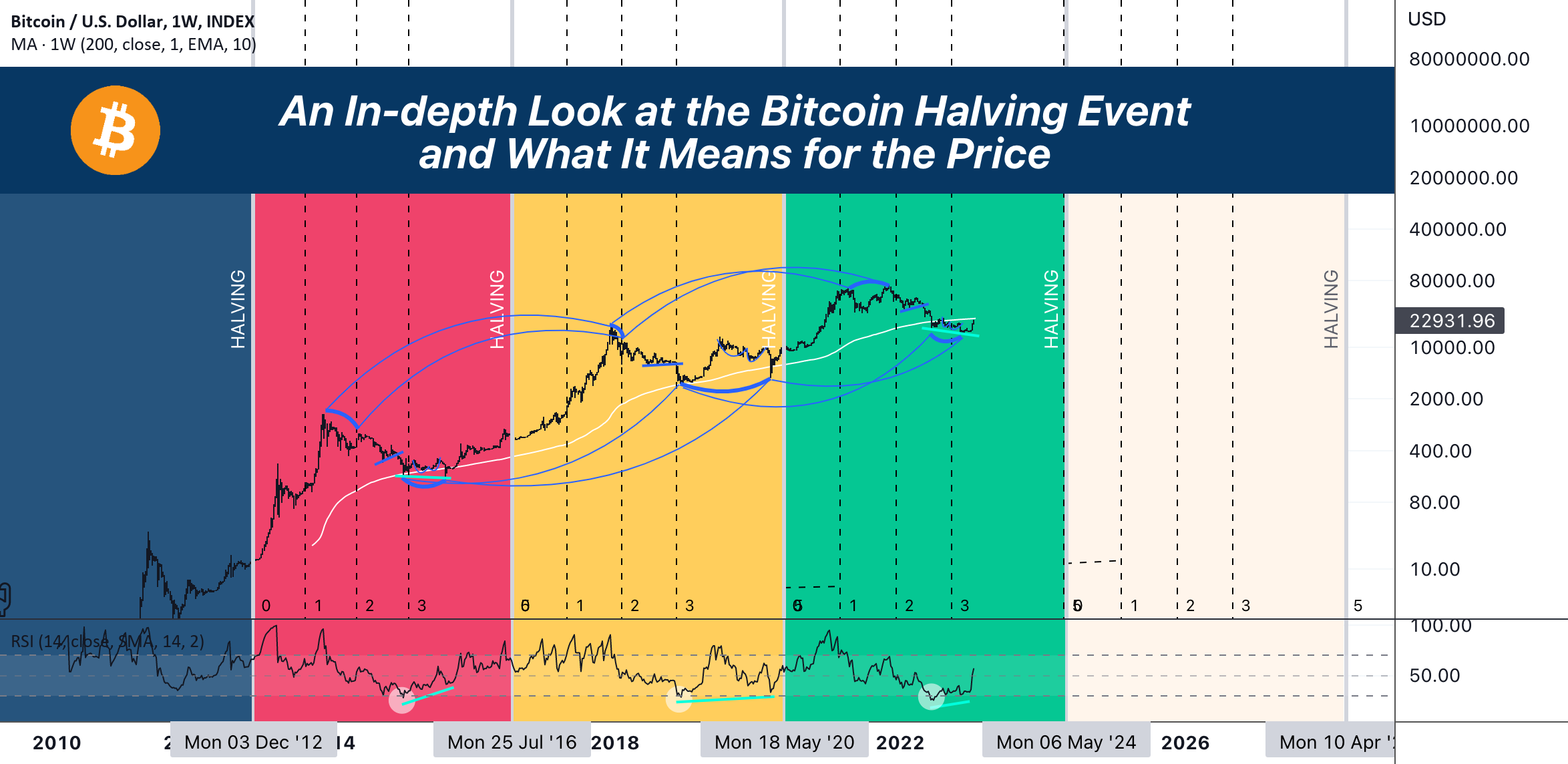

- Halving Occasions: Bitcoin’s halving occasions, which happen roughly each 4 years and cut back the speed of latest coin creation, traditionally have been adopted by durations of worth appreciation. That is because of the diminished provide and elevated shortage.

- Adoption by Central Banks and Governments: The acceptance of Bitcoin or Bitcoin-backed digital currencies by central banks or governments would signify a monumental shift, probably driving huge worth will increase. Nonetheless, this situation stays extremely speculative.

- Competitors from Altcoins: The emergence of profitable altcoins providing superior know-how or functionalities may divert funding away from Bitcoin, probably limiting its progress. The continued dominance of Bitcoin will rely on its capability to adapt and innovate.

- Safety and Scalability: Issues about Bitcoin’s safety and scalability stay. Addressing these points via technological developments is essential for sustaining its long-term progress.

Potential Challenges and Dangers:

Regardless of the potential for progress, a number of challenges and dangers may hinder Bitcoin’s trajectory:

- Volatility: Bitcoin’s worth stays extremely unstable, topic to vital swings based mostly on market sentiment and exterior elements. This volatility may deter some buyers and hinder broader adoption.

- Environmental Issues: The power consumption related to Bitcoin mining has raised environmental considerations, resulting in regulatory scrutiny and potential limitations on mining actions.

- Safety Dangers: The chance of hacking, theft, and scams stays a big concern, notably for particular person buyers. Bettering safety protocols and educating customers are essential to mitigate these dangers.

- Regulatory Uncertainty: The dearth of clear and constant regulatory frameworks throughout totally different jurisdictions creates uncertainty and might hinder institutional funding.

Conclusion:

The hypothetical progress chart offered here’s a speculative exploration of Bitcoin’s potential trajectory past 2025. Whereas it suggests a typically optimistic outlook pushed by growing adoption and institutional curiosity, it additionally acknowledges the inherent volatility and dangers related to the cryptocurrency market. The precise worth of Bitcoin will rely on a fancy interaction of things, together with technological developments, regulatory developments, macroeconomic situations, and the general evolution of the cryptocurrency panorama. It’s essential for buyers to conduct thorough analysis, perceive the dangers, and diversify their portfolios earlier than investing in Bitcoin or every other cryptocurrency. This text serves as a thought-provoking exploration, not a monetary suggestion. All the time seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied useful insights into Bitcoin’s Trajectory Past 2025: A Hypothetical Development Chart and Market Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!