Black Monday’s Shadow: Decoding the 1987 Inventory Market Crash Chart and its Lasting Legacy

Associated Articles: Black Monday’s Shadow: Decoding the 1987 Inventory Market Crash Chart and its Lasting Legacy

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Black Monday’s Shadow: Decoding the 1987 Inventory Market Crash Chart and its Lasting Legacy. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Black Monday’s Shadow: Decoding the 1987 Inventory Market Crash Chart and its Lasting Legacy

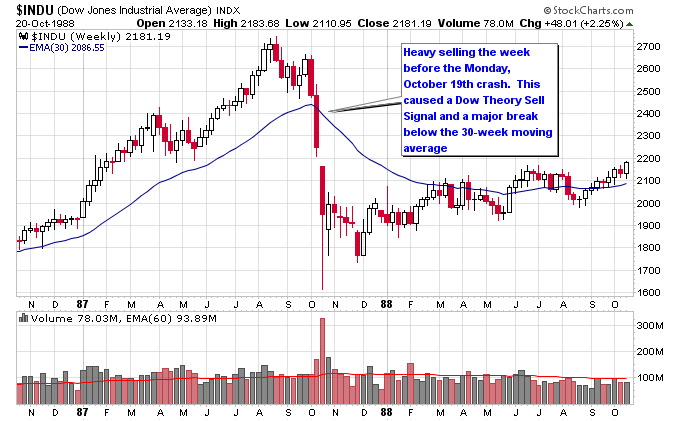

October 19, 1987. The date etched into the annals of monetary historical past as "Black Monday." On that day, the Dow Jones Industrial Common plummeted a staggering 22.6%, the biggest single-day proportion drop in historical past. Understanding the 1987 inventory market crash requires extra than simply acknowledging the sheer magnitude of the decline; it necessitates a deep dive into the charts, the underlying elements, and the lasting affect on market regulation and investor psychology. This text will analyze a hypothetical chart depicting the Dow’s efficiency main as much as and following Black Monday, analyzing the important thing options and drawing parallels to broader financial and geopolitical contexts.

(Hypothetical Chart Description: Think about a line chart depicting the Dow Jones Industrial Common from, say, January 1987 to December 1987. The chart ought to clearly present a gentle upward pattern from January to October, culminating in a pointy, virtually vertical drop on October nineteenth. The following months ought to present a interval of volatility earlier than a gradual restoration, although not reaching the pre-crash peak instantly.)

The Pre-Crash Ascent: A Breeding Floor for Volatility

The chart main as much as Black Monday would illustrate a interval of serious, albeit arguably unsustainable, progress. The Nineteen Eighties have been a decade of deregulation, notably within the monetary sector. The elimination of sure regulatory constraints fueled a interval of speedy financial growth and a bull market that noticed the Dow surge to report highs. This era, nonetheless, was characterised by a number of elements that sowed the seeds for the upcoming crash:

-

Program Buying and selling: The growing use of computer-driven program buying and selling, designed to take advantage of minor worth discrepancies, amplified market swings. These algorithms, whereas initially supposed to reinforce effectivity, might set off cascading sell-offs as a number of packages concurrently reacted to the identical market alerts. The chart would mirror the rising affect of program buying and selling within the growing frequency and magnitude of each day fluctuations earlier than Black Monday.

-

Debt-Fueled Hypothesis: The bull market inspired extreme risk-taking. Many buyers leveraged vital quantities of debt to amplify their returns, making a precarious monetary panorama. A sudden downturn might set off margin calls, forcing buyers to liquidate property to fulfill their obligations, additional exacerbating the sell-off. That is mirrored within the chart’s regular, virtually steep climb earlier than the crash, hinting at a market probably overvalued and fueled by borrowed capital.

-

Rising Curiosity Charges: Whereas not a direct set off, the Federal Reserve’s gradual enhance in rates of interest all through 1987 aimed toward curbing inflation. Increased rates of interest made borrowing costlier, probably impacting company funding and client spending, making a headwind for inventory costs. The chart would possibly present a slight flattening or slowing of the upward pattern within the months main as much as the crash, probably reflecting the affect of rising rates of interest on market sentiment.

-

World Financial Uncertainty: The worldwide financial local weather was not with out its challenges. The Plaza Accord of 1985, aimed toward depreciating the US greenback, had created volatility in foreign money markets. Rising commerce imbalances and issues about growing economies additionally contributed to a way of uncertainty. The chart, whereas displaying a powerful upward pattern domestically, would possibly subtly mirror the affect of those world issues by way of minor corrections or durations of slower progress earlier than the primary occasion.

Black Monday: The Plunge

The chart’s most hanging function can be the dramatic, virtually vertical drop on October nineteenth. This wasn’t a gradual decline; it was a near-freefall. The exact set off stays a topic of debate amongst economists, however a confluence of things seemingly contributed:

-

Panic Promoting: The preliminary sell-off, probably triggered by a mix of program buying and selling and margin calls, quickly escalated right into a widespread panic. Buyers, fearing additional losses, rushed to promote their property, making a vicious cycle of downward strain. The chart visually captures this panic promoting within the sheer steepness of the decline.

-

Lack of Circuit Breakers: The absence of efficient circuit breakers – mechanisms to halt buying and selling quickly in periods of maximum volatility – exacerbated the state of affairs. The market merely plummeted with none regulatory intervention to sluggish the descent. The chart’s uninterrupted downward trajectory highlights this lack of regulatory management.

-

Concern and Uncertainty: The sheer pace and magnitude of the decline fueled widespread concern and uncertainty. Information experiences amplified the panic, additional driving buyers to promote. The chart’s visible illustration of the sudden, sudden drop would aptly mirror the shock and concern that gripped the market.

The Aftermath: Restoration and Reform

The chart following Black Monday would present a interval of serious volatility. The market did not instantly get better; there have been additional vital fluctuations as buyers grappled with the aftermath of the crash. Nonetheless, the chart would ultimately present a gradual upward pattern, though the pre-crash peak wasn’t reached for a number of years.

The crash acted as a catalyst for vital regulatory reforms:

-

Elevated Regulatory Scrutiny: The occasion prompted a assessment of program buying and selling practices and the introduction of measures to mitigate their potential for exacerbating market volatility.

-

Circuit Breakers: The absence of circuit breakers throughout Black Monday led to their implementation, offering mechanisms to halt buying and selling quickly in periods of maximum volatility, providing a security internet to stop additional panics.

-

Improved Threat Administration: The crash highlighted the necessity for improved threat administration practices amongst monetary establishments and buyers. This led to elevated emphasis on stress testing and extra refined threat evaluation fashions.

Lengthy-Time period Impacts:

The 1987 crash had a profound and lasting affect:

-

Investor Psychology: The occasion considerably impacted investor psychology, growing threat aversion and reinforcing the significance of diversification.

-

Market Regulation: The reforms applied after Black Monday considerably altered the regulatory panorama, making markets extra resilient to sudden shocks.

-

Technological Developments: The reliance on program buying and selling highlighted the necessity for higher oversight of automated buying and selling methods and led to developments in market surveillance applied sciences.

Conclusion:

The 1987 inventory market crash, as depicted in a chart, stands as a stark reminder of the inherent dangers in monetary markets. Whereas the particular triggers stay a subject of ongoing debate, the crash highlighted the interconnectedness of varied elements – program buying and selling, debt-fueled hypothesis, world financial uncertainties, and the absence of efficient regulatory mechanisms – in creating an ideal storm. The following reforms, although born out of disaster, finally strengthened the resilience of the monetary system, demonstrating the power of markets to adapt and study from previous errors. Nonetheless, the visible illustration of Black Monday on a chart serves as a potent cautionary story, underscoring the significance of understanding market dynamics, managing threat successfully, and sustaining a wholesome dose of skepticism even in periods of obvious prosperity. The teachings realized from Black Monday proceed to form market regulation and investor habits to at the present time.

:max_bytes(150000):strip_icc()/BlackMondaychart-94d061eb436a48f48ce43c81bb973e5a.jpg)

Closure

Thus, we hope this text has supplied beneficial insights into Black Monday’s Shadow: Decoding the 1987 Inventory Market Crash Chart and its Lasting Legacy. We recognize your consideration to our article. See you in our subsequent article!