Breakout Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Breakout Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Breakout Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Breakout Chart Patterns: A Complete Information (PDF Downloadable)

Breakout chart patterns symbolize a strong software in technical evaluation, providing merchants alternatives to establish potential worth actions in varied monetary markets. These patterns emerge when a safety consolidates inside an outlined vary, adopted by a decisive break above (upward breakout) or under (downward breakout) the established boundaries. Recognizing and deciphering these patterns can considerably improve a dealer’s capability to foretell future worth route and handle danger. This complete information explores varied breakout patterns, their traits, buying and selling methods, and danger administration strategies. A downloadable PDF model is offered on the finish of this text.

Understanding Breakout Patterns: The Fundamentals

Breakout patterns are shaped during times of market indecision, the place consumers and sellers are comparatively balanced. This consolidation section ends in worth motion confined inside a particular vary, usually characterised by a predictable form. The sample’s significance lies within the subsequent breakout, which alerts a possible shift in momentum. Merchants make the most of these patterns to anticipate the continuation of the prevailing pattern or a possible reversal.

The effectiveness of breakout buying and selling depends on a number of key components:

- Quantity: Elevated quantity accompanying the breakout confirms the power of the transfer and validates the sign. Low quantity breakouts are sometimes thought of weaker and vulnerable to false alerts.

- Affirmation: Affirmation from different technical indicators, reminiscent of transferring averages or oscillators, strengthens the buying and selling sign and reduces the danger of false breakouts.

- Assist and Resistance Ranges: Breakouts are sometimes interpreted relative to established help and resistance ranges. A decisive break above resistance suggests upward momentum, whereas a break under help alerts potential draw back.

- Sample Form and Traits: The particular form and traits of the sample (e.g., triangle, rectangle, flag) present insights into the potential magnitude and period of the following worth transfer.

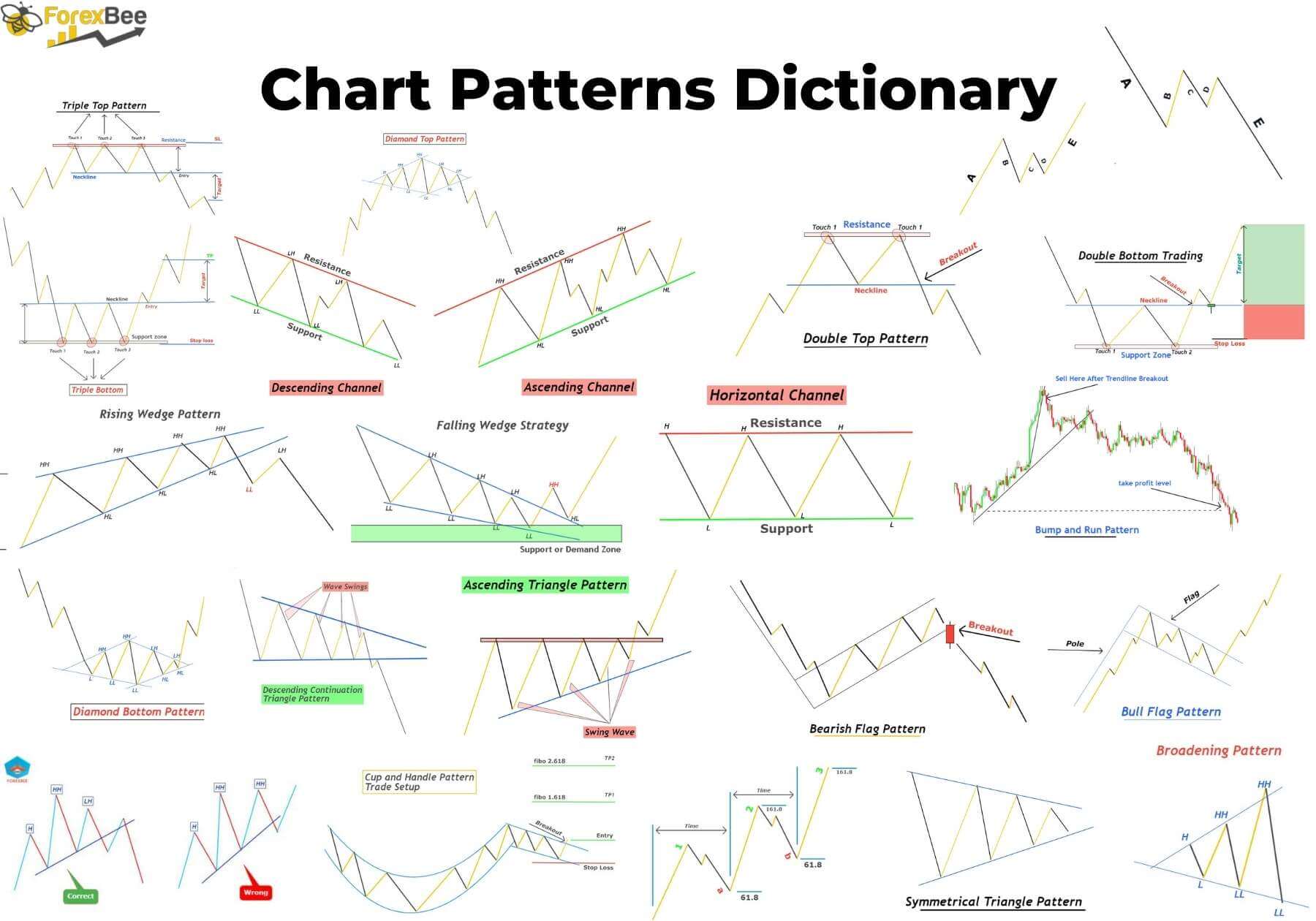

Frequent Breakout Chart Patterns:

A number of frequent breakout patterns present invaluable buying and selling alternatives. Let’s delve into a few of the most steadily used:

1. Triangles:

Triangles are characterised by converging trendlines, representing a interval of consolidation. There are three important sorts:

- Symmetrical Triangles: These patterns have converging trendlines with roughly equal slopes, suggesting a interval of indecision. The breakout route is unsure till the value breaks above the higher trendline (bullish) or under the decrease trendline (bearish).

- Ascending Triangles: These patterns have a flat decrease trendline (help) and an upward sloping higher trendline (resistance). They’re usually bullish, with a breakout anticipated above the higher trendline.

- Descending Triangles: These patterns have a downward sloping higher trendline (resistance) and a flat higher trendline (help). They’re usually bearish, with a breakout anticipated under the decrease trendline.

2. Rectangles:

Rectangles are characterised by two parallel horizontal trendlines, representing a interval of consolidation inside an outlined vary. A breakout above the higher trendline is taken into account bullish, whereas a breakout under the decrease trendline is taken into account bearish. The value goal after a rectangle breakout is usually calculated by measuring the peak of the rectangle and projecting that distance from the breakout level.

3. Flags and Pennants:

Flags and pennants are short-term consolidation patterns that seem inside a powerful trending market.

- Flags: These patterns resemble a barely sloped parallelogram, with the value consolidating inside parallel trendlines. The breakout is often within the route of the previous pattern.

- Pennants: These patterns resemble a symmetrical triangle however are shorter in period and usually happen inside a powerful pattern. The breakout is often within the route of the previous pattern.

4. Head and Shoulders:

Whereas technically a reversal sample, the breakout from a head and shoulders sample may be thought of a kind of breakout. The sample consists of three peaks, with the center peak (the "head") being considerably increased than the opposite two ("shoulders"). A decisive break under the neckline is taken into account a bearish sign.

5. Double Tops and Double Bottoms:

Just like head and shoulders, double tops and double bottoms are reversal patterns. A double high consists of two comparable worth peaks, whereas a double backside consists of two comparable worth troughs. A breakout under the neckline of a double high or above the neckline of a double backside alerts a possible pattern reversal.

Buying and selling Methods for Breakout Patterns:

A number of buying and selling methods may be employed when buying and selling breakout patterns:

- Aggressive Breakout Technique: Enter an extended place instantly after a worth breaks above resistance (bullish breakout) or a brief place instantly after a worth breaks under help (bearish breakout). This technique requires tight stop-loss orders to handle danger.

- Conservative Breakout Technique: Await affirmation earlier than getting into a commerce. This would possibly contain ready for a candlestick shut above resistance or under help, or affirmation from different technical indicators.

- Quantity Affirmation Technique: Solely enter a commerce if the breakout is accompanied by considerably elevated quantity. This confirms the power of the transfer and reduces the danger of false breakouts.

- Trailing Cease-Loss Technique: As soon as a commerce is entered, use a trailing stop-loss order to guard income and handle danger. This enables the commerce to trip the value motion whereas limiting potential losses.

Danger Administration in Breakout Buying and selling:

Efficient danger administration is essential in breakout buying and selling. Take into account these factors:

- Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Place stop-loss orders just under help for lengthy positions and simply above resistance for brief positions.

- Place Sizing: Decide the suitable place dimension based mostly in your danger tolerance and account steadiness. By no means danger greater than a small share of your capital on any single commerce.

- False Breakouts: Pay attention to the opportunity of false breakouts. These happen when the value breaks by way of a help or resistance stage however fails to maintain the transfer. Use affirmation alerts to cut back the danger of false breakouts.

- Cash Administration: Develop a complete cash administration plan to make sure long-term profitability. This contains setting clear buying and selling objectives, managing danger, and persistently evaluating your buying and selling efficiency.

Conclusion:

Breakout chart patterns supply a invaluable software for figuring out potential worth actions in monetary markets. By understanding the traits of varied patterns and using acceptable buying and selling methods and danger administration strategies, merchants can improve their capability to capitalize on market alternatives. Do not forget that no buying and selling technique ensures success, and diligent analysis, follow, and danger administration are essential for long-term profitability.

(Downloadable PDF Hyperlink Right here: [Insert PDF Link Here]) This PDF will include a summarized model of this text, together with charts illustrating every sample mentioned. The hyperlink will must be changed with an precise hyperlink to a hosted PDF file. The PDF ought to embrace visually interesting charts and clear explanations for simpler understanding.

Closure

Thus, we hope this text has offered invaluable insights into Breakout Chart Patterns: A Complete Information (PDF Downloadable). We hope you discover this text informative and useful. See you in our subsequent article!