Bullish Continuation Chart Patterns: Driving the Wave of Uptrends

Associated Articles: Bullish Continuation Chart Patterns: Driving the Wave of Uptrends

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Bullish Continuation Chart Patterns: Driving the Wave of Uptrends. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Bullish Continuation Chart Patterns: Driving the Wave of Uptrends

Bullish continuation patterns are invaluable instruments for technical merchants. They sign a brief pause or consolidation inside a prevailing uptrend, suggesting the upward momentum is more likely to resume after a interval of relaxation. Understanding these patterns permits merchants to determine potential shopping for alternatives and capitalize on additional worth appreciation. In contrast to reversal patterns, which point out a change within the dominant development, continuation patterns verify the present development and provide strategic entry factors for extending current lengthy positions or initiating new ones. This text delves into a number of key bullish continuation patterns, exploring their traits, identification methods, and danger administration methods.

Understanding the Nature of Consolidations

Earlier than analyzing particular patterns, it is essential to grasp the underlying idea of consolidation. In a dynamic market, costs not often transfer in a straight line. Uptrends are sometimes punctuated by durations of consolidation, the place the value motion turns into much less risky and buying and selling range-bound. These durations of consolidation may be pushed by a number of elements, together with profit-taking, information occasions, or just a brief pause earlier than the subsequent leg of the uptrend. Bullish continuation patterns emerge throughout these consolidations, offering visible affirmation that the underlying bullish development stays intact.

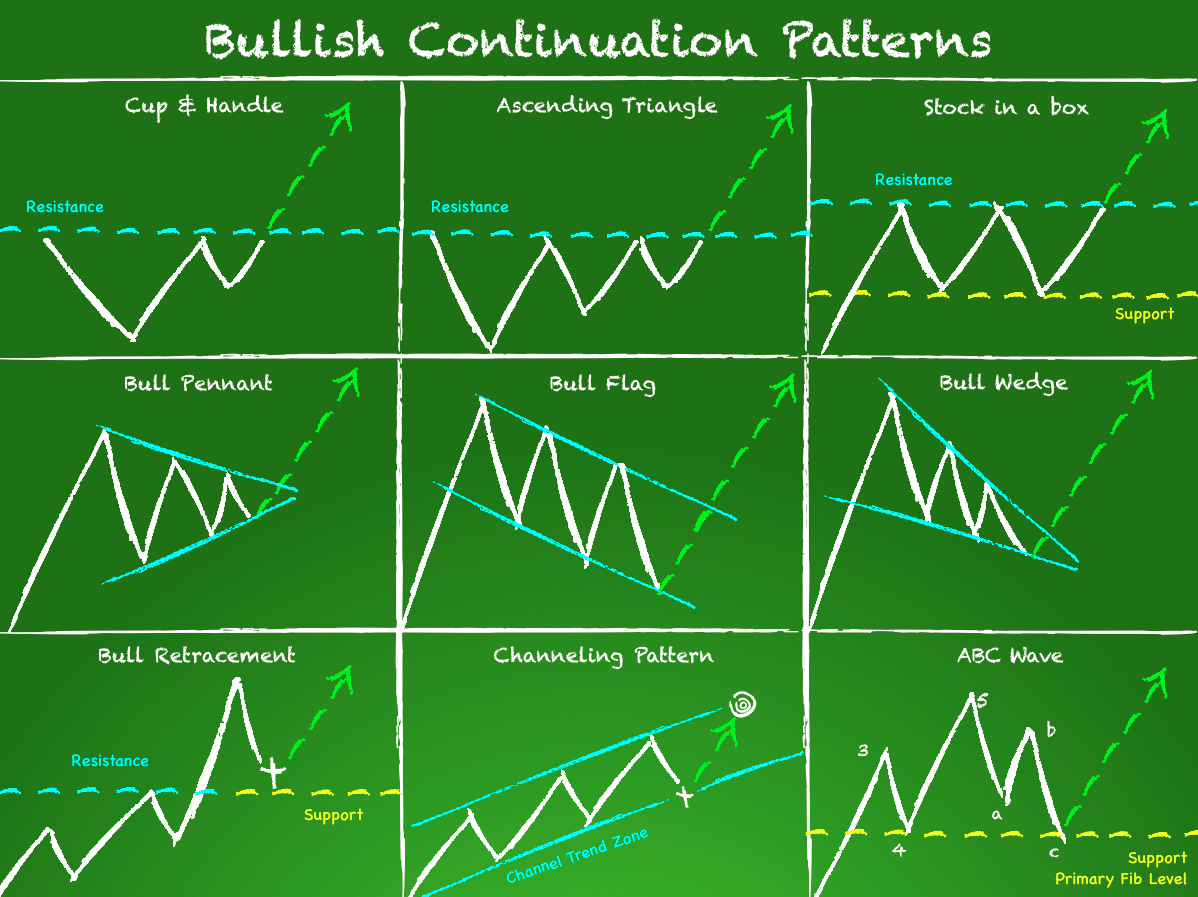

Key Bullish Continuation Chart Patterns:

A number of distinct patterns sign a bullish continuation. Every has its distinctive traits, serving to merchants to distinguish them and tailor their buying and selling methods accordingly.

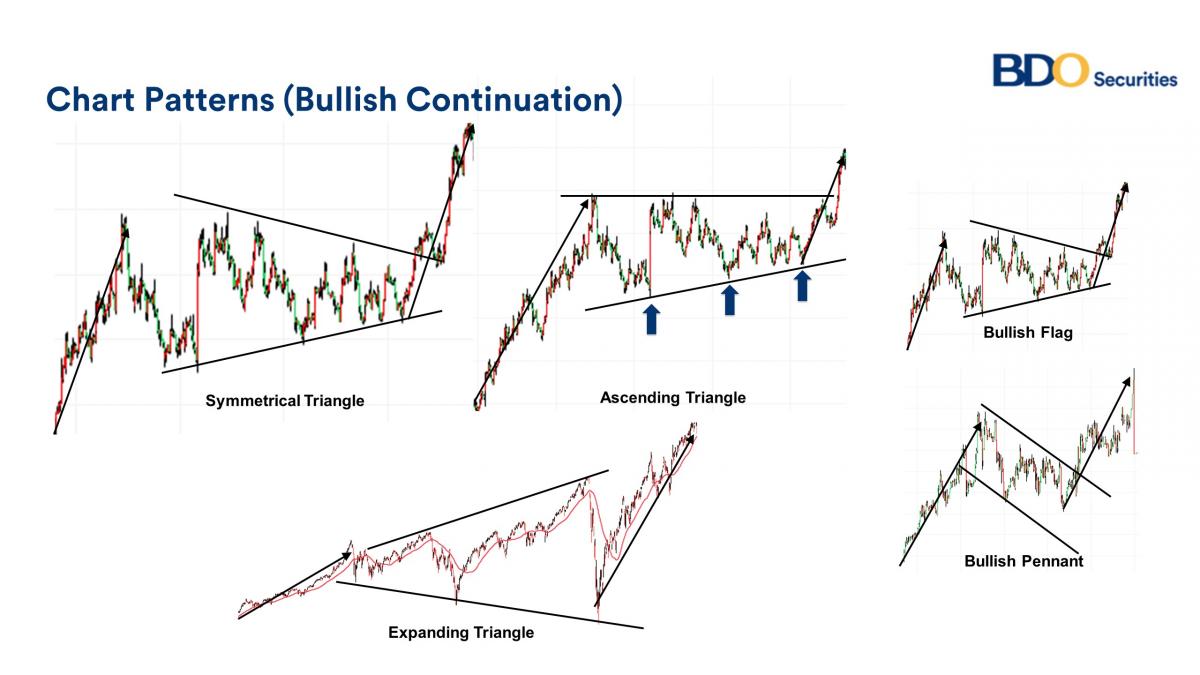

1. Triangles:

Triangles are among the many commonest and dependable continuation patterns. They’re characterised by converging trendlines, fashioned by connecting a collection of swing highs and swing lows. Three foremost forms of triangles exist:

-

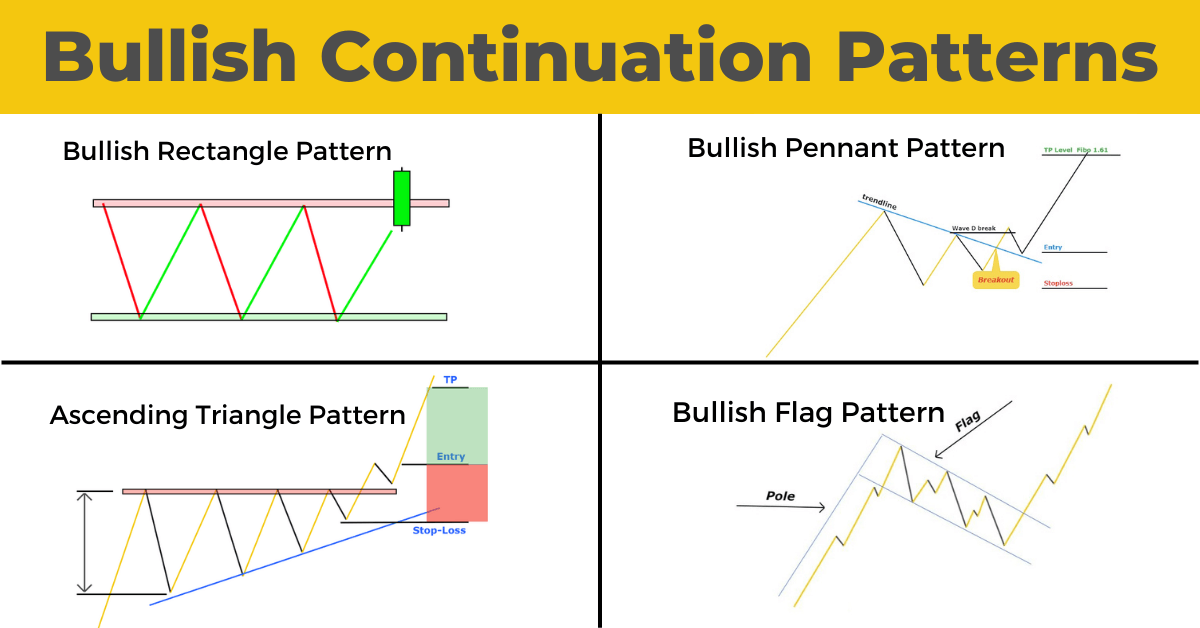

Ascending Triangles: These are fashioned by a horizontal resistance line and an upward-sloping help line. The value motion step by step pushes increased in opposition to the resistance, whereas help ranges constantly improve. Breakouts above the resistance line verify the continuation of the uptrend.

-

Descending Triangles: These characteristic a horizontal help line and a downward-sloping resistance line. The value motion step by step declines towards the help, whereas resistance ranges constantly lower. Breakouts above the resistance line verify the continuation of the uptrend.

-

Symmetrical Triangles: These are fashioned by converging trendlines with neither a horizontal help nor resistance line. The value motion oscillates inside a narrowing vary, making a symmetrical form. Breakouts above the higher trendline verify the continuation of the uptrend.

Figuring out Triangles:

Figuring out triangles entails plotting trendlines connecting swing highs and lows. The convergence of those traces ought to be comparatively clear. Merchants typically use Fibonacci retracement ranges to estimate the potential breakout goal. The breakout sometimes happens across the time the triangle’s width is reached.

2. Flags and Pennants:

Flags and pennants are characterised by a pointy worth transfer adopted by a interval of consolidation inside a parallelogram-shaped sample.

-

Flags: Flags show a comparatively parallel trendline sample, typically with a barely downward slope. This implies a brief pause within the uptrend.

-

Pennants: Pennants are characterised by converging trendlines, forming a triangular form, much like a miniature symmetrical triangle.

Figuring out Flags and Pennants:

Each patterns comply with a major worth advance. The consolidation part is comparatively short-lived, sometimes lasting a couple of days to some weeks. Breakouts above the higher trendline verify the continuation of the uptrend.

3. Rectangles:

Rectangles are horizontal consolidation patterns characterised by two parallel horizontal traces representing help and resistance. The value motion oscillates between these ranges earlier than ultimately breaking out. A breakout above the resistance line confirms the continuation of the uptrend.

Figuring out Rectangles:

Figuring out rectangles entails observing the constant worth motion bouncing between clearly outlined horizontal help and resistance ranges. The size of the consolidation interval can fluctuate considerably.

4. Double Tops and Bottoms (Whereas technically reversal, can act as continuation):

Whereas typically related to reversal patterns, double tops and bottoms can typically act as continuation patterns, significantly in robust trending markets. A double high happens when the value reaches an analogous excessive twice earlier than breaking out above the earlier excessive. A double backside, conversely, sees the value reaching an analogous low twice earlier than breaking out above the earlier low. In a powerful uptrend, a double backside may be interpreted as a brief pause earlier than the upward momentum resumes.

Figuring out Double Tops/Bottoms as Continuation:

The context is essential. Search for affirmation from different indicators, reminiscent of quantity and momentum, to find out if the sample is a continuation or a reversal. Robust quantity on the breakout confirms a continuation.

Threat Administration and Buying and selling Methods:

Profitable buying and selling with continuation patterns requires a strong danger administration technique:

-

Cease-Loss Orders: Place stop-loss orders under the help stage of the sample to restrict potential losses if the breakout fails.

-

Goal Costs: Use Fibonacci extensions or different technical indicators to undertaking potential worth targets after a breakout.

-

Affirmation: Search for affirmation of the breakout with elevated quantity and momentum.

-

Persistence: Keep away from impulsive buying and selling. Await a transparent breakout above the resistance line earlier than getting into a protracted place.

-

Place Sizing: Handle danger successfully by utilizing acceptable place sizing methods.

Conclusion:

Bullish continuation patterns provide priceless insights for merchants searching for to capitalize on ongoing uptrends. By understanding the traits of triangles, flags, pennants, rectangles, and even double bottoms in the best context, merchants can determine potential entry factors and handle danger successfully. Nevertheless, it is essential to do not forget that no sample ensures success. Combining chart patterns with different technical indicators and elementary evaluation enhances the accuracy of buying and selling selections. Constant follow, self-discipline, and danger administration are important for profitable buying and selling utilizing bullish continuation patterns. Keep in mind to at all times conduct thorough analysis and contemplate your private danger tolerance earlier than getting into any commerce.

Closure

Thus, we hope this text has offered priceless insights into Bullish Continuation Chart Patterns: Driving the Wave of Uptrends. We thanks for taking the time to learn this text. See you in our subsequent article!