Chart of Accounts for a Retail Retailer: A Complete Information

Associated Articles: Chart of Accounts for a Retail Retailer: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Chart of Accounts for a Retail Retailer: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Chart of Accounts for a Retail Retailer: A Complete Information

A well-structured chart of accounts (COA) is the spine of any profitable retail enterprise. It is a systematic itemizing of all of the monetary accounts utilized by an organization to report its monetary transactions. A strong COA permits for correct monetary reporting, environment friendly tax preparation, and knowledgeable enterprise decision-making. For a retail retailer, the COA must be particularly tailor-made to seize the distinctive features of its operations, together with stock administration, gross sales transactions, and varied bills. This text supplies a complete information to creating and managing a chart of accounts for a retail enterprise.

I. Understanding the Construction of a Retail Chart of Accounts:

A retail chart of accounts usually follows a standardized format, utilizing a numbering system to categorize accounts and keep consistency. This enables for simple monitoring and reporting. Widespread classes embrace:

-

Belongings: These characterize what the corporate owns. For a retail retailer, this consists of:

-

Present Belongings: Belongings anticipated to be transformed into money inside one yr. Examples embrace:

- Money on Hand

- Money in Financial institution

- Accounts Receivable (cash owed by prospects)

- Stock (items out there on the market)

- Pay as you go Bills (insurance coverage, lease, and many others.)

-

Non-Present Belongings: Belongings not anticipated to be transformed into money inside one yr. Examples embrace:

- Property, Plant, and Tools (PP&E) – Retailer constructing, fixtures, gear

- Lengthy-term Investments

-

Present Belongings: Belongings anticipated to be transformed into money inside one yr. Examples embrace:

-

Liabilities: These characterize what the corporate owes to others. Examples embrace:

-

Present Liabilities: Liabilities due inside one yr. Examples embrace:

- Accounts Payable (cash owed to suppliers)

- Salaries Payable

- Gross sales Tax Payable

- Brief-term Loans

-

Non-Present Liabilities: Liabilities due after one yr. Examples embrace:

- Lengthy-term Loans

- Mortgages

-

Present Liabilities: Liabilities due inside one yr. Examples embrace:

-

Fairness: This represents the proprietor’s stake within the enterprise. For a sole proprietorship or partnership, this could be a easy capital account. For a company, it will embrace:

- Widespread Inventory

- Retained Earnings

-

Income: This represents the revenue generated from the sale of products and companies. For a retail retailer, this consists of:

- Gross sales Income (from varied product classes)

- Gross sales Returns and Allowances (changes for returned or broken items)

- Different Income (e.g., rental revenue from unused house)

-

Bills: These characterize the prices incurred in working the enterprise. It is a essential part for retail companies and needs to be detailed to permit for efficient price administration. Examples embrace:

- Price of Items Bought (COGS): The direct prices related to producing or buying items bought. It is a vital account for retail companies and wishes cautious monitoring.

-

Working Bills: Prices incurred within the day-to-day operating of the enterprise. Examples embrace:

- Lease Expense

- Salaries and Wages

- Utilities (electrical energy, water, fuel)

- Advertising and marketing and Promoting

- Insurance coverage

- Repairs and Upkeep

- Depreciation (for PP&E)

- Credit score Card Processing Charges

- Transport and Dealing with

- Worker Advantages

- Workplace Provides

- Authorized and Skilled Charges

II. Particular Account Concerns for Retail Shops:

Retail companies require particular accounts to precisely mirror their operations. Listed here are some key concerns:

-

Stock Administration: A strong COA must accommodate totally different stock valuation strategies (FIFO, LIFO, weighted common) and monitor stock ranges precisely. This would possibly contain separate accounts for various product classes or areas. Contemplate accounts like:

- Stock – Uncooked Supplies (if relevant)

- Stock – Work in Progress (if relevant)

- Stock – Completed Items (for retail, this is almost all)

- Stock Shrinkage (to account for loss because of theft or harm)

-

Gross sales Monitoring: The COA ought to enable for detailed gross sales monitoring, damaged down by product class, gross sales channel (on-line, in-store), and cost technique. This enables for analyzing gross sales tendencies and figuring out best-selling merchandise. Contemplate accounts like:

- Gross sales Income – In-Retailer

- Gross sales Income – On-line

- Gross sales Income – Particular Product Classes (e.g., Clothes, Electronics)

- Gross sales Reductions

- Gross sales Tax Receivable

-

Buyer Relationship Administration (CRM): Whereas indirectly a part of the COA, integrating CRM knowledge can improve monetary reporting. Monitoring buyer segments and their buying conduct can inform advertising and marketing methods and stock administration.

-

Multi-Location Companies: If the retail retailer has a number of areas, the COA must be designed to trace monetary knowledge individually for every location. This enables for correct efficiency comparisons and identification of underperforming branches.

-

E-commerce Particular Accounts: For on-line retailers, further accounts are wanted to trace bills associated to web site upkeep, internet advertising, cost gateway charges, and transport prices.

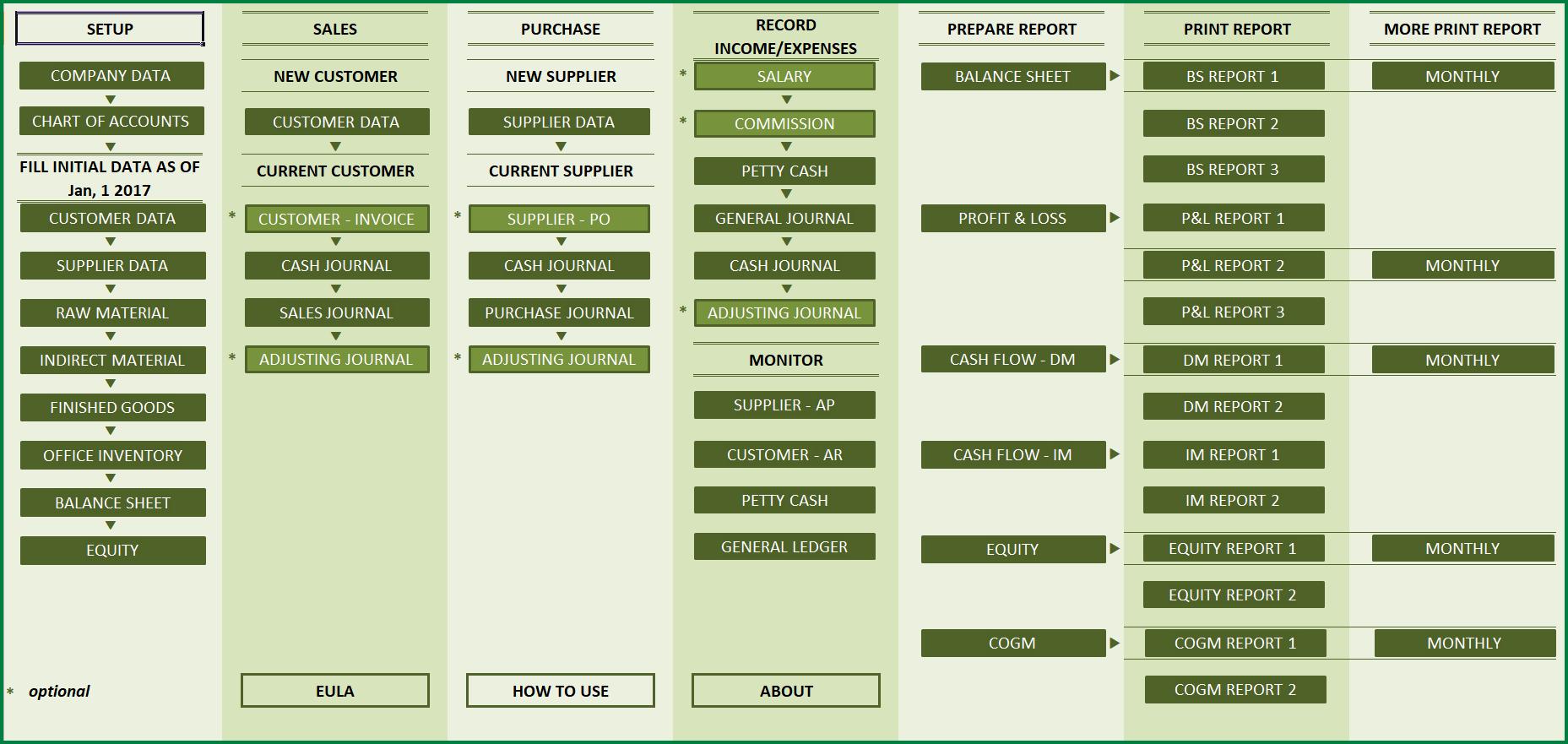

III. Selecting a Chart of Accounts Construction:

There are a number of methods to construction a COA. The most typical are:

-

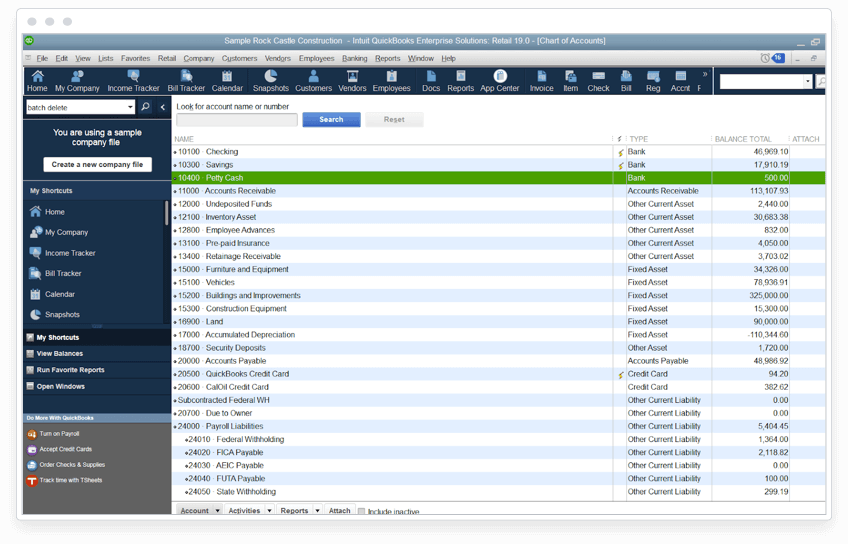

Numeric System: Accounts are assigned numbers, typically with a hierarchical construction (e.g., 1000-1999 for Belongings, 2000-2999 for Liabilities). That is typically most popular for its readability and ease of use with accounting software program.

-

Alphanumeric System: Combines numbers and letters for extra detailed categorization. This may be helpful for bigger companies with advanced operations.

-

Hybrid System: Combines parts of each numeric and alphanumeric programs.

IV. Implementing and Sustaining the Chart of Accounts:

-

Accounting Software program: Using accounting software program is essential for managing a COA successfully. Software program automates many duties, together with account creation, transaction recording, and monetary reporting. Well-liked choices embrace QuickBooks, Xero, and Sage.

-

Common Evaluation and Updates: The COA will not be a static doc. It needs to be reviewed and up to date commonly to mirror adjustments within the enterprise’s operations, new product strains, or evolving accounting requirements.

-

Consistency: Sustaining consistency in using accounts is crucial for correct monetary reporting. All staff concerned in monetary transactions needs to be educated on the correct use of the COA.

-

Inside Controls: Sturdy inside controls are crucial to stop errors and fraud. This consists of segregation of duties, common reconciliation of accounts, and periodic audits.

V. Instance Chart of Accounts for a Retail Retailer:

It is a simplified instance and needs to be tailored to the particular wants of your corporation:

| Account Quantity | Account Title | Class |

|---|---|---|

| 1000 | Money on Hand | Present Belongings |

| 1010 | Money in Financial institution | Present Belongings |

| 1100 | Accounts Receivable | Present Belongings |

| 1200 | Stock – Clothes | Present Belongings |

| 1210 | Stock – Equipment | Present Belongings |

| 1220 | Stock – Sneakers | Present Belongings |

| 1300 | Pay as you go Insurance coverage | Present Belongings |

| 1400 | Retailer Constructing | Non-Present Belongings |

| 1410 | Retailer Fixtures | Non-Present Belongings |

| 2000 | Accounts Payable | Present Liabilities |

| 2100 | Salaries Payable | Present Liabilities |

| 2200 | Gross sales Tax Payable | Present Liabilities |

| 3000 | Proprietor’s Fairness | Fairness |

| 4000 | Gross sales Income – Clothes | Income |

| 4010 | Gross sales Income – Equipment | Income |

| 4020 | Gross sales Income – Sneakers | Income |

| 5000 | Price of Items Bought – Clothes | Bills |

| 5010 | Price of Items Bought – Equipment | Bills |

| 5020 | Price of Items Bought – Sneakers | Bills |

| 5100 | Lease Expense | Bills |

| 5200 | Salaries Expense | Bills |

| 5300 | Utilities Expense | Bills |

| 5400 | Advertising and marketing Expense | Bills |

| 5500 | Insurance coverage Expense | Bills |

| 5600 | Depreciation Expense | Bills |

VI. Conclusion:

A well-designed and meticulously maintained chart of accounts is a vital element of profitable retail operations. By fastidiously categorizing accounts and monitoring monetary knowledge precisely, retail companies can acquire beneficial insights into their efficiency, make knowledgeable selections, and guarantee long-term profitability. Do not forget that it is a dynamic instrument that should adapt to the altering wants of your corporation. Common assessment, updates, and using applicable accounting software program are important for maximizing its effectiveness.

Closure

Thus, we hope this text has supplied beneficial insights into Chart of Accounts for a Retail Retailer: A Complete Information. We admire your consideration to our article. See you in our subsequent article!