Chart of Accounts for Rental Property: A Complete Information

Associated Articles: Chart of Accounts for Rental Property: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Chart of Accounts for Rental Property: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart of Accounts for Rental Property: A Complete Information

Managing rental properties efficiently requires meticulous monetary record-keeping. A well-structured chart of accounts is the cornerstone of this course of, offering a scientific framework for monitoring revenue, bills, and the general monetary well being of your funding. This text will delve into the important parts of a complete chart of accounts particularly designed for rental properties, providing steering on categorization, finest practices, and the advantages of a strong accounting system.

Understanding the Chart of Accounts:

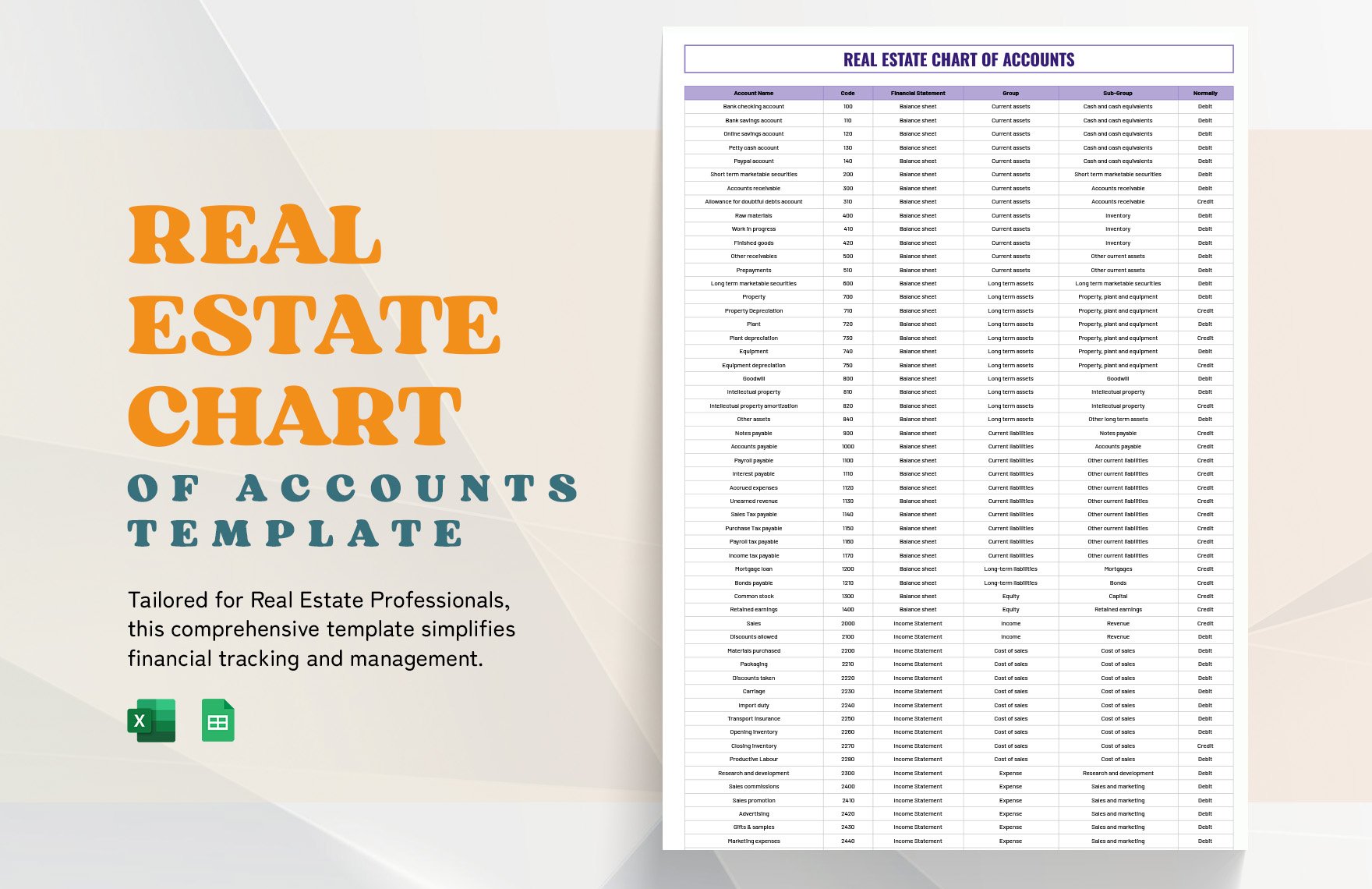

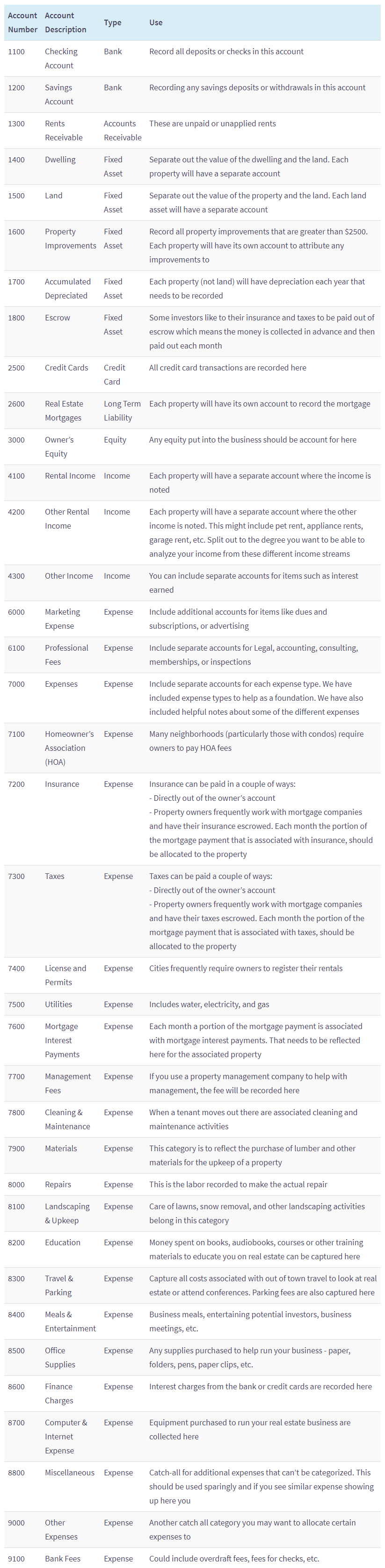

A chart of accounts is just a listing of all of the accounts utilized by a enterprise to document monetary transactions. Every account has a singular quantity and a descriptive identify, permitting for straightforward categorization and evaluation. For rental properties, this technique means that you can monitor revenue streams, numerous bills, and the general profitability of every property or your whole portfolio. A well-designed chart of accounts facilitates correct monetary reporting, tax preparation, and knowledgeable decision-making.

Key Account Classes for Rental Properties:

The chart of accounts for a rental property ought to be complete, but simply navigable. This is a breakdown of important classes, with examples of sub-accounts inside every:

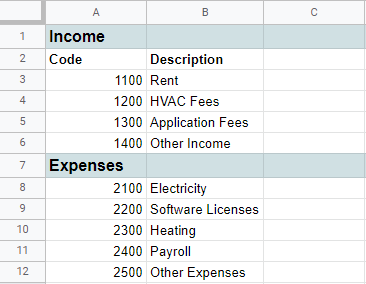

I. Revenue Accounts:

-

Rental Revenue: That is the first revenue supply. Sub-accounts could be created for every rental property to trace revenue individually:

4010-Rental Revenue - Property A4020-Rental Revenue - Property B4030-Rental Revenue - Property C

-

Late Charges: Observe late lease funds.

4040-Late Charges - Property A4050-Late Charges - Property B

-

Different Revenue: This class captures miscellaneous revenue sources, similar to:

4060-Parking Charges4070-Laundry Revenue4080-Storage Charges

II. Expense Accounts:

This part kinds the majority of your chart of accounts and requires detailed categorization for correct tax reporting and monetary evaluation.

-

Repairs and Upkeep: This can be a vital expense class. Think about breaking it down additional:

5010-Plumbing Repairs5020-Electrical Repairs5030-Equipment Repairs5040-Portray and Adorning5050-Roof Repairs5060-Landscaping

-

Insurance coverage: Separate accounts for several types of insurance coverage are essential:

5110-Property Insurance coverage5120-Legal responsibility Insurance coverage

-

Taxes: Categorize property taxes individually from different taxes:

5210-Property Taxes5220-Gross sales Tax (if relevant)

-

Utilities: Observe utility bills for every property individually:

5310-Water - Property A5320-Electrical energy - Property A5330-Gasoline - Property A-

5340-Water - Property Band so forth.

-

Mortgage Curiosity: If the property is mortgaged, monitor curiosity funds individually:

5410-Mortgage Curiosity - Property A5420-Mortgage Curiosity - Property B

-

Depreciation: Precisely monitor depreciation on the property and any enhancements. Use separate accounts for every property:

5510-Depreciation - Property A5520-Depreciation - Property B

-

Administration Charges: Should you use a property administration firm, monitor these charges:

5610-Property Administration Charges

-

Promoting and Advertising: Prices related to discovering tenants:

5710-Promoting Prices

-

Authorized and Skilled Charges: Bills associated to authorized recommendation, accounting, and so forth.:

5810-Authorized Charges5820-Accounting Charges

-

Emptiness Losses: Observe intervals when the property is vacant:

5910-Emptiness Losses

-

Provides: Observe minor provides used for upkeep:

6010-Cleansing Provides6020-Restore Provides

III. Asset Accounts:

-

Property: Checklist every rental property as a separate asset account:

1010-Property A1020-Property B

-

Safety Deposits: Observe safety deposits obtained from tenants:

1110-Safety Deposits - Property A1120-Safety Deposits - Property B

IV. Legal responsibility Accounts:

-

Mortgage Payable: Observe the excellent stability on any mortgages:

2010-Mortgage Payable - Property A2020-Mortgage Payable - Property B

- Different Liabilities: Embody some other excellent money owed or obligations.

V. Fairness Accounts:

- Proprietor’s Fairness: This account displays the proprietor’s funding within the rental property.

Finest Practices for Chart of Accounts Design:

- Consistency: Keep constant naming conventions and numbering methods all through your chart of accounts.

- Specificity: Use detailed sub-accounts to trace bills precisely. That is essential for tax functions and monetary evaluation.

- Common Overview: Periodically evaluate your chart of accounts to make sure it stays related and displays your present wants. Add or modify accounts as essential.

- Software program Integration: Use accounting software program that integrates seamlessly along with your chart of accounts. This can streamline your bookkeeping and reporting processes.

- Tax Issues: Construction your chart of accounts to align with tax laws. Correct categorization is important for correct tax filings.

Advantages of a Nicely-Structured Chart of Accounts:

- Improved Monetary Reporting: Correct monetary statements present a transparent image of your rental property’s efficiency.

- Enhanced Tax Compliance: Correctly categorized bills simplify tax preparation and cut back the chance of errors.

- Efficient Budgeting and Forecasting: Observe bills and revenue to create practical budgets and forecasts.

- Higher Determination-Making: Information-driven insights allow knowledgeable selections relating to repairs, renovations, and different investments.

- Streamlined Bookkeeping: A well-organized chart of accounts simplifies the bookkeeping course of, saving effort and time.

Selecting Accounting Software program:

Quite a few accounting software program choices can be found, catering to numerous wants and budgets. Think about elements like ease of use, options, scalability, and integration capabilities when selecting software program. Standard choices embrace QuickBooks Self-Employed, Xero, and FreshBooks. Many supply free trials, permitting you to check the software program earlier than committing.

Conclusion:

A well-designed chart of accounts is an indispensable instrument for managing rental properties successfully. By meticulously monitoring revenue and bills, you possibly can achieve useful insights into your funding’s efficiency, optimize your monetary technique, and guarantee compliance with tax laws. Investing time in making a complete and well-organized chart of accounts is a vital step in direction of profitable rental property administration. Bear in mind to seek the advice of with a tax skilled or accountant to make sure your chart of accounts aligns with present tax legal guidelines and finest practices to your particular circumstances.

Closure

Thus, we hope this text has supplied useful insights into Chart of Accounts for Rental Property: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!