Chart of Accounts Record Template: A Complete Information for Companies of All Sizes

Associated Articles: Chart of Accounts Record Template: A Complete Information for Companies of All Sizes

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Chart of Accounts Record Template: A Complete Information for Companies of All Sizes. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart of Accounts Record Template: A Complete Information for Companies of All Sizes

A chart of accounts (COA) is the spine of any sound monetary system. It is a structured listing of all of the accounts a enterprise makes use of to file its monetary transactions. Consider it as an in depth organizational map of your organization’s funds, categorizing each penny earned and spent. With out a well-designed and meticulously maintained COA, correct monetary reporting, budgeting, and evaluation turn out to be just about unattainable. This text gives a complete information to making a chart of accounts listing template, protecting its construction, important components, finest practices, and concerns for companies of assorted sizes and industries.

Understanding the Construction of a Chart of Accounts

A typical chart of accounts follows a hierarchical construction, typically utilizing a numbering system for clear categorization and straightforward identification. This construction sometimes organizes accounts into main classes, then subcategories, and eventually, particular person accounts. The commonest construction makes use of a five-digit or extra numbering system, although the particular format may be tailored to the corporate’s wants.

A typical construction may appear like this:

-

1000 – Belongings: Symbolize what an organization owns.

-

1100 – Present Belongings: Belongings anticipated to be transformed to money inside a yr.

- 1110 – Money: Money available and in banks.

- 1120 – Accounts Receivable: Cash owed to the corporate by clients.

- 1130 – Stock: Items held on the market.

-

1200 – Non-Present Belongings: Belongings anticipated for use for greater than a yr.

- 1210 – Property, Plant, and Tools (PP&E): Buildings, equipment, and many others.

- 1220 – Intangible Belongings: Patents, copyrights, logos.

-

1100 – Present Belongings: Belongings anticipated to be transformed to money inside a yr.

-

2000 – Liabilities: Symbolize what an organization owes to others.

-

2100 – Present Liabilities: Money owed due inside a yr.

- 2110 – Accounts Payable: Cash owed to suppliers.

- 2120 – Salaries Payable: Wages owed to staff.

- 2130 – Brief-Time period Loans: Loans due inside a yr.

-

2200 – Non-Present Liabilities: Money owed due in additional than a yr.

- 2210 – Lengthy-Time period Loans: Loans due in additional than a yr.

- 2220 – Mortgage Payable: Mortgage on property.

-

2100 – Present Liabilities: Money owed due inside a yr.

-

3000 – Fairness: Represents the proprietor’s funding within the firm.

- 3100 – Proprietor’s Fairness: Capital contributions and retained earnings.

-

4000 – Income: Earnings generated from enterprise operations.

- 4100 – Gross sales Income: Income from gross sales of products or providers.

- 4200 – Service Income: Income from providers supplied.

-

5000 – Bills: Prices incurred in producing income.

- 5100 – Value of Items Bought (COGS): Direct prices related to producing items.

- 5200 – Promoting Bills: Bills associated to advertising and marketing and gross sales.

- 5300 – Administrative Bills: Bills associated to basic enterprise operations.

- 5400 – Analysis and Improvement Bills: Bills associated to analysis and improvement actions.

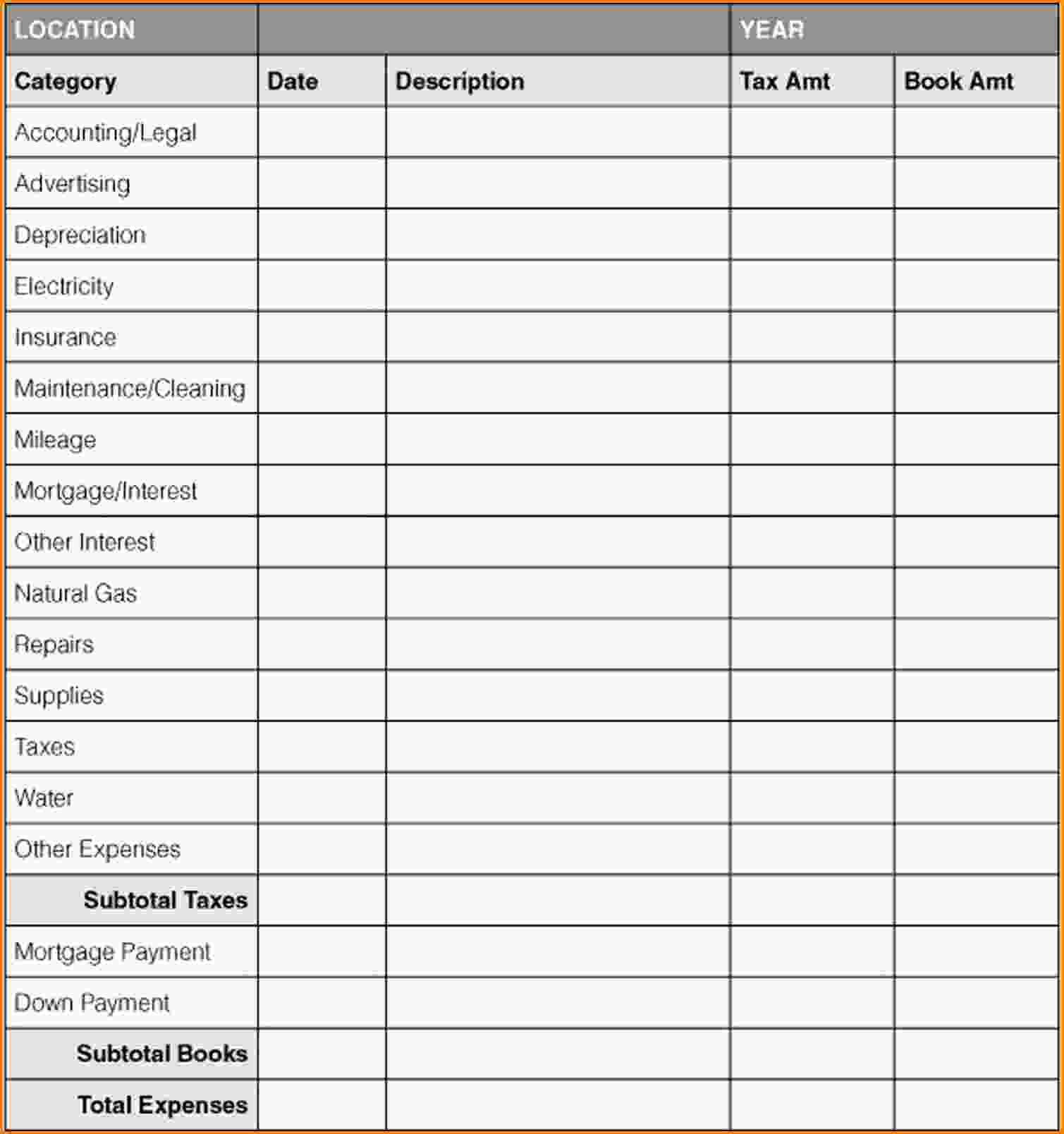

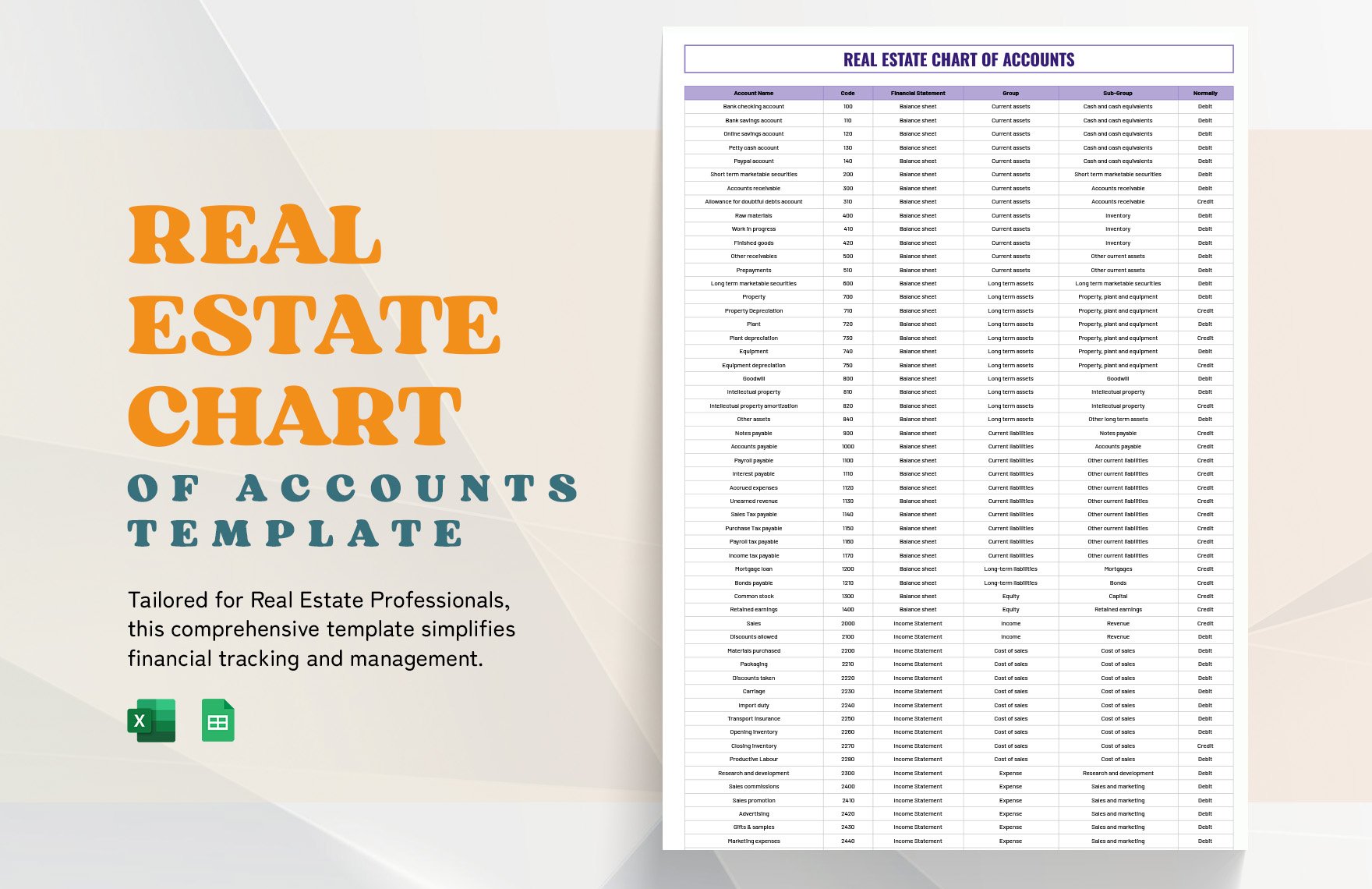

Important Components of a Chart of Accounts Record Template

A complete chart of accounts template ought to embrace the next components:

- Account Quantity: A singular numerical identifier for every account.

- Account Title: A transparent and descriptive title for every account.

- Account Sort: Signifies whether or not the account is an asset, legal responsibility, fairness, income, or expense.

- Description: A short clarification of the account’s function.

- Regular Stability: Signifies whether or not the account sometimes has a debit or credit score stability (property, bills, and dividends have debit balances; liabilities, fairness, and revenues have credit score balances).

- Sub-accounts (if relevant): Permits for additional breakdown of main accounts.

Greatest Practices for Making a Chart of Accounts

- Begin Easy, then Develop: Start with a primary chart of accounts and add accounts as your online business grows and its wants evolve.

- Use a Constant Numbering System: This ensures readability and facilitates environment friendly reporting.

- Be Particular and Descriptive: Use clear and concise account names that precisely replicate the account’s function.

- Keep Consistency: Adhere to the identical accounting ideas and practices constantly all through the chart of accounts.

- Frequently Evaluate and Replace: Periodically evaluation your chart of accounts to make sure it stays correct and related to your online business operations. Modifications in enterprise actions or accounting requirements could necessitate changes.

- Take into account Trade-Particular Accounts: Some industries have distinctive accounting necessities, so tailor your COA to replicate these wants. For instance, a producing firm will want accounts for work-in-progress and completed items stock, whereas a service-based enterprise may not.

- Use a Chart of Accounts Software program: Accounting software program can automate many points of COA administration, lowering handbook effort and enhancing accuracy.

Chart of Accounts Templates for Totally different Enterprise Sizes

The complexity of a chart of accounts will range relying on the scale and nature of the enterprise.

Small Companies: A smaller enterprise may use an easier COA with fewer accounts. They will concentrate on the important classes like money, accounts receivable, accounts payable, gross sales income, and main expense classes.

Medium-Sized Companies: As a enterprise grows, its COA might want to turn out to be extra detailed. This may embrace extra particular expense accounts, separate accounts for various product strains or departments, and accounts for long-term property and liabilities.

Giant Companies: Giant companies typically have very complicated COAs with quite a few accounts and sub-accounts. They may use a multi-level numbering system and make use of specialised accounting software program to handle their monetary knowledge successfully.

Trade-Particular Concerns

The chart of accounts also needs to be tailor-made to the particular business by which the enterprise operates. For instance:

- Retail: Wants accounts for stock, gross sales reductions, and returns.

- Manufacturing: Requires accounts for uncooked supplies, work-in-progress, and completed items.

- Service-Based mostly Companies: Deal with accounts for service income and associated bills.

- Non-profit Organizations: Wants accounts for grants, donations, and program bills.

Software program and Instruments for Chart of Accounts Administration

Quite a few accounting software program packages supply instruments to create, handle, and keep a chart of accounts. These instruments typically present options like:

- Automated Account Numbering: Simplifies the creation of recent accounts.

- Account Hierarchy Visualization: Gives a transparent overview of the COA construction.

- Integration with different Monetary Programs: Facilitates seamless knowledge stream between completely different accounting modules.

- Reporting and Evaluation Instruments: Permits the era of assorted monetary stories based mostly on the COA knowledge.

Conclusion:

A well-designed chart of accounts is essential for correct monetary reporting, budgeting, and evaluation. By following the very best practices outlined on this article and choosing an acceptable template, companies of all sizes can create a COA that successfully helps their monetary administration wants. Do not forget that the COA is a residing doc; it needs to be repeatedly reviewed and up to date to replicate the evolving wants of the enterprise. Investing effort and time in creating and sustaining a strong COA pays dividends when it comes to improved monetary management and decision-making. The bottom line is to begin with a strong basis, adapt it to your particular wants, and keep its accuracy over time.

Closure

Thus, we hope this text has supplied precious insights into Chart of Accounts Record Template: A Complete Information for Companies of All Sizes. We hope you discover this text informative and useful. See you in our subsequent article!