Chart of Accounts Varieties: A Complete Information for Companies

Associated Articles: Chart of Accounts Varieties: A Complete Information for Companies

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Chart of Accounts Varieties: A Complete Information for Companies. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Chart of Accounts Varieties: A Complete Information for Companies

A chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured record of all of the accounts a enterprise makes use of to file its monetary transactions. Selecting the best sort of chart of accounts is essential for correct monetary reporting, environment friendly bookkeeping, and knowledgeable decision-making. Whereas the basic ideas stay constant, the precise construction and categorization can differ considerably relying on the enterprise’s dimension, {industry}, and accounting wants. This text delves into the assorted forms of chart of accounts, highlighting their strengths and weaknesses to assist companies choose probably the most acceptable choice.

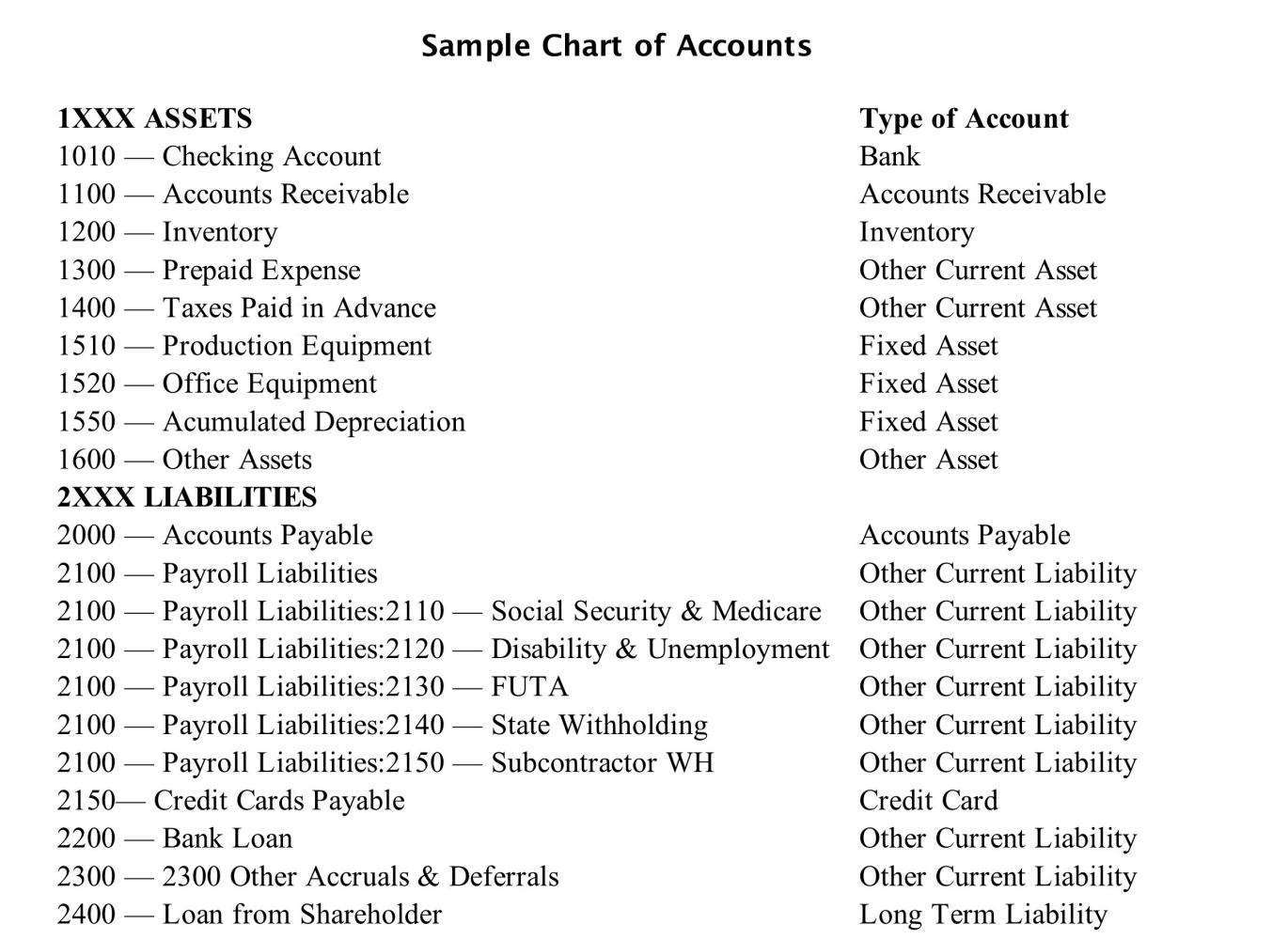

1. The Conventional Chart of Accounts:

That is the commonest and broadly understood sort of chart of accounts. It follows a hierarchical construction, usually utilizing a numbering system to categorize accounts into main teams and subgroups. These teams normally symbolize broad monetary points of the enterprise, reminiscent of property, liabilities, fairness, income, and bills. Every account inside these teams is additional detailed, permitting for granular monitoring of particular transactions.

-

Benefits: Easy to know and implement, broadly accepted by accounting software program and professionals, readily adaptable to varied enterprise sizes. The hierarchical construction permits for simple summarization and reporting.

-

Disadvantages: Can grow to be cumbersome and complicated for bigger companies with various operations. Sustaining consistency and accuracy throughout quite a few accounts might be difficult. It may not be versatile sufficient to accommodate specialised accounting wants of particular industries. For instance, a producing firm would possibly require extra detailed stock monitoring than a easy service-based enterprise.

-

Instance Construction:

-

1000 – Belongings:

- 1100 – Present Belongings

- 1110 – Money

- 1120 – Accounts Receivable

- 1200 – Mounted Belongings

- 1210 – Property, Plant, and Tools

- 1100 – Present Belongings

-

2000 – Liabilities:

- 2100 – Present Liabilities

- 2110 – Accounts Payable

- 2200 – Lengthy-Time period Liabilities

- 2210 – Mortgage Payable

- 2100 – Present Liabilities

-

3000 – Fairness:

- 3100 – Retained Earnings

-

4000 – Income:

- 4100 – Gross sales Income

-

5000 – Bills:

- 5100 – Price of Items Offered

- 5200 – Working Bills

-

1000 – Belongings:

2. The Business-Particular Chart of Accounts:

Many industries have distinctive accounting necessities and rules. An industry-specific chart of accounts is designed to replicate these particular wants. For instance, a development firm would possibly want accounts for progress billings, retainage, and alter orders, that are much less related to a retail enterprise. Equally, a healthcare supplier would require accounts for affected person billing, insurance coverage reimbursements, and medical provides, which aren’t typical for a producing agency.

-

Benefits: Offers a pre-configured construction tailor-made to the {industry}’s particular accounting practices and regulatory necessities. This simplifies the setup course of and ensures compliance.

-

Disadvantages: May not be fully adaptable to the distinctive wants of a selected enterprise inside that {industry}. Switching to a distinct industry-specific chart of accounts might be disruptive and time-consuming.

-

Instance: A development chart of accounts would possibly embrace accounts for "Progress Billings," "Retainage Revenue," "Change Orders," and "Building in Progress," which would not be present in a retail chart of accounts.

3. The Modified Chart of Accounts:

This can be a hybrid strategy the place companies begin with an ordinary chart of accounts (both conventional or industry-specific) and modify it to fulfill their particular wants. This enables for personalisation whereas sustaining a level of standardization. It affords flexibility with out sacrificing the advantages of a structured strategy.

-

Benefits: Presents a steadiness between standardization and customization. Permits companies to tailor their accounting system to their particular operational necessities.

-

Disadvantages: Requires cautious planning and execution to make sure consistency and accuracy. The modification course of might be time-consuming and require experience in accounting ideas. Inconsistent modifications can result in reporting inaccuracies.

-

Instance: A retail enterprise would possibly modify an ordinary chart of accounts by including accounts for particular product classes or advertising and marketing campaigns to trace efficiency extra precisely.

4. The Custom-made Chart of Accounts:

This kind of chart of accounts is designed from scratch to fulfill the distinctive wants of a specific enterprise. It affords most flexibility however requires vital experience in accounting ideas and the enterprise’s operations. That is usually utilized by giant companies with advanced monetary buildings and various enterprise models.

-

Benefits: Offers most flexibility to accommodate the precise accounting wants and reporting necessities of the enterprise. Permits for a extremely tailor-made and environment friendly monetary administration system.

-

Disadvantages: Requires vital experience in accounting and enterprise operations. Could be costly and time-consuming to develop and implement. Sustaining consistency and accuracy might be difficult. Integration with current accounting software program would possibly require vital customization.

5. The Chart of Accounts for Non-profit Organizations:

Non-profit organizations have distinctive accounting necessities, usually ruled by particular rules and reporting requirements. Their chart of accounts usually consists of accounts for various funding sources, grants, donations, and program bills. These accounts are designed to display the accountable use of funds and adjust to regulatory necessities.

-

Benefits: Particularly designed to fulfill the distinctive accounting wants of non-profits, guaranteeing compliance with regulatory necessities and facilitating clear reporting.

-

Disadvantages: May not be appropriate for for-profit companies. The construction could also be extra advanced than an ordinary chart of accounts.

Selecting the Proper Chart of Accounts:

The number of the suitable chart of accounts sort is determined by a number of components:

-

Enterprise Dimension and Complexity: Small companies would possibly discover a conventional or modified chart of accounts enough, whereas bigger companies with various operations would possibly want a personalized or industry-specific chart.

-

Business: Sure industries have distinctive accounting necessities, necessitating using industry-specific charts.

-

Accounting Software program: The chosen accounting software program would possibly affect the construction and format of the chart of accounts.

-

Reporting Necessities: The extent of element required for monetary reporting will affect the granularity of the chart of accounts.

-

Regulatory Compliance: Compliance with industry-specific rules and accounting requirements is essential in choosing the suitable chart of accounts.

Conclusion:

Choosing the suitable chart of accounts is a crucial determination for any enterprise. A well-designed chart of accounts ensures correct monetary reporting, facilitates environment friendly bookkeeping, and helps knowledgeable decision-making. Understanding the assorted forms of chart of accounts and their respective strengths and weaknesses is essential for making an knowledgeable selection that aligns with the enterprise’s particular wants and goals. Consulting with an accounting skilled is extremely beneficial to make sure the chosen chart of accounts is suitable and successfully helps the enterprise’s monetary administration objectives. Common overview and updates to the chart of accounts are additionally essential to replicate modifications within the enterprise’s operations and regulatory surroundings.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has supplied invaluable insights into Chart of Accounts Varieties: A Complete Information for Companies. We hope you discover this text informative and useful. See you in our subsequent article!