Chart of the Week: Unpacking the International Semiconductor Scarcity’s Lingering Impression

Associated Articles: Chart of the Week: Unpacking the International Semiconductor Scarcity’s Lingering Impression

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Chart of the Week: Unpacking the International Semiconductor Scarcity’s Lingering Impression. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart of the Week: Unpacking the International Semiconductor Scarcity’s Lingering Impression

![]()

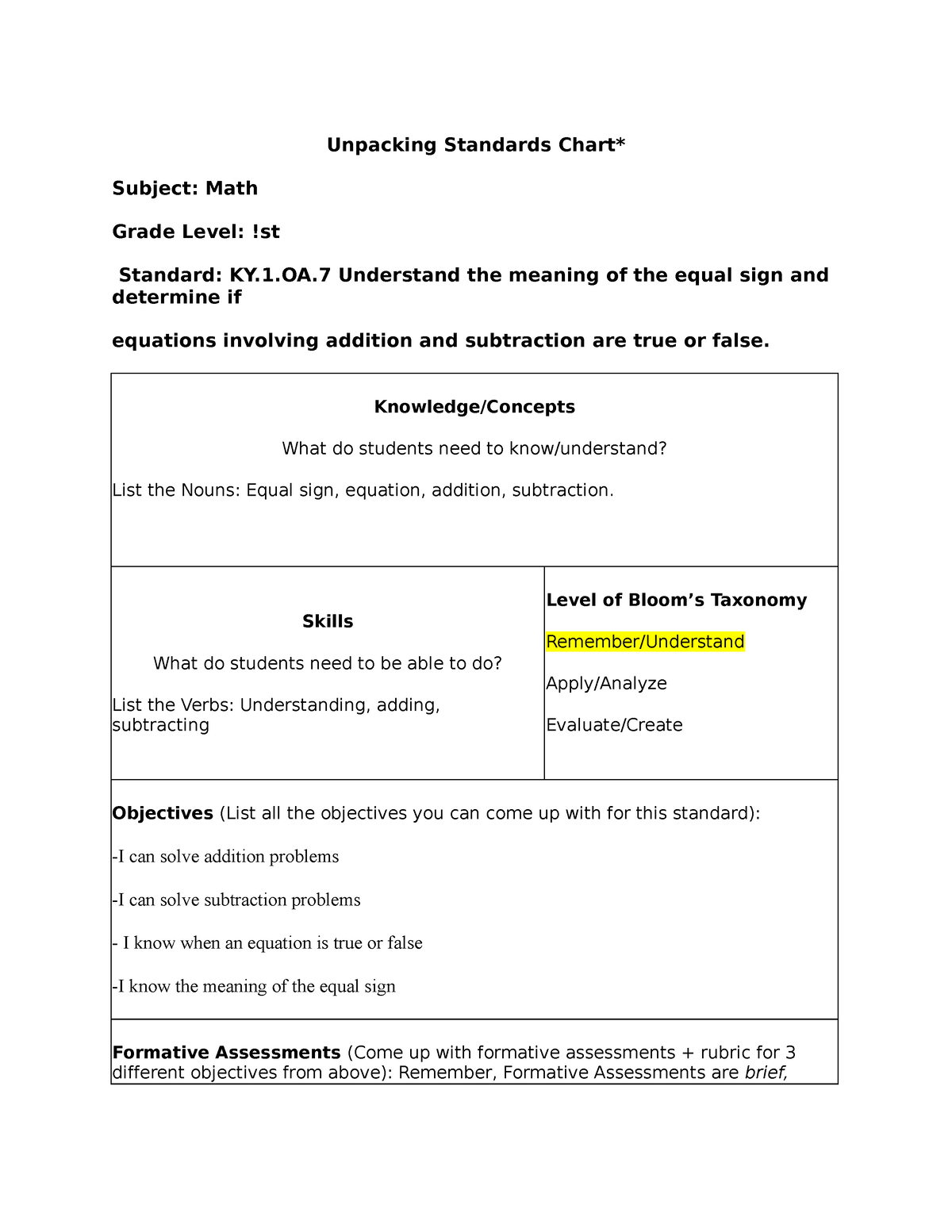

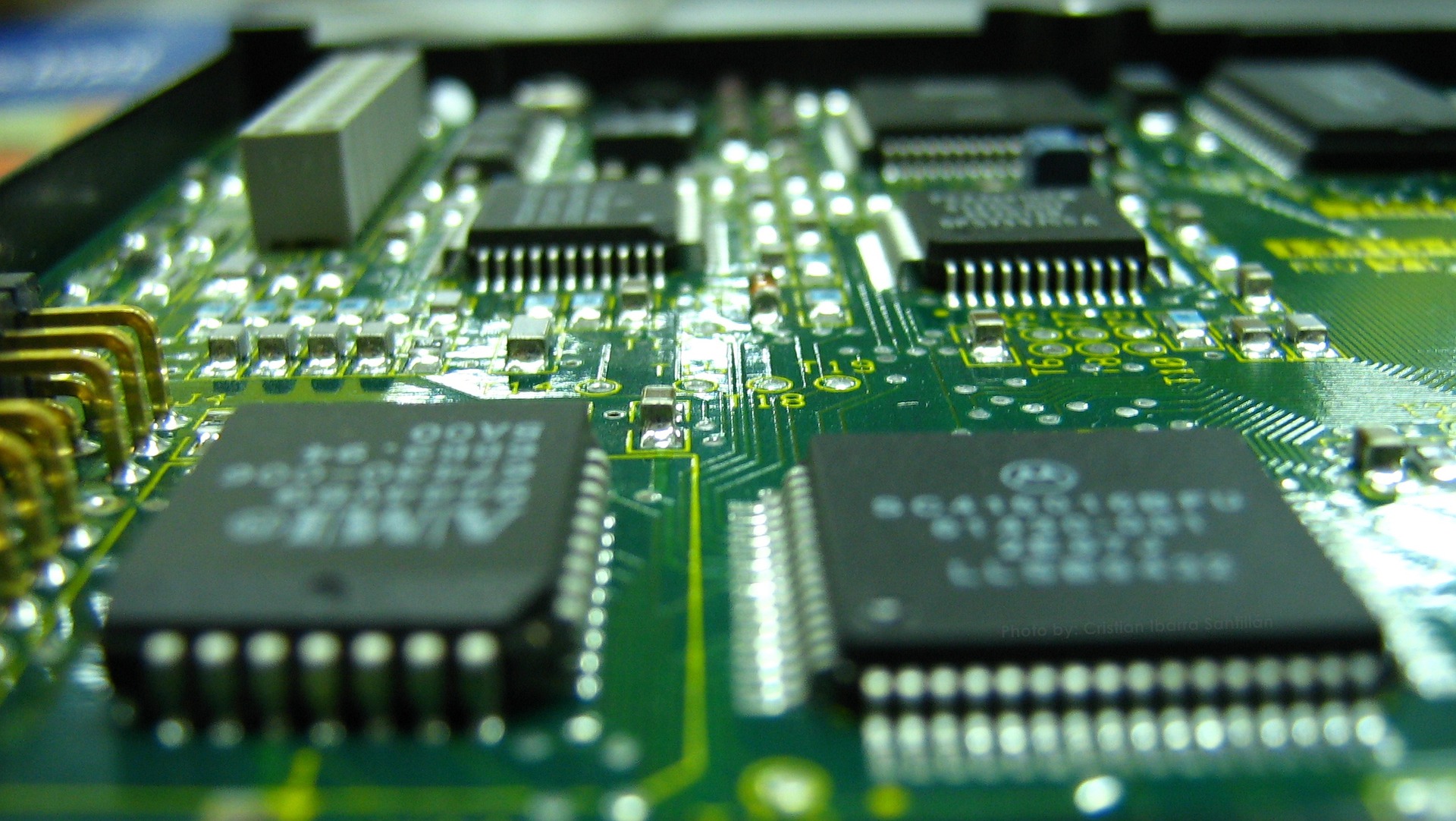

This week’s chart focuses on the lingering results of the worldwide semiconductor scarcity, a disaster that dramatically impacted varied industries from automotive manufacturing to shopper electronics in 2020 and 2021. Whereas the speedy acute section has subsided, the ripple results proceed to reshape international provide chains and financial landscapes. The chart we’ll analyze depicts the year-over-year share change in international semiconductor gross sales from 2019 to 2023 (projected), highlighting the volatility and uneven restoration throughout completely different market segments.

(Insert chart right here: A line graph exhibiting year-over-year share change in international semiconductor gross sales, ideally damaged down by main software segments like automotive, shopper electronics, computing, and so on. Knowledge ought to present a big drop in 2020-2021 adopted by a restoration, however with uneven development throughout segments.)

The preliminary shock of the semiconductor scarcity, triggered by a confluence of things together with the COVID-19 pandemic, elevated demand for electronics fueled by distant work and digitalization, and geopolitical tensions, led to a big downturn in manufacturing and availability. Automotive producers have been significantly exhausting hit, dealing with manufacturing halts and important monetary losses as a consequence of a scarcity of important microchips. This shortage drove costs up, creating additional instability in already fragile provide chains.

The chart clearly demonstrates the sharp decline in semiconductor gross sales development in 2020 and 2021. The damaging development percentages replicate the shortcoming of producers to satisfy the surging demand, resulting in backlogs, delays, and finally, misplaced income. The following restoration, whereas optimistic, is much from uniform. Some segments, like shopper electronics, skilled a faster rebound, pushed by pent-up demand and continued technological developments. Others, notably the automotive trade, have confronted a slower and more difficult restoration path.

Dissecting the Uneven Restoration:

The uneven nature of the restoration highlights the advanced interaction of things influencing semiconductor demand and provide. Whereas the general market has proven indicators of development, the precise wants and restoration trajectories of various sectors differ considerably:

-

Automotive: The automotive trade stays significantly weak. The lengthy lead occasions for semiconductor orders, coupled with the advanced and extremely specialised nature of automotive chips, imply that the trade continues to grapple with provide constraints. This has resulted in persistent manufacturing delays, impacting automobile availability and driving up costs for customers. The shift in direction of electrical automobiles (EVs) additional exacerbates the difficulty, as EVs require a considerably greater variety of chips in comparison with conventional combustion engine automobiles.

-

Client Electronics: The patron electronics sector, boosted by robust demand for laptops, smartphones, and gaming consoles through the pandemic, skilled a comparatively sooner restoration. Nevertheless, this phase can also be vulnerable to fluctuations in shopper spending and evolving technological tendencies. The saturation of the market in sure areas and the emergence of recent applied sciences can impression demand and, consequently, semiconductor gross sales.

-

Computing: The computing sector, encompassing knowledge facilities, servers, and private computer systems, has proven comparatively secure development. The continuing digital transformation and the rising reliance on cloud computing proceed to drive demand for high-performance computing chips. Nevertheless, this sector can also be delicate to financial downturns, as companies might delay investments in IT infrastructure during times of uncertainty.

-

Industrial and IoT: The commercial and Web of Issues (IoT) sectors are experiencing important development, pushed by automation, good manufacturing, and the rising connectivity of units. This phase is anticipated to be a key driver of semiconductor demand within the coming years, however the numerous nature of functions and the lengthy lead occasions for specialised chips pose challenges.

Past the Numbers: Lengthy-Time period Implications:

The semiconductor scarcity has uncovered the vulnerabilities of globalized provide chains and highlighted the strategic significance of semiconductor manufacturing. A number of key implications are rising:

-

Reshoring and Nearshoring: Governments worldwide are actively selling reshoring and nearshoring initiatives to scale back reliance on single-source suppliers and improve home manufacturing capabilities. This entails important investments in semiconductor manufacturing services and supporting infrastructure.

-

Elevated Funding in R&D: The scarcity has spurred elevated funding in analysis and growth to enhance chip design, manufacturing processes, and provide chain resilience. This contains exploring different supplies and applied sciences to scale back dependence on particular suppliers and geographical areas.

-

Authorities Intervention and Subsidies: Governments are offering substantial monetary incentives and subsidies to draw semiconductor manufacturing investments and bolster home industries. This displays the popularity of semiconductors as a crucial element of nationwide safety and financial competitiveness.

-

Provide Chain Diversification: Firms are actively diversifying their provide chains to scale back their dependence on single suppliers and mitigate the danger of future disruptions. This entails establishing relationships with a number of suppliers in numerous geographical areas.

-

Concentrate on Sustainability: The environmental impression of semiconductor manufacturing is more and more coming underneath scrutiny. The trade is dealing with stress to undertake extra sustainable practices and scale back its carbon footprint.

Conclusion:

The worldwide semiconductor scarcity, whereas seemingly receding from its peak depth, continues to exert a big affect on international economies and industries. The chart’s depiction of uneven restoration underscores the complexities of the semiconductor market and the varied challenges confronted by completely different sectors. The long-term implications of this disaster are far-reaching, driving important adjustments in international provide chains, authorities insurance policies, and trade methods. Understanding these dynamics is essential for navigating the evolving panorama of the semiconductor trade and its profound impression on the worldwide financial system. Additional evaluation, incorporating components comparable to geopolitical instability, technological developments, and fluctuating shopper demand, will probably be obligatory to totally grasp the continuing ramifications of this pivotal occasion. Future charts will probably be important in monitoring the progress of those changes and assessing the long-term well being and resilience of the worldwide semiconductor ecosystem.

![]()

![]()

![]()

Closure

Thus, we hope this text has offered priceless insights into Chart of the Week: Unpacking the International Semiconductor Scarcity’s Lingering Impression. We hope you discover this text informative and useful. See you in our subsequent article!