Chart Sample Recognition in Python: A Deep Dive into Technical Evaluation

Associated Articles: Chart Sample Recognition in Python: A Deep Dive into Technical Evaluation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Chart Sample Recognition in Python: A Deep Dive into Technical Evaluation. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Chart Sample Recognition in Python: A Deep Dive into Technical Evaluation

Chart patterns, recurring formations in worth charts, are a cornerstone of technical evaluation. Skilled merchants use these patterns to foretell future worth actions, figuring out potential purchase or promote alternatives. Whereas human interpretation stays essential, Python presents highly effective instruments to automate the identification and evaluation of those patterns, enabling sooner screening of huge datasets and probably bettering buying and selling methods. This text will delve into the world of chart sample recognition utilizing Python, protecting numerous patterns, implementation strategies, and the related challenges.

Understanding Chart Patterns:

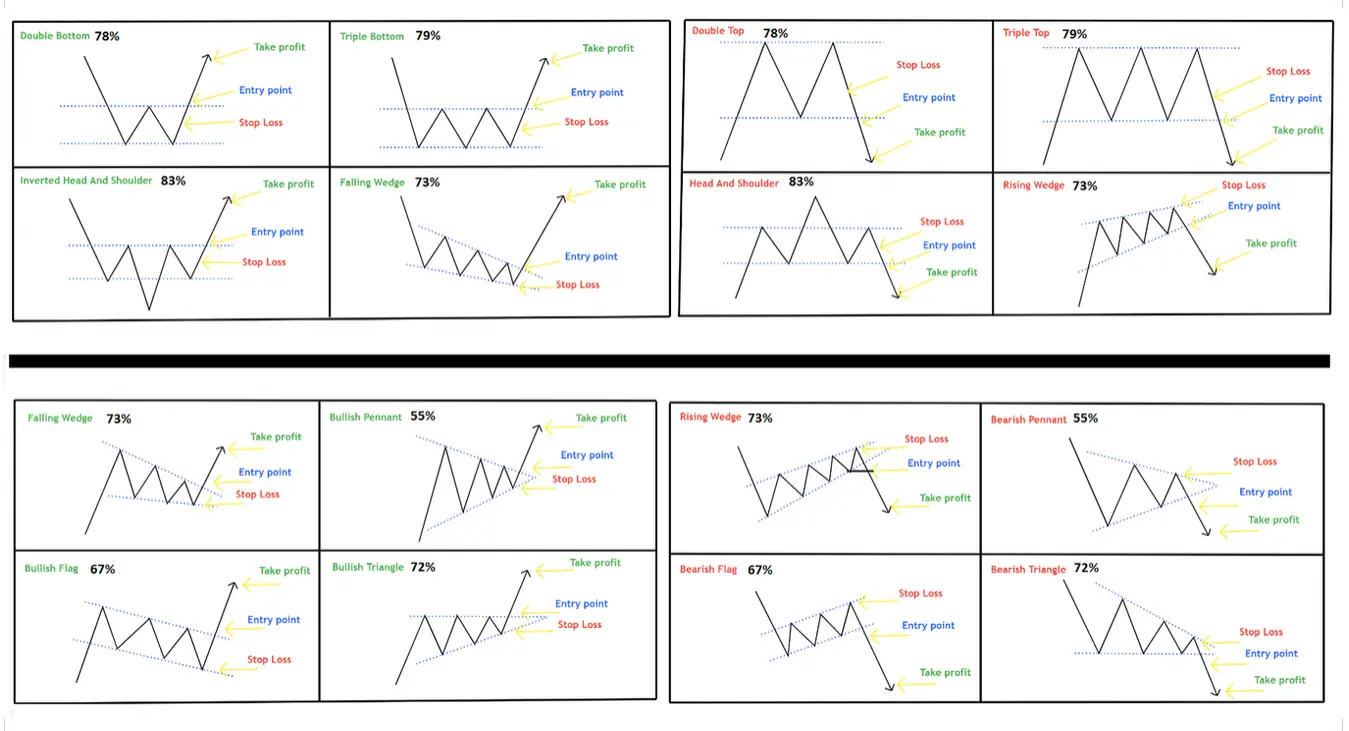

Chart patterns signify the collective habits of market individuals, reflecting shifts in sentiment and momentum. They’re categorized broadly into continuation and reversal patterns.

-

Continuation Patterns: These counsel the prevailing pattern will proceed after a short lived pause. Examples embrace:

- Triangles: Symmetrical, ascending, and descending triangles point out consolidation earlier than a breakout within the route of the prevailing pattern.

- Flags and Pennants: These resemble small, short-term consolidations inside a powerful pattern, suggesting a continuation of that pattern after the consolidation interval.

- Rectangles: Horizontal consolidations that point out a interval of sideways buying and selling earlier than a breakout.

- Wedges: Just like triangles, however with converging trendlines that slope both upward (rising wedge, bearish) or downward (falling wedge, bullish).

-

Reversal Patterns: These point out a possible change within the prevailing pattern. Examples embrace:

- Head and Shoulders: A traditional reversal sample consisting of three peaks (left shoulder, head, proper shoulder), with decrease troughs between them. A neckline connects the troughs, and a break under it alerts a possible bearish reversal.

- Inverse Head and Shoulders: The mirror picture of the top and shoulders sample, indicating a possible bullish reversal.

- Double Tops/Bottoms: Two peaks (tops) or troughs (bottoms) at roughly the identical worth degree, suggesting a possible reversal after a break under (tops) or above (bottoms) the help/resistance degree.

Python Implementation: Libraries and Methods:

A number of Python libraries are instrumental in chart sample recognition:

- Pandas: For knowledge manipulation and cleansing. Value knowledge, usually obtained from monetary APIs or databases, must be organized right into a Pandas DataFrame for environment friendly processing.

- NumPy: For numerical computations, particularly when coping with array operations for trendline calculations.

- Scikit-learn: Whereas indirectly used for sample identification, it may be useful for duties like outlier detection and smoothing worth knowledge to enhance sample readability.

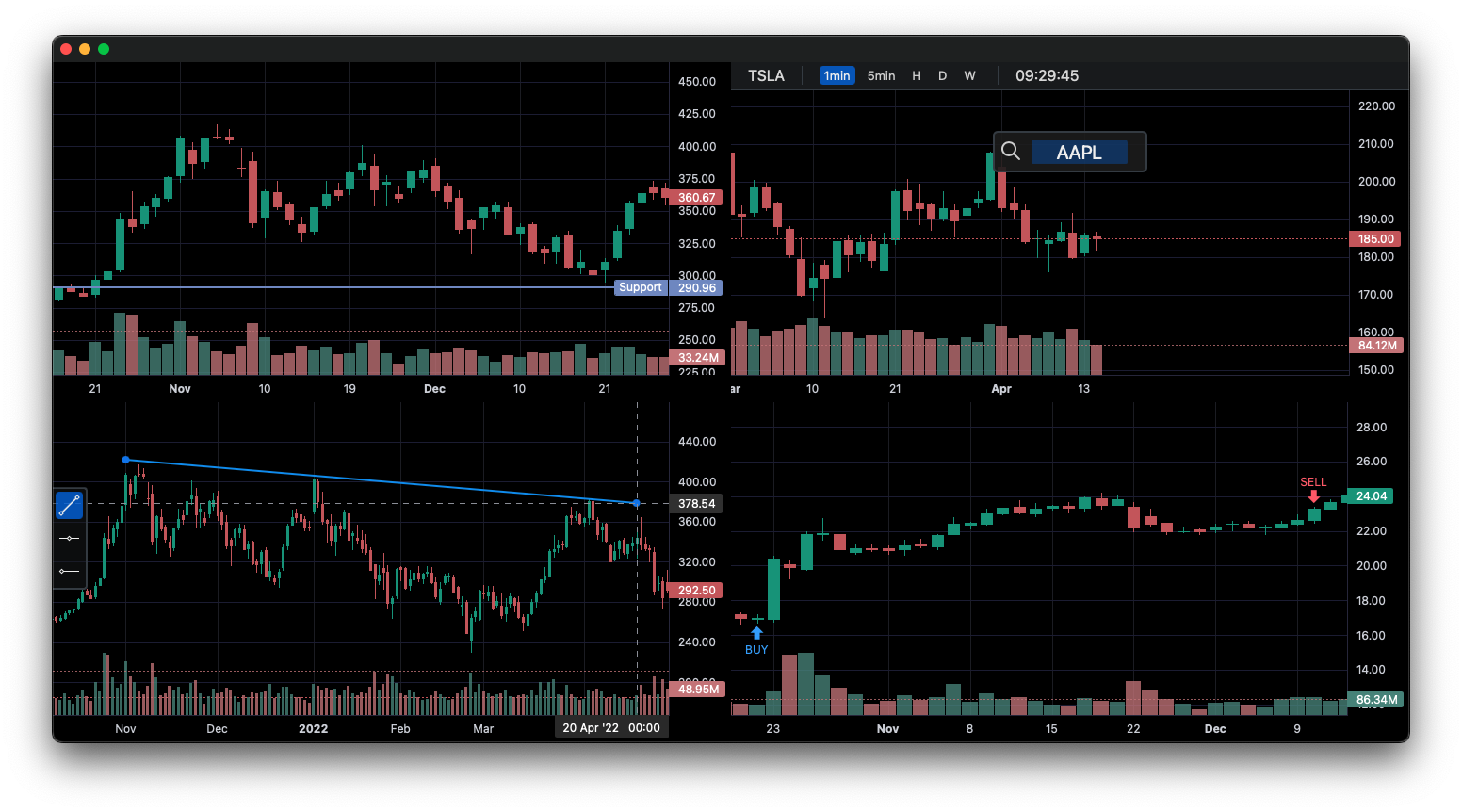

- Matplotlib and Seaborn: For visualization. Plotting worth charts with recognized patterns is important for validation and understanding.

- TA-Lib (Technical Evaluation Library): Supplies features for numerous technical indicators, which might complement chart sample evaluation.

Algorithmic Approaches:

Figuring out chart patterns algorithmically requires a multi-step course of:

-

Information Acquisition and Preprocessing: Get hold of historic worth knowledge (Open, Excessive, Low, Shut – OHLC) from a dependable supply. Clear the information, dealing with lacking values and outliers. Smoothing strategies like transferring averages can enhance sample identification.

-

Trendline Identification: It is a essential step. Algorithms can determine trendlines utilizing linear regression or different becoming strategies on worth highs and lows. The accuracy of trendline identification instantly impacts sample recognition. Issues embrace:

- Least Squares Regression: A standard strategy to suit a line to a set of factors.

- Sturdy Regression: Much less delicate to outliers, that are widespread in monetary knowledge.

- Adaptive Trendline Becoming: Adjusts to altering market circumstances.

-

Sample Matching: As soon as trendlines are recognized, algorithms can match worth actions in opposition to predefined sample standards. This usually entails evaluating distances, angles, and worth ranges. For instance, a head and shoulders sample may be recognized by evaluating the heights of the shoulders and the top, and the break under the neckline.

-

Sample Affirmation: Recognized patterns shouldn’t be handled as definitive alerts. Affirmation via different technical indicators (quantity, RSI, MACD) or elementary evaluation can considerably enhance buying and selling choices.

-

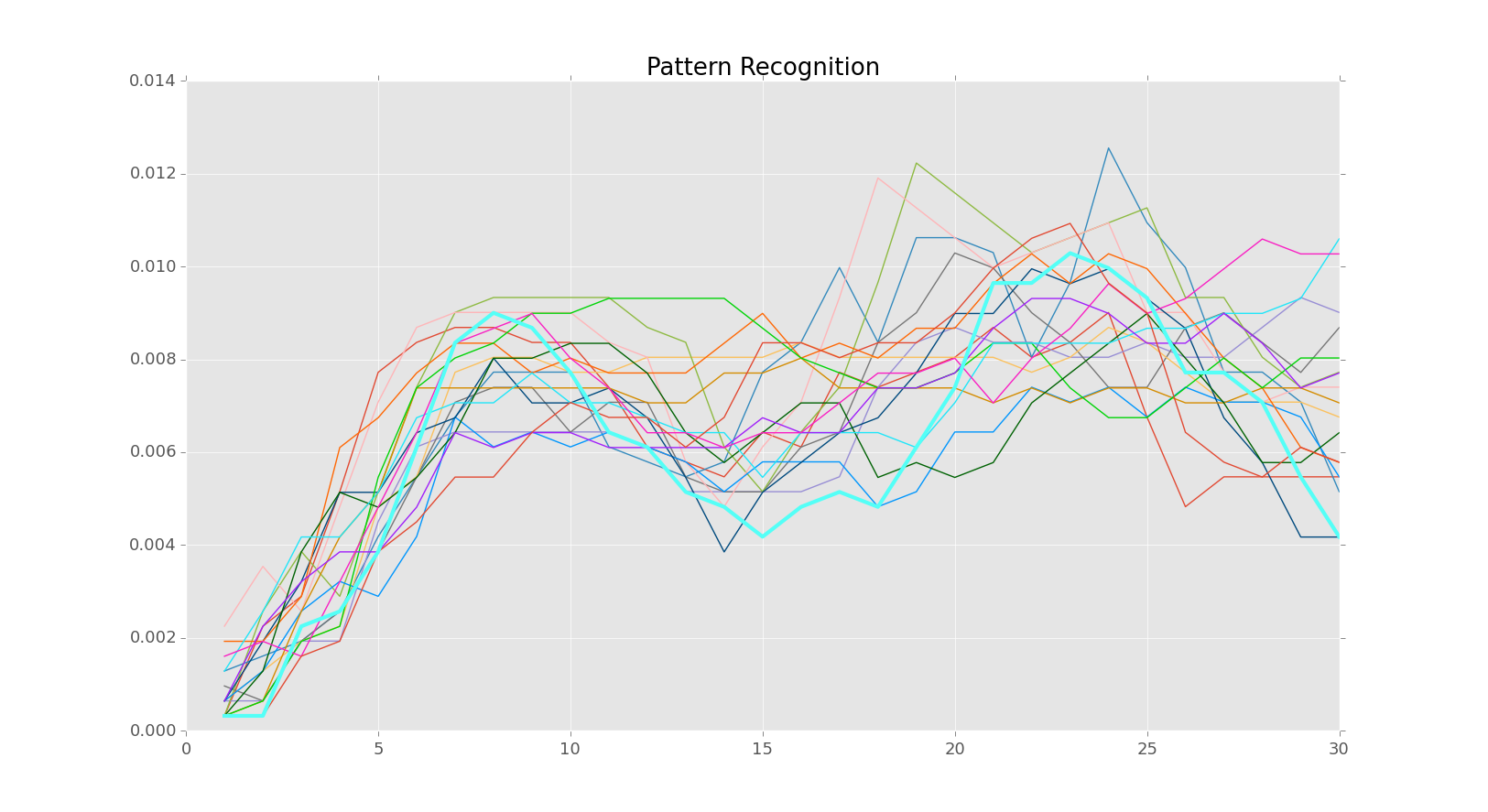

Visualization: Plotting the recognized patterns on the worth chart permits visible inspection and validation. This step is essential for debugging algorithms and constructing confidence within the outcomes.

Instance: Figuring out a Easy Triangle Sample (Conceptual):

A simplified strategy to figuring out an ascending triangle would possibly contain:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

# Assume 'df' is a Pandas DataFrame with OHLC knowledge

# Determine highs and lows inside a selected timeframe

highs = df['High'].rolling(window=20).max() # Instance window dimension

lows = df['Low'].rolling(window=20).min()

# Match linear regression to highs and lows (simplified instance)

# ... (Code for linear regression utilizing NumPy or Scikit-learn) ...

# Examine for convergence of trendlines (simplified instance)

# ... (Code to test the slope and distance between trendlines) ...

# If convergence standards are met, flag a possible ascending triangle

# Plot the chart with recognized triangle

plt.plot(df['Close'])

# ... (Code to plot trendlines and spotlight the triangle) ...

plt.present()It is a extremely simplified instance. Actual-world implementations require strong error dealing with, extra refined trendline becoming, and exact pattern-matching standards.

Challenges and Limitations:

Chart sample recognition utilizing Python faces a number of challenges:

- Subjectivity: Human interpretation of chart patterns can fluctuate. Algorithmic approaches should account for this inherent subjectivity by defining clear and constant standards.

- Noise and Outliers: Monetary knowledge is inherently noisy. Outliers can considerably have an effect on trendline becoming and sample identification. Sturdy statistical strategies are important.

- Overfitting: Algorithms can overfit to historic knowledge, resulting in poor efficiency on new knowledge. Cross-validation and rigorous testing are obligatory.

- Computational Complexity: Figuring out advanced patterns in giant datasets might be computationally costly. Environment friendly algorithms and optimized code are essential.

- False Alerts: Algorithms can generate false alerts, resulting in incorrect buying and selling choices. Affirmation from different indicators is essential to mitigate this danger.

Conclusion:

Chart sample recognition utilizing Python presents a strong technique to automate technical evaluation, probably bettering buying and selling methods. Nevertheless, it is important to grasp the constraints and challenges concerned. Sturdy algorithms, cautious knowledge preprocessing, and thorough validation are essential for growing dependable and efficient programs. Combining algorithmic evaluation with human experience stays essentially the most promising strategy to harnessing the ability of chart patterns in buying and selling. Additional analysis and improvement in areas like machine studying and deep studying might considerably improve the accuracy and effectivity of automated chart sample recognition. Keep in mind that any buying and selling technique based mostly on chart patterns carries inherent danger, and thorough backtesting and danger administration are paramount.

Closure

Thus, we hope this text has offered useful insights into Chart Sample Recognition in Python: A Deep Dive into Technical Evaluation. We respect your consideration to our article. See you in our subsequent article!