Chart Sample Buying and selling Junkies: The Attract and Peril of Visible Evaluation

Associated Articles: Chart Sample Buying and selling Junkies: The Attract and Peril of Visible Evaluation

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Chart Sample Buying and selling Junkies: The Attract and Peril of Visible Evaluation. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Chart Sample Buying and selling Junkies: The Attract and Peril of Visible Evaluation

The flickering display, the hypnotic dance of traces and curves – for some merchants, the attract of chart patterns is irresistible. They spend hours, days, even years, poring over historic worth knowledge, looking for these telltale formations that promise riches. These are the chart sample buying and selling junkies, people captivated by the visible artistry of the market, satisfied that deciphering these patterns holds the important thing to constant profitability. However whereas the pursuit may be intellectually stimulating and visually charming, the truth is much extra nuanced and infrequently far much less rewarding than the perceived promise.

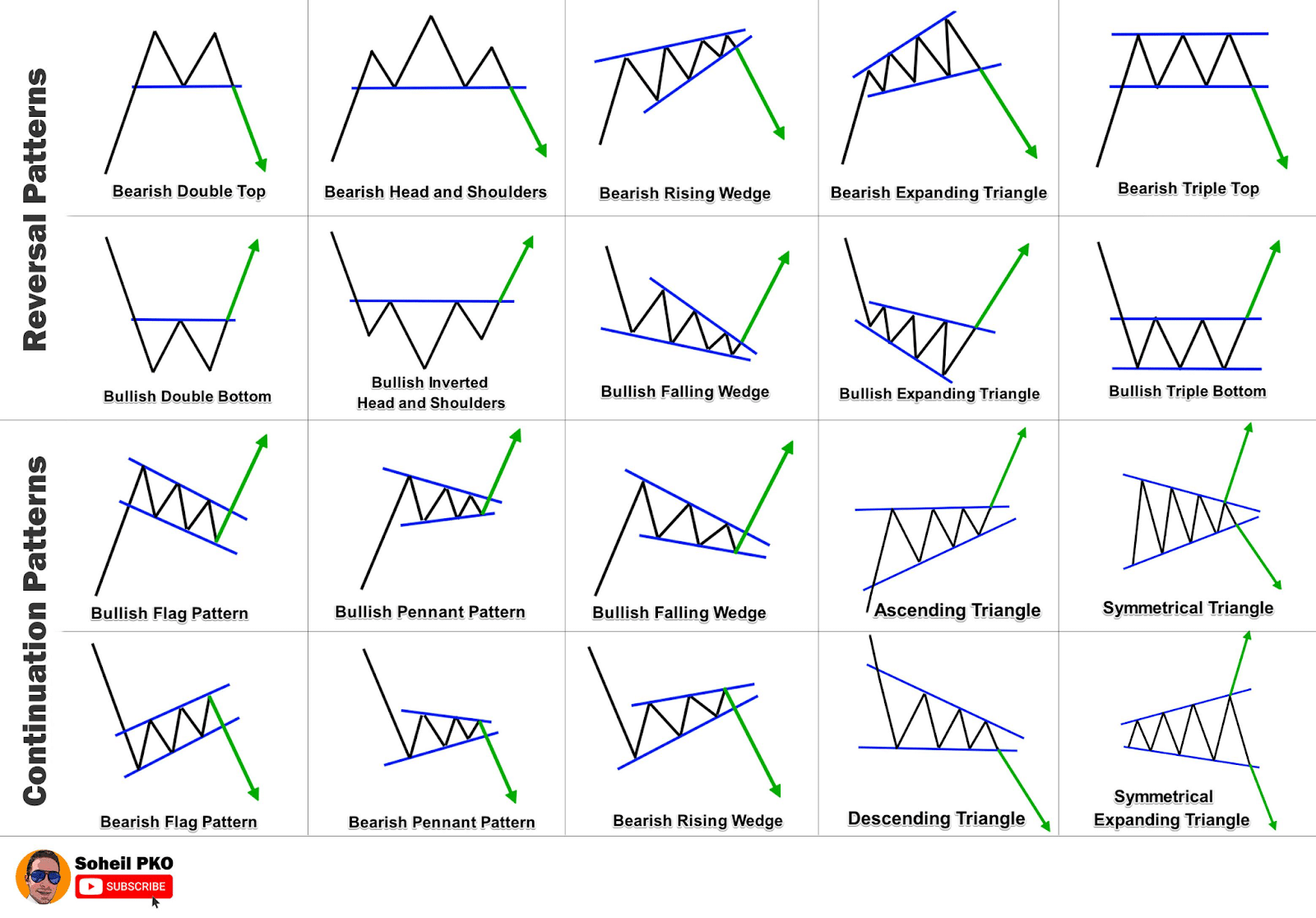

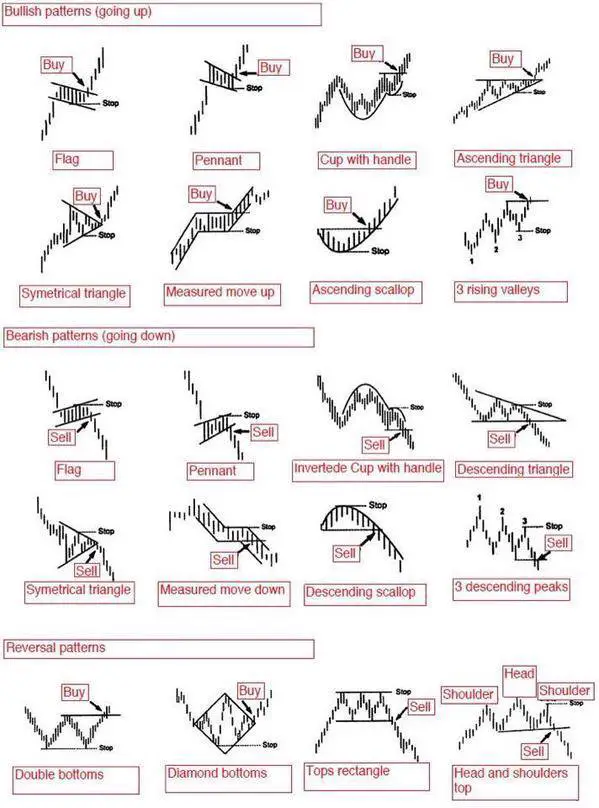

The enchantment of chart sample buying and selling lies in its obvious simplicity. In contrast to advanced quantitative fashions or elementary evaluation requiring deep dives into monetary statements, chart patterns provide a seemingly easy strategy. Recognizing formations like head and shoulders, double tops and bottoms, triangles, flags, and pennants requires a eager eye and a few observe, however the conceptual framework is comparatively accessible. This accessibility attracts in a variety of merchants, from seasoned professionals to enthusiastic newcomers, all lured by the potential for fast earnings. The visible nature of the evaluation additionally lends itself to intuitive understanding, making it simpler to know than summary statistical ideas. An image, in any case, is value a thousand phrases, or so the saying goes.

Nonetheless, this obvious simplicity masks a major hazard: the subjective nature of sample identification. Whereas sure textbook examples of chart patterns are readily identifiable, the real-world software is much extra ambiguous. Value motion isn’t pristine; it is messy, noisy, and infrequently unpredictable. What one dealer may interpret as a basic head and shoulders sample, one other may dismiss as random worth fluctuations. This subjectivity opens the door to affirmation bias, the place merchants selectively concentrate on patterns that affirm their pre-existing beliefs, whereas ignoring those who contradict them. The human mind is remarkably adept at discovering patterns the place none exist, a phenomenon often known as apophenia. This cognitive bias can lead chart sample junkies down a rabbit gap of false alerts, leading to important losses.

Moreover, the reliance on historic knowledge is a double-edged sword. Whereas previous efficiency may be informative, it is not essentially indicative of future outcomes. Markets are dynamic methods influenced by a large number of things, together with financial occasions, geopolitical tensions, technological developments, and shifts in investor sentiment. A chart sample that labored flawlessly previously may fail utterly sooner or later, rendering your entire evaluation nugatory. This inherent unpredictability is commonly missed by chart sample junkies, who are inclined to concentrate on the visible enchantment of the patterns somewhat than the underlying market forces that drive worth actions.

The psychological affect of chart sample buying and selling can be detrimental. The fixed seek for patterns can grow to be addictive, resulting in overtrading and impulsive selections. The fun of figuring out a possible sample and anticipating a major worth transfer may be intoxicating, main merchants to chase fast wins somewhat than concentrate on a sound, long-term technique. The emotional rollercoaster of wins and losses additional exacerbates this addictive habits, making a cycle of chasing losses and amplifying threat. This will result in important monetary losses and even psychological misery.

One other essential flaw in relying solely on chart patterns is the dearth of context. Whereas patterns can present clues about potential worth actions, they not often inform the entire story. Ignoring elementary evaluation, macroeconomic indicators, and information occasions can result in disastrous outcomes. As an illustration, a bullish chart sample is perhaps utterly negated by a sudden announcement of unfavorable earnings or a major geopolitical occasion. Chart sample junkies usually fail to combine these essential parts into their decision-making course of, resulting in a slim and doubtlessly flawed perspective.

The proliferation of buying and selling platforms and on-line sources has additional fueled the chart sample buying and selling craze. Many platforms provide automated sample recognition instruments, which, whereas useful in figuring out potential formations, usually lack the essential aspect of human judgment. These instruments can generate quite a few alerts, a lot of that are false positives, resulting in extreme buying and selling and elevated transaction prices. The convenience of entry to those instruments additionally lowers the barrier to entry, attracting novice merchants who lack the mandatory expertise and understanding of market dynamics.

Nonetheless, it is not solely truthful to dismiss chart sample buying and selling as solely nugatory. When used judiciously and along side different types of evaluation, chart patterns can present beneficial insights into market sentiment and potential worth actions. They’ll function a supplementary device, confirming alerts from different analyses or offering extra context. For instance, a breakout from a triangle sample, confirmed by a surge in buying and selling quantity and optimistic elementary information, may provide a high-probability buying and selling alternative. The important thing lies in understanding the constraints of chart sample evaluation and avoiding overreliance on visible cues alone.

Profitable merchants who incorporate chart patterns into their methods usually make use of a multi-faceted strategy, combining visible evaluation with elementary analysis, technical indicators, and threat administration strategies. They perceive that chart patterns are merely one piece of the puzzle, and so they use them cautiously, avoiding emotional decision-making and adhering to strict threat administration protocols. In addition they acknowledge the inherent uncertainty of the market and keep away from overconfidence, recognizing that even probably the most promising patterns can fail.

In conclusion, chart sample buying and selling is usually a fascinating and intellectually stimulating pursuit, however it’s essential to strategy it with a wholesome dose of skepticism and a deep understanding of its limitations. The attract of visible simplicity may be misleading, masking the complexities of market dynamics and the potential for important losses. Whereas chart patterns is usually a beneficial device when used appropriately, they need to by no means be the only foundation for buying and selling selections. For these tempted by the hypnotic dance of traces and curves, the trail to constant profitability lies not in turning into a chart sample buying and selling junkie, however in growing a well-rounded buying and selling technique that includes a number of types of evaluation and prioritizes sound threat administration. The pursuit of visible patterns must be a complement to a broader, extra sturdy buying and selling strategy, not its basis. In any other case, the attract of the chart might grow to be a entice, resulting in monetary wreck and a disillusionment with the markets as a complete.

![Chart Patterns Cheat Sheet [FREE Download], 52% OFF](https://m.media-amazon.com/images/I/71l0kqiqfpL._AC_UF894,1000_QL80_.jpg)

Closure

Thus, we hope this text has offered beneficial insights into Chart Sample Buying and selling Junkies: The Attract and Peril of Visible Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!