Chart Patterns After the Purchase: Deciphering Market Sentiment and Predicting Value Actions

Associated Articles: Chart Patterns After the Purchase: Deciphering Market Sentiment and Predicting Value Actions

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Chart Patterns After the Purchase: Deciphering Market Sentiment and Predicting Value Actions. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Chart Patterns After the Purchase: Deciphering Market Sentiment and Predicting Value Actions

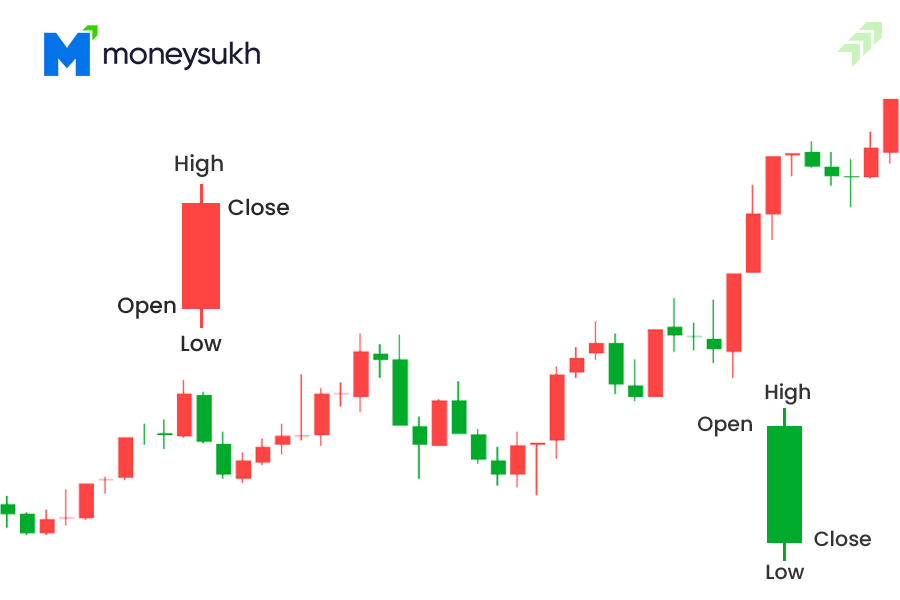

The acquisition of a monetary asset, whether or not it is a inventory, cryptocurrency, or commodity, marks a vital level in an investor’s journey. Nonetheless, the choice to purchase is simply half the battle. Understanding what occurs after the purchase, particularly figuring out and decoding chart patterns that emerge, is important to maximizing earnings and mitigating losses. This text delves into the world of post-buy chart patterns, exploring their significance, widespread sorts, and the way they’ll inform your buying and selling choices.

The Significance of Submit-Purchase Evaluation:

Merely shopping for an asset and hoping for the very best is a recipe for disappointment. Market dynamics are continuously shifting, influenced by a myriad of things together with information occasions, financial indicators, and general investor sentiment. Submit-buy evaluation, via the lens of chart patterns, permits merchants to:

- Verify entry choices: A powerful chart sample forming after a purchase can validate your preliminary funding thesis, offering reassurance and doubtlessly triggering additional accumulation.

- Establish potential revenue targets: Sure patterns recommend a possible value vary the place the asset would possibly consolidate or expertise a pullback, providing alternatives to take earnings or regulate stop-loss orders.

- Acknowledge early warning indicators: Unfavourable chart patterns can sign potential bother, permitting merchants to exit positions earlier than vital losses happen.

- Handle threat successfully: By understanding potential value actions, merchants can implement threat administration methods like trailing stops or hedging to guard their capital.

- Adapt buying and selling methods: Chart patterns can reveal shifts in market momentum, prompting merchants to regulate their buying and selling strategy, corresponding to switching from a long-term maintain to a short-term buying and selling technique.

Frequent Chart Patterns After a Purchase:

Quite a few chart patterns can develop after a profitable purchase. These may be broadly categorized into continuation patterns (suggesting the pattern will proceed) and reversal patterns (suggesting a change in pattern path).

1. Continuation Patterns:

These patterns usually point out a short lived pause within the prevailing uptrend earlier than the worth resumes its upward trajectory.

-

Flags and Pennants: These patterns resemble flags or pennants on a flagpole. They seem as a interval of consolidation inside a longtime uptrend, characterised by converging trendlines. A breakout above the higher trendline confirms the continuation of the uptrend. Flags are usually characterised by a tighter, extra parallel vary, whereas pennants exhibit a broader, triangular form.

-

Triangles: Triangles are characterised by converging trendlines, making a triangular form on the chart. There are three primary sorts: symmetrical, ascending, and descending. Symmetrical triangles recommend a continuation of the prevailing pattern after a breakout, whereas ascending triangles are bullish and descending triangles are bearish. Within the context of a post-buy evaluation, a symmetrical or ascending triangle could be optimistic, confirming the uptrend’s energy.

-

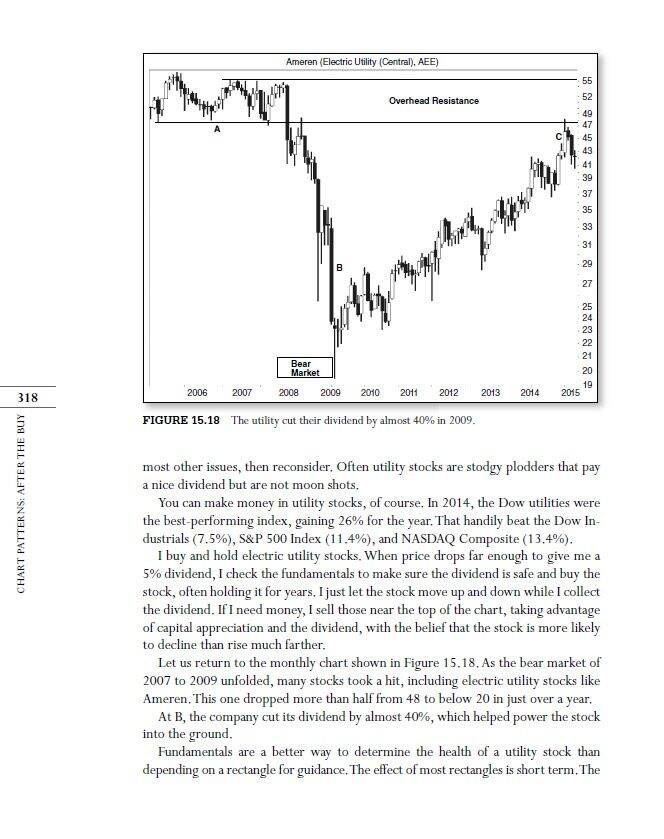

Rectangles: Rectangles are characterised by horizontal help and resistance ranges, creating an oblong form on the chart. The value consolidates inside this vary earlier than ultimately breaking out, normally within the path of the previous pattern. A breakout above the resistance line after a purchase confirms the continuation of the uptrend.

2. Reversal Patterns:

These patterns recommend a possible shift from an uptrend to a downtrend. Figuring out these patterns after a purchase is essential for threat administration.

-

Head and Shoulders: This can be a traditional reversal sample. It consists of three peaks, with the center peak (the "head") being the very best. A neckline connects the troughs between the peaks. A break beneath the neckline indicators a possible bearish reversal.

-

Double Tops and Triple Tops: These patterns encompass two or three peaks at roughly the identical value degree, adopted by a decline. A break beneath the neckline (the trough between the peaks) suggests a possible reversal.

-

Rounding Tops: This sample resembles a rounded hilltop, indicating a gradual lack of upward momentum. The value steadily declines after reaching the height, signaling a possible reversal.

-

Double Bottoms and Triple Bottoms: Whereas primarily related to reversals in downtrends, these may also seem after a purchase, indicating a possible pause earlier than additional upward motion. Nonetheless, a failure to interrupt above the earlier highs may recommend a weakening uptrend.

3. Different Essential Concerns:

-

Quantity: Analyzing quantity alongside chart patterns is essential. A powerful breakout from a continuation sample ought to ideally be accompanied by elevated quantity, confirming the energy of the transfer. Conversely, an absence of quantity accompanying a breakout can sign weak point.

-

Assist and Resistance Ranges: Figuring out key help and resistance ranges is important for setting stop-loss orders and revenue targets. Breaks above resistance ranges typically verify the energy of the uptrend, whereas breaks beneath help ranges can sign a possible reversal.

-

Indicators: Technical indicators, corresponding to RSI, MACD, and shifting averages, can be utilized to substantiate the indicators generated by chart patterns. For instance, a bullish divergence between value and RSI can verify the energy of a possible upward breakout.

-

Context is Key: Chart patterns shouldn’t be interpreted in isolation. Think about the broader market context, information occasions, and basic components affecting the asset’s value. A chart sample might need a unique significance relying on the general market sentiment and the precise asset’s traits.

Sensible Software and Danger Administration:

Understanding post-buy chart patterns just isn’t merely theoretical. It is a essential aspect of lively buying and selling and threat administration. Right here’s easy methods to apply this data:

-

Set Life like Expectations: No chart sample ensures future value actions. They supply chances, not certainties.

-

Use Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Place them beneath key help ranges recognized via chart sample evaluation.

-

Trailing Stops: Think about using trailing stops to lock in earnings as the worth strikes in your favor. This lets you journey the pattern whereas defending your beneficial properties.

-

Diversify Your Portfolio: Do not put all of your eggs in a single basket. Diversification throughout totally different property and methods reduces general portfolio threat.

-

Steady Studying: The world of chart patterns is huge and ever-evolving. Steady studying and observe are essential for mastering this ability.

Conclusion:

Chart patterns provide a robust instrument for analyzing market sentiment and predicting value actions after a purchase. By understanding widespread continuation and reversal patterns, incorporating quantity evaluation, and using threat administration strategies, merchants can considerably enhance their decision-making course of and enhance their probabilities of success. Nonetheless, keep in mind that chart patterns are only one piece of the puzzle. Combining technical evaluation with basic evaluation and a sound threat administration technique is essential for long-term success within the monetary markets. The journey after the purchase is simply as vital, if no more so, than the preliminary buy determination itself. Cautious remark and interpretation of post-buy chart patterns are important for navigating the complexities of the market and maximizing your funding potential.

![[PDF READ ONLINE] Chart Patterns: After the Buy (Wiley Trading) - Chart](https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/5c4714533dfbc343eba5a21bbd341365/thumb_1200_1698.png)

Closure

Thus, we hope this text has supplied beneficial insights into Chart Patterns After the Purchase: Deciphering Market Sentiment and Predicting Value Actions. We thanks for taking the time to learn this text. See you in our subsequent article!