Chart Patterns Cheat Sheet: A Free Information to Mastering Technical Evaluation

Associated Articles: Chart Patterns Cheat Sheet: A Free Information to Mastering Technical Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chart Patterns Cheat Sheet: A Free Information to Mastering Technical Evaluation. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart Patterns Cheat Sheet: A Free Information to Mastering Technical Evaluation

Technical evaluation is a robust device for merchants, permitting them to establish potential tendencies and predict future worth actions primarily based on historic information. A cornerstone of technical evaluation lies in recognizing and decoding chart patterns. These patterns, fashioned by worth motion on a chart, typically present invaluable insights into market sentiment and potential future worth actions. This text serves as a complete, free cheat sheet, guiding you thru a number of the commonest and efficient chart patterns. We’ll discover their traits, implications, and the way to successfully make the most of them in your buying and selling technique.

Understanding Chart Patterns: The Fundamentals

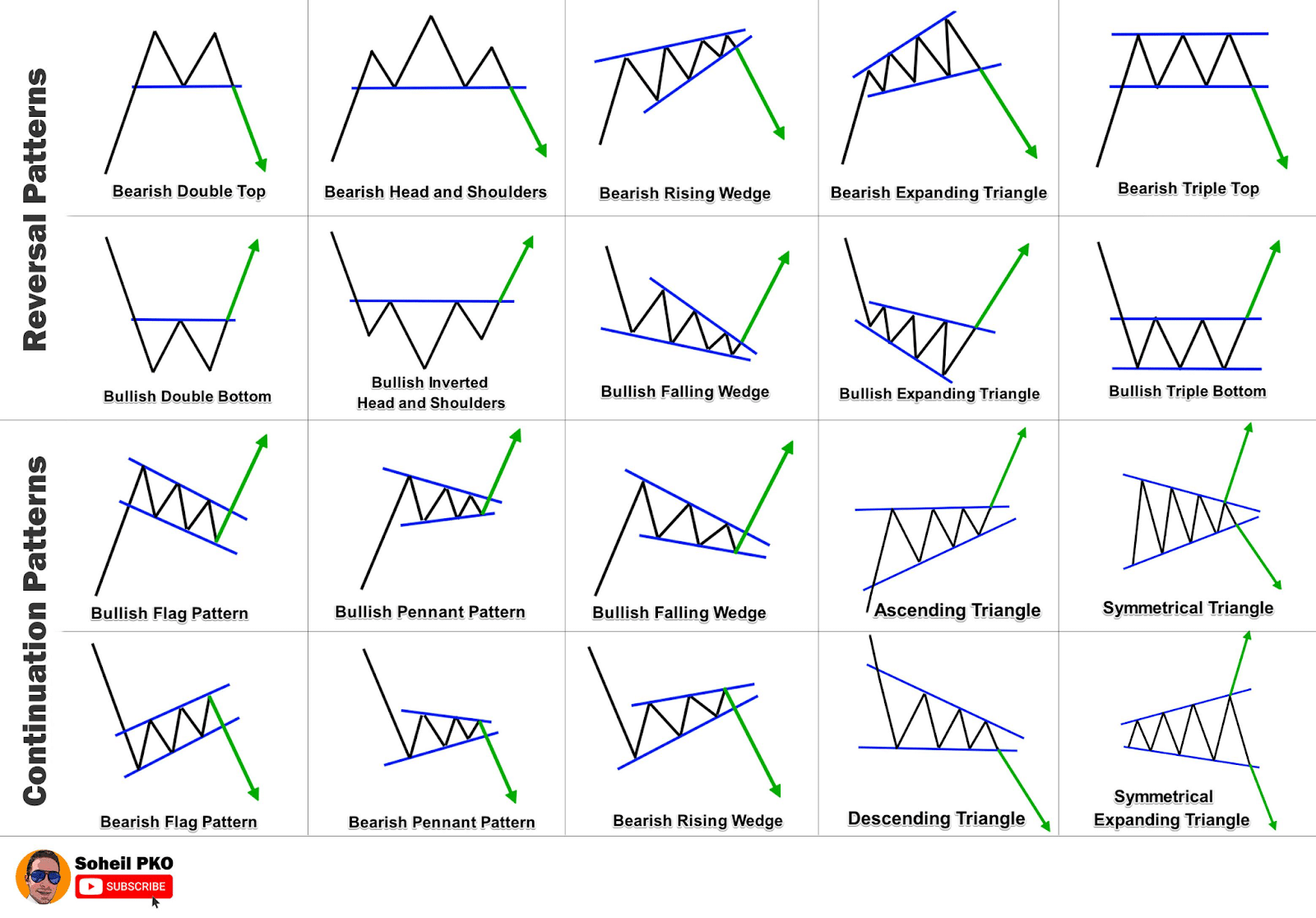

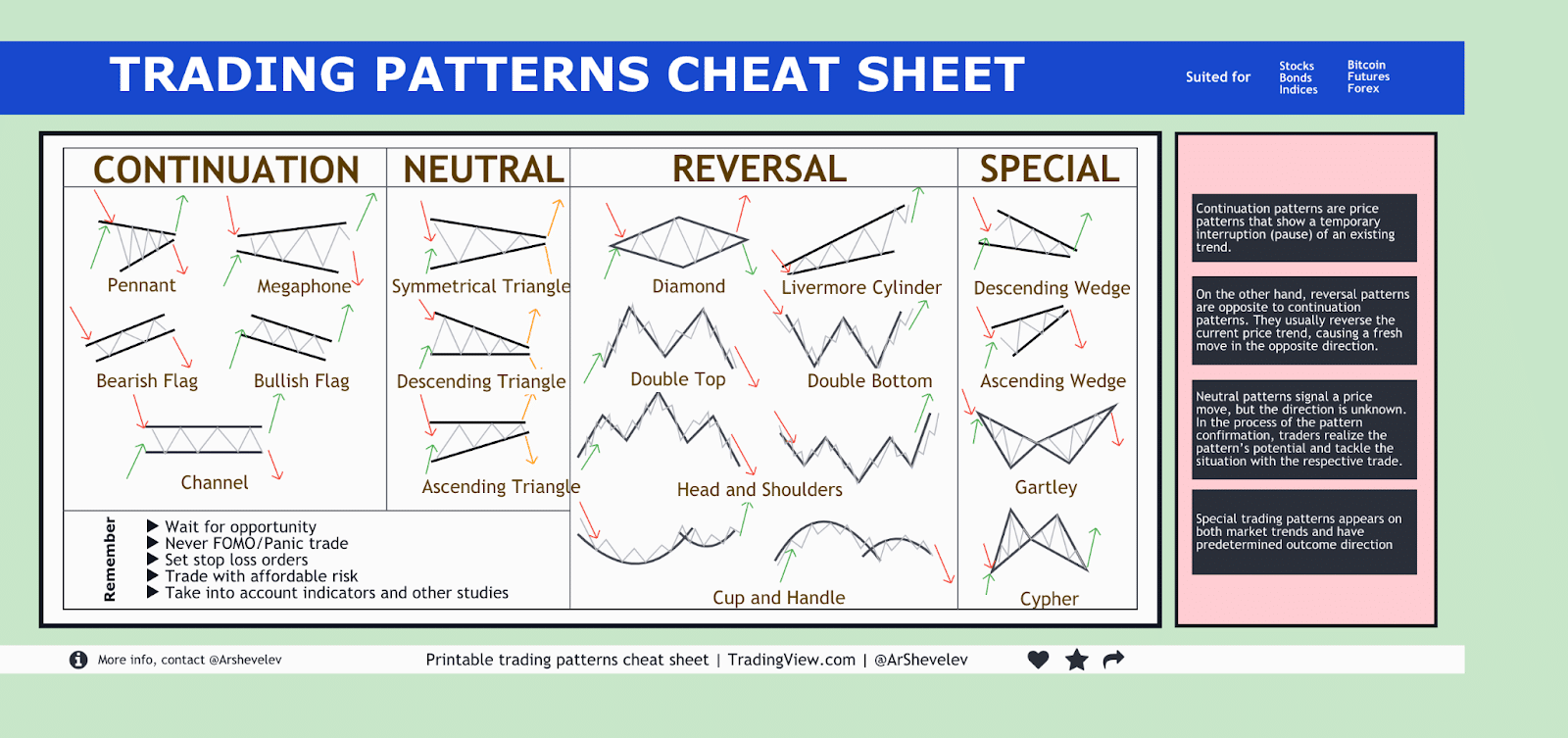

Earlier than diving into particular patterns, it is essential to understand the elemental ideas. Chart patterns are visually identifiable formations created by the interaction of provide and demand. They’re usually categorized as both continuation patterns or reversal patterns.

-

Continuation Patterns: These patterns counsel a brief pause in an current development earlier than the development resumes in its authentic path. Merchants typically use continuation patterns to establish potential entry factors to journey the continuing development.

-

Reversal Patterns: These patterns point out a possible shift within the prevailing development. They sign a attainable change from an uptrend to a downtrend (or vice versa), providing alternatives for merchants to enter positions within the new path.

Key Components for Sample Identification:

Profitable chart sample recognition requires cautious statement of a number of key components:

-

Value Motion: The motion of the worth itself is paramount. Pay shut consideration to highs, lows, and the general form of the sample.

-

Quantity: Quantity typically confirms the validity of a sample. Elevated quantity through the formation of a sample often strengthens the sign.

-

Assist and Resistance Ranges: Patterns typically type round key assist and resistance ranges, highlighting the worth’s battle between patrons and sellers.

-

Time Body: The timeframe you select (e.g., each day, weekly, month-to-month) will affect the sample’s significance and the potential period of the expected transfer.

Half 1: Continuation Patterns

1. Triangles:

Triangles are characterised by converging trendlines, indicating a interval of consolidation. There are three principal varieties:

-

Symmetrical Triangle: A symmetrical triangle is fashioned by two converging trendlines, with the worth oscillating between them. This sample suggests a continuation of the present development after the breakout. The breakout path (up or down) is often decided by the pre-existing development.

-

Ascending Triangle: An ascending triangle reveals a flat higher trendline and an upward sloping decrease trendline. This sample usually signifies a bullish continuation, with a breakout anticipated above the higher trendline.

-

Descending Triangle: A descending triangle shows a flat decrease trendline and a downward sloping higher trendline. This sample often suggests a bearish continuation, with a breakout anticipated under the decrease trendline.

2. Flags and Pennants:

These patterns are characterised by a quick interval of consolidation after a pointy worth transfer.

-

Flag: A flag resembles an oblong or barely slanted field following a powerful development. The breakout usually happens within the path of the previous development.

-

Pennant: A pennant is just like a flag however has converging trendlines, forming a triangular form. The breakout can be anticipated within the path of the previous development.

3. Rectangles:

Rectangles are characterised by horizontal assist and resistance ranges, with worth motion oscillating between them. The breakout often happens within the path of the previous development.

4. Wedges:

Wedges are characterised by converging trendlines, just like triangles, however the slope of the trendlines determines whether or not it is a bullish or bearish wedge.

-

Rising Wedge: A rising wedge is often bearish, suggesting a possible reversal regardless of its upward sloping traces. The breakout often happens downwards.

-

Falling Wedge: A falling wedge is often bullish, suggesting a possible continuation of the uptrend. The breakout often happens upwards.

Half 2: Reversal Patterns

1. Head and Shoulders:

The top and shoulders sample is a basic reversal sample, indicating a possible shift in development. It consists of three peaks (left shoulder, head, proper shoulder), with the top being the best peak. A neckline connects the troughs between the peaks. A break under the neckline confirms the bearish reversal. An inverse head and shoulders sample alerts a bullish reversal.

2. Double Tops and Double Bottoms:

These patterns include two comparable worth peaks (double high) or troughs (double backside). The neckline connects the troughs (for double tops) or the peaks (for double bottoms). A break under the neckline (double high) or above the neckline (double backside) confirms the reversal.

3. Triple Tops and Triple Bottoms:

Much like double tops and bottoms, however with three peaks or troughs. These patterns are stronger alerts of reversal as a result of elevated affirmation.

4. Rounding Tops and Rounding Bottoms:

Rounding tops are characterised by a gradual curving worth decline, whereas rounding bottoms present a gradual curving worth improve. These patterns signify a reversal over an extended interval.

5. Broadening Formations:

Broadening formations are much less frequent however important. They include widening worth swings, signifying growing volatility and infrequently precede a powerful development reversal. Broadening tops are bearish, and broadening bottoms are bullish.

Half 3: Utilizing Chart Patterns Successfully

Affirmation and Danger Administration:

Whereas chart patterns present invaluable insights, they shouldn’t be utilized in isolation. At all times verify sample alerts with different indicators, reminiscent of quantity, transferring averages, and oscillators (RSI, MACD). Efficient danger administration is essential. At all times use stop-loss orders to restrict potential losses and take-profit orders to safe income.

Selecting the Proper Timeframe:

The timeframe you choose considerably impacts sample identification and buying and selling choices. Longer timeframes (weekly, month-to-month) reveal broader tendencies, whereas shorter timeframes (each day, hourly) present extra speedy buying and selling alternatives. Experiment with completely different timeframes to seek out what most accurately fits your buying and selling model.

Practising Sample Recognition:

Mastering chart sample recognition requires observe and expertise. Begin by analyzing historic charts, specializing in figuring out patterns and observing their subsequent worth actions. Use a paper buying and selling account to check your methods earlier than risking actual capital.

Conclusion:

Chart patterns are a invaluable device for technical merchants, providing insights into market sentiment and potential worth actions. This free cheat sheet offers a complete overview of frequent chart patterns, their traits, and implications. Do not forget that constant observe, danger administration, and affirmation with different indicators are key to efficiently utilizing chart patterns in your buying and selling technique. This information serves as a place to begin; additional analysis and steady studying are important for mastering technical evaluation and attaining constant buying and selling success. At all times keep in mind that buying and selling entails danger, and previous efficiency is just not indicative of future outcomes. Seek the advice of with a monetary advisor earlier than making any funding choices.

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-1024x724.png)

Closure

Thus, we hope this text has offered invaluable insights into Chart Patterns Cheat Sheet: A Free Information to Mastering Technical Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!