Chart Patterns Each Dealer Ought to Know: Decoding Market Psychology Via Visuals

Associated Articles: Chart Patterns Each Dealer Ought to Know: Decoding Market Psychology Via Visuals

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Chart Patterns Each Dealer Ought to Know: Decoding Market Psychology Via Visuals. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Chart Patterns Each Dealer Ought to Know: Decoding Market Psychology Via Visuals

Technical evaluation is a cornerstone of profitable buying and selling, providing a framework to interpret market actions and predict future worth motion. Whereas indicators present numerical insights, chart patterns supply a visible illustration of market psychology, revealing shifts in momentum and potential turning factors. Understanding and recognizing these patterns can considerably improve your buying and selling technique, serving to you determine high-probability setups and handle danger extra successfully. This text will delve into among the most prevalent and dependable chart patterns each dealer ought to know, exploring their traits, implications, and sensible functions.

I. Reversal Patterns: Predicting Turning Factors

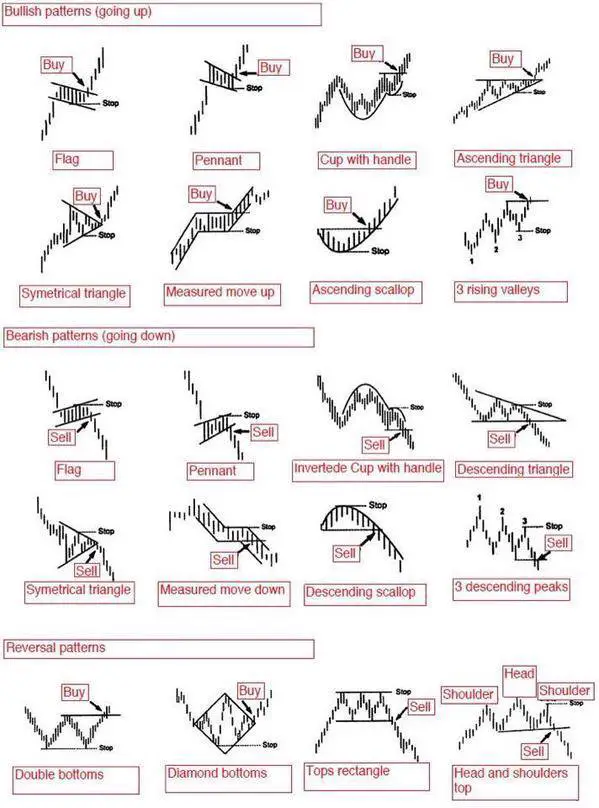

Reversal patterns sign a possible shift within the prevailing development. They seem on the finish of an uptrend (for bearish reversal patterns) or a downtrend (for bullish reversal patterns), indicating a attainable change in market sentiment.

A. Head and Shoulders (H&S): This traditional sample consists of three peaks, with the center peak (the "head") being considerably increased than the opposite two ("shoulders"). A neckline, a trendline connecting the troughs between the peaks, is an important component. A bearish H&S sample suggests a possible worth drop as soon as the worth breaks beneath the neckline. The goal worth is commonly calculated by measuring the space between the pinnacle and the neckline and projecting it downwards from the neckline’s breakout level. Affirmation is commonly sought by way of elevated buying and selling quantity in the course of the breakout.

B. Inverse Head and Shoulders (IH&S): The mirror picture of the H&S sample, the IH&S is a bullish reversal sample. It options three troughs, with the center trough being considerably decrease than the opposite two. A neckline connects the peaks between the troughs. A breakout above the neckline alerts a possible uptrend, with the goal worth calculated equally to the H&S sample, however projected upwards.

C. Double Prime and Double Backside: These patterns are less complicated than H&S however equally vital. A double prime varieties when the worth reaches two comparable highs, adopted by a decline. A double backside varieties when the worth reaches two comparable lows, adopted by an increase. The neckline for each patterns is the road connecting the troughs (double prime) or peaks (double backside) between the 2 highs or lows. A breakout beneath the neckline in a double prime or above the neckline in a double backside alerts a possible development reversal.

D. Triple Prime and Triple Backside: Much like double tops and bottoms, however with three cases of comparable highs or lows, these patterns supply stronger affirmation of a possible reversal. The neckline is drawn equally, and a breakout above/beneath it alerts a possible development reversal. The longer the sample takes to type, the extra vital the potential reversal.

II. Continuation Patterns: Confirming Present Developments

Continuation patterns recommend that the prevailing development will seemingly proceed after a short lived pause or consolidation. These patterns supply alternatives to enter trades within the course of the present development with decreased danger.

A. Triangles: Triangles are characterised by converging trendlines, forming a triangular form. There are three important sorts: symmetrical, ascending, and descending. Symmetrical triangles recommend a continuation of the present development, with the breakout occurring in both course. Ascending triangles (increased highs and flat lows) are bullish, suggesting a continuation of the uptrend. Descending triangles (flat highs and decrease lows) are bearish, suggesting a continuation of the downtrend. The breakout normally happens across the apex of the triangle.

B. Flags and Pennants: These patterns resemble small flags or pennants connected to a pole (the earlier development). Flags are characterised by parallel trendlines, suggesting a short lived pause within the development. Pennants are comparable however have converging trendlines, making a triangular form. Breakouts from flags and pennants sometimes happen within the course of the previous development.

C. Rectangles: Rectangles are characterised by two parallel horizontal trendlines, representing a interval of consolidation. Breakouts from rectangles sometimes happen within the course of the previous development. The peak of the rectangle can usually be used to undertaking the potential goal worth after the breakout.

III. Different Necessary Chart Patterns:

A. Gaps: Gaps are vital worth actions with none buying and selling exercise. They usually point out a fast shift in market sentiment, pushed by information occasions or surprising developments. Gaps may be analyzed to know potential worth targets and reversals. Frequent sorts embody breakaway gaps, exhaustion gaps, and customary gaps.

B. Rounding Tops and Bottoms: These patterns are characterised by a gradual curve within the worth motion, forming a rounded form. Rounding tops are bearish and sign a possible downtrend, whereas rounding bottoms are bullish and sign a possible uptrend. These patterns can take a substantial period of time to totally develop.

C. Wedges: Wedges are much like triangles, however the converging trendlines are inclined, both upwards (bullish wedge) or downwards (bearish wedge). Bullish wedges are usually bearish, suggesting a possible downward breakout, whereas bearish wedges are usually bullish, suggesting a possible upward breakout.

IV. Sensible Utility and Issues:

Figuring out chart patterns is just one side of profitable buying and selling. A number of essential issues have to be factored in:

- Affirmation: Relying solely on chart patterns is dangerous. Verify your evaluation with different technical indicators (e.g., transferring averages, RSI, MACD) and basic evaluation.

- Quantity: Observe buying and selling quantity throughout breakouts. Excessive quantity confirms the energy of the breakout, whereas low quantity suggests weak point and potential false breakouts.

- Threat Administration: All the time use stop-loss orders to restrict potential losses. Decide your danger tolerance earlier than getting into any commerce.

- Context: Think about the broader market context. A chart sample could also be much less dependable if the general market is experiencing vital volatility or uncertainty.

- Apply: Mastering chart sample recognition requires apply. Analyze historic charts and backtest your buying and selling methods to enhance your accuracy.

V. Conclusion:

Chart patterns present invaluable insights into market psychology and potential worth actions. By understanding their traits and implications, merchants can improve their decision-making course of and enhance their buying and selling efficiency. Nonetheless, it is essential to keep in mind that chart patterns aren’t foolproof predictors, and profitable buying and selling requires a holistic method that integrates technical and basic evaluation, danger administration, and disciplined execution. Steady studying and apply are important to mastering the artwork of chart sample recognition and using them successfully in your buying and selling technique. Bear in mind to all the time mix your sample evaluation with different types of technical and basic evaluation for the perfect outcomes. The patterns mentioned right here symbolize a place to begin; additional analysis into extra complicated and nuanced patterns will deepen your understanding and enhance your buying and selling acumen.

Closure

Thus, we hope this text has supplied worthwhile insights into Chart Patterns Each Dealer Ought to Know: Decoding Market Psychology Via Visuals. We hope you discover this text informative and helpful. See you in our subsequent article!