Chart Trendlines: Unveiling Market Course and Predicting Future Worth Actions

Associated Articles: Chart Trendlines: Unveiling Market Course and Predicting Future Worth Actions

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Chart Trendlines: Unveiling Market Course and Predicting Future Worth Actions. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Chart Trendlines: Unveiling Market Course and Predicting Future Worth Actions

Trendlines are elementary instruments in technical evaluation, offering visible representations of value path and momentum. They assist merchants and buyers determine potential assist and resistance ranges, predict future value actions, and make knowledgeable buying and selling selections. Whereas not foolproof predictors, trendlines supply precious insights into the underlying market sentiment and may considerably improve buying and selling methods. This text will delve into the intricacies of chart trendlines, exploring their varied sorts, building methods, interpretation, and limitations.

Understanding the Fundamentals: What are Trendlines?

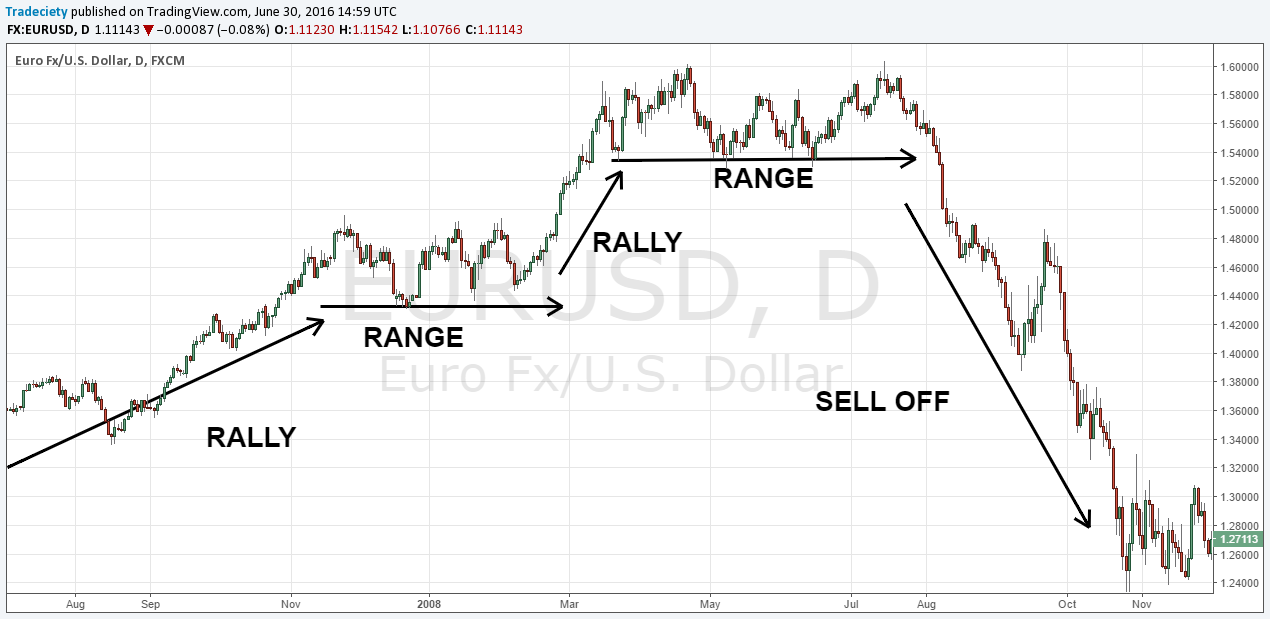

A trendline is a straight line drawn on a chart connecting a collection of serious highs (for downtrends) or lows (for uptrends). These strains visually signify the prevailing pattern of an asset’s value over a selected interval. The accuracy and reliability of a trendline rely closely on the standard and consistency of the worth information used to assemble it. A trendline’s effectiveness is enhanced when it connects a number of swing highs or swing lows – vital value factors that mark a short lived reversal within the prevailing pattern.

Kinds of Trendlines:

A number of forms of trendlines exist, every providing distinctive insights into market dynamics:

-

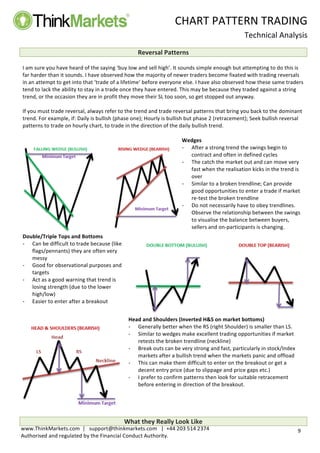

Uptrend Line: That is drawn by connecting a collection of rising lows. Every subsequent low must be greater than the earlier one, indicating bullish momentum. The uptrend line serves as a assist stage; value bounces off this line, confirming the uptrend’s energy. Breaks under the uptrend line typically sign a possible pattern reversal.

-

Downtrend Line: That is drawn by connecting a collection of falling highs. Every subsequent excessive must be decrease than the earlier one, indicating bearish momentum. The downtrend line serves as a resistance stage; value struggles to interrupt above this line, confirming the downtrend’s energy. Breaks above the downtrend line typically sign a possible pattern reversal.

-

Horizontal Trendline (Help/Resistance): This can be a horizontal line drawn throughout a collection of value factors, indicating a big assist or resistance stage. Help ranges mark value flooring the place shopping for stress tends to outweigh promoting stress, stopping additional value declines. Resistance ranges mark value ceilings the place promoting stress tends to outweigh shopping for stress, stopping additional value will increase. Breaks above resistance or under assist typically sign vital value actions.

-

Parallel Channels: These are fashioned by drawing two parallel trendlines, one connecting a collection of highs and the opposite connecting a collection of lows. The area between the strains represents the channel’s width, indicating the worth vary inside which the asset is prone to commerce. Breakouts from parallel channels typically sign vital value actions.

-

Angular Trendlines: These are trendlines which might be neither horizontal nor completely sloped, typically representing a change within the tempo of a pattern. They will point out acceleration or deceleration of the worth motion.

Developing Efficient Trendlines:

Drawing correct trendlines requires cautious commentary and judgment. Listed below are some key concerns:

-

Figuring out Swing Highs/Lows: Deal with figuring out vital highs and lows, representing short-term reversals within the pattern. Minor fluctuations must be ignored.

-

Connecting at Least Two Factors: A trendline wants a minimum of two factors to be drawn. Extra factors improve its validity and reliability. The extra factors it touches, the stronger the trendline.

-

Utilizing a Constant Timeframe: Stick with a constant timeframe (e.g., each day, weekly, month-to-month) when drawing trendlines to take care of consistency and keep away from deceptive interpretations.

-

Contemplating the Context: At all times contemplate the broader market context and different technical indicators when decoding trendlines. They shouldn’t be utilized in isolation.

-

Utilizing Charting Software program: Most charting software program mechanically attracts trendlines, providing varied instruments for exact placement and adjustment.

Deciphering Trendline Breaks and Retests:

Trendline breaks are essential indicators, typically indicating a possible pattern reversal. Nonetheless, it is vital to differentiate between real breaks and short-term pullbacks.

-

Real Break: A real break happens when the worth decisively breaks by means of the trendline and sustains the transfer past it. This typically confirms a pattern reversal.

-

Retest: A retest happens when the worth briefly breaks the trendline however then reverses again, touching the damaged trendline once more. This may present a affirmation of the pattern reversal or a possible entry level for merchants.

-

False Breakouts: These are situations the place the worth briefly breaks the trendline however fails to maintain the transfer, returning to the unique pattern. These might be misleading and must be handled with warning.

Limitations of Trendlines:

Whereas trendlines are precious instruments, they’ve limitations:

-

Subjectivity: Drawing trendlines includes a level of subjectivity. Completely different analysts might draw trendlines in a different way, resulting in various interpretations.

-

Not Foolproof: Trendlines should not good predictors. Worth actions might be unpredictable, and trendlines might be damaged unexpectedly.

-

Dependence on Context: Trendlines must be used along with different technical indicators and elementary evaluation to enhance accuracy.

-

Market Volatility: In extremely unstable markets, trendlines could also be much less dependable, as value fluctuations could make it tough to determine clear swing highs and lows.

Integrating Trendlines with Different Technical Indicators:

Utilizing trendlines along with different technical indicators enhances their effectiveness. Combining trendlines with indicators like:

-

Transferring Averages: Transferring averages can affirm the pattern indicated by the trendline. A rising shifting common helps an uptrend line, whereas a falling shifting common helps a downtrend line.

-

RSI (Relative Power Index): RSI helps assess the energy of the pattern. Overbought or oversold circumstances can sign potential pattern reversals.

-

MACD (Transferring Common Convergence Divergence): MACD can affirm pattern modifications and determine potential momentum shifts.

-

Quantity: Analyzing buying and selling quantity alongside trendlines helps affirm the energy of value actions. Excessive quantity accompanying a trendline break will increase the reliability of the sign.

Conclusion:

Trendlines are highly effective instruments for visualizing market path, figuring out assist and resistance ranges, and predicting future value actions. Whereas not foolproof, their efficient use, along with different technical indicators and sound threat administration, can considerably improve buying and selling methods. Understanding the several types of trendlines, their building, interpretation, and limitations is essential for merchants and buyers looking for to realize precious insights from value charts. Keep in mind that constant follow, cautious commentary, and a holistic method to technical evaluation are key to mastering the artwork of utilizing trendlines successfully. At all times bear in mind to mix technical evaluation with elementary evaluation and threat administration for a well-rounded method to investing.

Closure

Thus, we hope this text has offered precious insights into Chart Trendlines: Unveiling Market Course and Predicting Future Worth Actions. We respect your consideration to our article. See you in our subsequent article!