Charting Your Course to Buying and selling Success: A Complete Information to Chart Evaluation

Associated Articles: Charting Your Course to Buying and selling Success: A Complete Information to Chart Evaluation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Charting Your Course to Buying and selling Success: A Complete Information to Chart Evaluation. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Charting Your Course to Buying and selling Success: A Complete Information to Chart Evaluation

The world of buying and selling is a posh tapestry woven with financial indicators, information occasions, and market sentiment. But, at its coronary heart lies a easy, visible device: the chart. Charts present a concise illustration of value actions over time, providing invaluable insights for merchants of all ranges. Mastering chart evaluation will not be merely helpful; it is important for navigating the unstable waters of the monetary markets. This text will delve into the assorted varieties of charts, key indicators, and techniques employed by profitable merchants to unlock the facility of chart evaluation.

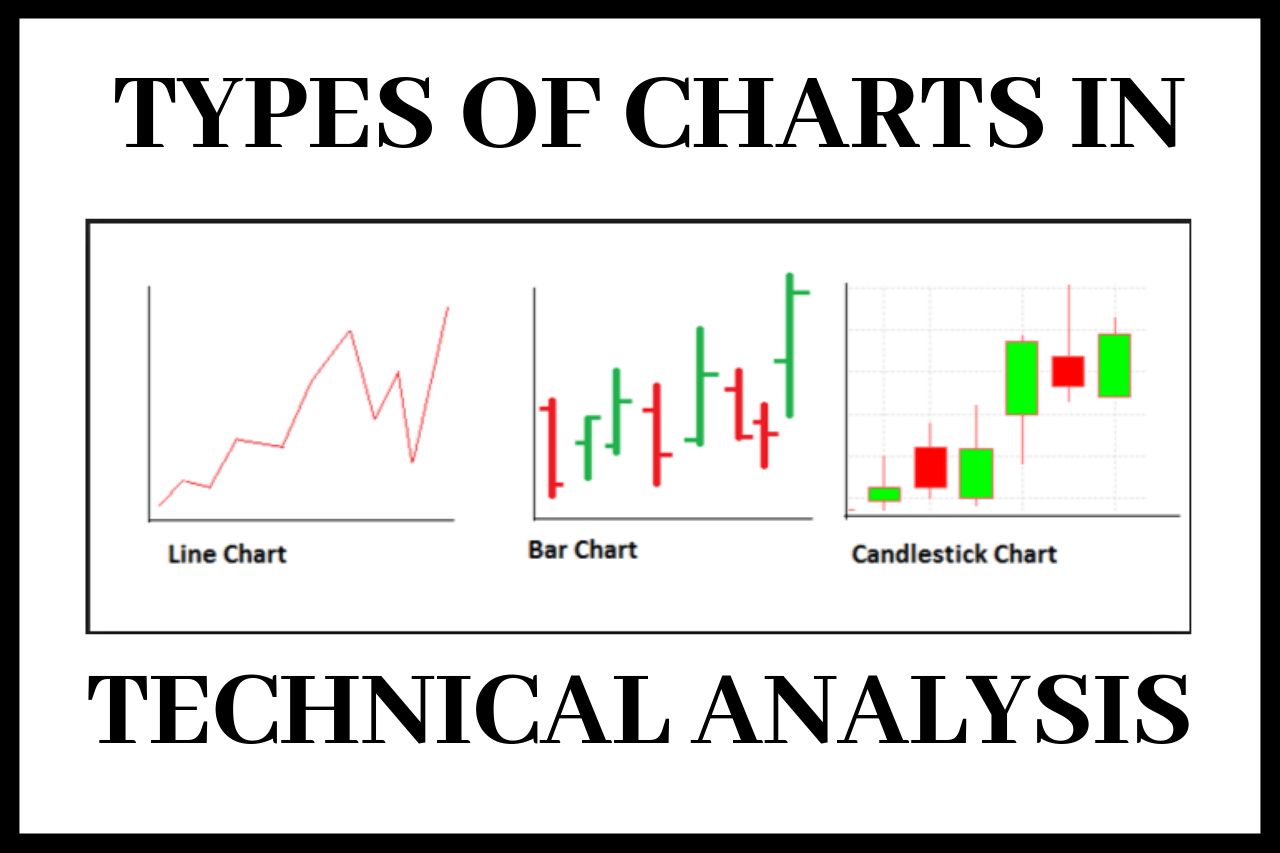

Understanding the Fundamentals: Chart Varieties

Earlier than diving into superior methods, it is essential to know the fundamental varieties of charts utilized in buying and selling. Every gives a novel perspective on value motion, and the selection of chart is dependent upon the dealer’s technique and time horizon.

-

Line Charts: The best type, line charts join closing costs over a selected interval. They supply a transparent overview of the general pattern however lack the element of different chart varieties. Very best for figuring out long-term developments and recognizing important highs and lows.

-

Bar Charts: These charts show the excessive, low, open, and shut (OHLC) costs for a given interval. The vertical bar represents the worth vary, with the horizontal line indicating the open and shut. Bar charts provide a richer dataset than line charts, revealing extra details about intraday value fluctuations. They’re notably helpful for figuring out value gaps and reversals.

-

Candlestick Charts: A visually interesting and informative chart kind, candlestick charts additionally show OHLC knowledge however in a extra intuitive method. The "physique" of the candlestick represents the vary between the open and shut costs, whereas the "wicks" (or shadows) prolong to the excessive and low costs. The colour of the physique (usually inexperienced for bullish and crimson for bearish) additional enhances the visible interpretation of value motion. Candlestick patterns, mentioned later, are a cornerstone of technical evaluation.

-

Level & Determine Charts: Not like the earlier three, level & determine charts ignore time. As a substitute, they focus solely on value actions. A brand new ‘X’ is plotted when the worth rises a predetermined quantity, and an ‘O’ when it falls. This chart kind filters out noise and emphasizes important value modifications, making it appropriate for figuring out sturdy developments and potential breakouts.

Key Indicators: Deciphering the Information

Charts alone present solely a partial image. Technical indicators, derived from value and quantity knowledge, add one other layer of study, serving to merchants affirm developments, establish potential turning factors, and handle danger. A few of the most generally used indicators embody:

-

Transferring Averages (MA): MAs clean out value fluctuations by averaging costs over a selected interval (e.g., 50-day MA, 200-day MA). They assist establish developments and potential assist/resistance ranges. Crossovers between completely different MAs (e.g., a 50-day MA crossing above a 200-day MA) are sometimes interpreted as purchase indicators.

-

Relative Power Index (RSI): An oscillator that measures the magnitude of current value modifications to guage overbought or oversold situations. RSI values above 70 typically recommend an overbought market, whereas values beneath 30 point out an oversold market. Divergences between RSI and value motion can be important buying and selling indicators.

-

MACD (Transferring Common Convergence Divergence): One other momentum oscillator that compares two shifting averages to establish modifications in pattern. MACD crossovers (the MACD line crossing its sign line) and divergences are used to generate buying and selling indicators.

-

Bollinger Bands: These bands plot customary deviations round a shifting common, illustrating value volatility. Worth bounces off the higher and decrease bands can point out potential reversal factors. The widening of the bands signifies rising volatility, whereas narrowing suggests reducing volatility.

-

Quantity: Whereas not a technical indicator in itself, quantity offers essential context to cost actions. Excessive quantity confirms value modifications, whereas low quantity suggests weak strikes that will simply reverse.

Chart Patterns: Unveiling Market Psychology

Chart patterns symbolize recurring value formations that usually predict future value actions. Recognizing these patterns permits merchants to anticipate potential developments and make knowledgeable choices. Some frequent chart patterns embody:

-

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the "head") being the very best. A break beneath the neckline confirms the sample and indicators a possible downtrend.

-

Inverse Head and Shoulders: The bullish counterpart to the top and shoulders sample, signaling a possible uptrend.

-

Triangles: Consolidation patterns characterised by converging trendlines. Breakouts from triangles can affirm the continuation or reversal of the prevailing pattern. Symmetrical, ascending, and descending triangles are frequent variations.

-

Flags and Pennants: Quick-term consolidation patterns that usually happen inside a bigger pattern. Breakouts from flags and pennants usually affirm the continuation of the pattern.

-

Double Tops and Double Bottoms: Reversal patterns fashioned by two related peaks (double high) or troughs (double backside). A break beneath the neckline of a double high or above the neckline of a double backside indicators a possible pattern reversal.

Timeframes and Methods:

The timeframe chosen for chart evaluation considerably impacts buying and selling methods.

-

Lengthy-term merchants (Swing Merchants and Place Merchants): Make the most of every day, weekly, and month-to-month charts to establish main developments and maintain positions for prolonged durations. They deal with basic evaluation along with technical evaluation.

-

Quick-term merchants (Day Merchants and Scalpers): Make use of intraday charts (5-minute, 15-minute, 1-hour charts) to establish short-term value fluctuations and capitalize on fast value actions. They rely closely on technical evaluation and infrequently use high-frequency buying and selling methods.

Threat Administration: The Unsung Hero

Regardless of how refined your chart evaluation expertise, danger administration is paramount. Using applicable stop-loss orders, place sizing methods, and diversification minimizes potential losses and protects your capital.

Conclusion:

Chart evaluation is a strong device for navigating the complexities of the monetary markets. By understanding completely different chart varieties, using key indicators, recognizing chart patterns, and implementing sturdy danger administration methods, merchants can improve their decision-making course of and enhance their possibilities of success. Nonetheless, it is essential to do not forget that no buying and selling technique ensures earnings. Steady studying, adapting to market situations, and disciplined execution are important for long-term success in buying and selling. The journey to mastering chart evaluation is ongoing, requiring dedication, follow, and a willingness to be taught from each successes and failures. The charts present the map; your talent and self-discipline chart your course.

Closure

Thus, we hope this text has offered precious insights into Charting Your Course to Buying and selling Success: A Complete Information to Chart Evaluation. We respect your consideration to our article. See you in our subsequent article!