Chartink Intraday Screeners: Unlocking Worthwhile Buying and selling Alternatives

Associated Articles: Chartink Intraday Screeners: Unlocking Worthwhile Buying and selling Alternatives

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Chartink Intraday Screeners: Unlocking Worthwhile Buying and selling Alternatives. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Chartink Intraday Screeners: Unlocking Worthwhile Buying and selling Alternatives

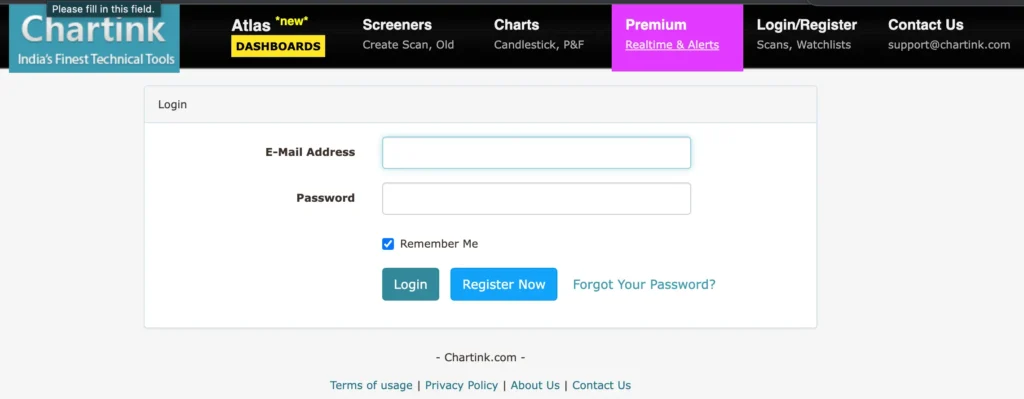

The intraday market is a dynamic beast, demanding pace, precision, and a eager understanding of value motion. For merchants searching for an edge, refined screening instruments are indispensable. Chartink, a well-liked platform for technical evaluation and backtesting, gives a strong suite of intraday screeners that may considerably improve your buying and selling technique. This text explores the most effective Chartink intraday screeners, highlighting their options, advantages, and how one can successfully make the most of them for worthwhile buying and selling.

Understanding Chartink’s Strengths:

Chartink differentiates itself by its in depth library of pre-built screeners, customizable choices, and integration with in style charting platforms. Its power lies in its skill to filter by huge quantities of market information, figuring out shares that meet particular standards, saving merchants helpful effort and time. Whereas different platforms provide related functionalities, Chartink’s user-friendly interface and complete documentation make it accessible to each novice and skilled merchants.

Selecting the Proper Intraday Screener: Key Issues:

Earlier than diving into particular screeners, it is essential to grasp your buying and selling model and goals. Totally different screeners cater to completely different methods:

-

Your Buying and selling Fashion: Are you a scalper, day dealer, or swing dealer? Scalpers want screeners that determine high-volume, short-term value actions, whereas day merchants may deal with shares with robust momentum all through the day. Swing merchants, alternatively, might make the most of screeners figuring out shares poised for longer-term value appreciation.

-

Your Threat Tolerance: Aggressive merchants may make use of screeners concentrating on high-volatility shares, accepting greater threat for doubtlessly greater rewards. Conservative merchants will want screeners specializing in lower-volatility shares with constant value motion.

-

Market Circumstances: The effectiveness of a screener can fluctuate based mostly on market circumstances. Throughout unstable intervals, sure screeners may yield extra outcomes than others. It is important to adapt your screening standards based mostly on market sentiment and general volatility.

-

Particular Indicators: Chartink gives a big selection of technical indicators. Understanding which indicators are most related to your buying and selling model is crucial. Well-liked selections embrace Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), Quantity, and varied shifting averages.

High Chartink Intraday Screeners & Methods:

Whereas the "greatest" screener is subjective and is dependent upon particular person wants, a number of stand out for his or her reputation and effectiveness:

1. Breakout Screener: It is a cornerstone of many intraday methods. It identifies shares which have not too long ago damaged by resistance ranges, suggesting a possible upward value motion. The screener may be personalized to incorporate quantity affirmation, guaranteeing the breakout is critical and never only a random value fluctuation.

-

Customization: Modify parameters just like the interval for calculating resistance, the required quantity enhance, and the minimal value motion after the breakout.

-

Technique: Mix this screener with different indicators like RSI or MACD to verify the power of the breakout and determine potential entry and exit factors. Use stop-loss orders to handle threat.

2. Excessive-Quantity Screener: Liquidity is essential for intraday buying and selling. This screener identifies shares with unusually excessive buying and selling quantity, indicating robust curiosity and potential for important value actions.

-

Customization: Set a threshold for quantity relative to the common quantity over a selected interval. Contemplate incorporating value adjustments alongside quantity to filter out noisy indicators.

-

Technique: Excessive quantity alone would not assure revenue. Use this screener along side different indicators to verify the course of the worth motion. Search for affirmation from value motion and candlestick patterns.

3. RSI Oversold/Overbought Screener: The RSI indicator measures the momentum of value adjustments. This screener identifies shares the place the RSI is oversold (under a sure threshold, typically 30) or overbought (above a sure threshold, typically 70), suggesting potential reversals.

-

Customization: Modify the RSI interval and the oversold/overbought thresholds based mostly in your threat tolerance and market circumstances.

-

Technique: Oversold circumstances may point out a shopping for alternative, whereas overbought circumstances may recommend a promoting alternative. Nevertheless, RSI divergences ought to be thought-about for affirmation. By no means rely solely on RSI for buying and selling selections.

4. Shifting Common Crossover Screener: This screener identifies shares the place a shorter-term shifting common crosses above a longer-term shifting common (a bullish sign) or vice versa (a bearish sign).

-

Customization: Experiment with completely different shifting common intervals (e.g., 5-day MA crossing above 20-day MA).

-

Technique: It is a basic trend-following technique. Verify the sign with different indicators and value motion earlier than coming into a commerce.

5. Hole-Up/Hole-Down Screener: This screener identifies shares that open with a big hole up or down from the day past’s closing value. Gaps can point out robust momentum and potential buying and selling alternatives.

-

Customization: Set a threshold for the minimal hole dimension to filter out insignificant gaps.

-

Technique: Hole-up shares could be appropriate for lengthy positions, whereas gap-down shares could be appropriate for brief positions. Nevertheless, at all times contemplate the danger concerned and use applicable threat administration strategies.

Past Pre-built Screeners: Customizing Your Strategy:

Chartink’s energy lies in its flexibility. Whereas pre-built screeners provide a place to begin, you may customise them to create extremely particular methods tailor-made to your wants. This entails:

-

Combining A number of Indicators: As a substitute of counting on a single indicator, mix a number of indicators to create extra strong and dependable indicators. For instance, mix a breakout screener with RSI and quantity affirmation.

-

Adjusting Parameters: Experiment with completely different parameter values to optimize the screener’s efficiency. Backtesting is essential for this course of.

-

Including Customized Circumstances: Chartink means that you can add customized circumstances based mostly on particular value patterns, candlestick formations, or different technical indicators.

Threat Administration and Backtesting:

Irrespective of how refined your screener, threat administration is paramount. At all times use stop-loss orders to restrict potential losses. Moreover, backtesting your methods utilizing historic information is essential to judge their effectiveness and refine your parameters. Chartink facilitates backtesting, permitting you to evaluate the efficiency of your screeners over completely different market circumstances.

Conclusion:

Chartink’s intraday screeners provide a robust software for merchants searching for to enhance their effectivity and profitability. By understanding your buying and selling model, fastidiously choosing screeners, customizing your method, and rigorously managing threat, you may leverage Chartink’s capabilities to determine worthwhile buying and selling alternatives within the dynamic intraday market. Do not forget that no screener ensures earnings, and steady studying and adaptation are important for long-term success. At all times mix technical evaluation with basic evaluation and sound threat administration practices for optimum outcomes.

Closure

Thus, we hope this text has supplied helpful insights into Chartink Intraday Screeners: Unlocking Worthwhile Buying and selling Alternatives. We thanks for taking the time to learn this text. See you in our subsequent article!