copper vs gold worth chart

Associated Articles: copper vs gold worth chart

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to copper vs gold worth chart. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

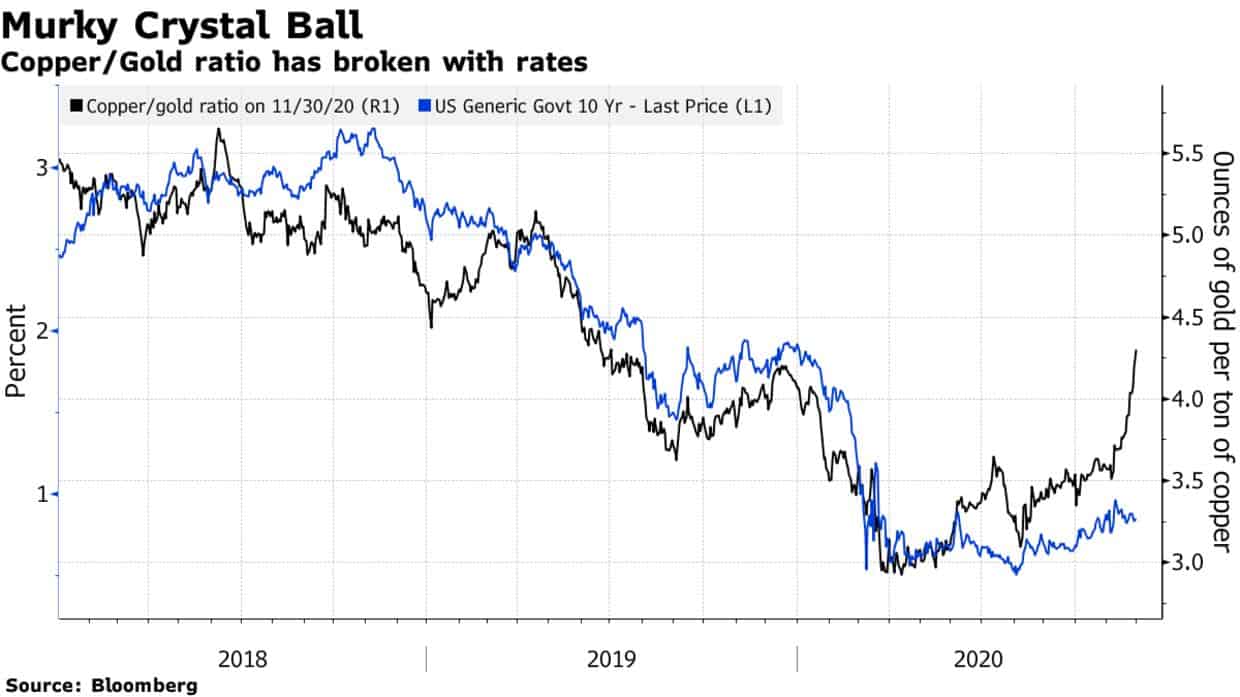

Copper vs. Gold: A Comparative Value Chart Evaluation and Market Outlook

Copper and gold, two outstanding commodities with distinct industrial and funding functions, have traditionally exhibited intriguing worth correlations. Whereas each are thought of protected haven property throughout instances of financial uncertainty, their worth actions are pushed by completely different elementary components, resulting in durations of divergence and convergence. Analyzing a comparative worth chart of copper and gold over the previous twenty years reveals priceless insights into the interaction of macroeconomic situations, industrial demand, and investor sentiment.

Understanding the Fundamentals:

Earlier than diving into the value chart evaluation, it is essential to grasp the underlying drivers of every metallic’s worth.

Gold:

- Protected Haven Asset: Gold’s main operate is as a retailer of worth and a hedge towards inflation and geopolitical dangers. When traders understand uncertainty out there, they typically flock to gold, driving up its worth. This "flight to security" is a big issue influencing gold’s worth.

- Inflation Hedge: Gold’s worth typically rises in periods of excessive inflation because it retains its worth higher than fiat currencies. This makes it a lovely funding for preserving buying energy.

- Jewellery and Funding Demand: Vital demand for gold comes from the jewellery business and particular person traders buying gold bars, cash, and ETFs. Adjustments in these demand patterns can affect the value.

- Central Financial institution Exercise: Central banks worldwide maintain important gold reserves. Their shopping for or promoting actions can affect the market worth.

- Foreign money Fluctuations: The worth of gold is often inversely correlated with the US greenback. A weaker greenback typically boosts gold costs, making it extra reasonably priced for patrons utilizing different currencies.

Copper:

- Industrial Metallic: Copper is primarily an industrial metallic, important for varied functions, together with electrical wiring, building, and manufacturing. Its worth is closely influenced by international financial progress and industrial manufacturing.

- Provide and Demand Dynamics: Copper’s worth is delicate to the stability between provide and demand. Components corresponding to mine manufacturing, recycling charges, and international financial exercise considerably have an effect on its worth.

- Technological Developments: Technological improvements, significantly within the renewable vitality sector (e.g., electrical autos, photo voltaic panels), can considerably affect copper demand. Elevated adoption of those applied sciences normally results in larger copper costs.

- Geopolitical Dangers: Geopolitical instability, significantly in main copper-producing international locations, can disrupt provide chains and affect costs.

- Stock Ranges: Adjustments in copper inventories held by exchanges and producers can affect worth actions. Excessive stock ranges typically exert downward strain on costs.

Analyzing the Value Chart (2000-Current):

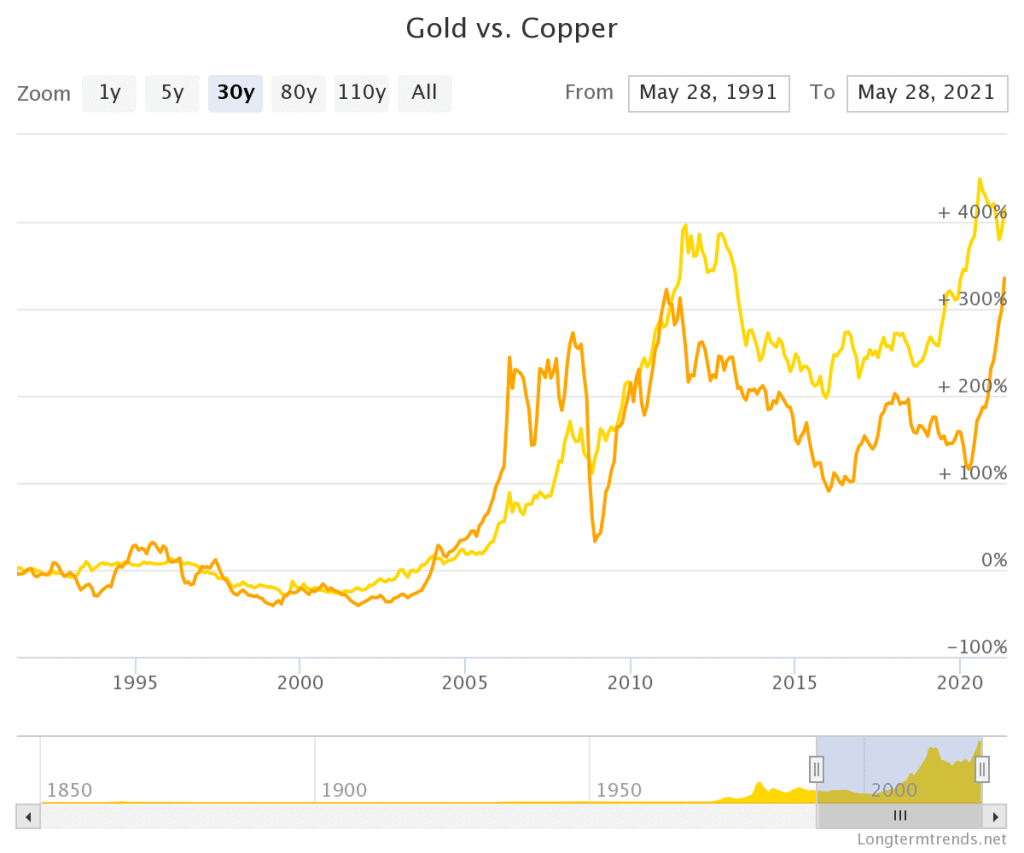

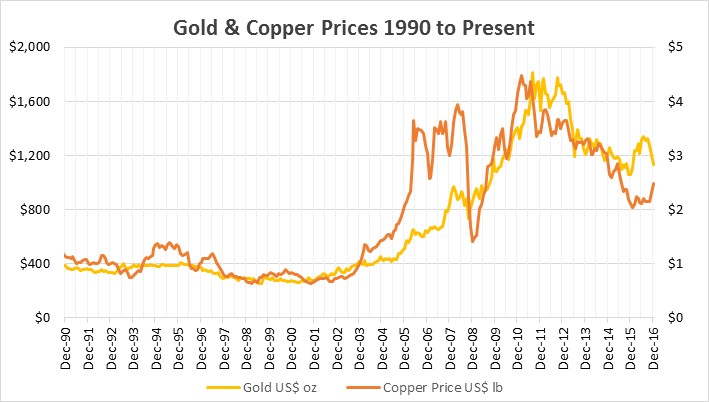

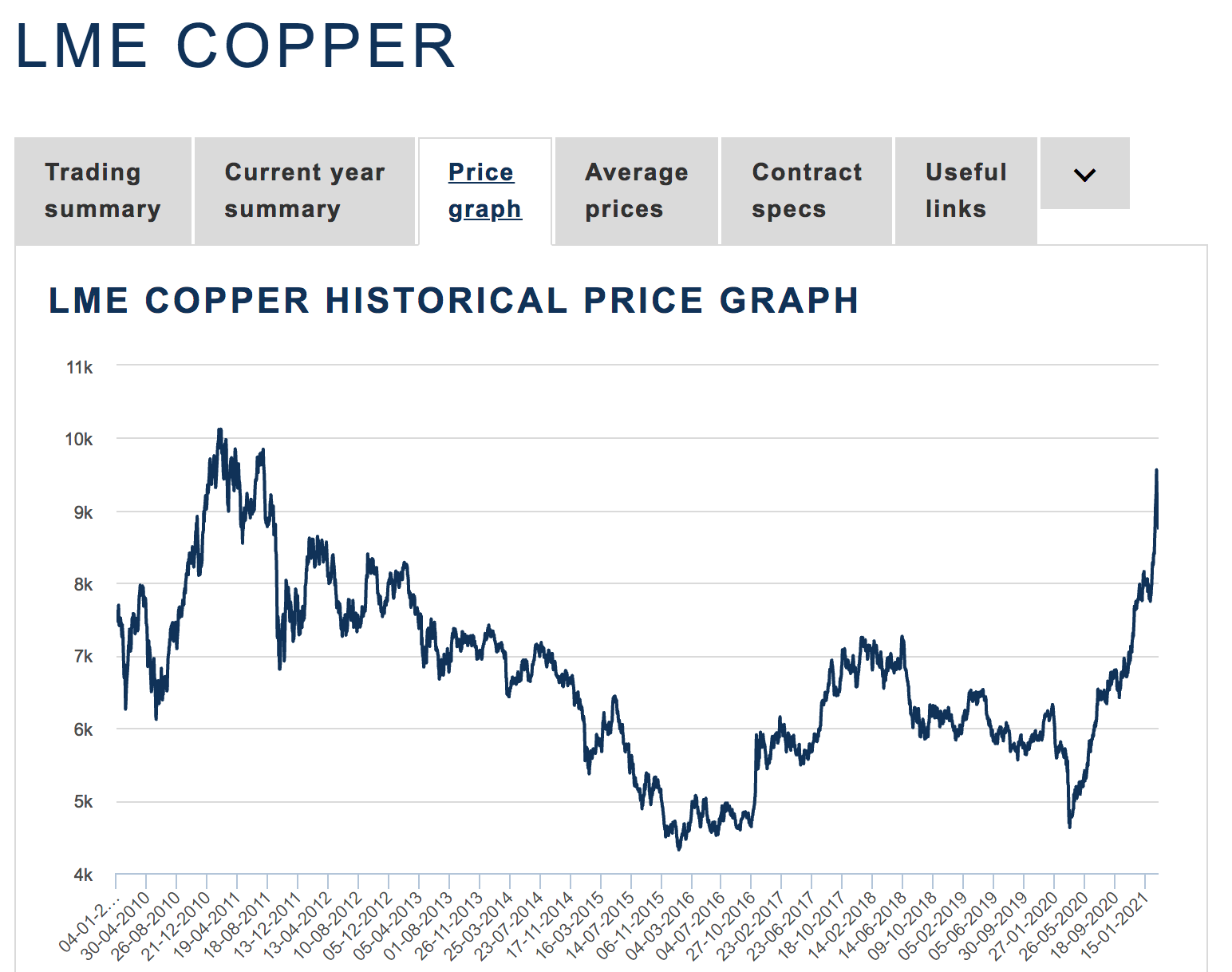

A visible comparability of copper and gold worth charts over the previous twenty years reveals a number of key durations of convergence and divergence:

-

Early 2000s: Each copper and gold skilled a interval of comparatively regular progress, reflecting a worldwide financial growth. The correlation between the 2 was comparatively weak throughout this time, indicating that different components moreover international progress have been influencing their costs.

-

2008 Monetary Disaster: Each metals confirmed a big worth drop within the wake of the 2008 monetary disaster, reflecting the worldwide financial downturn and elevated threat aversion. Nonetheless, gold’s decline was much less pronounced than copper’s, highlighting its function as a protected haven asset. This era clearly demonstrates the divergence of their responses to financial shocks.

-

Submit-2008 Restoration: Following the monetary disaster, each metals skilled a interval of restoration, however their worth actions diverged once more. Copper’s worth was extra carefully tied to the worldwide financial restoration, whereas gold’s worth was influenced extra by components like inflation issues and geopolitical instability.

-

2011-2015: Gold skilled a big worth surge, pushed by elevated investor demand throughout a interval of world financial uncertainty and quantitative easing by central banks. Copper’s worth, whereas additionally rising, didn’t expertise the identical dramatic rise, reflecting the differing drivers of their respective markets.

-

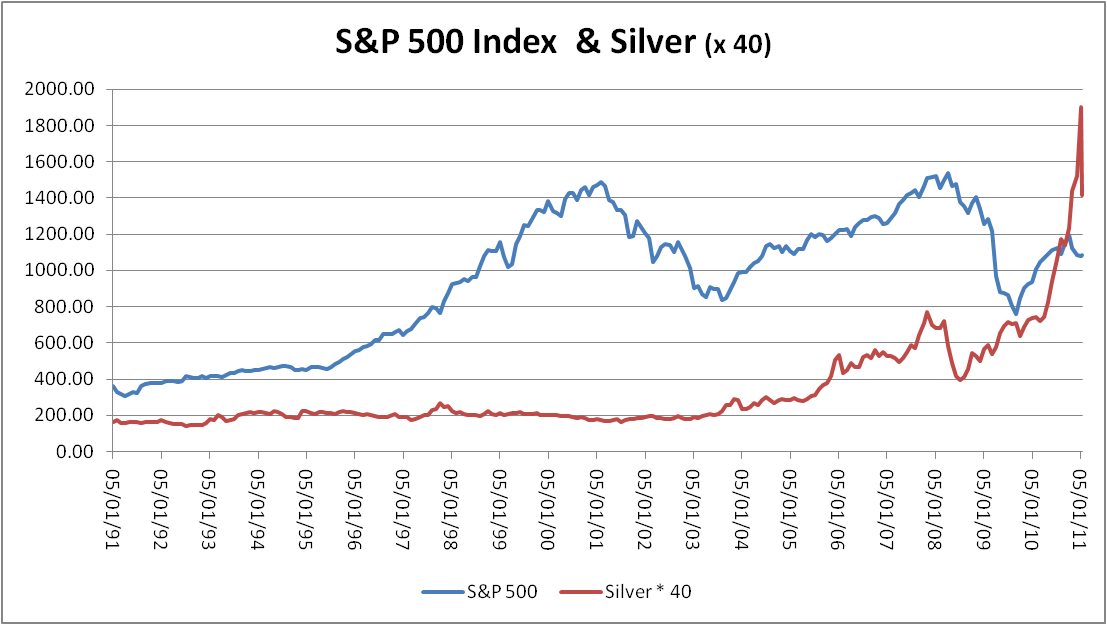

2015-2020: Each metals skilled a interval of worth stagnation or slight decline, reflecting international financial slowdown and uncertainty. Nonetheless, the correlation between them remained comparatively weak.

-

2020-Current: The COVID-19 pandemic initially precipitated a big worth drop in each metals, however their subsequent restoration paths differed. Gold skilled a surge in demand because of elevated uncertainty and financial stimulus, whereas copper’s restoration was extra carefully linked to the rebound in industrial exercise. This era highlights the interaction between protected haven demand and industrial demand.

Correlation and Causation:

Whereas the value charts could present durations of correlation, it is essential to do not forget that correlation doesn’t equal causation. The connection between copper and gold costs is complicated and influenced by a mess of interacting components. Whereas each might be affected by international financial progress, their sensitivity to various factors results in durations of divergence.

Components Affecting the Correlation:

- World Financial Development: Sturdy international financial progress typically helps larger costs for each metals, however the diploma of affect varies.

- Inflation: Inflation sometimes boosts gold costs extra considerably than copper costs.

- US Greenback Power: A powerful US greenback tends to negatively affect each metals, however the impact is normally extra pronounced on gold.

- Curiosity Charges: Increased rates of interest typically exert downward strain on each metals, however the affect is extra important on gold.

- Provide Chain Disruptions: Provide chain disruptions can affect each metals, however the results can differ relying on the precise nature of the disruption.

Market Outlook:

Predicting future worth actions for each copper and gold is inherently difficult, given the multitude of things at play. Nonetheless, a number of components might affect their future worth trajectories:

- World Financial Development: The tempo of world financial progress will considerably affect copper demand. A sturdy restoration would seemingly help larger copper costs.

- Inflationary Pressures: Persistent inflationary pressures might increase demand for each gold and copper, however the impact would seemingly be extra pronounced on gold.

- Geopolitical Dangers: Geopolitical instability might drive traders towards gold as a protected haven asset, whereas additionally probably impacting copper provide chains.

- Technological Developments: Continued technological developments in renewable vitality and electrical autos will seemingly improve demand for copper.

- Sustainability Considerations: Rising issues about environmental sustainability might result in elevated funding in inexperienced applied sciences, additional boosting copper demand.

Conclusion:

Analyzing the comparative worth chart of copper and gold reveals a posh relationship formed by distinct elementary drivers. Whereas each metals might be influenced by macroeconomic situations, their worth actions typically diverge because of variations of their industrial and funding functions. Understanding these elementary drivers, together with present market situations and future outlook, is essential for traders searching for to navigate the dynamic interaction between these two necessary commodities. Cautious consideration of the components mentioned above, coupled with ongoing market monitoring, is crucial for knowledgeable funding choices in each copper and gold. The longer term worth relationship between these two metals will proceed to be an enchanting and dynamic space of examine for market analysts and traders alike.

Closure

Thus, we hope this text has supplied priceless insights into copper vs gold worth chart. We thanks for taking the time to learn this text. See you in our subsequent article!