Deciphering the 10-12 months Treasury Yield Chart on TradingView: A Complete Information

Associated Articles: Deciphering the 10-12 months Treasury Yield Chart on TradingView: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Deciphering the 10-12 months Treasury Yield Chart on TradingView: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Deciphering the 10-12 months Treasury Yield Chart on TradingView: A Complete Information

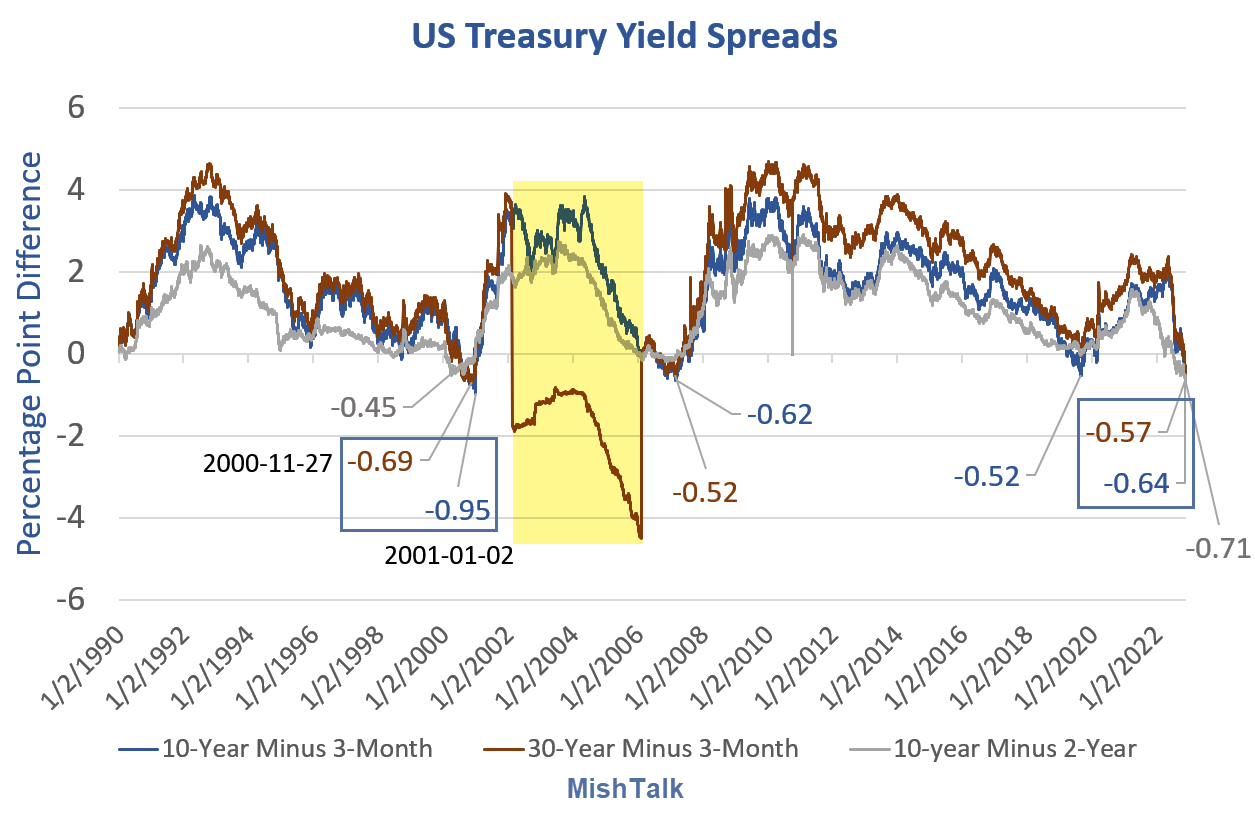

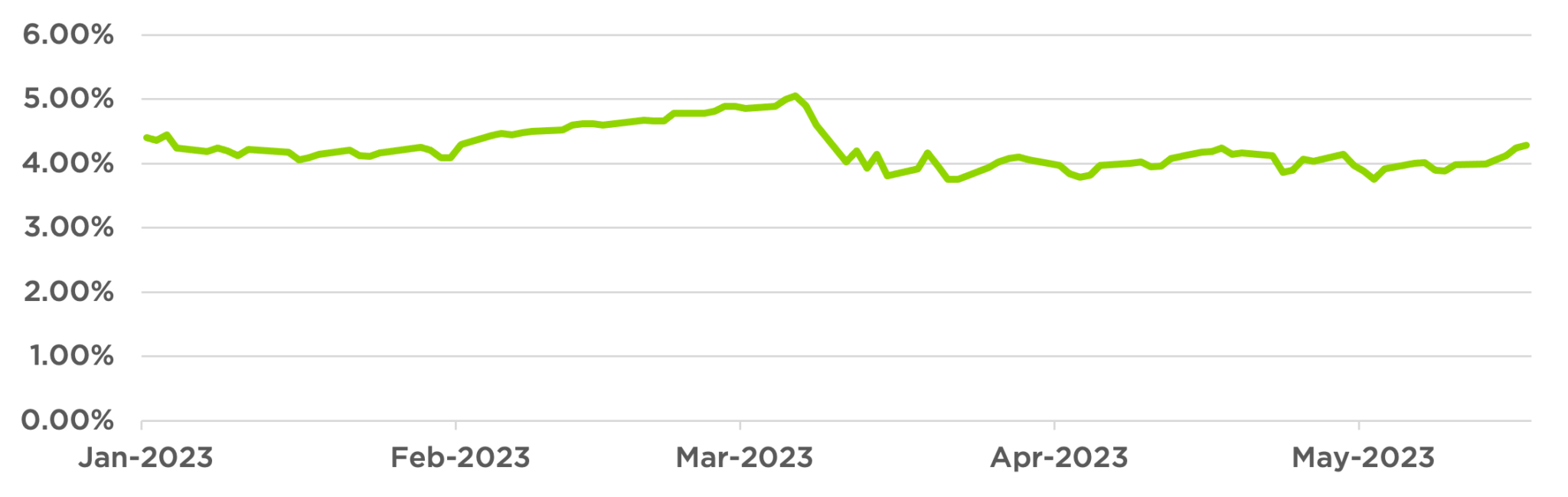

The ten-year Treasury yield is a cornerstone of the worldwide monetary market, influencing all the pieces from mortgage charges and company borrowing prices to the valuation of equities and the course of the greenback. Monitoring its motion is essential for traders of all stripes, and TradingView gives a robust platform for analyzing this very important indicator. This text delves deep into decoding the 10-year Treasury yield chart on TradingView, exploring its historic context, technical evaluation methods, elementary drivers, and sensible implications for buying and selling and funding selections.

Understanding the 10-12 months Treasury Yield

The ten-year Treasury yield represents the return an investor receives for holding a U.S. Treasury bond that matures in ten years. It is a benchmark fee, reflecting the market’s expectation of future inflation, financial progress, and the perceived threat of holding authorities debt. A better yield signifies larger returns but in addition doubtlessly larger inflation or elevated perceived threat. Conversely, a decrease yield suggests decrease returns however doubtlessly decrease inflation and decrease perceived threat. The yield strikes inversely to the bond’s worth; when the value of the bond rises, the yield falls, and vice-versa.

Navigating the TradingView Chart

TradingView gives a plethora of instruments and indicators to investigate the 10-year Treasury yield. To start, seek for the ticker image, usually "TNX" (or an analogous designation relying in your area and information supplier). As soon as the chart hundreds, you will see the yield plotted in opposition to time. TradingView permits you to customise the chart’s timeframe (from intraday to many years), add numerous indicators, draw trendlines, and carry out backtesting.

Key Components of Technical Evaluation on TradingView:

-

Transferring Averages: Easy Transferring Averages (SMAs) and Exponential Transferring Averages (EMAs) assist clean out worth fluctuations and determine developments. A generally used mixture is the 50-day and 200-day SMA. A bullish crossover happens when the shorter-term SMA crosses above the longer-term SMA, suggesting a possible upward pattern. A bearish crossover indicators the alternative.

-

Relative Energy Index (RSI): The RSI is a momentum oscillator that helps determine overbought and oversold situations. Readings above 70 usually counsel an overbought market, whereas readings under 30 counsel an oversold market. These ranges aren’t absolute indicators however reasonably indicators of potential pattern reversals.

-

MACD (Transferring Common Convergence Divergence): The MACD is one other momentum indicator that compares two transferring averages. Crossovers of the MACD line above its sign line counsel bullish momentum, whereas crossovers under counsel bearish momentum. Divergences between the MACD and worth motion may also be worthwhile indicators.

-

Bollinger Bands: Bollinger Bands show worth volatility by plotting customary deviations round a transferring common. Worth actions outdoors the bands usually sign potential breakouts or reversals.

-

Fibonacci Retracements: These instruments determine potential help and resistance ranges primarily based on Fibonacci ratios. They’re helpful for predicting worth reversals inside a pattern.

-

Trendlines: Drawing trendlines on the chart helps visualize the general course of the yield. Breaks above upward-sloping trendlines counsel bullish momentum, whereas breaks under downward-sloping trendlines counsel bearish momentum.

Basic Elements Influencing the 10-12 months Treasury Yield:

Technical evaluation is simply a part of the equation. Understanding the basic drivers of the 10-year Treasury yield is essential for knowledgeable buying and selling and funding selections. These components embody:

-

Inflation Expectations: Rising inflation usually pushes yields larger as traders demand larger returns to compensate for the erosion of buying energy. Conversely, falling inflation can result in decrease yields. Inflation expectations are sometimes mirrored in inflation-indexed bonds and inflation indicators just like the Client Worth Index (CPI).

-

Financial Development: Robust financial progress usually results in larger yields as traders anticipate elevated demand for credit score and better inflation. Weak financial progress, however, can result in decrease yields as traders search the protection of presidency bonds. Financial indicators like GDP progress, employment information, and client confidence play a vital function.

-

Federal Reserve Coverage: The Federal Reserve’s financial coverage considerably impacts Treasury yields. Rate of interest hikes usually push yields larger, whereas fee cuts push yields decrease. The Fed’s communication concerning its coverage intentions is carefully scrutinized by market contributors.

-

World Financial Situations: World financial occasions, similar to geopolitical instability, forex fluctuations, and worldwide commerce disputes, can affect investor sentiment and Treasury yields. These occasions can create uncertainty, resulting in a flight to security and decrease yields, or set off risk-on sentiment and better yields.

-

Authorities Debt Ranges: Excessive ranges of presidency debt can doubtlessly result in larger yields as traders turn out to be involved in regards to the authorities’s means to repay its obligations.

Sensible Implications for Buying and selling and Investing:

Understanding the 10-year Treasury yield chart on TradingView can have important implications for numerous funding methods:

-

Mounted Earnings Investing: Buyers in fixed-income securities want to watch yield actions to evaluate the worth of their holdings and make knowledgeable selections about shopping for or promoting bonds.

-

Fairness Investing: Adjustments in Treasury yields can influence fairness valuations. Rising yields can put downward stress on fairness costs, whereas falling yields can have the alternative impact.

-

Foreign money Buying and selling: The ten-year Treasury yield influences the worth of the US greenback. Greater yields have a tendency to draw overseas funding, strengthening the greenback.

-

Mortgage Charges: Mortgage charges are sometimes linked to the 10-year Treasury yield. Adjustments within the yield can straight have an effect on borrowing prices for homebuyers.

Conclusion:

The ten-year Treasury yield chart on TradingView is a robust software for analyzing a vital market indicator. By combining technical evaluation methods with an understanding of elementary financial components, traders can achieve worthwhile insights into market dynamics and make knowledgeable buying and selling and funding selections. Nevertheless, it is essential to keep in mind that no single indicator gives a foolproof prediction of future yield actions. A complete method, combining chart evaluation, elementary analysis, and threat administration, is crucial for achievement in navigating the complexities of the bond market. Steady studying and adaptation are very important on this ever-evolving panorama. Bear in mind to at all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied worthwhile insights into Deciphering the 10-12 months Treasury Yield Chart on TradingView: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!