Deciphering the Brent Crude Oil Worth Chart: A Complete Evaluation

Associated Articles: Deciphering the Brent Crude Oil Worth Chart: A Complete Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Deciphering the Brent Crude Oil Worth Chart: A Complete Evaluation. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Deciphering the Brent Crude Oil Worth Chart: A Complete Evaluation

Brent crude oil, a worldwide benchmark for pricing crude oil, has a historical past as risky as it’s influential. Its worth actions instantly affect international economies, influencing every part from gasoline costs on the pump to the price of manufacturing and transportation. Understanding the Brent crude oil worth chart, subsequently, is essential for traders, policymakers, and anybody looking for to know the intricacies of the worldwide power market. This text will delve into the components driving Brent crude worth fluctuations, analyze historic traits, and supply insights into decoding the chart for future predictions.

Understanding the Chart’s Elements:

A typical Brent crude oil worth chart shows the worth of a barrel of Brent crude over a specified interval, normally starting from a number of days to a number of years. The chart sometimes makes use of a line graph, with the x-axis representing time and the y-axis representing the worth per barrel (normally in US {dollars}). Varied indicators could be overlaid, together with:

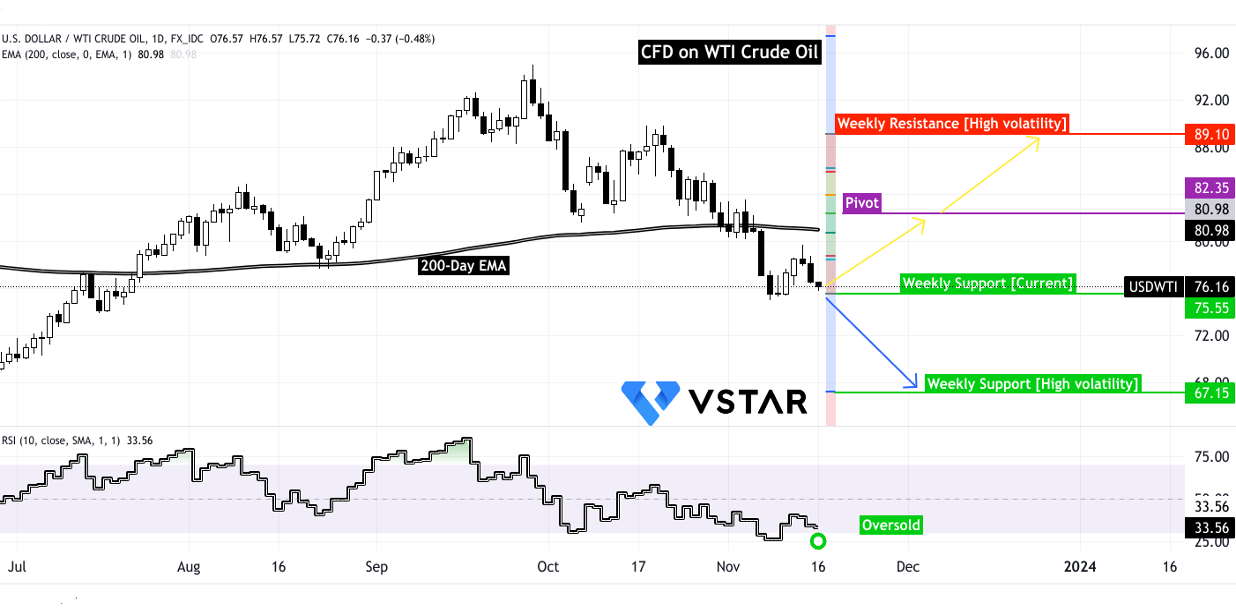

- Transferring Averages: These clean out worth fluctuations, serving to to establish traits. Widespread transferring averages embody 50-day, 100-day, and 200-day averages. A rising transferring common suggests an upward development, whereas a falling one suggests a downward development.

- Relative Power Index (RSI): This momentum indicator helps decide whether or not the worth is overbought (above 70) or oversold (beneath 30), doubtlessly signaling a reversal.

- Bollinger Bands: These bands present worth volatility. Costs outdoors the bands recommend excessive volatility, doubtlessly indicating a breakout or a reversal.

- Assist and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by. Assist ranges symbolize costs the place shopping for strain is predicted to outweigh promoting strain, whereas resistance ranges symbolize the other.

Components Influencing Brent Crude Costs:

The worth of Brent crude is influenced by a fancy interaction of things, broadly categorized as:

-

Provide and Demand: That is the elemental driver. Elevated international demand, coupled with constrained provide, pushes costs greater. Conversely, a surplus of provide relative to demand results in decrease costs. Components affecting provide embody OPEC+ manufacturing quotas, geopolitical instability in oil-producing areas, technological developments in oil extraction, and surprising disruptions like pure disasters or pipeline outages. Demand is influenced by international financial development, industrial exercise, differences due to the season (greater demand throughout winter), and the adoption of different power sources.

-

Geopolitical Occasions: Political instability in main oil-producing areas, such because the Center East, North Africa, or Russia, can considerably affect provide and, consequently, costs. Sanctions, wars, or political upheavals can disrupt manufacturing and transportation, main to cost spikes. The continuing battle in Ukraine, for instance, has had a profound affect on international power markets, contributing to vital worth will increase.

-

OPEC+ Actions: The Group of the Petroleum Exporting Nations (OPEC) and its allies (OPEC+) play a vital position in influencing international oil provide. Their manufacturing quotas and agreements considerably affect the market. Selections to extend or lower manufacturing can have a dramatic impact on Brent crude costs. Analyzing OPEC+ statements and actions is important for understanding potential worth actions.

-

Financial Progress and World Demand: Robust international financial development usually interprets to greater power consumption and, subsequently, greater oil costs. Recessions or financial slowdowns, then again, have a tendency to scale back demand and put downward strain on costs. Key financial indicators, similar to GDP development charges and industrial manufacturing indices, are precious instruments for assessing future demand.

-

US Greenback Power: The US greenback is the first foreign money utilized in oil buying and selling. A stronger greenback makes oil dearer for patrons utilizing different currencies, doubtlessly lowering demand and placing downward strain on costs. Conversely, a weaker greenback can enhance demand and improve costs.

-

Hypothesis and Funding: The futures market performs a big position in Brent crude worth fluctuations. Speculators and traders can drive costs up or down based mostly on their expectations of future provide and demand. This may result in vital worth volatility, even within the absence of basic shifts available in the market.

-

Technological Developments: Improvements in oil extraction applied sciences, similar to hydraulic fracturing ("fracking"), can considerably improve provide, doubtlessly resulting in decrease costs. Equally, developments in renewable power applied sciences can progressively scale back the demand for oil in the long run.

Deciphering the Chart: Historic Tendencies and Future Predictions:

Analyzing the Brent crude worth chart over totally different timeframes reveals a number of key traits:

-

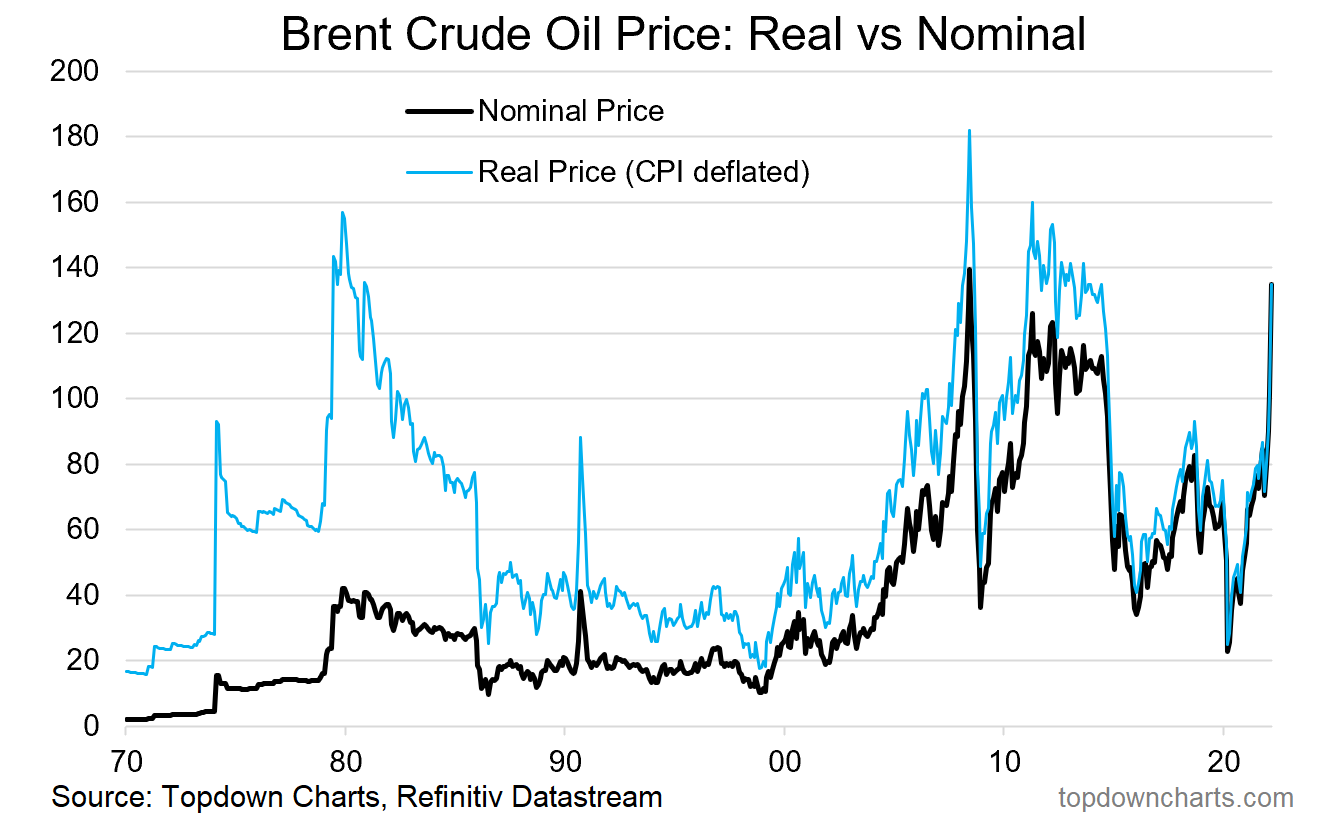

Lengthy-Time period Tendencies: Over the previous few a long time, the worth of Brent crude has skilled vital volatility, with intervals of sustained excessive costs interspersed with intervals of decrease costs. These long-term traits are largely pushed by shifts in international provide and demand, in addition to main geopolitical occasions.

-

Quick-Time period Fluctuations: Day-to-day and week-to-week worth actions are sometimes influenced by short-term components, similar to information occasions, speculative buying and selling, and short-term provide disruptions. These fluctuations could be fairly vital, making short-term forecasting difficult.

-

Cyclical Patterns: Whereas not completely predictable, the Brent crude worth chart usually displays cyclical patterns, with intervals of worth will increase adopted by intervals of decline. Figuring out these cycles can present insights into potential future worth actions, although warning needs to be exercised as these patterns will not be all the time dependable.

Predicting future Brent crude costs is inherently troublesome because of the complicated interaction of things talked about above. Nonetheless, by fastidiously analyzing the chart, contemplating historic traits, and monitoring present occasions and financial indicators, traders and analysts could make extra knowledgeable predictions. Basic evaluation, specializing in provide and demand dynamics, geopolitical dangers, and financial development, is essential. Technical evaluation, utilizing chart patterns and indicators, can present supplementary insights.

Conclusion:

The Brent crude oil worth chart is a robust device for understanding the dynamics of the worldwide power market. Whereas predicting future costs with certainty is not possible, analyzing the chart together with a radical understanding of the underlying components influencing provide and demand permits for extra knowledgeable decision-making. By fastidiously contemplating geopolitical occasions, financial indicators, OPEC+ actions, and market sentiment, traders and analysts can develop a extra nuanced perspective on potential worth actions and mitigate dangers related to this risky commodity. Steady monitoring of the chart and its indicators, coupled with a deep understanding of the worldwide power panorama, stays important for navigating the complexities of the Brent crude market.

Closure

Thus, we hope this text has offered precious insights into Deciphering the Brent Crude Oil Worth Chart: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!