Deciphering the CalPERS 2% at 55 Chart: A Complete Information to Retirement Planning

Associated Articles: Deciphering the CalPERS 2% at 55 Chart: A Complete Information to Retirement Planning

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Deciphering the CalPERS 2% at 55 Chart: A Complete Information to Retirement Planning. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Deciphering the CalPERS 2% at 55 Chart: A Complete Information to Retirement Planning

The California Public Workers’ Retirement System (CalPERS) is without doubt one of the largest public pension funds on this planet, offering retirement safety for over 1.9 million members. A big facet of CalPERS’ profit construction is the "2% at 55" formulation, a key component for a lot of members planning their retirement. Nonetheless, understanding this seemingly easy phrase requires a deeper dive into its intricacies and implications. This text gives a complete overview of the CalPERS 2% at 55 chart, explaining its mechanics, limitations, and the way it impacts retirement planning.

Understanding the "2% at 55" Formulation

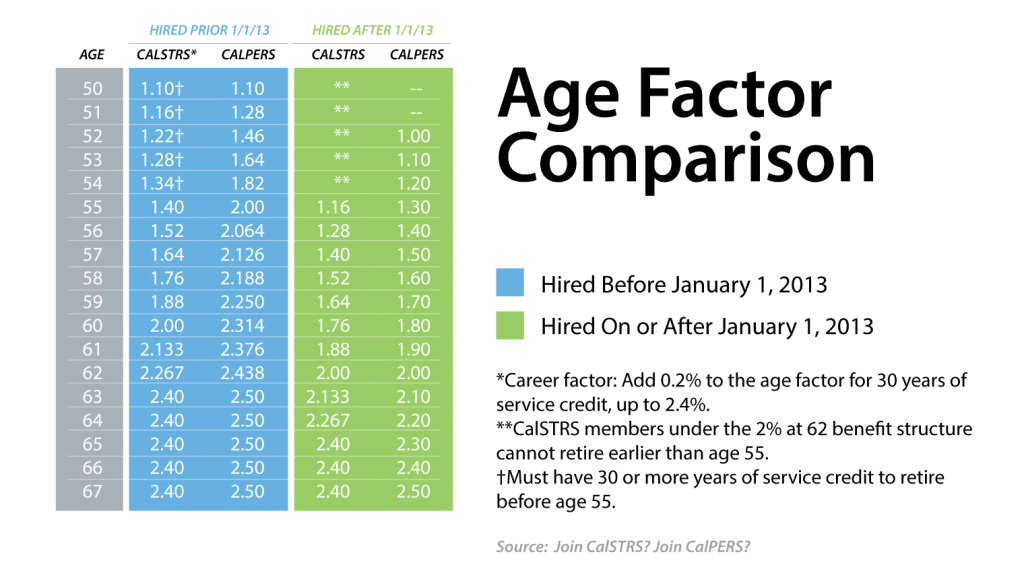

The "2% at 55" formulation, extra precisely described as a "2% at 55 closing compensation," refers to a particular tier of CalPERS advantages. It is essential to know that this formulation is not relevant to all CalPERS members. The tier to which a member belongs will depend on their employment begin date. Members who entered CalPERS underneath this particular tier are entitled to a month-to-month retirement profit calculated as follows:

- 2%: This represents the share of their closing common compensation (FAC) they obtain for annually of credited service.

- 55: This represents the earliest age at which they will retire and obtain their full profit with none discount.

Calculating Closing Common Compensation (FAC)

The FAC is a essential part in figuring out the retirement profit. It is often calculated as the common of the highest-earning 36 months of compensation through the member’s CalPERS service. Which means that excessive earners in direction of the tip of their careers considerably affect their closing retirement profit. Understanding this calculation is important for members to maximise their retirement financial savings and strategize their profession trajectory. Components like wage will increase, promotions, and time beyond regulation can all have an effect on the FAC and, subsequently, the ultimate retirement profit.

The CalPERS 2% at 55 Chart: A Visible Illustration

Whereas there is not a single, formally revealed "CalPERS 2% at 55 chart," the formulation itself might be represented graphically for instance the connection between years of service, closing common compensation, and the ensuing month-to-month retirement profit. This hypothetical chart would present a linear relationship, with the month-to-month profit growing proportionally with each years of service and FAC. For instance:

- 30 years of service, $100,000 FAC: (2% x 30 years x $100,000) / 12 months = $5,000 month-to-month profit

- 20 years of service, $150,000 FAC: (2% x 20 years x $150,000) / 12 months = $5,000 month-to-month profit

- 10 years of service, $200,000 FAC: (2% x 10 years x $200,000) / 12 months = $3,333.33 month-to-month profit

This illustrates that attaining the next month-to-month profit might be achieved by way of both an extended profession or the next FAC. The hypothetical chart would visually characterize this relationship, permitting members to estimate their potential retirement earnings based mostly on their anticipated FAC and years of service.

Components Affecting the Retirement Profit

The "2% at 55" formulation gives a baseline understanding of the retirement profit. Nonetheless, a number of different components affect the ultimate quantity:

- Early Retirement: Retiring earlier than age 55 ends in a discount within the month-to-month profit. The discount varies relying on the age at retirement and is calculated utilizing particular actuarial tables offered by CalPERS.

- Service Retirement: Retiring at age 55 or later with none discount requires a minimal variety of years of service.

- Incapacity Retirement: Members who change into disabled could also be eligible for incapacity retirement advantages, that are calculated in another way and should fluctuate relying on the extent of the incapacity.

- Value of Residing Changes (COLAs): CalPERS gives annual COLAs to assist retirees keep their buying energy. Nonetheless, the COLA proportion varies from yr to yr and is topic to legislative and actuarial concerns.

- Demise Advantages: CalPERS gives loss of life advantages to the surviving partner or designated beneficiaries. The quantity will depend on the member’s years of service and gathered contributions.

Limitations of the "2% at 55" Formulation

It’s essential to acknowledge the restrictions of relying solely on the "2% at 55" formulation for retirement planning:

- Tiered System: This formulation applies solely to a particular tier of CalPERS members. These in different tiers have completely different profit formulation.

- Closing Common Compensation Volatility: The FAC is prone to fluctuations in wage through the closing 36 months of employment. Sudden job loss, wage freezes, or modifications in employment can considerably have an effect on the ultimate calculation.

- Inflation: The "2% at 55" formulation does not inherently account for inflation. Whereas COLAs assist mitigate this, their proportion is just not assured and should not totally offset rising dwelling prices.

- Healthcare Prices: Retirement planning ought to embrace concerns for healthcare bills, which might be substantial in later years. The CalPERS retirement profit alone might not cowl all healthcare wants.

Strategic Planning for Retirement with CalPERS

Understanding the "2% at 55" formulation is simply step one in complete retirement planning. Members ought to proactively have interaction in a number of methods:

- Maximize Contributions: Contribute the utmost allowable quantity to their CalPERS account to extend their retirement advantages.

- Monitor FAC: Often observe their compensation to know its affect on their projected retirement profit.

- Plan for Healthcare Prices: Develop a plan to cowl healthcare bills in retirement, contemplating Medicare, supplemental insurance coverage, and different choices.

- Diversify Financial savings: Complement CalPERS advantages with further financial savings by way of 401(ok)s, IRAs, or different funding automobiles.

- Seek the advice of with a Monetary Advisor: Search skilled recommendation from a monetary advisor specializing in retirement planning to create a customized technique.

Conclusion

The CalPERS "2% at 55" formulation gives a framework for understanding retirement advantages for a particular group of members. Nonetheless, it isn’t a standalone resolution for complete retirement planning. By understanding the formulation’s mechanics, limitations, and related components, CalPERS members could make knowledgeable selections about their profession, financial savings, and general retirement technique. Proactive planning, together with maximizing contributions, monitoring compensation, and diversifying financial savings, is essential for making certain a safe and cozy retirement. Consulting with a monetary advisor can present personalised steerage and assist navigate the complexities of CalPERS advantages and retirement planning. Bear in mind, the "2% at 55" chart, whereas hypothetical, serves as a helpful instrument for visualizing the connection between years of service, closing common compensation, and the ensuing retirement profit, finally empowering members to make knowledgeable selections about their monetary future.

Closure

Thus, we hope this text has offered helpful insights into Deciphering the CalPERS 2% at 55 Chart: A Complete Information to Retirement Planning. We thanks for taking the time to learn this text. See you in our subsequent article!