Deciphering the Descending Triangle: A Complete Information to This Chart Sample

Associated Articles: Deciphering the Descending Triangle: A Complete Information to This Chart Sample

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Deciphering the Descending Triangle: A Complete Information to This Chart Sample. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Deciphering the Descending Triangle: A Complete Information to This Chart Sample

The descending triangle, a prevalent chart sample in technical evaluation, indicators potential bearish continuation or reversal, relying on its context and accompanying indicators. Understanding its formation, interpretation, and limitations is essential for merchants in search of to leverage its predictive energy. This text supplies a complete exploration of the descending triangle, masking its traits, identification, buying and selling methods, and potential pitfalls.

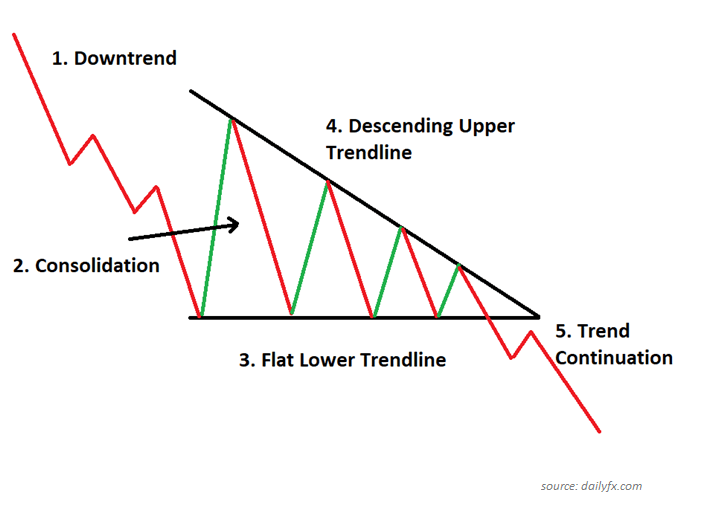

Understanding the Formation of a Descending Triangle

A descending triangle is a chart sample characterised by a sequence of decrease highs and comparatively flat lows. This creates a triangle form that progressively narrows, therefore the identify "descending." The higher trendline connects a sequence of decrease highs, representing declining promoting stress or resistance. The decrease trendline, usually horizontal or barely upward sloping, connects a sequence of upper lows, suggesting help ranges are holding comparatively agency. This convergence of the 2 trendlines creates a visible illustration of a battle between consumers and sellers, with sellers progressively gaining the higher hand.

Key Traits of a Descending Triangle:

- Decrease Highs: The sample’s defining function is a sequence of progressively cheaper price highs. Every subsequent excessive is decrease than the earlier one, indicating weakening shopping for stress.

- Flat or Barely Upward Sloping Lows: The decrease trendline, connecting the lows, is both horizontal or barely upward sloping. This means constant help, stopping a major value decline.

- Converging Trendlines: A very powerful attribute is the convergence of the higher and decrease trendlines. Because the triangle narrows, the value vary contracts, signifying growing uncertainty and potential for a breakout.

- Timeframe: Descending triangles can kind throughout numerous timeframes, from short-term (intraday) to long-term (month-to-month or yearly) charts. The length of the sample’s formation can range considerably.

- Quantity: Sometimes, quantity tends to lower because the triangle kinds. This contraction in quantity displays the declining buying and selling exercise as the value vary narrows. A big enhance in quantity throughout the breakout confirms the sample’s validity.

Figuring out a Descending Triangle:

Figuring out a descending triangle requires cautious remark and a eager understanding of technical evaluation ideas. The method usually entails:

- Figuring out the Higher Trendline: Draw a trendline connecting a minimum of two decrease highs. Ideally, it is best to have three or extra factors to verify the trendline’s validity.

- Figuring out the Decrease Trendline: Draw a trendline connecting a minimum of two increased lows. This trendline is usually horizontal or barely upward sloping.

- Confirming Convergence: Observe whether or not the higher and decrease trendlines are converging. The narrowing value vary is a vital factor of the descending triangle sample.

- Contemplating Quantity: Analyze the quantity accompanying the value motion. Reducing quantity throughout the formation of the triangle helps the sample’s validity.

- Contemplating the Context: Analyze the broader market situations and the asset’s general development. The sample’s interpretation can range relying on the context.

Buying and selling Methods for Descending Triangles:

The first buying and selling technique for a descending triangle entails anticipating a breakout. Merchants usually search for a decisive break under the decrease trendline as a sign to provoke a brief place.

- Shorting on Breakout: The commonest technique is to quick the asset when the value decisively breaks under the decrease trendline, accompanied by elevated quantity. This confirms the bearish sign and suggests additional draw back potential.

- Cease-Loss Placement: A stop-loss order ought to be positioned above the decrease trendline or barely above the latest swing excessive to restrict potential losses if the breakout fails.

- Goal Value: The goal value for a brief place might be calculated utilizing numerous strategies, equivalent to measuring the peak of the triangle and projecting it downwards from the breakout level. This is named the "measuring approach." Fibonacci retracement ranges will also be used to find out potential goal costs.

- Affirmation Alerts: Affirmation indicators, equivalent to detrimental divergence in an oscillator (RSI, MACD), can enhance the boldness stage within the commerce setup. These indicators point out weakening bullish momentum.

Potential Pitfalls and Limitations:

Whereas descending triangles might be efficient buying and selling instruments, it’s essential to pay attention to their limitations:

- False Breakouts: The worth could sometimes break under the decrease trendline solely to revert again above it. This can be a false breakout and might result in vital losses if not managed correctly. Elevated quantity throughout a real breakout is essential for affirmation.

- Lack of Affirmation: Relying solely on the descending triangle sample with out contemplating different indicators can result in inaccurate predictions. Affirmation from different technical indicators and elementary evaluation is essential.

- Subjectivity in Trendline Drawing: Drawing trendlines might be subjective, and completely different merchants could draw them barely in another way, resulting in variations in interpretation.

- Time Sensitivity: The sample’s formation can take a substantial period of time, probably delaying the breakout. Merchants want persistence and self-discipline to attend for the best alternative.

- Market Situations: The effectiveness of the descending triangle sample might be influenced by broader market situations. During times of excessive volatility, the sample’s reliability could also be diminished.

Descending Triangles vs. Different Chart Patterns:

It is very important distinguish descending triangles from different comparable chart patterns, equivalent to:

- Symmetrical Triangles: Symmetrical triangles have each higher and decrease trendlines converging, however in contrast to descending triangles, they do not essentially point out a bearish bias.

- Ascending Triangles: Ascending triangles have a flat higher trendline and an upward sloping decrease trendline, indicating a bullish bias.

- Head and Shoulders: This can be a vital reversal sample that’s distinct from a descending triangle in its formation and implications.

Conclusion:

The descending triangle is a robust chart sample that may present beneficial insights into potential value actions. Nonetheless, it shouldn’t be utilized in isolation. Combining it with different technical indicators, elementary evaluation, and danger administration methods considerably enhances its predictive energy and reduces the chance of false indicators. Profitable buying and selling utilizing descending triangles requires a deep understanding of its traits, a disciplined method to entry and exit methods, and a sensible evaluation of the sample’s limitations. All the time do not forget that no buying and selling technique is foolproof, and losses are an inherent a part of the buying and selling course of. Thorough analysis, cautious planning, and efficient danger administration are important for navigating the complexities of the monetary markets.

![Chart Patterns – The Advanced Guide [Bonus Cheat Sheet] - ForexSpringBoard](https://forexspringboard.com/wp-content/uploads/2018/11/descending_triangle-768x471.png)

Closure

Thus, we hope this text has offered beneficial insights into Deciphering the Descending Triangle: A Complete Information to This Chart Sample. We admire your consideration to our article. See you in our subsequent article!