Deciphering the Micron Expertise Inventory Chart: A Deep Dive right into a Reminiscence Market Large

Associated Articles: Deciphering the Micron Expertise Inventory Chart: A Deep Dive right into a Reminiscence Market Large

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the Micron Expertise Inventory Chart: A Deep Dive right into a Reminiscence Market Large. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Deciphering the Micron Expertise Inventory Chart: A Deep Dive right into a Reminiscence Market Large

:max_bytes(150000):strip_icc()/mu2-fbdc00e518784a0aa8e70e46cf837d6b.jpg)

Micron Expertise (MU) is a number one participant within the dynamic world of semiconductor reminiscence, producing DRAM (Dynamic Random-Entry Reminiscence) and NAND flash reminiscence – the essential elements powering the whole lot from smartphones and PCs to information facilities and autonomous autos. Understanding the Micron Expertise inventory chart requires extra than simply glancing on the worth fluctuations; it calls for a nuanced understanding of the corporate’s place inside the broader semiconductor business, its cyclical nature, and the interaction of varied macroeconomic and technological components.

The Cyclical Nature of the Semiconductor Business:

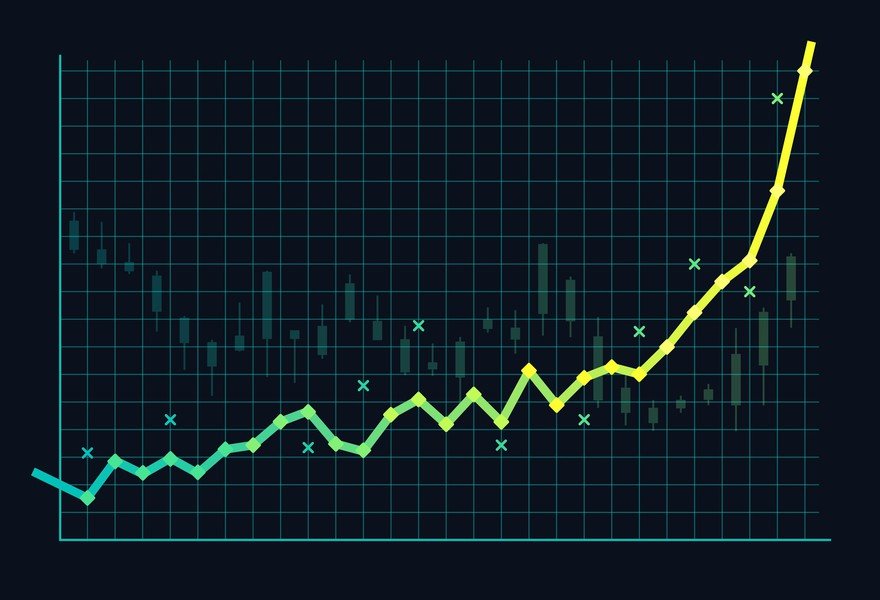

Earlier than diving into particular chart patterns, it is essential to acknowledge the inherently cyclical nature of the semiconductor business. Reminiscence chip costs, and consequently Micron’s inventory worth, are topic to vital swings pushed by provide and demand. Durations of sturdy demand, typically fueled by technological developments and financial development, result in worth will increase and sturdy firm income, leading to a rising inventory worth. Conversely, durations of oversupply, financial downturns, or technological shifts can result in worth wars, decreased profitability, and a falling inventory worth. This cyclical sample is a defining attribute of MU’s chart, typically manifesting as distinct peaks and troughs.

Analyzing the Micron Inventory Chart: Key Indicators and Patterns:

Analyzing the Micron inventory chart includes analyzing numerous technical indicators and recognizing recurring patterns. These instruments present insights into potential worth actions and assist buyers make knowledgeable selections. Nevertheless, it is essential to keep in mind that technical evaluation isn’t a foolproof predictor of the longer term, and elementary evaluation ought to at all times complement technical evaluation.

-

Transferring Averages: Transferring averages, such because the 50-day and 200-day transferring averages, easy out worth fluctuations and supply a clearer image of the general development. A bullish crossover happens when the shorter-term transferring common (e.g., 50-day) crosses above the longer-term transferring common (e.g., 200-day), suggesting a possible uptrend. Conversely, a bearish crossover alerts a possible downtrend. Observing the connection between these transferring averages on the Micron chart can supply beneficial insights into the prevailing momentum.

-

Relative Energy Index (RSI): The RSI is a momentum indicator that measures the magnitude of latest worth modifications to guage overbought or oversold circumstances. An RSI above 70 typically suggests the inventory is overbought, implying a possible correction or pullback. Conversely, an RSI beneath 30 suggests the inventory is oversold, doubtlessly indicating a shopping for alternative. Nevertheless, it is vital to notice that the RSI can stay in overbought or oversold territory for prolonged durations, notably in sturdy traits.

-

Help and Resistance Ranges: Help ranges characterize worth factors the place shopping for stress is powerful sufficient to stop additional worth declines. Resistance ranges are worth factors the place promoting stress is powerful sufficient to stop additional worth will increase. Figuring out these ranges on the Micron chart might help predict potential worth reversals or breakouts. Breakouts above resistance ranges typically sign bullish momentum, whereas breakdowns beneath help ranges typically sign bearish momentum.

-

Quantity: Analyzing buying and selling quantity alongside worth actions supplies essential context. Excessive quantity throughout worth will increase confirms the power of the uptrend, whereas excessive quantity throughout worth decreases confirms the power of the downtrend. Low quantity throughout worth actions typically suggests a scarcity of conviction and should point out a possible reversal.

-

Chart Patterns: Recognizing chart patterns, akin to head and shoulders, double tops/bottoms, triangles, and flags, can present insights into potential worth actions. These patterns typically supply clues concerning the power and course of the development. For instance, a head and shoulders sample is commonly thought-about a bearish reversal sample, whereas a double backside sample is commonly thought-about a bullish reversal sample. Figuring out these patterns on the Micron chart requires expertise and a eager eye for element.

Elements Influencing the Micron Inventory Chart:

Past technical evaluation, understanding the elemental components influencing Micron’s efficiency is important. These embody:

-

Reminiscence Chip Demand: The demand for DRAM and NAND flash reminiscence is closely influenced by the efficiency of the broader know-how sector, notably the smartphone, PC, information middle, and automotive industries. Robust demand results in increased costs and elevated profitability for Micron, positively impacting the inventory worth.

-

Provide and Competitors: Micron competes with different main reminiscence chip producers, together with Samsung, SK Hynix, and Western Digital. The aggressive panorama considerably influences pricing and market share, immediately impacting Micron’s profitability and inventory worth. Oversupply conditions can result in worth wars and diminished margins.

-

Technological Developments: Steady technological developments in reminiscence chip know-how are essential for Micron’s long-term success. The corporate’s potential to innovate and produce modern reminiscence chips is a key driver of its development and inventory worth efficiency.

-

Geopolitical Elements: World commerce tensions, sanctions, and geopolitical instability can considerably affect the semiconductor business, affecting provide chains and market dynamics. These components can introduce volatility into Micron’s inventory worth.

-

Financial Circumstances: Macroeconomic components, akin to financial development, rates of interest, and inflation, additionally affect the demand for reminiscence chips and consequently Micron’s inventory worth. Financial downturns typically result in diminished demand and decrease inventory costs.

Lengthy-Time period Outlook and Funding Technique:

Micron’s long-term outlook is determined by its potential to navigate the cyclical nature of the semiconductor business, preserve its aggressive edge by technological innovation, and adapt to altering market dynamics. Traders ought to rigorously contemplate these components earlier than making funding selections. A diversified funding technique, coupled with thorough elementary and technical evaluation, is essential for managing threat and maximizing potential returns.

Conclusion:

The Micron Expertise inventory chart is a posh tapestry woven from technical indicators, cyclical market forces, and macroeconomic influences. Understanding these interwoven parts is essential for navigating the volatility inherent within the semiconductor business and making knowledgeable funding selections. Whereas technical evaluation can present beneficial insights into potential worth actions, it is important to enhance this with a radical understanding of the elemental components driving Micron’s efficiency. By combining each approaches, buyers can develop a complete technique for evaluating the Micron inventory chart and making sound funding selections. Keep in mind that previous efficiency isn’t indicative of future outcomes, and investing within the inventory market at all times carries inherent dangers. Thorough analysis and a well-defined funding plan are paramount to success.

Closure

Thus, we hope this text has offered beneficial insights into Deciphering the Micron Expertise Inventory Chart: A Deep Dive right into a Reminiscence Market Large. We thanks for taking the time to learn this text. See you in our subsequent article!