Deciphering the Quarterly GDP Development Chart: A 20-12 months Retrospective and Future Implications

Associated Articles: Deciphering the Quarterly GDP Development Chart: A 20-12 months Retrospective and Future Implications

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Deciphering the Quarterly GDP Development Chart: A 20-12 months Retrospective and Future Implications. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Deciphering the Quarterly GDP Development Chart: A 20-12 months Retrospective and Future Implications

The quarterly Gross Home Product (GDP) progress chart serves as a significant barometer of a nation’s financial well being. It gives a snapshot of the general financial exercise, revealing traits in manufacturing, consumption, and funding over three-month durations. Analyzing this chart, notably over an extended timeframe just like the previous 20 years, presents invaluable insights into financial cycles, coverage effectiveness, and future projections. This text will delve into the nuances of a hypothetical quarterly GDP progress chart spanning from 2003 to 2023, analyzing key durations of progress and recession, contributing elements, and the implications for future financial planning. Whereas we can’t generate a visible chart right here, we are going to analyze the hypothetical knowledge as if it had been offered graphically.

Hypothetical Information and Development Evaluation (2003-2023):

Let’s assume our hypothetical chart reveals a typically upward development from 2003 to 2023, punctuated by durations of serious progress and contraction. We’ll break down these durations as an example the evaluation course of:

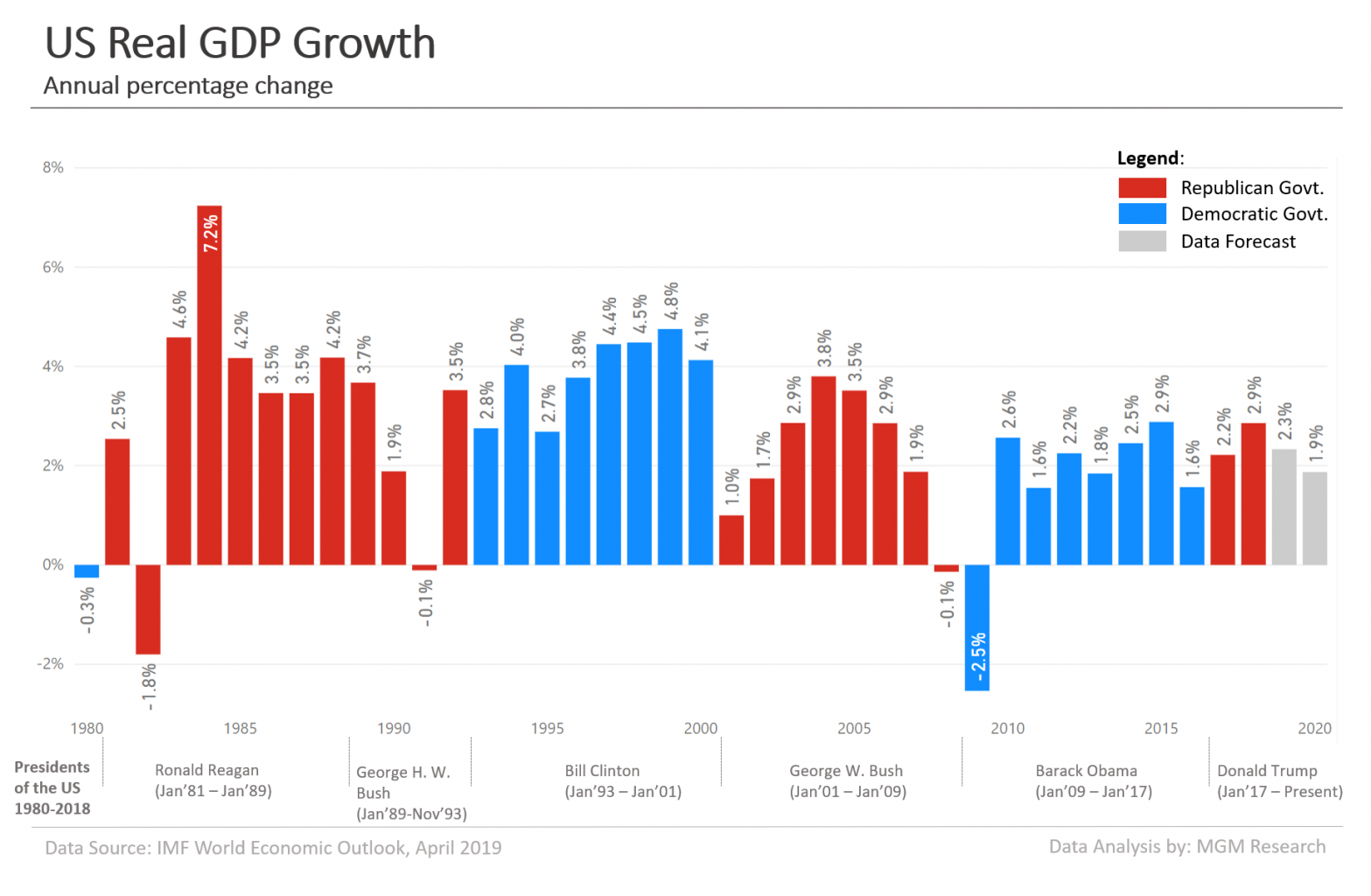

2003-2007: The Pre-Disaster Growth: This era doubtless exhibits constant, albeit various, optimistic quarterly progress. The typical progress fee could be round 3%, with some quarters exceeding 4% and others barely beneath. This era might be characterised by sturdy shopper spending, fueled by low rates of interest and rising dwelling costs. Funding in infrastructure and know-how may additionally have contributed considerably to this enlargement. The chart would visually present a comparatively easy upward trajectory.

2007-2009: The World Monetary Disaster: The chart would dramatically shift on this interval, displaying a pointy decline in GDP progress, culminating in a number of quarters of detrimental progress – a recession. This downturn could be visually represented by a steep downward slope. The causes, clearly mirrored within the accompanying financial knowledge, would come with the subprime mortgage disaster, the collapse of Lehman Brothers, and the next credit score crunch. The severity of the contraction could be visually obvious, highlighting the influence of the disaster.

2009-2012: Restoration and Stagnation: Following the disaster, the chart would present a gradual restoration, with progress charges slowly growing from detrimental to optimistic territory. Nonetheless, the restoration could be uneven, with some quarters displaying modest progress whereas others stay sluggish. This era of sluggish progress, also known as "secular stagnation," could be visually evident as a flatter, much less steep upward development in comparison with the pre-crisis increase. Components contributing to this sluggish restoration would possibly embody excessive ranges of debt, lingering uncertainty within the monetary markets, and sluggish job creation.

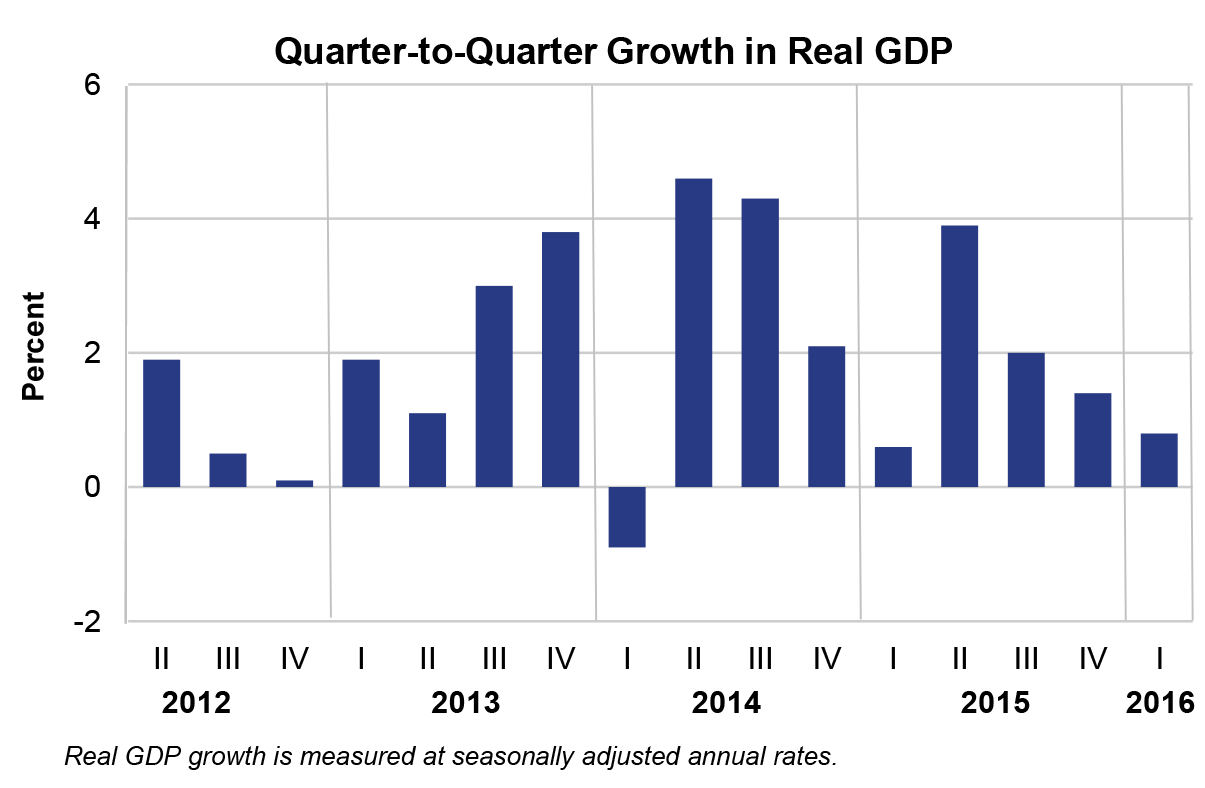

2012-2019: Average Development and Coverage Affect: This era doubtless exhibits a extra constant, reasonable progress fee, averaging maybe round 2-2.5%. The chart would show a comparatively steady, upward development, although not as steep because the pre-crisis increase. Authorities insurance policies, similar to quantitative easing and financial stimulus, could be mirrored in durations of barely greater progress. Technological developments and globalization may be contributing elements to this sustained, albeit reasonable, enlargement.

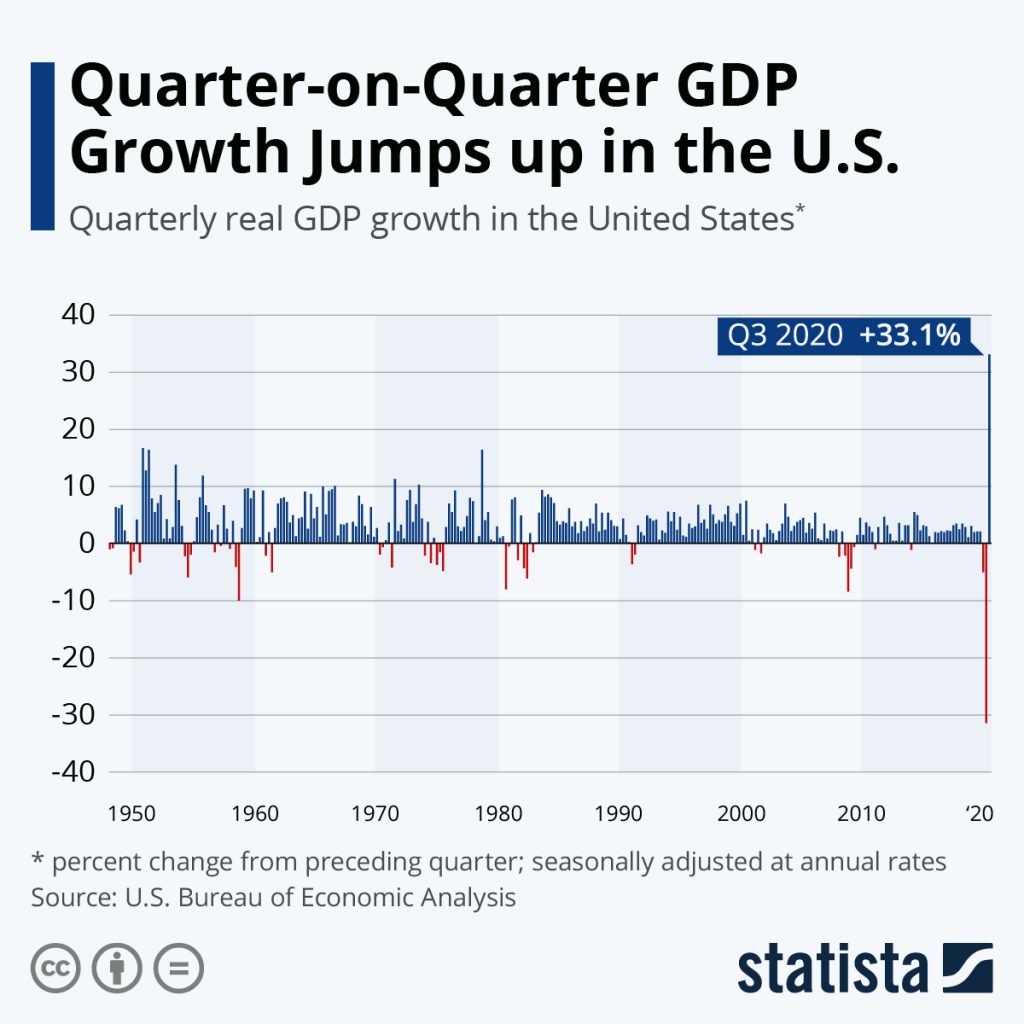

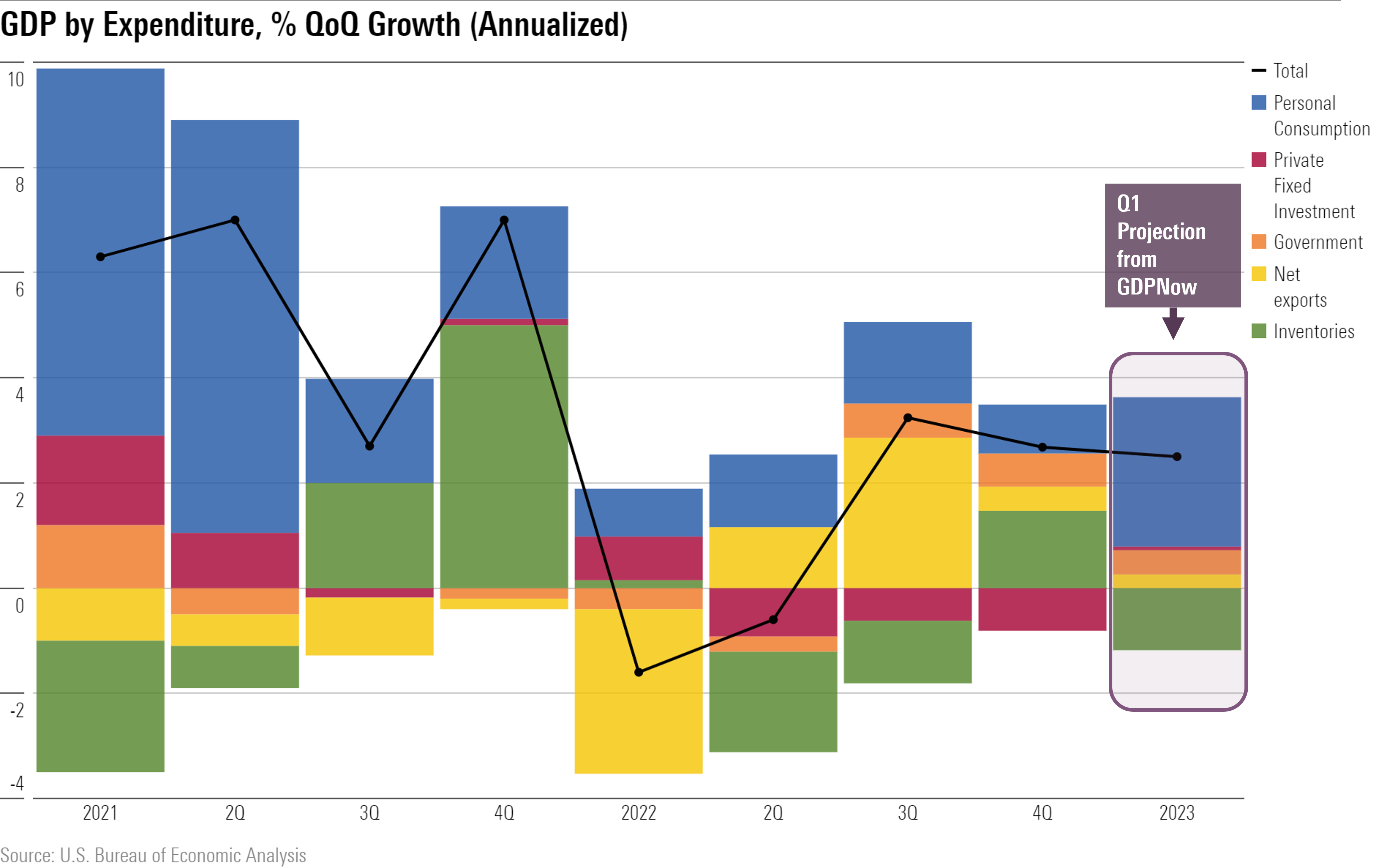

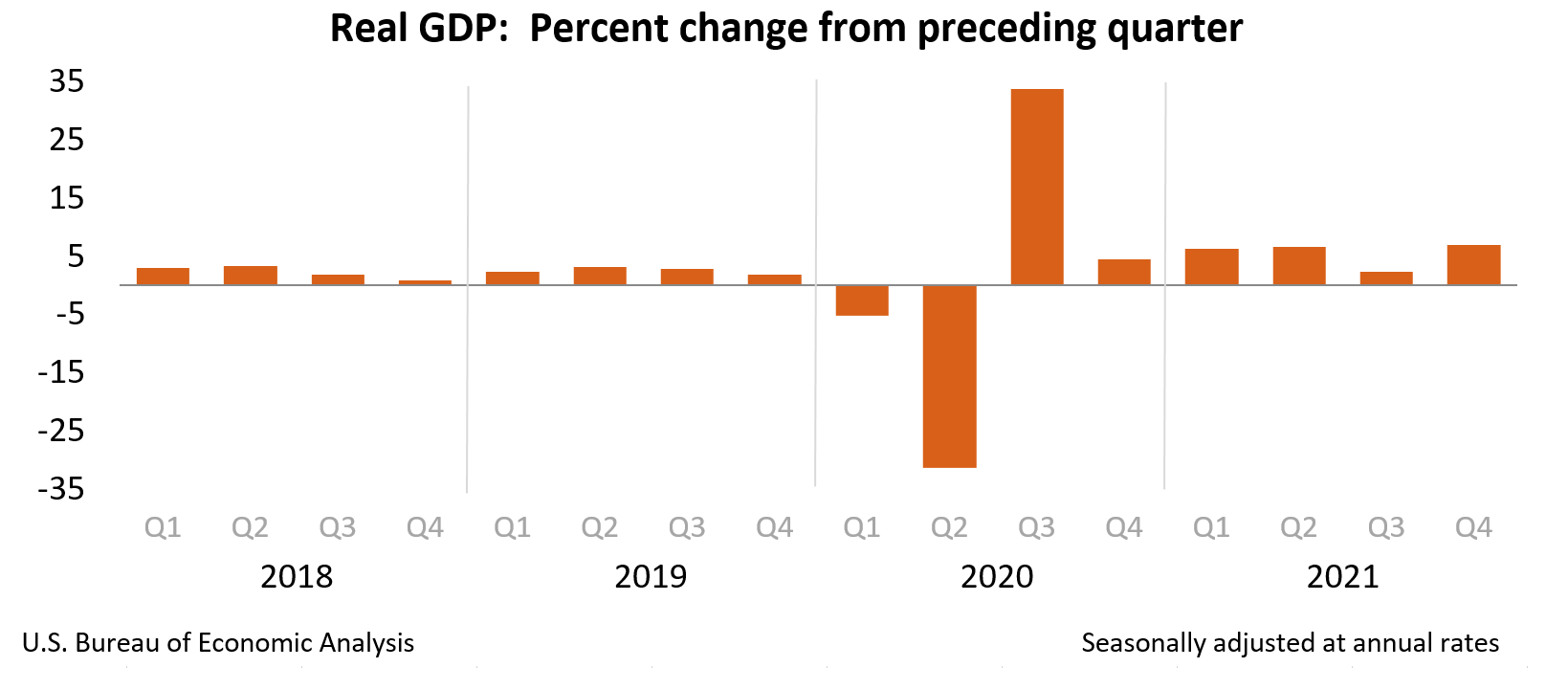

2020-2023: The Pandemic and its Aftermath: The chart would exhibit a dramatic and unprecedented occasion – the COVID-19 pandemic. The preliminary quarters of 2020 would present a pointy, steep decline, reflecting the speedy financial fallout from lockdowns and widespread enterprise closures. The visible illustration could be strikingly much like, although probably steeper than, the 2007-2009 recession. Subsequent quarters would present a blended image, with some durations of speedy progress fueled by pent-up demand and authorities stimulus, adopted by durations of slower progress as a result of provide chain disruptions and inflationary pressures. The chart would mirror the volatility and uncertainty of this era, visually displaying sharp ups and downs.

Decoding the Chart’s Nuances:

Analyzing the chart requires extra than simply observing the general development. A number of nuances deserve cautious consideration:

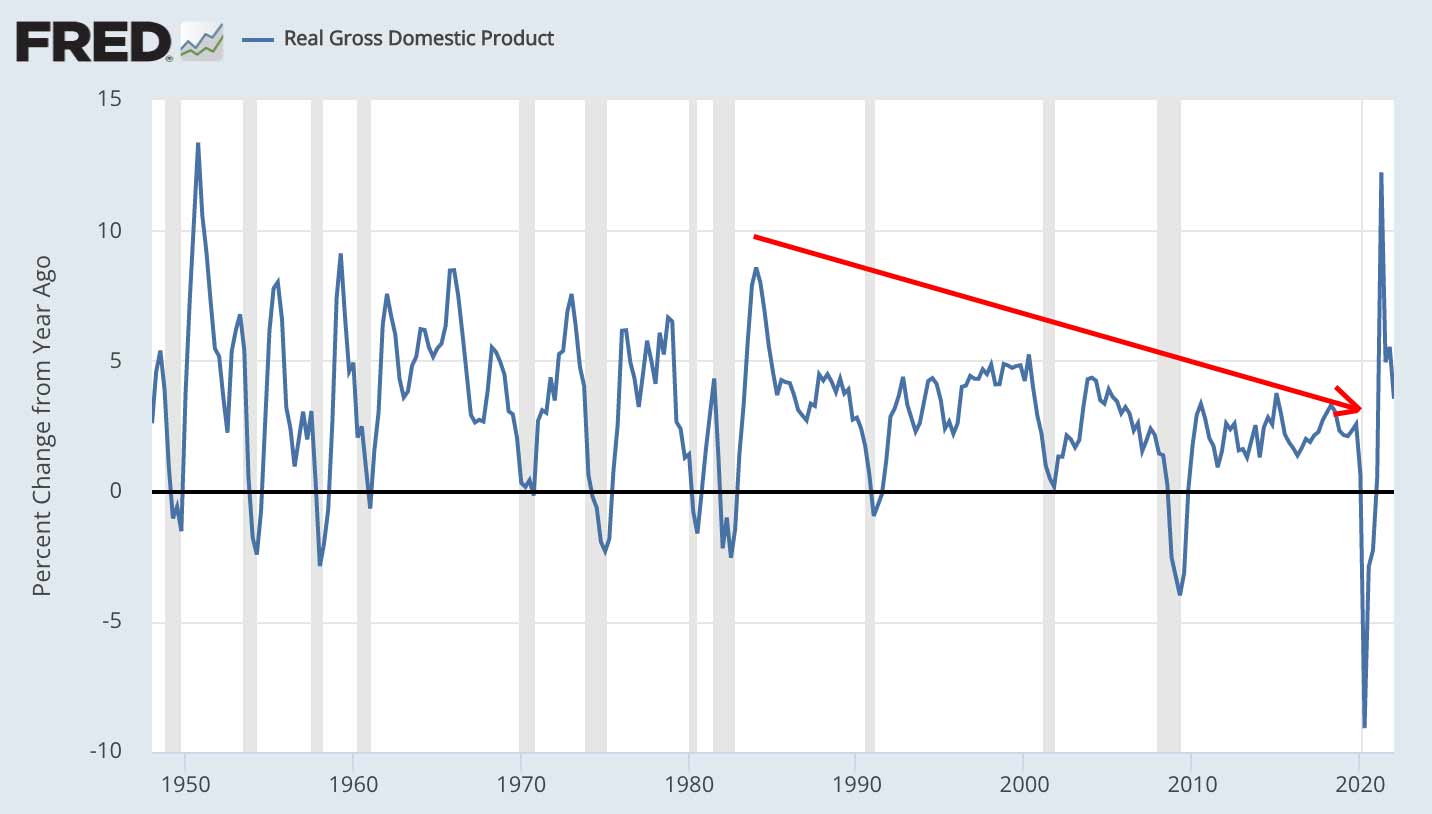

- Volatility: The diploma of fluctuation across the development line reveals the steadiness or instability of the financial system. Excessive volatility signifies better uncertainty and danger.

- Development Fee Variations: Evaluating progress charges throughout completely different sectors (e.g., manufacturing, companies, building) gives a extra granular understanding of the financial drivers.

- Correlation with Different Indicators: Analyzing the GDP progress chart alongside different financial indicators, similar to inflation, unemployment, and shopper confidence, helps to construct a extra complete image of the financial panorama.

- Coverage Implications: The chart can be utilized to evaluate the effectiveness of presidency insurance policies geared toward stimulating financial progress or mitigating recessions.

Future Implications and Forecasting:

By learning the historic knowledge represented within the chart, economists can develop fashions to forecast future GDP progress. These fashions incorporate varied elements, together with demographic traits, technological developments, international financial circumstances, and authorities insurance policies. Nonetheless, it is essential to do not forget that financial forecasting is inherently unsure. Unexpected occasions, similar to pandemics or geopolitical shocks, can considerably influence the accuracy of forecasts.

The hypothetical chart, spanning 20 years, would spotlight the cyclical nature of financial progress, punctuated by durations of enlargement and contraction. Understanding these cycles is essential for companies, buyers, and policymakers to make knowledgeable selections. For instance, companies can use the chart to anticipate modifications in demand and regulate their funding methods accordingly. Buyers can use it to evaluate danger and return in numerous asset courses. Policymakers can use it to design efficient insurance policies to advertise sustainable financial progress and mitigate the influence of financial downturns.

Conclusion:

The quarterly GDP progress chart is a strong device for understanding the dynamics of a nation’s financial system. Analyzing a long-term chart, such because the hypothetical one described above, gives precious insights into previous financial efficiency, contributing elements, and potential future traits. Whereas forecasting stays inherently unsure, an intensive evaluation of historic knowledge, coupled with an understanding of present financial circumstances and potential dangers, permits for extra knowledgeable decision-making throughout varied sectors of the financial system. The chart, subsequently, serves not simply as a historic document, however as an important instrument for navigating the complexities of the fashionable financial panorama.

Closure

Thus, we hope this text has offered precious insights into Deciphering the Quarterly GDP Development Chart: A 20-12 months Retrospective and Future Implications. We hope you discover this text informative and helpful. See you in our subsequent article!