Deciphering the Silver Value: A Complete Information to Candlestick Chart Evaluation

Associated Articles: Deciphering the Silver Value: A Complete Information to Candlestick Chart Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the Silver Value: A Complete Information to Candlestick Chart Evaluation. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Deciphering the Silver Value: A Complete Information to Candlestick Chart Evaluation

Silver, a valuable steel with a wealthy historical past and various functions, has at all times held a distinguished place within the funding world. Understanding its worth actions is essential for merchants and traders alike. Whereas numerous analytical instruments exist, candlestick charts provide a strong visible illustration of worth motion, offering insights into market sentiment and potential future developments. This text delves deep into the world of silver worth candlestick charts, exploring their interpretation and the way they can be utilized to make knowledgeable buying and selling choices.

Understanding Candlestick Charts: The Fundamentals

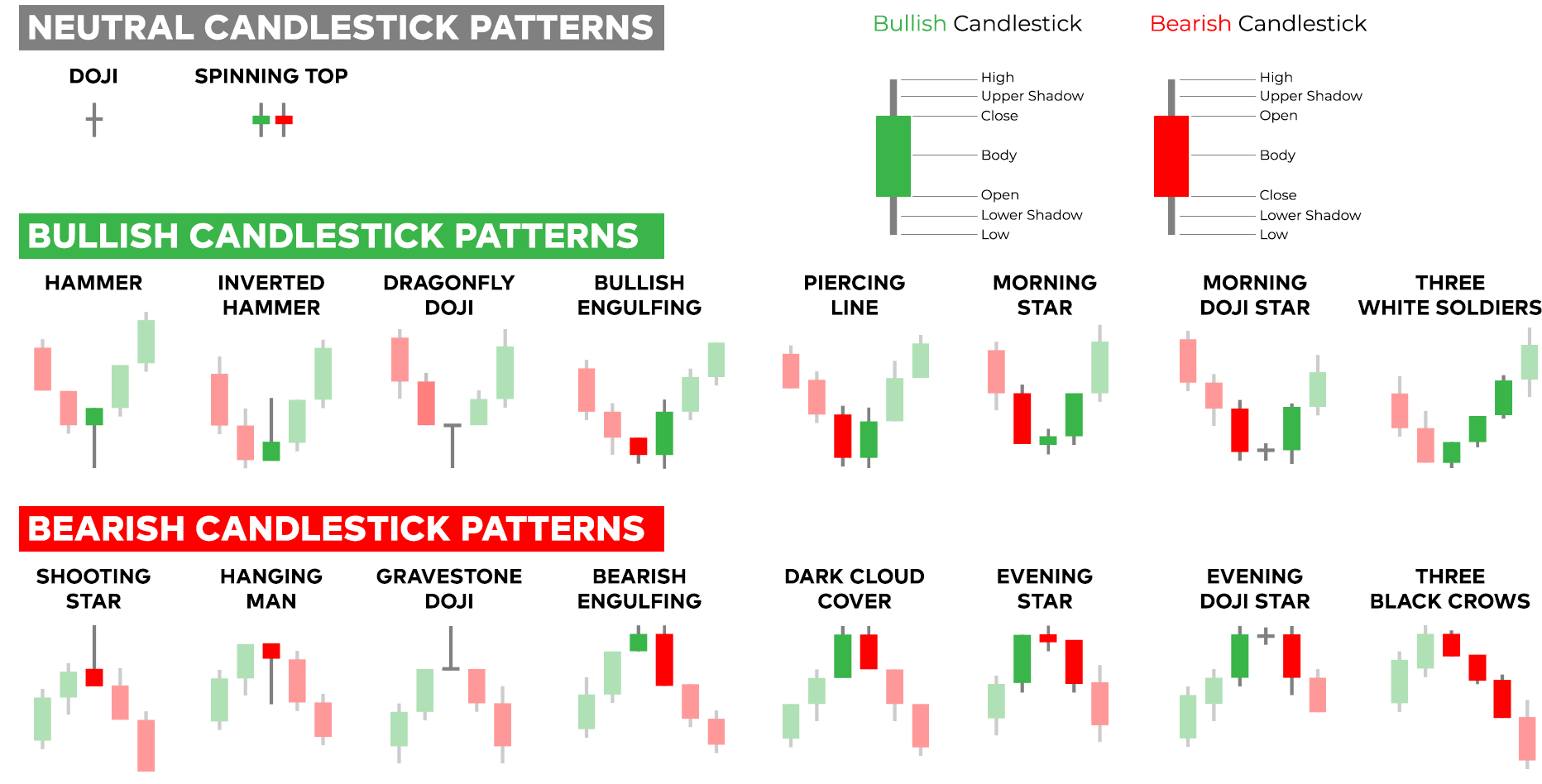

Candlestick charts symbolize worth information for a particular interval (e.g., each day, hourly, weekly). Every candlestick shows 4 key items of data:

- Open: The value at first of the interval.

- Excessive: The very best worth reached throughout the interval.

- Low: The bottom worth reached throughout the interval.

- Shut: The value on the finish of the interval.

The "physique" of the candlestick represents the distinction between the open and shut costs. A inexperienced or white candlestick signifies a closing worth greater than the opening worth (a bullish sign), whereas a purple or black candlestick signifies a closing worth decrease than the opening worth (a bearish sign). The "wicks" (or shadows) prolong from the physique to the excessive and low costs, indicating the worth vary throughout the interval.

Decoding Silver Value Candlestick Patterns: Single Candlesticks

Particular person candlestick patterns can provide worthwhile clues about market sentiment. Some widespread patterns embody:

-

Doji: A candlestick with just about equal opening and shutting costs, forming a small physique with lengthy higher and decrease wicks. It indicators indecision or a possible reversal out there. Within the context of silver, a doji after a robust upward pattern would possibly recommend a pause or perhaps a bearish reversal, prompting merchants to contemplate profit-taking or hedging methods. Conversely, a doji after a protracted downtrend may sign a possible bullish turnaround.

-

Hammer: A candlestick with a small physique on the high quality and an extended decrease wick, suggesting sturdy shopping for stress close to the low. A hammer in a silver worth chart typically signifies a possible bullish reversal, particularly when confirmed by subsequent bullish candlesticks. Merchants would possibly look to enter lengthy positions after observing a hammer, anticipating a worth improve.

-

Hanging Man: Much like a hammer, but it surely varieties after an uptrend. The small physique is on the backside of the vary, and the lengthy decrease wick suggests potential promoting stress, hinting at a attainable bearish reversal. Within the silver market, a dangling man may sign a possible prime, prompting merchants to contemplate brief positions or protecting measures.

-

Engulfing Sample: This sample consists of two candlesticks. The second candlestick utterly engulfs the physique of the primary. A bullish engulfing sample (a big inexperienced candlestick following a purple one) suggests a possible bullish reversal, whereas a bearish engulfing sample (a big purple candlestick following a inexperienced one) suggests a possible bearish reversal. In silver buying and selling, this sample generally is a sturdy indicator of a shift in momentum.

-

Spinning Prime: This candlestick has a small physique and comparatively lengthy higher and decrease wicks, indicating indecision and a range-bound market. Whereas not as definitive as different patterns, a spinning prime in a silver chart can sign a interval of consolidation earlier than a possible breakout in both route.

Decoding Silver Value Candlestick Patterns: A number of Candlesticks

Extra advanced patterns emerge when analyzing a number of candlesticks collectively. These patterns provide a extra complete image of the market’s dynamics:

-

Morning Star: A 3-candlestick reversal sample. It consists of a bearish candlestick adopted by a small physique (doji or small candlestick) after which a robust bullish candlestick, indicating a possible backside. Within the silver market, a morning star generally is a sturdy bullish sign, suggesting a possible shopping for alternative.

-

Night Star: The other of a morning star, this bearish reversal sample consists of a bullish candlestick adopted by a small physique after which a robust bearish candlestick, indicating a possible prime. Merchants would possibly think about brief positions or protecting measures upon observing a night star in a silver chart.

-

Three White Troopers: Three consecutive bullish candlesticks with every candlestick opening greater and shutting greater than the earlier one. This sample is a robust bullish sign, indicating rising shopping for stress and a possible uptrend. Within the silver market, it suggests a major bullish momentum.

-

Three Black Crows: The bearish counterpart of three white troopers, this sample reveals three consecutive bearish candlesticks, every opening decrease and shutting decrease than the earlier one. It is a sturdy bearish sign indicating sturdy promoting stress and a possible downtrend. This sample in silver may sign a major sell-off.

Combining Candlestick Evaluation with Different Indicators

Whereas candlestick patterns present worthwhile insights, it is essential to mix them with different technical indicators for a extra strong buying and selling technique. These indicators can affirm or contradict the indicators offered by candlestick patterns. Examples embody:

-

Transferring Averages: These indicators easy out worth fluctuations, serving to to establish developments. A crossover of a short-term transferring common above a long-term transferring common (a bullish crossover) can affirm a bullish candlestick sample.

-

Relative Energy Index (RSI): This momentum indicator measures the pace and alter of worth actions. An RSI above 70 signifies overbought situations, whereas an RSI under 30 signifies oversold situations. These ranges may also help establish potential reversals.

-

Quantity: Analyzing buying and selling quantity alongside candlestick patterns can affirm the power of a transfer. Excessive quantity accompanying a bullish candlestick sample reinforces the bullish sign, whereas low quantity suggests weak momentum.

Elements Influencing Silver Costs Past Chart Patterns

It is necessary to keep in mind that candlestick patterns are just one piece of the puzzle. Macroeconomic elements considerably affect silver costs:

-

Industrial Demand: Silver’s industrial functions (electronics, photo voltaic power, and many others.) considerably affect its worth. Elevated demand results in greater costs.

-

Funding Demand: Silver’s enchantment as a safe-haven asset and its use in exchange-traded funds (ETFs) affect its worth. Elevated funding demand tends to push costs greater.

-

US Greenback Energy: The US greenback’s worth inversely correlates with silver costs. A robust greenback sometimes results in decrease silver costs, because it makes silver costlier for consumers utilizing different currencies.

-

Inflationary Pressures: In periods of excessive inflation, silver typically acts as a hedge in opposition to inflation, resulting in elevated demand and better costs.

-

Geopolitical Occasions: International political instability and uncertainty can drive traders in the direction of safe-haven belongings like silver, rising demand and costs.

Conclusion:

Candlestick chart evaluation is a worthwhile instrument for understanding silver worth actions. By studying to establish and interpret numerous candlestick patterns and mixing this data with different technical indicators and elementary evaluation, merchants and traders can enhance their decision-making course of and doubtlessly improve their buying and selling methods. Nevertheless, it is essential to keep in mind that no buying and selling technique ensures income, and threat administration is paramount. Thorough analysis, cautious planning, and a disciplined strategy are important for achievement within the dynamic silver market. The insights gained from candlestick charts needs to be thought of alongside different market elements to create a well-rounded buying and selling plan. Continuous studying and adaptation are key to navigating the complexities of the silver market and attaining constant outcomes.

Closure

Thus, we hope this text has offered worthwhile insights into Deciphering the Silver Value: A Complete Information to Candlestick Chart Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!