Deciphering the TradingView Chart: A Complete Information

Associated Articles: Deciphering the TradingView Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deciphering the TradingView Chart: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Deciphering the TradingView Chart: A Complete Information

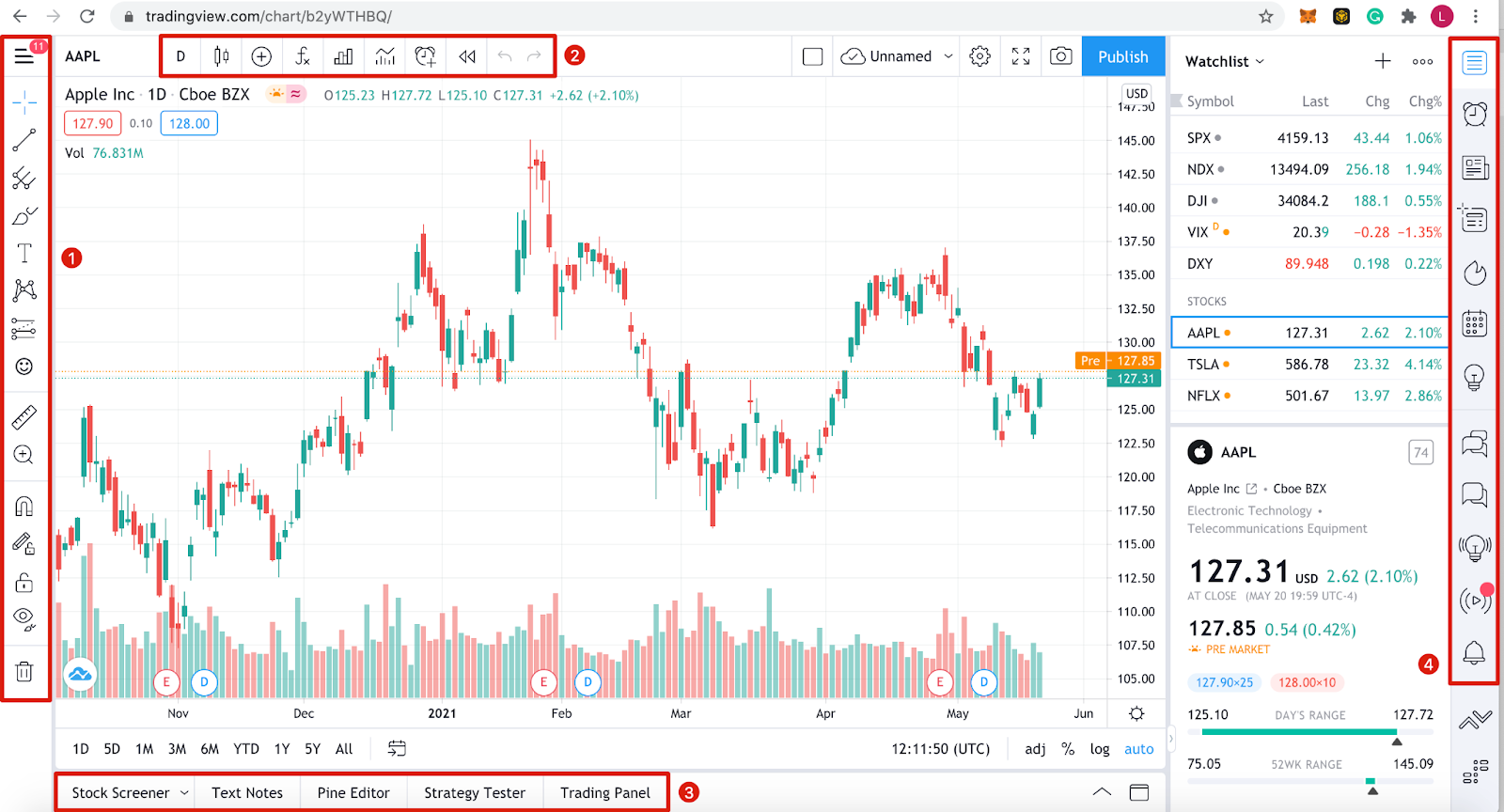

TradingView has grow to be the go-to platform for thousands and thousands of merchants worldwide, providing a strong and versatile charting interface. Nonetheless, its in depth options will be overwhelming for freshmen. This complete information will break down the important parts of a TradingView chart, explaining the best way to interpret them and use them for efficient buying and selling evaluation. We’ll cowl the whole lot from primary candlestick patterns to superior indicators, empowering you to navigate the platform with confidence.

I. Understanding the Fundamentals: The Chart Itself

On the coronary heart of TradingView lies the chart. The commonest chart kind is the candlestick chart, which visually represents value actions over a particular interval. Every candlestick represents a time interval (e.g., 1-minute, 5-minute, day by day, weekly). The candlestick’s physique reveals the value vary between the open and shutting costs. A inexperienced (or white) candlestick signifies a closing value increased than the opening value (bullish), whereas a crimson (or black) candlestick reveals a closing value decrease than the opening value (bearish). The wicks (shadows) extending above and beneath the physique symbolize the excessive and low costs throughout that interval.

Understanding candlestick patterns is essential. Easy patterns like hammer, hanging man, engulfing patterns, and doji can present insights into potential reversals or continuations of developments. Extra complicated patterns, just like the three white troopers or three black crows, supply stronger indicators however require extra expertise to reliably establish.

Past candlesticks, TradingView helps different chart varieties like line charts, which merely join closing costs, and bar charts, which give related data to candlesticks however in a distinct visible format. The selection of chart kind is determined by particular person preferences and analytical wants. Candlestick charts are usually most popular for his or her visible richness and skill to convey extra data at a look.

II. Navigating the TradingView Interface: Key Parts

TradingView’s interface is extremely customizable, however some key parts stay constant:

- Chart Space: That is the central a part of the display screen displaying the value chart. You may zoom out and in, pan left and proper, and alter the timeframe.

- Timeframe Selector: Positioned normally on the backside left, this lets you swap between completely different timeframes (e.g., 1-minute, 5-minute, 1-hour, day by day, weekly, month-to-month). Selecting the best timeframe is crucial; shorter timeframes present extra element however will be noisy, whereas longer timeframes present a broader perspective however might miss short-term alternatives.

- Indicator Panel: This panel, usually positioned on the left or proper, means that you can add and handle technical indicators. We’ll delve into particular indicators later.

- Drawing Instruments: TradingView supplies a complete suite of drawing instruments, together with development strains, Fibonacci retracements, help/resistance ranges, channels, and extra. These instruments assist establish patterns, challenge value targets, and handle threat.

- Order Administration (Elective): If linked to a brokerage account, TradingView means that you can place and handle orders immediately from the platform.

III. Mastering Technical Indicators: Unveiling Market Insights

Technical indicators are mathematical calculations utilized to cost knowledge to generate buying and selling indicators. TradingView presents an unlimited library of indicators, categorized into a number of teams:

-

Development Indicators: These indicators assist establish the general path of the market. Examples embrace:

- Shifting Averages (MA): Easy Shifting Common (SMA), Exponential Shifting Common (EMA), Weighted Shifting Common (WMA). These easy out value fluctuations and spotlight developments.

- MACD (Shifting Common Convergence Divergence): This momentum indicator identifies modifications in development energy.

- ADX (Common Directional Index): Measures the energy of a development.

- Parabolic SAR (Cease and Reverse): A trailing stop-loss indicator.

-

Momentum Indicators: These measure the pace and energy of value actions. Examples embrace:

- RSI (Relative Power Index): Measures the magnitude of current value modifications to guage overbought or oversold circumstances.

- Stochastic Oscillator: One other momentum indicator that identifies overbought and oversold circumstances.

- Williams %R: Just like the Stochastic Oscillator.

-

Volatility Indicators: These measure the diploma of value fluctuation. Examples embrace:

- Bollinger Bands: Present value volatility and potential reversal factors.

- Common True Vary (ATR): Measures market volatility.

-

Quantity Indicators: These analyze buying and selling quantity to substantiate value actions and establish potential breakouts. Examples embrace:

- On-Steadiness Quantity (OBV): Cumulative quantity indicator reflecting shopping for and promoting stress.

- Chaikin Cash Circulation: Measures the move of cash into and out of a safety.

IV. Using Drawing Instruments: Visualizing Market Buildings

TradingView’s drawing instruments are invaluable for figuring out patterns and help/resistance ranges. Key instruments embrace:

- Development Strains: Join vital highs or lows to establish the general development. Uptrend strains join rising lows, whereas downtrend strains join falling highs.

- Assist and Resistance Ranges: Horizontal strains drawn at value ranges the place the value has beforehand bounced or damaged by means of. These ranges typically act as boundaries to cost actions.

- Fibonacci Retracements: Based mostly on the Fibonacci sequence, these instruments challenge potential help and resistance ranges primarily based on previous value swings.

- Channels: Parallel strains drawn to surround value actions inside an outlined vary.

- Rectangles, Circles, and different Shapes: Used to focus on particular value areas or patterns.

V. Combining Indicators and Drawing Instruments: A Holistic Strategy

The true energy of TradingView lies in combining indicators and drawing instruments for a complete evaluation. As an illustration, you would possibly use shifting averages to establish the development, RSI to gauge momentum, and Fibonacci retracements to challenge potential value targets. Combining these instruments permits for a extra nuanced understanding of the market and will increase the accuracy of buying and selling indicators. Nonetheless, it is essential to keep away from "indicator overload" – too many indicators can create confusion and result in inaccurate interpretations.

VI. Backtesting and Technique Optimization:

TradingView permits for backtesting methods utilizing its Pine Script programming language. This function enables you to take a look at your buying and selling concepts on historic knowledge, assessing their profitability and threat earlier than implementing them in stay buying and selling. Backtesting is essential for refining your buying and selling methods and figuring out potential flaws.

VII. Essential Concerns:

- No Holy Grail: No single indicator or mixture of indicators ensures earnings. Market circumstances are continuously altering, and what works in a single state of affairs might not work in one other.

- Danger Administration: All the time implement a sturdy threat administration plan, together with stop-loss orders and place sizing, to guard your capital.

- Training and Apply: Mastering TradingView and technical evaluation requires time, effort, and observe. Repeatedly be taught and refine your abilities.

This information supplies a complete overview of the best way to learn a TradingView chart. By understanding the basics of candlestick patterns, using technical indicators successfully, and using drawing instruments strategically, you possibly can considerably improve your buying and selling evaluation and decision-making course of. Do not forget that constant studying and observe are essential for achievement within the dynamic world of buying and selling. All the time conduct thorough analysis and contemplate consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered priceless insights into Deciphering the TradingView Chart: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!