Deciphering the USD/JPY Chart on eToro: A Complete Information for Merchants

Associated Articles: Deciphering the USD/JPY Chart on eToro: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Deciphering the USD/JPY Chart on eToro: A Complete Information for Merchants. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Deciphering the USD/JPY Chart on eToro: A Complete Information for Merchants

The USD/JPY foreign money pair, representing the US greenback towards the Japanese yen, is a extremely liquid and regularly traded instrument within the foreign exchange market. Its value actions are influenced by a posh interaction of macroeconomic elements, geopolitical occasions, and market sentiment. Understanding interpret the USD/JPY chart on a platform like eToro is essential for merchants looking for to navigate this dynamic market. This text gives a complete information to analyzing the USD/JPY chart on eToro, encompassing technical evaluation, elementary evaluation, and danger administration methods.

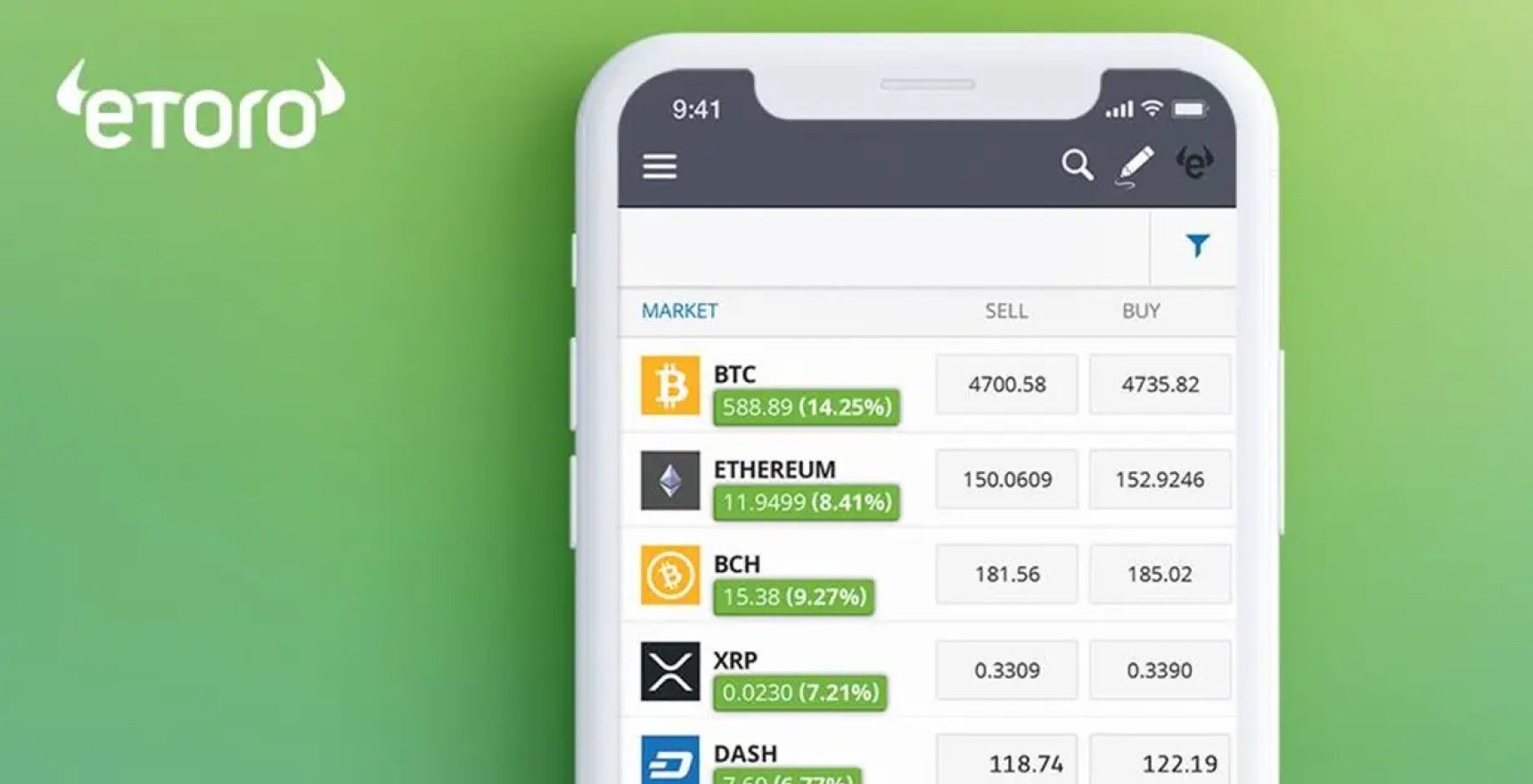

eToro’s Charting Instruments and Options:

Earlier than diving into the evaluation, it is vital to know the instruments and options eToro gives for charting the USD/JPY pair. eToro presents a user-friendly charting interface with a spread of customizable choices, together with:

-

A number of Chart Sorts: eToro permits merchants to pick out from varied chart sorts, together with candlestick charts, bar charts, and line charts. Every kind presents a barely totally different perspective on value motion. Candlestick charts, particularly, are widespread for his or her potential to visually characterize value opening, closing, excessive, and low values inside a selected timeframe.

-

Technical Indicators: A wide selection of technical indicators can be found, together with transferring averages (SMA, EMA), Relative Power Index (RSI), MACD, Bollinger Bands, and Fibonacci retracements. These indicators assist determine developments, momentum, and potential assist and resistance ranges. Understanding use these indicators successfully is paramount to profitable buying and selling.

-

Timeframes: Merchants can regulate the timeframe of the chart, starting from intraday charts (e.g., 1-minute, 5-minute, 1-hour) to longer-term charts (e.g., each day, weekly, month-to-month). Selecting the best timeframe will depend on the dealer’s buying and selling technique and time horizon. Scalpers would possibly want shorter timeframes, whereas long-term traders would possibly deal with each day or weekly charts.

-

Drawing Instruments: eToro gives varied drawing instruments, reminiscent of pattern strains, horizontal strains, Fibonacci retracements, and channels. These instruments assist determine assist and resistance ranges, trendlines, and potential reversal factors.

-

Customizable Layouts: Merchants can personalize their chart layouts by including or eradicating indicators, adjusting colours, and altering the general look to go well with their preferences. A well-organized chart enhances readability and improves decision-making.

Technical Evaluation of the USD/JPY Chart:

Technical evaluation focuses on previous value motion and market patterns to foretell future value actions. Key points of technical evaluation when decoding the USD/JPY chart on eToro embrace:

-

Development Identification: Figuring out the general pattern (uptrend, downtrend, or sideways) is essential. Trendlines, transferring averages, and different indicators may also help decide the dominant pattern. A transparent uptrend would possibly recommend additional value appreciation, whereas a downtrend signifies potential additional declines.

-

Assist and Resistance Ranges: Assist ranges characterize value factors the place shopping for stress is anticipated to outweigh promoting stress, stopping additional value declines. Resistance ranges are the other – value factors the place promoting stress is anticipated to exceed shopping for stress, halting value will increase. Breaks above resistance or beneath assist can sign important value actions.

-

Candlestick Patterns: Candlestick patterns present insights into the market’s sentiment and potential value reversals. Widespread patterns embrace hammer, hanging man, engulfing patterns, and doji, every suggesting a selected market situation.

-

Transferring Averages: Transferring averages clean out value fluctuations and assist determine developments. The intersection of various transferring averages (e.g., a 50-day SMA crossing above a 200-day SMA) can sign a bullish crossover, indicating a possible uptrend.

-

Oscillators: Oscillators, such because the RSI and MACD, measure momentum and potential overbought or oversold situations. RSI values above 70 typically recommend an overbought market, hinting at a possible value correction, whereas values beneath 30 point out an oversold market, suggesting a possible value rebound.

Basic Evaluation of the USD/JPY Chart:

Basic evaluation considers macroeconomic elements and geopolitical occasions that affect the USD/JPY trade fee. Key parts to contemplate embrace:

-

US Curiosity Charges: Greater US rates of interest typically appeal to overseas funding, growing demand for the US greenback and strengthening the USD/JPY. Conversely, decrease rates of interest can weaken the greenback. Bulletins from the Federal Reserve (Fed) concerning rate of interest choices considerably influence the USD/JPY.

-

Japanese Curiosity Charges: Just like US rates of interest, adjustments in Japanese rates of interest affect the yen’s worth. Decrease rates of interest in Japan can weaken the yen relative to the greenback.

-

Financial Knowledge: Financial knowledge releases from each the US and Japan, reminiscent of GDP progress, inflation charges, employment figures, and commerce balances, can considerably affect the USD/JPY. Stronger-than-expected financial knowledge normally strengthens the respective foreign money.

-

Geopolitical Occasions: World political occasions, reminiscent of commerce wars, political instability, and pure disasters, can influence the USD/JPY. Uncertainty typically results in a flight to security, strengthening the yen as a safe-haven foreign money.

-

Danger Urge for food: Market sentiment and danger urge for food play a vital position. In periods of heightened danger aversion, traders have a tendency to maneuver in direction of safe-haven belongings just like the yen, inflicting the USD/JPY to say no.

Danger Administration Methods on eToro:

Buying and selling the USD/JPY on eToro, like another monetary market, entails danger. Efficient danger administration is essential for preserving capital and minimizing potential losses:

-

Place Sizing: Decide the suitable quantity of capital to allocate to every commerce primarily based in your danger tolerance. By no means danger greater than you’ll be able to afford to lose.

-

Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. A stop-loss order robotically closes a commerce when the worth reaches a predetermined stage.

-

Take-Revenue Orders: Take-profit orders assist safe earnings by robotically closing a commerce when the worth reaches a specified goal stage.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio by buying and selling different foreign money pairs or asset lessons to cut back total danger.

-

Backtesting: Earlier than implementing any buying and selling technique, backtest it utilizing historic knowledge to evaluate its efficiency and refine your method.

Conclusion:

Efficiently buying and selling the USD/JPY on eToro requires a complete understanding of each technical and elementary evaluation, coupled with strong danger administration methods. By successfully using eToro’s charting instruments, decoding market indicators, and staying knowledgeable about macroeconomic elements and geopolitical occasions, merchants can enhance their probabilities of making knowledgeable choices and navigating the complexities of this dynamic foreign money pair. Do not forget that buying and selling entails inherent dangers, and previous efficiency isn’t indicative of future outcomes. Steady studying and adaptation are important for long-term success in foreign currency trading. All the time conduct thorough analysis and think about looking for recommendation from a certified monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered priceless insights into Deciphering the USD/JPY Chart on eToro: A Complete Information for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!