Deciphering the Sure Financial institution Chart on TradingView: A Complete Evaluation

Associated Articles: Deciphering the Sure Financial institution Chart on TradingView: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Deciphering the Sure Financial institution Chart on TradingView: A Complete Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Deciphering the Sure Financial institution Chart on TradingView: A Complete Evaluation

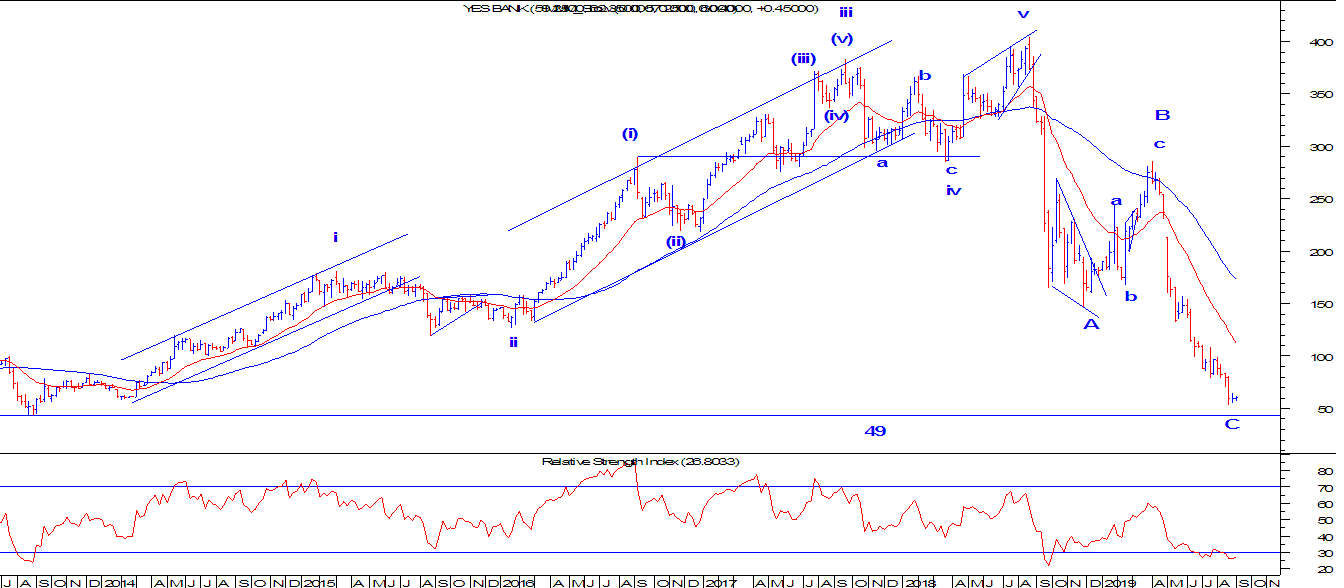

Sure Financial institution, as soon as a distinguished participant within the Indian banking sector, has skilled a tumultuous journey, making its chart on TradingView a captivating case research for merchants and traders alike. Analyzing its worth motion requires a nuanced method, contemplating its advanced historical past, regulatory interventions, and ongoing restructuring. This text will delve deep into deciphering the Sure Financial institution chart on TradingView, exploring numerous technical indicators, worth patterns, and basic components influencing its worth motion.

Understanding the Historic Context:

Earlier than diving into technical evaluation, it is essential to acknowledge Sure Financial institution’s turbulent previous. The financial institution confronted important challenges stemming from asset high quality points, resulting in a pointy decline in its share worth. The Reserve Financial institution of India (RBI) intervened, imposing restrictions and ultimately facilitating a reconstruction scheme. This era of uncertainty created important volatility, mirrored dramatically within the worth chart on TradingView. Understanding this historic context is paramount to deciphering the following worth actions. The chart reveals intervals of maximum volatility, sharp drops, and intervals of relative calm following the RBI intervention and subsequent restructuring.

Technical Evaluation on TradingView:

TradingView presents a complete suite of instruments to investigate Sure Financial institution’s chart. Let’s discover some key facets:

1. Worth Motion and Candlestick Patterns:

The Sure Financial institution chart showcases a wide range of candlestick patterns, reflecting the fluctuating market sentiment. Figuring out these patterns can supply clues about potential future worth actions. For example, observing bearish engulfing patterns in periods of downward stress can point out a continuation of the downtrend. Conversely, bullish engulfing patterns in periods of restoration would possibly sign a possible worth reversal. Analyzing the candlestick our bodies (actual our bodies) and wicks (shadows) offers priceless details about the power of patrons and sellers at numerous worth ranges. Lengthy higher wicks counsel promoting stress, whereas lengthy decrease wicks point out shopping for stress.

2. Shifting Averages:

Shifting averages (MA), equivalent to the straightforward transferring common (SMA) and exponential transferring common (EMA), are extensively used indicators on TradingView. These clean out worth fluctuations and assist establish tendencies. A generally used mixture is the 50-day and 200-day SMA. A bullish crossover happens when the 50-day SMA crosses above the 200-day SMA, suggesting a possible uptrend. Conversely, a bearish crossover signifies a possible downtrend. Analyzing the connection between the value and the transferring averages can present insights into the general market sentiment and potential assist and resistance ranges.

3. Relative Power Index (RSI):

The RSI is a momentum oscillator used to establish overbought and oversold circumstances. RSI values above 70 typically point out an overbought market, suggesting a possible worth correction. Values under 30 counsel an oversold market, doubtlessly indicating a worth bounce. Nonetheless, it is essential to do not forget that RSI divergences may present priceless insights. A bullish divergence happens when the value makes decrease lows, however the RSI makes increased lows, suggesting weakening bearish momentum. Equally, a bearish divergence can sign weakening bullish momentum.

4. MACD (Shifting Common Convergence Divergence):

The MACD is one other momentum indicator that compares two transferring averages to establish adjustments in momentum. A bullish crossover (MACD line crossing above the sign line) can point out a possible uptrend, whereas a bearish crossover suggests a possible downtrend. Analyzing MACD histograms may present insights into the power of the momentum. Giant constructive histograms counsel sturdy bullish momentum, whereas massive unfavorable histograms point out sturdy bearish momentum.

5. Help and Resistance Ranges:

Figuring out assist and resistance ranges on the Sure Financial institution chart is essential for understanding potential worth reversals. Help ranges signify worth factors the place shopping for stress is predicted to outweigh promoting stress, stopping additional declines. Resistance ranges signify worth factors the place promoting stress is predicted to outweigh shopping for stress, stopping additional advances. These ranges could be recognized utilizing earlier worth highs and lows, in addition to utilizing Fibonacci retracement ranges and different technical instruments out there on TradingView.

6. Quantity Evaluation:

Analyzing buying and selling quantity alongside worth motion is important for confirming worth actions. Excessive quantity throughout an uptrend confirms the power of the bullish momentum, whereas excessive quantity throughout a downtrend confirms the power of the bearish momentum. Low quantity throughout worth actions can counsel weak momentum and potential reversals. TradingView permits for straightforward overlaying of quantity information onto the value chart, facilitating a complete evaluation.

Basic Evaluation:

Whereas technical evaluation offers insights into worth actions, basic evaluation is essential for understanding the underlying components driving Sure Financial institution’s efficiency. Components to contemplate embody:

- Asset High quality: The financial institution’s Non-Performing Property (NPAs) and their administration are important to its monetary well being.

- Capital Adequacy Ratio (CAR): A robust CAR signifies the financial institution’s potential to soak up losses.

- Regulatory Compliance: The financial institution’s adherence to RBI laws is essential for its long-term stability.

- Administration Group and Technique: The effectiveness of the administration staff and their strategic route considerably impression the financial institution’s future prospects.

- Financial Circumstances: The general state of the Indian economic system and the banking sector impacts Sure Financial institution’s efficiency.

Combining Technical and Basic Evaluation:

A holistic method includes combining technical and basic evaluation. Whereas technical evaluation offers insights into short-term worth actions, basic evaluation presents a longer-term perspective. By integrating each, merchants and traders can develop a extra complete understanding of Sure Financial institution’s prospects and make knowledgeable buying and selling selections. For example, a bullish technical setup is perhaps validated by constructive basic developments, rising the boldness in a possible uptrend.

Conclusion:

Analyzing the Sure Financial institution chart on TradingView requires a cautious consideration of its distinctive historical past and the interaction of technical and basic components. Whereas the chart presents a fancy image, using the assorted instruments and indicators out there on TradingView, coupled with an intensive understanding of the financial institution’s basic place, permits for a extra knowledgeable evaluation of potential buying and selling alternatives and danger administration methods. It is essential to do not forget that previous efficiency shouldn’t be indicative of future outcomes, and buying and selling in risky shares like Sure Financial institution carries important danger. Thorough analysis and danger administration are paramount earlier than making any funding selections. At all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied priceless insights into Deciphering the Sure Financial institution Chart on TradingView: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!