Deciphering Right this moment’s Gold Chart: A Deep Dive into Emas Hari Ini

Associated Articles: Deciphering Right this moment’s Gold Chart: A Deep Dive into Emas Hari Ini

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Deciphering Right this moment’s Gold Chart: A Deep Dive into Emas Hari Ini. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Deciphering Right this moment’s Gold Chart: A Deep Dive into Emas Hari Ini

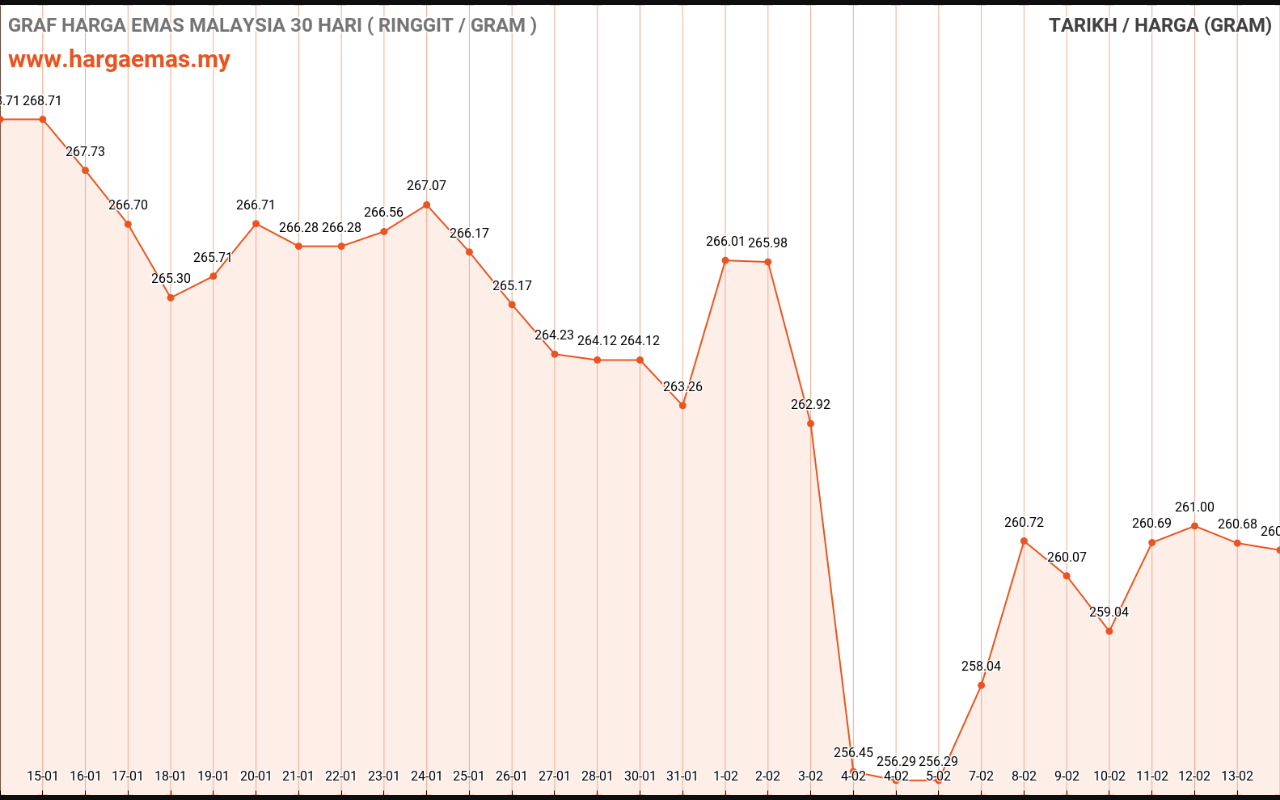

The value of gold, sometimes called "emas" in lots of components of the world, is a dynamic market influenced by a posh interaction of worldwide financial components, geopolitical occasions, and investor sentiment. Understanding right now’s gold chart ("emas hari ini") requires greater than only a look on the present worth; it necessitates a complete evaluation of the underlying forces shaping its trajectory. This text delves into the intricacies of decoding right now’s gold chart, exploring the important thing indicators, influencing components, and potential future worth actions.

Understanding the Chart:

Earlier than analyzing "emas hari ini," it is essential to grasp the fundamental elements of a gold worth chart. Sometimes, these charts show the value of gold (normally in US {dollars} per troy ounce) over a selected time interval, starting from intraday to years. Frequent chart varieties embody:

- Line Charts: These show the value over time, exhibiting the overall development.

- Candlestick Charts: These present a extra detailed image, showcasing the opening, closing, excessive, and low costs for every interval (e.g., hourly, day by day). The "physique" of the candlestick represents the value vary between the opening and shutting costs, whereas the "wicks" (or shadows) prolong to the excessive and low costs. Inexperienced or white candles usually point out a worth enhance, whereas crimson or black candles signify a worth lower.

- Bar Charts: Much like candlestick charts, bar charts show the excessive, low, open, and shut costs for a given interval.

Analyzing these charts includes figuring out key technical indicators akin to:

- Help and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt via. Help ranges characterize costs the place shopping for stress is predicted to outweigh promoting stress, stopping additional worth declines. Resistance ranges are the alternative, the place promoting stress is predicted to dominate, hindering worth will increase.

- Pattern Strains: These traces join a sequence of upper lows (uptrend) or decrease highs (downtrend), indicating the general course of the value motion.

- Shifting Averages: These are calculated by averaging the value over a particular interval (e.g., 50-day transferring common, 200-day transferring common). They easy out worth fluctuations and assist determine the general development. Crossovers between totally different transferring averages can sign potential purchase or promote indicators.

- Relative Energy Index (RSI): This momentum indicator measures the magnitude of current worth adjustments to judge overbought or oversold situations. RSI values above 70 usually counsel an overbought market, whereas values beneath 30 counsel an oversold market.

- MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the energy, course, momentum, and length of a development.

Components Influencing "Emas Hari Ini":

The value of gold is influenced by a large number of things, making correct prediction difficult. A few of the most vital embody:

- US Greenback Energy: Gold is priced in US {dollars}. A stronger greenback typically places downward stress on gold costs, because it turns into dearer for holders of different currencies to purchase gold. Conversely, a weaker greenback tends to spice up gold costs.

- Curiosity Charges: Larger rates of interest usually enhance the chance price of holding non-yielding property like gold, resulting in decrease demand. Decrease rates of interest can have the alternative impact. The Federal Reserve’s financial coverage selections considerably affect gold costs.

- Inflation: Gold is usually thought of a hedge in opposition to inflation. During times of excessive inflation, traders usually flock to gold as a retailer of worth, driving up costs.

- Geopolitical Uncertainty: Political instability, wars, and worldwide tensions usually increase gold costs, as traders search safe-haven property.

- Financial Progress: Robust financial progress can typically result in decrease gold costs as traders shift their focus to riskier property with larger potential returns. Conversely, financial slowdown or recessionary fears can drive traders in direction of gold.

- Provide and Demand: Adjustments in gold mining manufacturing, central financial institution gold reserves, and investor demand all affect the value.

- Market Sentiment: Investor psychology performs a vital position. Optimistic sentiment can drive costs larger, whereas detrimental sentiment can result in worth declines.

Decoding Right this moment’s Gold Chart: A Case Research (Hypothetical)

Let’s think about a hypothetical state of affairs for example the best way to interpret right now’s gold chart. Suppose the candlestick chart for "emas hari ini" reveals a bearish engulfing sample – a big crimson candlestick fully encompassing the earlier inexperienced candlestick. This sample suggests a possible reversal of the upward development. Moreover, the RSI is above 70, indicating an overbought market. The 50-day transferring common has crossed beneath the 200-day transferring common, a bearish sign often known as a "loss of life cross." Lastly, the value is approaching a powerful resistance stage.

This mixture of technical indicators and chart patterns suggests a bearish outlook for gold within the close to time period. Nevertheless, it is essential to contemplate the basic components as properly. If geopolitical tensions are escalating or inflation is unexpectedly excessive, these basic components might override the bearish technical indicators, probably supporting gold costs regardless of the technical indicators.

Disclaimer: It is essential to do not forget that technical evaluation will not be an actual science. Chart patterns and indicators might be deceptive, and no evaluation ensures future worth actions. This evaluation is for instructional functions solely and shouldn’t be thought of monetary recommendation. All the time conduct thorough analysis and seek the advice of with a certified monetary advisor earlier than making any funding selections.

Conclusion:

Analyzing "emas hari ini" requires a multifaceted method, combining technical evaluation of chart patterns and indicators with an understanding of the basic components influencing gold costs. Whereas technical evaluation can present beneficial insights into potential worth actions, it is important to contemplate the broader financial and geopolitical context. By rigorously inspecting each technical and basic components, traders can achieve a extra complete understanding of the gold market and make extra knowledgeable funding selections. Do not forget that the gold market is continually evolving, and steady monitoring and adaptation are important for profitable investing. The knowledge supplied on this article is for instructional functions solely and shouldn’t be interpreted as monetary recommendation. All the time conduct your personal analysis and seek the advice of with a certified skilled earlier than making any funding selections.

Closure

Thus, we hope this text has supplied beneficial insights into Deciphering Right this moment’s Gold Chart: A Deep Dive into Emas Hari Ini. We recognize your consideration to our article. See you in our subsequent article!