Decoding Medicare Complement Plan G: A Complete Profit Chart and Information

Associated Articles: Decoding Medicare Complement Plan G: A Complete Profit Chart and Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding Medicare Complement Plan G: A Complete Profit Chart and Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding Medicare Complement Plan G: A Complete Profit Chart and Information

Medicare could be a labyrinthine system, and selecting the best supplemental plan can really feel overwhelming. Medicare Complement Plan G, usually thought-about a best choice for a lot of seniors, provides sturdy protection that considerably reduces out-of-pocket bills. Understanding its advantages is essential for making an knowledgeable determination about your healthcare future. This text will delve into the intricacies of Plan G, offering an in depth profit chart and explaining its nuances.

Understanding Medicare and the Want for Supplemental Protection

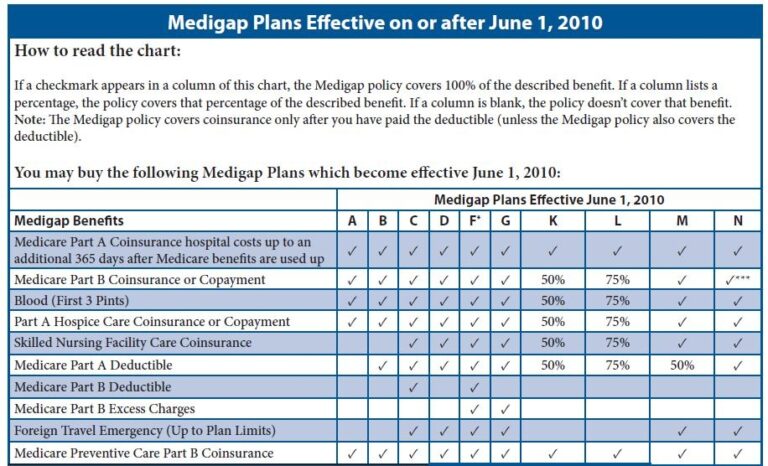

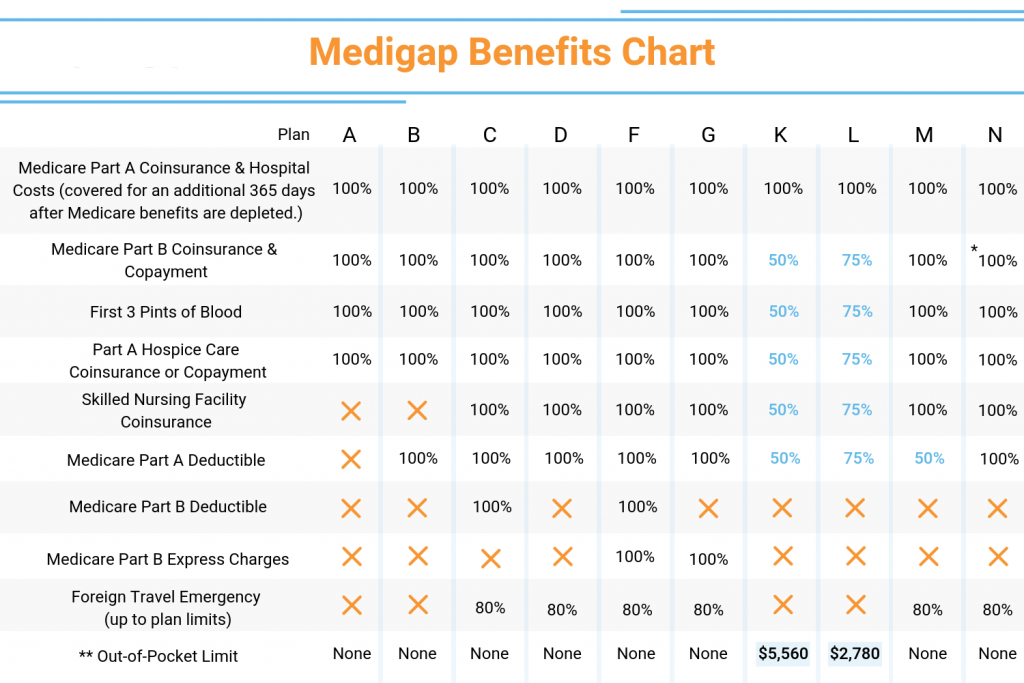

Earlier than diving into Plan G specifics, let’s briefly recap the Medicare system. Authentic Medicare includes Half A (hospital insurance coverage) and Half B (medical insurance coverage). Whereas Half A covers inpatient care, Half B covers physician visits, outpatient companies, and a few preventive care. Nonetheless, each components depart vital gaps in protection, leading to substantial out-of-pocket prices for beneficiaries. That is the place Medicare Complement plans, often known as Medigap plans, step in.

Medigap plans, provided by personal insurance coverage corporations, assist fill these gaps by paying for some or the entire prices that Authentic Medicare would not cowl. Plan G is one such plan, and it is extremely in style on account of its complete protection.

Medicare Complement Plan G Profit Chart:

The next chart outlines the advantages usually lined by Medicare Complement Plan G. It is essential to do not forget that particular advantages and prices can range barely relying on the insurance coverage firm and your location. At all times discuss with your coverage paperwork for exact particulars.

| Medicare Half | Lined Expense | Plan G Protection | Your Duty | Notes |

|---|---|---|---|---|

| Half A | Hospital inpatient care (deductible) | $0 | $0 | Plan G covers the Half A deductible. |

| Half A | Hospital inpatient care (coinsurance) | 100% | $0 | Plan G covers the Half A coinsurance. |

| Half A | Expert nursing facility care (coinsurance) | 100% | $0 | Plan G covers the Half A coinsurance for expert nursing facility care. |

| Half A | Hospice care | 100% | $0 | Plan G covers hospice care. |

| Half A | Blood (first 3 pints) | 100% | $0 | Plan G covers the primary 3 pints of blood. |

| Half B | Medical bills (deductible) | $0 | $0 | Plan G covers the Half B deductible. |

| Half B | Medical bills (coinsurance) | 100% | $0 | Plan G covers the Half B coinsurance (80% of accepted expenses). |

| Half B | Overseas Journey Emergency Care | Variable | Variable | Protection varies by insurer; test your coverage for particular particulars. |

| Half B | Extra Prices | 100% | $0 | Covers the distinction between Medicare’s accepted quantity and the physician’s invoice. |

Key Options of Plan G:

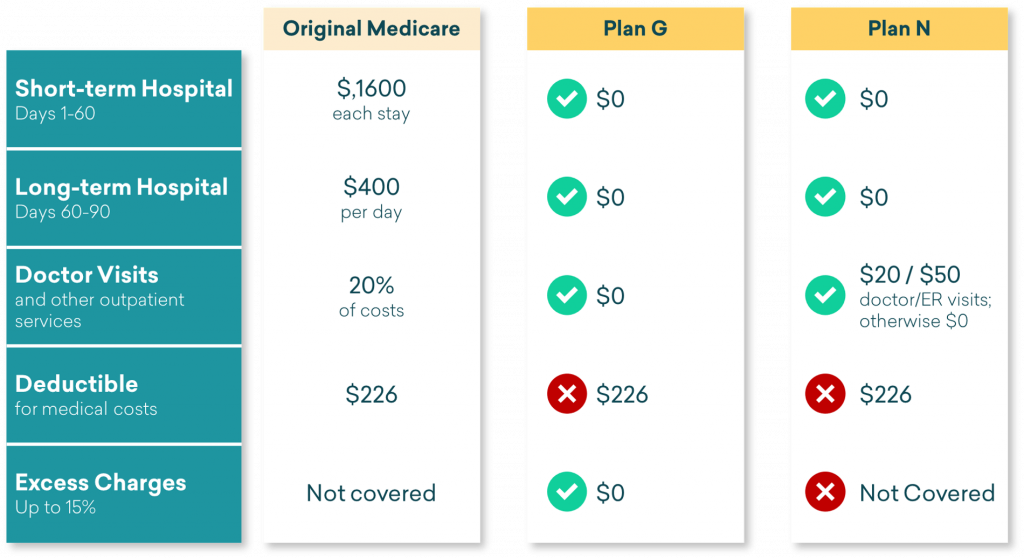

- Half A & Half B Protection: Plan G comprehensively covers each hospital and medical insurance coverage prices.

- No Half B Coinsurance: This can be a vital benefit. In contrast to another Medigap plans, Plan G covers 100% of Half B coinsurance, eliminating a significant supply of out-of-pocket expense.

- Half A & Half B Deductibles: Plan G covers each the Half A and Half B deductibles, additional minimizing your monetary burden.

- No Gaps in Protection: The plan goals to eradicate most cost-sharing liabilities, guaranteeing complete safety.

- Increased Premiums: Attributable to its in depth protection, Plan G typically comes with increased month-to-month premiums in comparison with plans with much less complete advantages.

What Plan G Does not Cowl:

Whereas Plan G provides in depth protection, it would not cowl every little thing. Vital exclusions embrace:

- Medicare Half B Premium: You are still accountable for paying your month-to-month Half B premium.

- Prices Associated to Non-Lined Companies: Medicare would not cowl all companies, and Plan G will not cowl these both. Examples embrace beauty surgical procedure, most dental care, and imaginative and prescient care.

- Lengthy-Time period Care: Plan G doesn’t cowl long-term care bills in assisted residing amenities or nursing properties.

- Well being Insurance coverage Premiums: Plan G is a supplemental plan; it would not substitute your want for Authentic Medicare.

Evaluating Plan G to Different Medigap Plans:

Plan G is usually in comparison with Plan F, which was as soon as essentially the most complete Medigap plan out there. Nonetheless, the sale of latest Plan F insurance policies was discontinued for many who enrolled in Medicare after January 1, 2020. The important thing distinction between Plan G and Plan F (for many who nonetheless maintain it) lies within the Half B deductible. Plan F covers the Half B deductible, whereas Plan G doesn’t. For this reason Plan G premiums are typically decrease than these of Plan F.

Selecting the Proper Medigap Plan:

Choosing the correct Medigap plan is a private determination primarily based in your particular person wants, well being standing, and monetary scenario. Elements to contemplate embrace:

- Your Well being Standing: For those who anticipate vital healthcare prices, a extra complete plan like Plan G may be a better option.

- Your Finances: Weigh the upper premiums of Plan G towards the potential financial savings from lowered out-of-pocket prices.

- Your Danger Tolerance: Think about your consolation stage with potential out-of-pocket bills.

- Your Lengthy-Time period Healthcare Wants: Take into consideration your potential future healthcare wants and whether or not a plan like Plan G sufficiently addresses them.

Open Enrollment and Past:

You’ve got a six-month window, referred to as the Medigap Open Enrollment Interval, to buy a Medigap coverage after you enroll in Half B of Medicare. Throughout this time, you should purchase any Medigap plan provided by insurers in your state with out present process medical underwriting. After this era, insurers can deny your utility or cost increased premiums primarily based in your well being standing.

Conclusion:

Medicare Complement Plan G provides substantial safety towards the monetary burdens of healthcare prices in retirement. Its complete protection of Half A and Half B prices, together with coinsurance and deductibles, makes it a preferred alternative for a lot of seniors. Nonetheless, it is essential to rigorously evaluation the profit chart, perceive its limitations, and evaluate it with different out there plans earlier than making a call. Consulting with a professional insurance coverage agent can present personalised steerage in navigating the complexities of Medicare and selecting one of the best Medigap plan to suit your particular person circumstances. Bear in mind to at all times test along with your chosen insurance coverage supplier for essentially the most up-to-date data on protection and premiums.

Closure

Thus, we hope this text has offered invaluable insights into Decoding Medicare Complement Plan G: A Complete Profit Chart and Information. We thanks for taking the time to learn this text. See you in our subsequent article!