Decoding Medicare Supplemental Plans: A Complete Comparability Chart and Information

Associated Articles: Decoding Medicare Supplemental Plans: A Complete Comparability Chart and Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding Medicare Supplemental Plans: A Complete Comparability Chart and Information. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding Medicare Supplemental Plans: A Complete Comparability Chart and Information

Navigating the complexities of Medicare can really feel like traversing a dense forest. Whereas Authentic Medicare (Components A and B) gives important protection, it leaves important gaps in out-of-pocket bills. That is the place Medicare Supplemental Insurance coverage, also called Medigap, steps in. Medigap plans assist fill these gaps, providing further protection for prices like deductibles, copayments, and coinsurance. Nonetheless, choosing the proper Medigap plan might be overwhelming, given the number of choices obtainable. This text gives an in depth comparability chart and a complete information that will help you make an knowledgeable choice.

Understanding Medicare Supplemental Plans (Medigap)

Medigap plans are bought by personal insurance coverage firms, not the federal government. They’re standardized, that means a Plan G in a single state is nearly similar to a Plan G in one other. This standardization permits for simpler comparability, however it’s essential to know the nuances of every plan to search out the very best match to your particular person wants and price range. There are at the moment ten standardized Medigap plans (A by means of N, excluding M), every providing a special mixture of protection. It is essential to notice that Plan F and Plan C are now not obtainable to new enrollees as of January 1, 2020, however those that have already got them can preserve them.

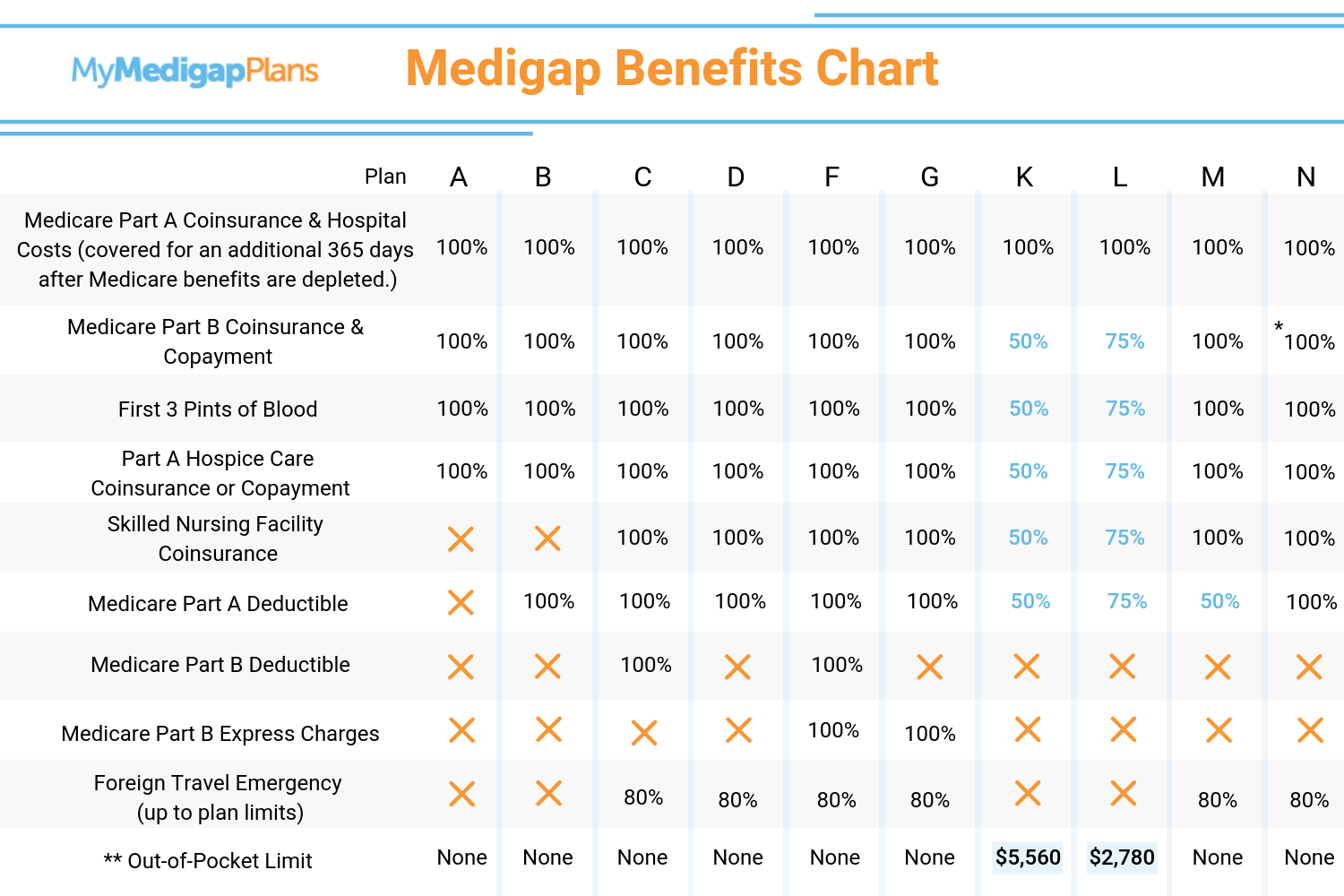

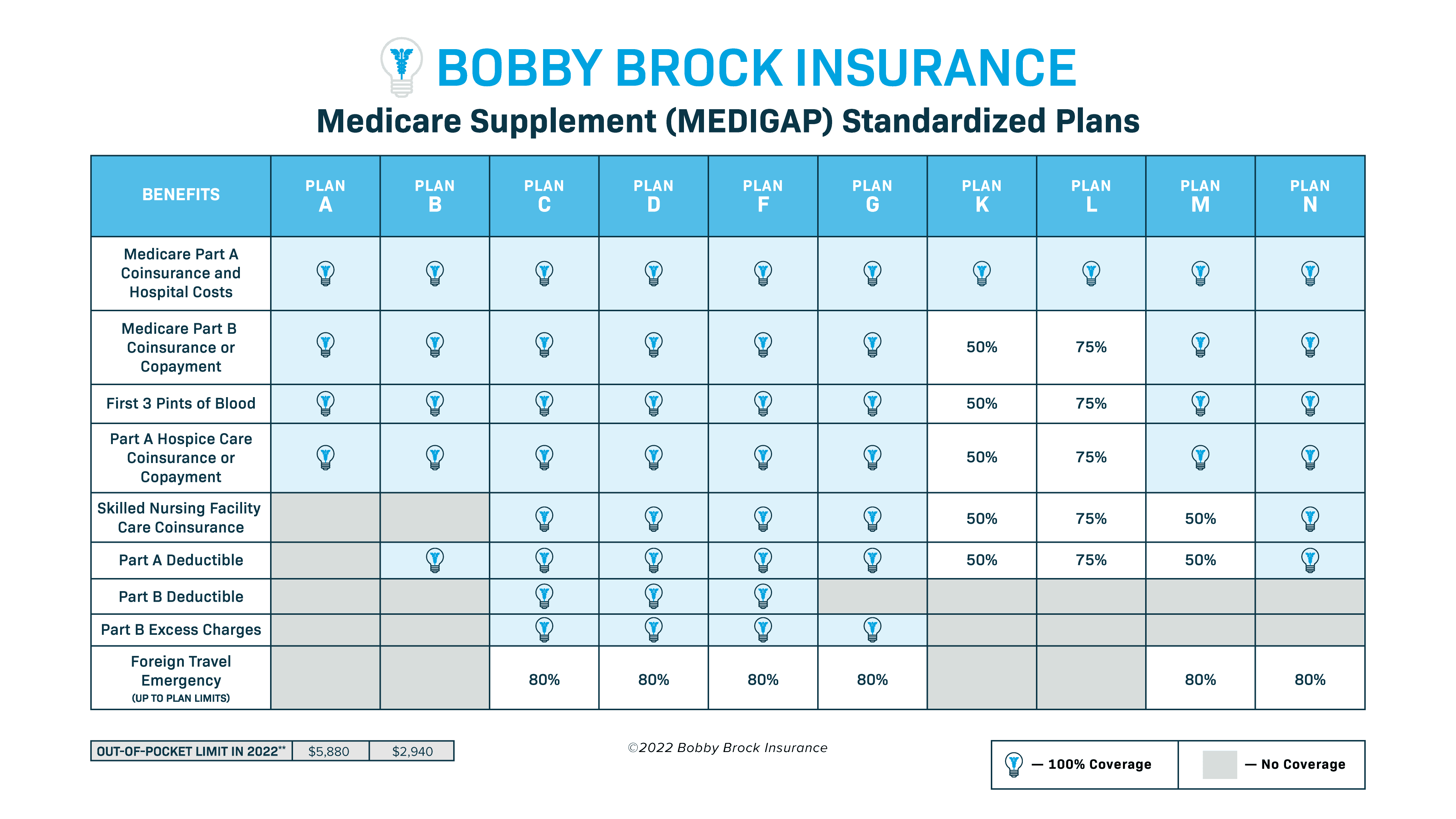

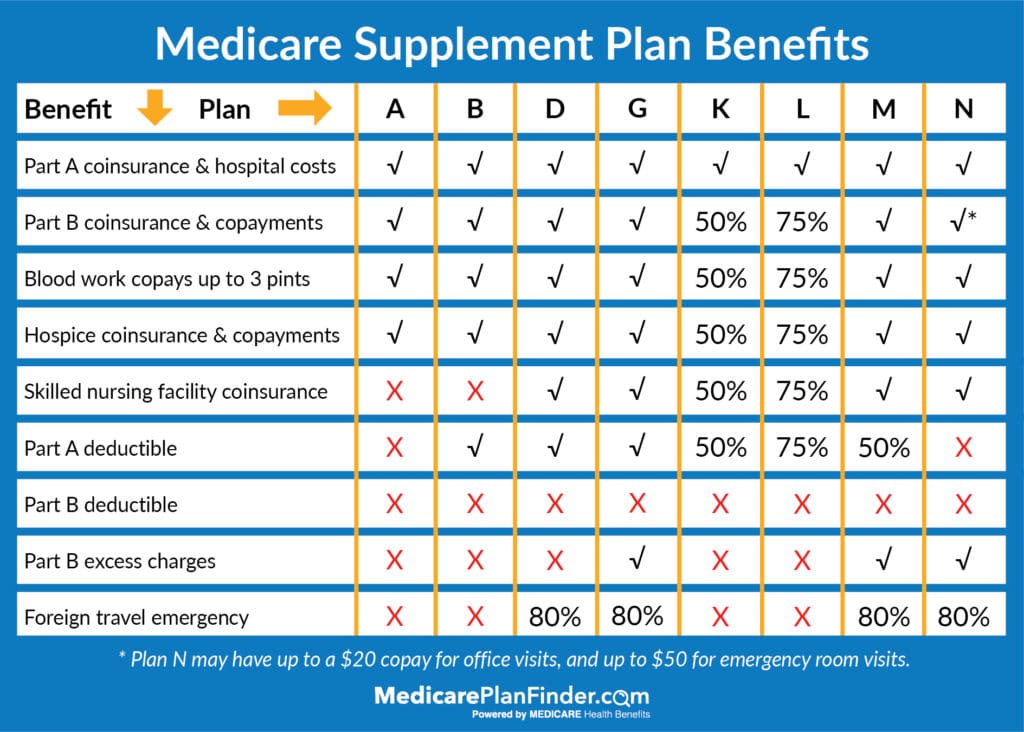

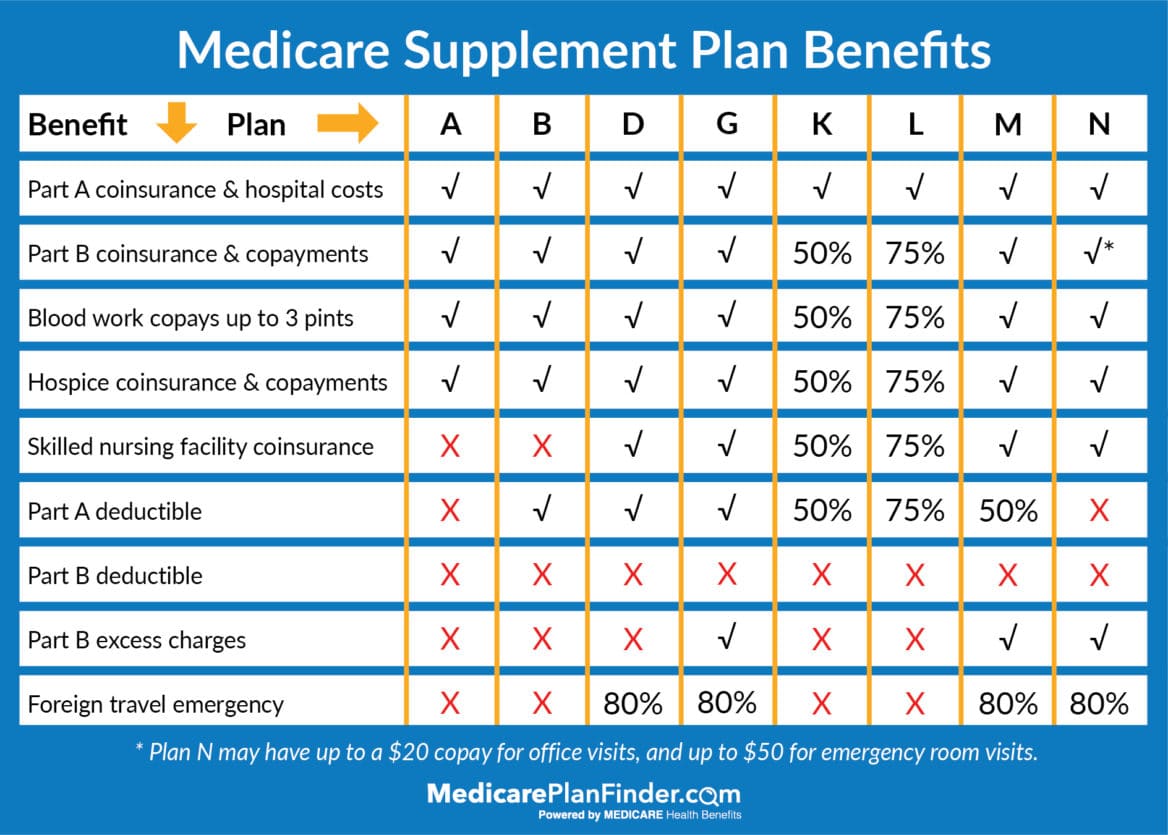

The Key Variations: A Comparability Chart

The next chart summarizes the important thing protection variations between the obtainable Medigap plans. Do not forget that particular prices will fluctuate relying in your location and the insurance coverage firm. This chart gives a generalized overview. All the time examine with particular person insurance coverage suppliers for correct pricing and particulars.

| Plan | Half A Copay (Hospital) | Half B Copay (Physician Visits) | International Journey Emergency Protection | Half B Extra Prices | Deductibles (Half A & B) | Different Protection |

|---|---|---|---|---|---|---|

| Plan A | $0 | $0 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection |

| Plan B | $0 | $0 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection |

| Plan C (Not Accessible to New Enrollees) | $0 | $0 | Sure | Sure | $0 | Complete Protection (Besides Half B deductible) |

| Plan D | $0 | $0 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection |

| Plan F (Not Accessible to New Enrollees) | $0 | $0 | Sure | Sure | $0 | Complete Protection (Contains Half B deductible) |

| Plan G | $0 | $0 (after preliminary deductible) | Sure | Sure | Half A deductible, $0 | Complete Protection (Besides Half B deductible) |

| Plan Ok | $0 | $0 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection with co-insurance |

| Plan L | $0 | $0 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection with co-insurance |

| Plan M | $0 | $0 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection with co-insurance |

| Plan N | $0 | $20 (after preliminary deductible) | No | No | Half A deductible, Half B deductible | Restricted Protection with co-insurance |

Decoding the Chart:

- Half A Copay (Hospital): This refers back to the quantity you may pay for hospital companies lined below Half A.

- Half B Copay (Physician Visits): This refers back to the quantity you may pay for physician visits and different outpatient companies lined below Half B.

- International Journey Emergency Protection: Signifies if the plan covers emergency medical care whereas touring exterior america.

- Half B Extra Prices: Some docs can cost greater than Medicare’s authorized quantity. This column signifies if the plan covers these extra costs.

- Deductibles (Half A & B): This reveals which deductibles, if any, the plan covers.

- Different Protection: It is a normal description of the extra protection past what’s listed above. That is the place the numerous variations between plans change into obvious.

Selecting the Proper Plan: A Step-by-Step Information

-

Assess Your Well being Wants: Contemplate your present well being standing and anticipated healthcare wants sooner or later. If you happen to anticipate frequent physician visits or hospitalizations, a extra complete plan may be useful.

-

Overview Your Funds: Medigap plans fluctuate considerably in price. Stability the extent of protection you want together with your price range. Contemplate the month-to-month premiums and the potential financial savings on out-of-pocket bills.

-

Examine Plans Aspect-by-Aspect: Use the comparability chart above and different sources from Medicare.gov and particular person insurance coverage firms to check plans. Pay shut consideration to the protection particulars and price variations.

-

Contemplate Future Wants: Your healthcare wants might change over time. Take into consideration your long-term well being prospects and select a plan that can proceed to satisfy your wants as you age.

-

Seek the advice of with an Insurance coverage Agent: An unbiased insurance coverage agent can present customized recommendation and enable you to examine plans from completely different firms. They will additionally enable you to perceive the complexities of Medigap and make sure you’re making your best option to your scenario.

-

Learn the Tremendous Print: Earlier than enrolling in a plan, fastidiously evaluate the coverage paperwork to know all of the phrases and situations. Take note of exclusions and limitations.

-

Open Enrollment Interval: You’ve gotten a six-month interval (beginning the month you flip 65 and are enrolled in Half B) to enroll in a Medigap plan with out medical underwriting. After this era, you could be topic to medical underwriting, which implies your well being standing will have an effect on your eligibility and premiums.

Necessary Issues:

- Pre-existing Situations: Medigap plans can’t deny protection primarily based on pre-existing situations when you’re enrolled.

- Assured Situation Rights: Throughout your six-month open enrollment interval, you’ve gotten the fitting to purchase any Medigap plan provided by the insurer in your state, no matter your well being.

- State Laws: State rules might fluctuate, so it is essential to examine the particular guidelines in your state.

- Switching Plans: You’ll be able to change Medigap plans, however there could also be limitations and restrictions.

Conclusion:

Selecting a Medicare Supplemental plan is a big choice that impacts your monetary well-being and entry to healthcare. By fastidiously contemplating your wants, price range, and the data supplied on this article and the comparability chart, you can also make an knowledgeable selection that gives you with the absolute best safety towards the excessive prices of healthcare. Keep in mind to seek the advice of with an insurance coverage agent or use on-line comparability instruments to get customized steerage and examine plans from a number of insurers. Do not hesitate to ask questions and make sure you totally perceive the protection and prices earlier than making your ultimate choice. Your well being and monetary safety rely on it.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding Medicare Supplemental Plans: A Complete Comparability Chart and Information. We hope you discover this text informative and useful. See you in our subsequent article!