Decoding Worthwhile Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Decoding Worthwhile Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding Worthwhile Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding Worthwhile Chart Patterns: A Complete Information (PDF Downloadable)

![10 Most Profitable Chart Patterns Analysis [PDF]](https://forexpops.com/wp-content/uploads/2023/01/Most-Profitable-Chart-Patterns-768x327.jpg)

Chart patterns, recurring formations in worth motion, are invaluable instruments for technical analysts. Whereas no sample ensures revenue, sure formations statistically exhibit larger possibilities of success, providing merchants a big edge in predicting future worth actions. This text delves into a few of the most worthwhile chart patterns, inspecting their traits, identification strategies, and threat administration methods. A downloadable PDF summarizing these patterns is offered on the finish.

I. Introduction: The Energy of Sample Recognition

Technical evaluation hinges on the assumption that historical past repeats itself. Chart patterns signify this repetition, offering visible cues about potential worth reversals or continuations. By recognizing these patterns, merchants can anticipate market shifts and place themselves accordingly. Nevertheless, it is essential to grasp that chart patterns usually are not standalone indicators; they need to be used at the side of different technical and basic evaluation instruments for optimum outcomes.

II. The Most Worthwhile Chart Patterns:

This part outlines a few of the most widely known and statistically profitable chart patterns:

A. Head and Shoulders (H&S): Reversal Sample

The Head and Shoulders sample is a traditional reversal formation indicating a possible shift from an uptrend to a downtrend (or vice-versa for an inverse H&S). It consists of three distinct peaks: a central "head" flanked by two smaller "shoulders." A neckline, a trendline connecting the troughs between the peaks, acts because the essential assist/resistance stage. A break under (for a bearish H&S) or above (for a bullish inverse H&S) the neckline confirms the sample and triggers a possible worth motion.

- Revenue Potential: Important worth declines (bearish) or will increase (bullish) are sometimes noticed after a neckline breakout.

- Affirmation: Elevated buying and selling quantity throughout the neckline breakout strengthens the sign.

- Threat Administration: Place stop-loss orders above the neckline (bearish) or under (bullish) to restrict potential losses.

B. Double Prime/Double Backside: Reversal Sample

These patterns resemble the letter "M" (double prime) or "W" (double backside). Two distinct peaks (double prime) or troughs (double backside) type at roughly the identical worth stage. A neckline connects the 2 troughs (double prime) or peaks (double backside). A break under the neckline in a double prime or above in a double backside alerts a possible reversal.

- Revenue Potential: The potential worth motion is often equal to the gap between the neckline and the very best peak (double prime) or the bottom trough (double backside).

- Affirmation: Search for elevated quantity throughout the neckline breakout. Affirmation from different indicators, akin to RSI or MACD, strengthens the sign.

- Threat Administration: Cease-loss orders needs to be positioned barely under the neckline (double prime) or above (double backside).

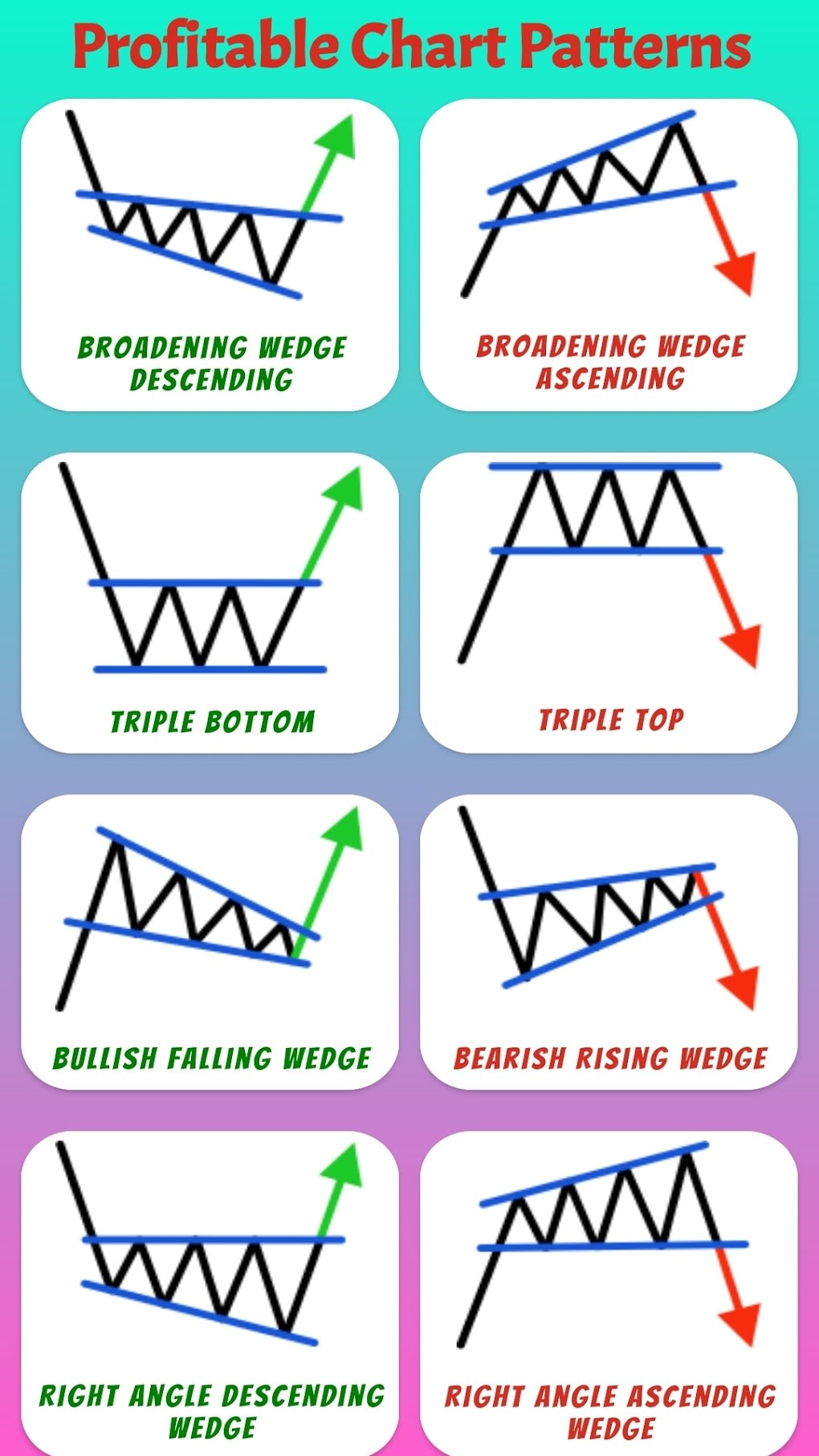

C. Triple Prime/Triple Backside: Reversal Sample

Much like double tops/bottoms, however with three distinct peaks or troughs, these patterns signify stronger reversal alerts as a result of elevated affirmation. The neckline’s breakout is an important affirmation sign.

- Revenue Potential: Usually gives larger revenue potential than double tops/bottoms as a result of stronger affirmation.

- Affirmation: Search for quantity affirmation and corroboration from different technical indicators.

- Threat Administration: Cease-loss orders needs to be positioned under the neckline (triple prime) or above (triple backside).

D. Flags and Pennants: Continuation Patterns

Flags and pennants are continuation patterns that usually seem throughout sturdy developments. They signify short-term pauses within the pattern earlier than the worth resumes its unique route. Flags are characterised by parallel trendlines, whereas pennants resemble triangles with converging trendlines.

- Revenue Potential: The worth motion after the breakout often follows the unique pattern’s route.

- Affirmation: Elevated quantity throughout the breakout strengthens the sign.

- Threat Administration: Cease-loss orders needs to be positioned under the decrease trendline of the flag/pennant (uptrend) or above the higher trendline (downtrend).

E. Triangles: Continuation or Reversal Patterns

Triangles are characterised by converging trendlines, making a triangular form on the chart. They are often symmetrical, ascending, or descending, every with barely totally different implications. Symmetrical triangles typically signify continuation patterns, whereas ascending (bullish) and descending (bearish) triangles trace at potential reversals.

- Revenue Potential: The potential worth motion is often equal to the triangle’s peak.

- Affirmation: Quantity evaluation throughout the breakout is essential. A powerful quantity surge confirms the breakout.

- Threat Administration: Cease-loss orders needs to be positioned outdoors the triangle’s boundaries.

F. Rectangles: Continuation Patterns

Rectangles are characterised by two horizontal trendlines representing assist and resistance ranges. Costs oscillate between these ranges earlier than a breakout happens, often within the route of the previous pattern.

- Revenue Potential: The potential worth motion after the breakout is commonly just like the rectangle’s peak.

- Affirmation: Elevated quantity throughout the breakout confirms the sign.

- Threat Administration: Cease-loss orders needs to be positioned outdoors the rectangle’s boundaries.

III. Bettering Sample Recognition:

Figuring out chart patterns precisely requires apply and expertise. Listed here are some tricks to improve your sample recognition expertise:

- Make the most of Completely different Timeframes: Analyze charts throughout numerous timeframes (e.g., day by day, weekly, month-to-month) to achieve a broader perspective.

- Mix with Different Indicators: Use chart patterns at the side of different technical indicators (e.g., RSI, MACD, transferring averages) to substantiate alerts.

- Give attention to Quantity: Pay shut consideration to quantity modifications throughout sample formation and breakouts. Greater quantity confirms the energy of the transfer.

- Follow and Persistence: Mastering chart sample recognition takes time and apply. Do not get discouraged by preliminary setbacks. Study out of your errors and refine your method.

IV. Threat Administration Methods:

Efficient threat administration is paramount when buying and selling chart patterns. Listed here are some important methods:

- Place Sizing: By no means threat greater than a small proportion of your buying and selling capital on a single commerce.

- Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses.

- Take-Revenue Orders: Set take-profit orders to lock in income when the worth reaches your goal.

- Diversification: Diversify your portfolio throughout totally different property and buying and selling methods to scale back general threat.

V. Conclusion:

Chart patterns supply beneficial insights into potential market actions, however they aren’t foolproof. Profitable buying and selling entails a mixture of sample recognition, technical evaluation, threat administration, and self-discipline. By mastering these components, merchants can considerably enhance their possibilities of figuring out worthwhile buying and selling alternatives. Keep in mind to all the time backtest your methods and adapt your method based mostly on market circumstances.

(Downloadable PDF Hyperlink Right here – This could get replaced with an precise hyperlink to a PDF file containing a summarized model of the article’s key factors, together with photographs of the chart patterns.)

This PDF will embody concise descriptions of every sample, accompanied by clear visible representations. It’s going to function a fast reference information for merchants trying to enhance their chart sample recognition expertise. Keep in mind that constant studying and adaptation are essential for fulfillment in buying and selling.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding Worthwhile Chart Patterns: A Complete Information (PDF Downloadable). We hope you discover this text informative and useful. See you in our subsequent article!