Decoding QQQ ETF: Value At present in India, Reside Chart Evaluation, and Funding Implications

Associated Articles: Decoding QQQ ETF: Value At present in India, Reside Chart Evaluation, and Funding Implications

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding QQQ ETF: Value At present in India, Reside Chart Evaluation, and Funding Implications. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding QQQ ETF: Value At present in India, Reside Chart Evaluation, and Funding Implications

The Invesco QQQ Belief (QQQ) is a well-liked exchange-traded fund (ETF) monitoring the Nasdaq-100 Index. Whereas indirectly traded on Indian exchanges, Indian traders can entry QQQ via worldwide brokerage accounts. Understanding its value actions, the underlying index, and related dangers is essential for anybody contemplating investing. This text delves into the present value of QQQ in India (as mirrored via worldwide platforms), supplies insights into decoding a stay chart, and discusses the implications for Indian traders. Please observe: As a result of dynamic nature of economic markets, any value talked about here’s a snapshot in time and can continually change. All the time check with your brokerage platform for probably the most up-to-date info.

Accessing QQQ in India:

Indian traders can not immediately purchase QQQ on the Nationwide Inventory Trade of India (NSE) or the Bombay Inventory Trade (BSE). Accessing QQQ requires a world brokerage account that permits buying and selling on US exchanges, equivalent to Interactive Brokers, TD Ameritrade, or comparable platforms. These accounts usually contain extra complexities, together with international forex alternate charges, potential withholding taxes, and regulatory issues. It is essential to totally analysis and perceive these components earlier than investing.

QQQ Value At present (Illustrative Instance):

(Disclaimer: This part supplies an instance solely. The precise value will differ. All the time test your brokerage account for the present value.)

Let’s assume, for illustrative functions, that the present value of QQQ on a selected day is $350. This value displays the aggregated worth of the underlying holdings of the ETF, which predominantly includes large-cap know-how firms listed on the Nasdaq-100. This value, nevertheless, must be transformed to Indian Rupees (INR) utilizing the prevailing USD/INR alternate fee to know its worth in Indian phrases. If the USD/INR alternate fee is 82.50, then the QQQ value in INR can be roughly ₹28,875 (350 USD x 82.50 INR/USD). It is a simplified calculation and doesn’t embrace brokerage charges, taxes, or different transaction prices.

Decoding a Reside QQQ Chart:

A stay chart for QQQ usually shows the value over time, usually with numerous technical indicators. Understanding these components is crucial for knowledgeable decision-making. Key elements to contemplate embrace:

-

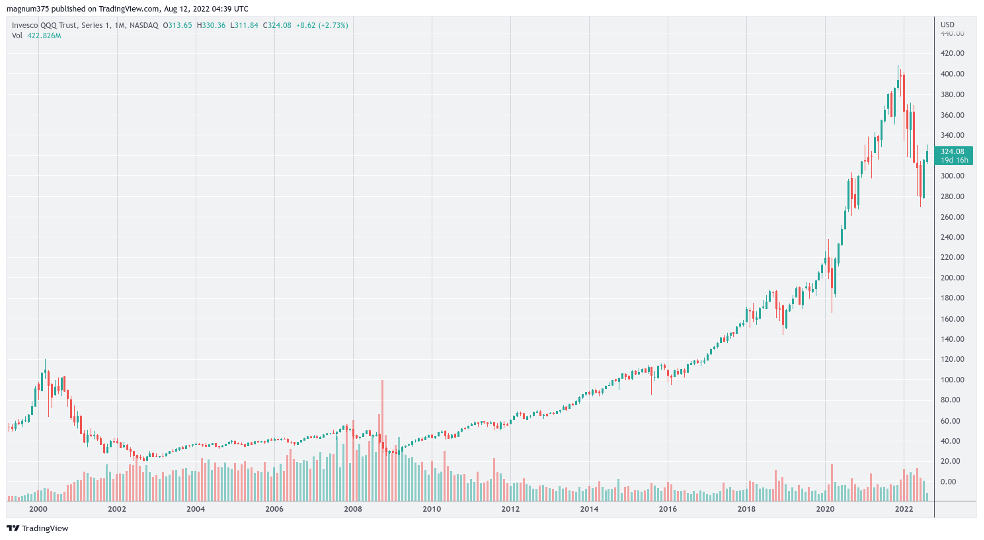

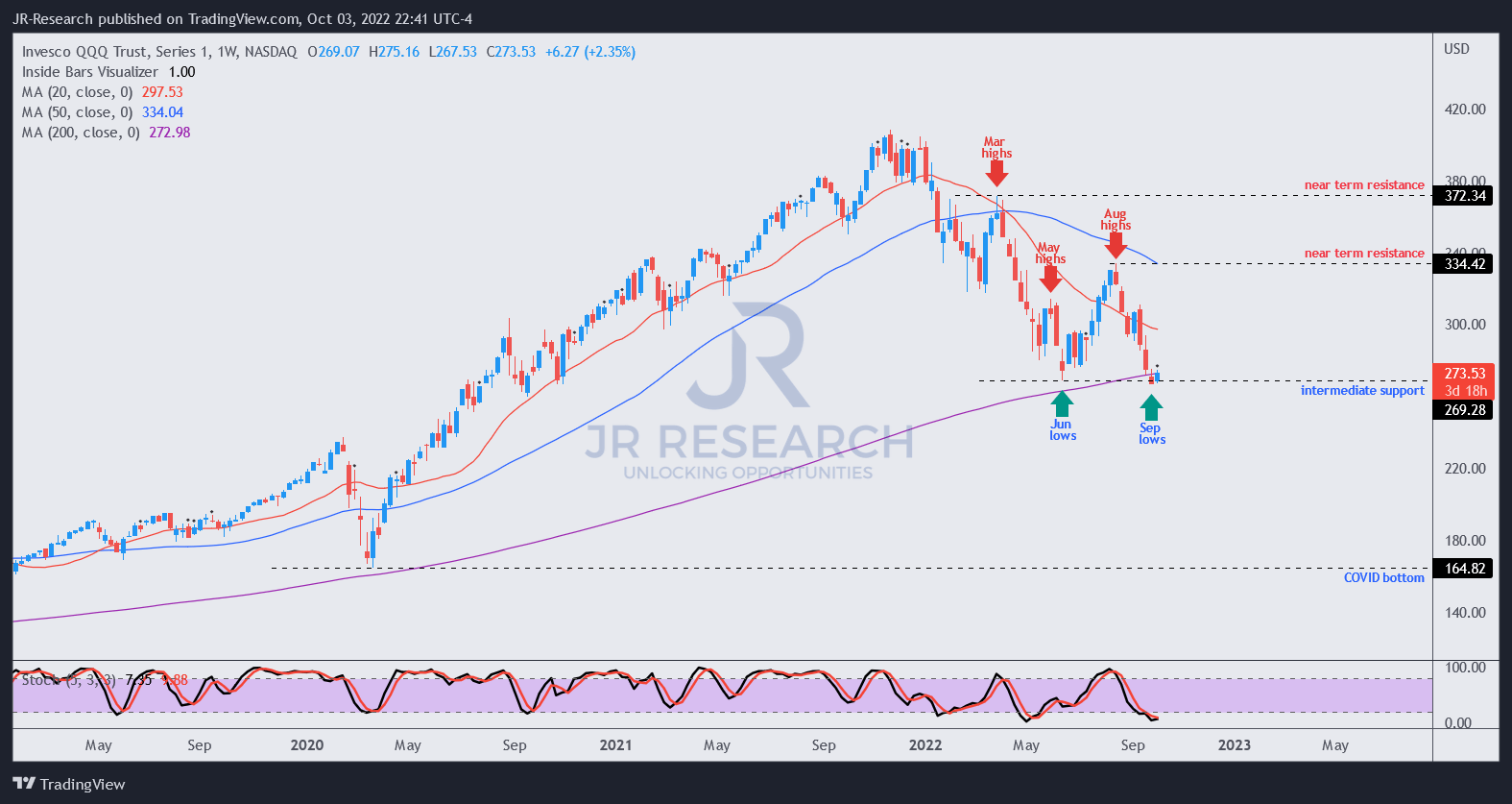

Value Motion: The chart exhibits the value fluctuations over totally different timeframes (e.g., 1-minute, each day, weekly, month-to-month). Upward tendencies recommend bullish sentiment, whereas downward tendencies point out bearish sentiment. Figuring out assist and resistance ranges is essential. Help ranges signify value factors the place shopping for stress is anticipated to outweigh promoting stress, probably stopping additional value declines. Resistance ranges are the other – value factors the place promoting stress is anticipated to beat shopping for stress, probably halting value will increase.

-

Quantity: The amount of shares traded accompanies the value knowledge. Excessive quantity throughout value will increase suggests robust shopping for stress, whereas excessive quantity throughout value decreases signifies important promoting stress. Low quantity can signify indecision or an absence of conviction available in the market.

-

Transferring Averages: These are calculated averages of the value over a specified interval (e.g., 50-day, 200-day shifting common). They easy out short-term value fluctuations, serving to establish longer-term tendencies. Crossovers of shifting averages can function potential purchase or promote indicators.

-

Relative Energy Index (RSI): This momentum indicator measures the magnitude of current value adjustments to judge overbought or oversold circumstances. RSI values above 70 usually recommend an overbought market (potential for a value correction), whereas values under 30 point out an oversold market (potential for a value rebound).

-

Different Indicators: Many different technical indicators exist, equivalent to MACD (Transferring Common Convergence Divergence), Bollinger Bands, and stochastic oscillators. These indicators present extra views on value tendencies and momentum. Nonetheless, relying solely on technical indicators with out contemplating basic evaluation may be dangerous.

Basic Evaluation of QQQ:

Whereas technical evaluation focuses on value charts, basic evaluation examines the underlying property of the QQQ ETF. Since QQQ tracks the Nasdaq-100, understanding the efficiency and prospects of the constituent firms is essential. Key components to contemplate embrace:

-

Sector Composition: The Nasdaq-100 is closely weighted in the direction of know-how firms. This focus exposes the ETF to important sector-specific dangers. A downturn within the know-how sector might severely affect QQQ’s efficiency.

-

Firm Efficiency: Analyzing the monetary well being and development prospects of the person firms throughout the Nasdaq-100 is crucial. Elements equivalent to income development, profitability, innovation, and aggressive panorama all play a task.

-

Macroeconomic Elements: Broader financial circumstances, equivalent to rate of interest adjustments, inflation, and geopolitical occasions, considerably affect the efficiency of know-how firms and, consequently, QQQ.

-

Valuation: Assessing the valuation of the Nasdaq-100 and its constituent firms is important. Metrics like price-to-earnings ratios (P/E) and price-to-sales ratios (P/S) may also help decide whether or not the ETF is overvalued or undervalued.

Funding Implications for Indian Buyers:

Investing in QQQ provides publicity to a diversified portfolio of main know-how firms. Nonetheless, it is essential to acknowledge the dangers:

-

Forex Threat: Fluctuations within the USD/INR alternate fee can considerably affect returns. A weakening rupee can cut back the worth of your funding when changing again to INR.

-

Market Threat: The know-how sector is inherently unstable. QQQ’s efficiency may be considerably affected by market sentiment and financial circumstances.

-

Regulatory and Tax Implications: Investing in worldwide markets entails navigating totally different regulatory frameworks and tax implications. Understanding these elements is essential to reduce potential liabilities.

-

Transaction Prices: Brokerage charges, commissions, and different transaction prices can eat into your returns.

Conclusion:

QQQ provides a compelling funding alternative for Indian traders searching for publicity to the US know-how sector. Nonetheless, it is essential to fastidiously contemplate the dangers and complexities concerned. Thorough analysis, a well-defined funding technique, diversification, and understanding the implications of forex fluctuations and worldwide rules are important for profitable investing in QQQ. All the time seek the advice of with a professional monetary advisor earlier than making any funding selections. Do not forget that previous efficiency just isn’t indicative of future outcomes, and investing within the inventory market at all times carries inherent threat. The data supplied right here is for instructional functions solely and shouldn’t be thought-about monetary recommendation.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding QQQ ETF: Value At present in India, Reside Chart Evaluation, and Funding Implications. We thanks for taking the time to learn this text. See you in our subsequent article!