Decoding Share Market Chart Patterns: A Complete Information (PDF-Pleasant)

Associated Articles: Decoding Share Market Chart Patterns: A Complete Information (PDF-Pleasant)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding Share Market Chart Patterns: A Complete Information (PDF-Pleasant). Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding Share Market Chart Patterns: A Complete Information (PDF-Pleasant)

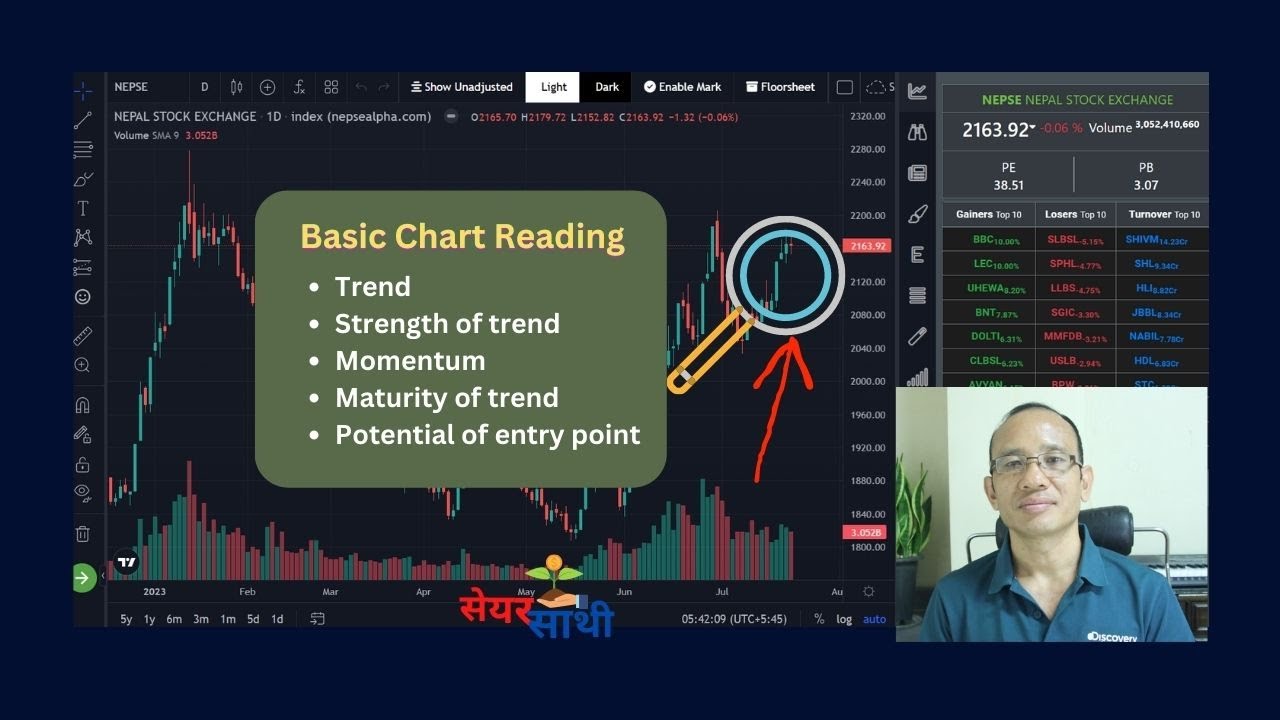

The share market, a posh and dynamic ecosystem, usually reveals its future path by recurring visible patterns on charts. Understanding these chart patterns is essential for each novice and skilled traders, permitting them to anticipate potential worth actions and make knowledgeable buying and selling selections. This text serves as a complete information to frequent share market chart patterns, appropriate for making a PDF useful resource for studying and reference. We are going to discover numerous patterns, their implications, and methods to establish them successfully.

I. Introduction to Chart Patterns:

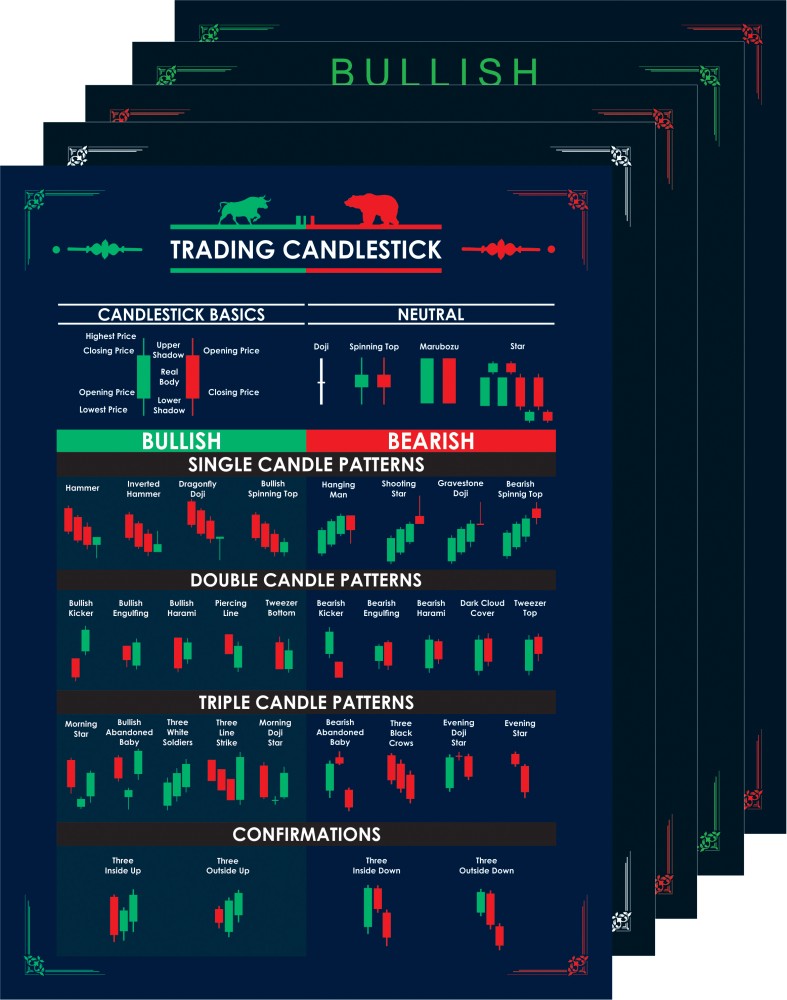

Chart patterns symbolize the collective habits of market contributors, mirrored in worth and quantity knowledge over time. They’re visible representations of provide and demand dynamics, providing clues about potential future worth tendencies. Whereas not foolproof predictors, recognizing these patterns considerably enhances buying and selling methods. They are often broadly categorized into two fundamental teams: continuation patterns and reversal patterns.

II. Continuation Patterns:

Continuation patterns recommend that the present pattern will possible proceed after a short lived pause or consolidation. These patterns usually happen in periods of sideways motion inside a longtime uptrend or downtrend.

-

Triangles: Triangles are characterised by converging trendlines, making a triangular form on the chart. There are three fundamental sorts:

- Symmetrical Triangles: These triangles have two converging trendlines, with neither being considerably steeper than the opposite. A breakout above the higher trendline suggests a continuation of the uptrend, whereas a break under the decrease trendline alerts a continuation of the downtrend. The breakout often happens roughly halfway by the triangle’s formation.

- Ascending Triangles: These triangles function a flat decrease trendline and an upward-sloping higher trendline. They usually point out a continuation of an uptrend, with the breakout occurring above the higher trendline.

- Descending Triangles: These triangles function a flat higher trendline and a downward-sloping decrease trendline. They recommend a continuation of a downtrend, with the breakout occurring under the decrease trendline.

-

Rectangles: Rectangles are characterised by two horizontal parallel trendlines, representing a interval of consolidation inside a prevailing pattern. A breakout above the higher trendline alerts a continuation of the uptrend, whereas a break under the decrease trendline suggests a continuation of the downtrend. The breakout’s magnitude is commonly much like the rectangle’s peak.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole (the prior pattern). They’re characterised by a quick interval of consolidation, usually with diminished volatility, adopted by a continuation of the earlier pattern. Flags are usually rectangular, whereas pennants are triangular.

-

Wedges: Wedges are triangular patterns that slope both upward (bullish wedge) or downward (bearish wedge). A bullish wedge is a bearish sample, suggesting a possible reversal downwards regardless of the upward sloping strains. Conversely, a bearish wedge is bullish, indicating a possible upward reversal.

III. Reversal Patterns:

Reversal patterns point out a possible shift within the prevailing pattern. They usually kind on the finish of a big pattern and sign a potential change in momentum.

-

Head and Shoulders: This is likely one of the most acknowledged reversal patterns. It consists of three peaks, with the center peak (the "head") being considerably greater than the opposite two ("shoulders"). A neckline connects the troughs between the peaks. A break under the neckline confirms the sample and alerts a possible downtrend. The worth goal for the downtrend is commonly calculated by measuring the gap between the top and the neckline and projecting it downwards from the neckline.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a possible reversal from a downtrend to an uptrend. A break above the neckline confirms the sample and alerts a possible uptrend. The worth goal is calculated equally to the top and shoulders sample, however projected upwards.

-

Double Tops and Double Bottoms: Double tops kind when the worth reaches the same excessive twice, adopted by a decline. A break under the help stage (between the 2 tops) confirms the sample and suggests a downtrend. Double bottoms are the alternative, with two comparable lows adopted by an upward break above the resistance stage (between the 2 bottoms), signaling a possible uptrend.

-

Triple Tops and Triple Bottoms: These patterns are much like double tops and bottoms, however with three peaks or troughs as a substitute of two. They’re usually thought of stronger reversal alerts because of the elevated affirmation.

-

Rounding Tops and Bottoms: These patterns are characterised by a gradual curve, forming a rounded form on the high (rounding high) or backside (rounding backside) of a pattern. Rounding tops point out a possible downtrend, whereas rounding bottoms recommend an uptrend. These patterns often take an extended time to kind than different reversal patterns.

IV. Figuring out and Utilizing Chart Patterns:

Figuring out chart patterns requires follow and expertise. Listed here are some key concerns:

-

Timeframe: Chart patterns can kind on numerous timeframes (each day, weekly, month-to-month). The timeframe chosen influences the sample’s significance and potential affect.

-

Quantity: Quantity affirmation is essential. Breakouts from patterns ought to ideally be accompanied by elevated quantity, reinforcing the sign’s energy.

-

Trendlines: Correct drawing of trendlines is crucial for figuring out patterns. Use help and resistance ranges to information your trendline drawing.

-

Affirmation: Take into account different technical indicators to substantiate the alerts generated by chart patterns. Shifting averages, RSI, and MACD can present extra affirmation.

-

Danger Administration: All the time make use of correct threat administration strategies, corresponding to stop-loss orders, to guard your capital. Chart patterns usually are not foolproof, and false breakouts can happen.

V. Limitations of Chart Patterns:

Whereas chart patterns present helpful insights, it is essential to grasp their limitations:

-

Subjectivity: Figuring out chart patterns may be subjective, with completely different merchants deciphering the identical chart otherwise.

-

False Alerts: Chart patterns can generate false alerts, resulting in incorrect buying and selling selections.

-

Context is Key: Chart patterns ought to be analyzed throughout the broader market context, contemplating financial indicators, information occasions, and general market sentiment.

-

Not a Standalone Technique: Chart patterns shouldn’t be used as a standalone buying and selling technique. Mix them with different technical and elementary evaluation strategies for higher decision-making.

VI. Conclusion:

Understanding and successfully using share market chart patterns can considerably enhance buying and selling methods. By mastering the identification and interpretation of assorted patterns, traders can achieve a greater understanding of market dynamics and doubtlessly improve their profitability. Nevertheless, keep in mind that constant follow, threat administration, and a holistic strategy combining chart patterns with different analytical instruments are essential for fulfillment within the dynamic world of share market buying and selling. This information serves as a basis; steady studying and sensible software are key to mastering this helpful ability. Keep in mind to at all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied helpful insights into Decoding Share Market Chart Patterns: A Complete Information (PDF-Pleasant). We respect your consideration to our article. See you in our subsequent article!