Decoding the 10-12 months Treasury Bond Yield Chart: A Decade of Volatility and Perception

Associated Articles: Decoding the 10-12 months Treasury Bond Yield Chart: A Decade of Volatility and Perception

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the 10-12 months Treasury Bond Yield Chart: A Decade of Volatility and Perception. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the 10-12 months Treasury Bond Yield Chart: A Decade of Volatility and Perception

The ten-year Treasury bond yield is a cornerstone of the worldwide monetary panorama. This seemingly easy metric – the return an investor receives on a 10-year U.S. authorities bond – acts as a strong barometer for financial well being, inflation expectations, and general market sentiment. Charting its trajectory over time gives invaluable insights into previous developments and potential future actions. This text will delve into an in depth evaluation of the 10-year Treasury bond yield chart, exploring its historic fluctuations, the components driving its actions, and its significance for buyers and policymakers alike.

Historic Context: A Rollercoaster Trip For the reason that Millennium

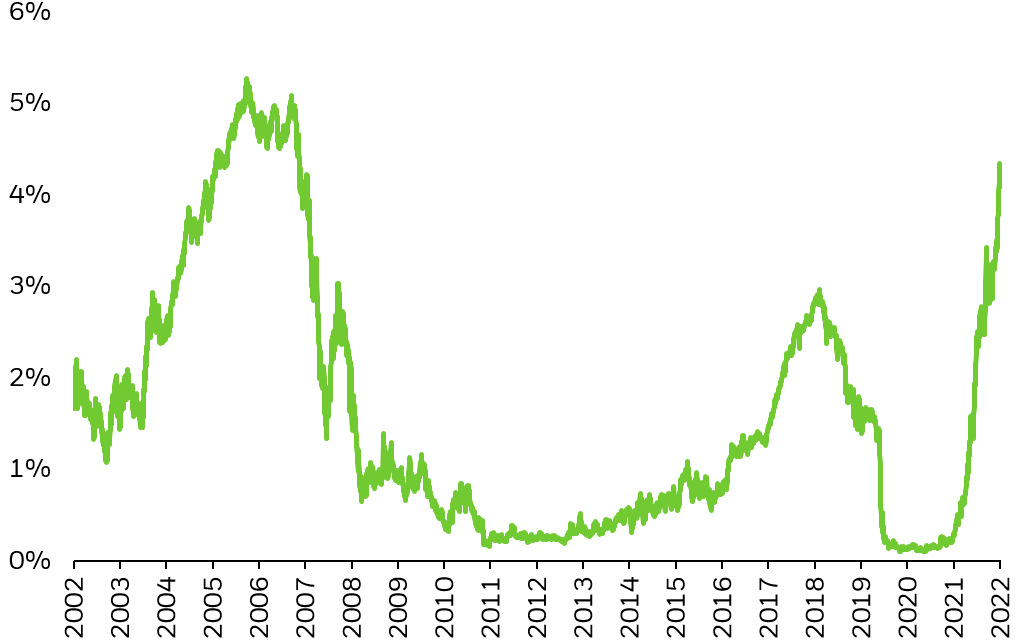

Inspecting a 10-year Treasury yield chart spanning the previous twenty years reveals a captivating narrative of financial booms, busts, and coverage interventions. The early 2000s noticed comparatively low yields, reflecting a interval of post-dot-com bubble restoration and low inflation. The chart would present a gradual upward development, punctuated by durations of slight decline mirroring financial slowdowns or durations of elevated danger aversion.

The 2008 international monetary disaster dramatically impacted the yield curve. Concern and uncertainty gripped markets, resulting in a flight to security. Buyers flocked to the perceived safety of U.S. Treasuries, driving yields all the way down to traditionally low ranges. The chart would sharply illustrate this plummet, reflecting the acute danger aversion out there. Subsequent quantitative easing (QE) packages applied by the Federal Reserve additional suppressed yields, pushing them even nearer to zero in some situations. This era underscores the 10-year yield’s function as a secure haven asset throughout instances of financial turmoil.

The interval following the 2008 disaster witnessed a protracted interval of near-zero rates of interest. The chart would depict a protracted interval of low yields, reflecting the Fed’s efforts to stimulate financial development. This low-yield surroundings introduced challenges for buyers in search of increased returns, pushing them in the direction of riskier property.

The following years, main as much as the current day, showcase a gradual however important upward development within the 10-year yield. This displays a lot of components, together with:

- Financial restoration and development: As the worldwide financial system recovered from the 2008 disaster, elevated demand for credit score and stronger inflation expectations pushed yields increased.

- Inflationary pressures: Rising inflation, pushed by components corresponding to provide chain disruptions and elevated shopper demand, has been a significant driver of yield will increase. The chart would clearly present a correlation between rising inflation and rising yields.

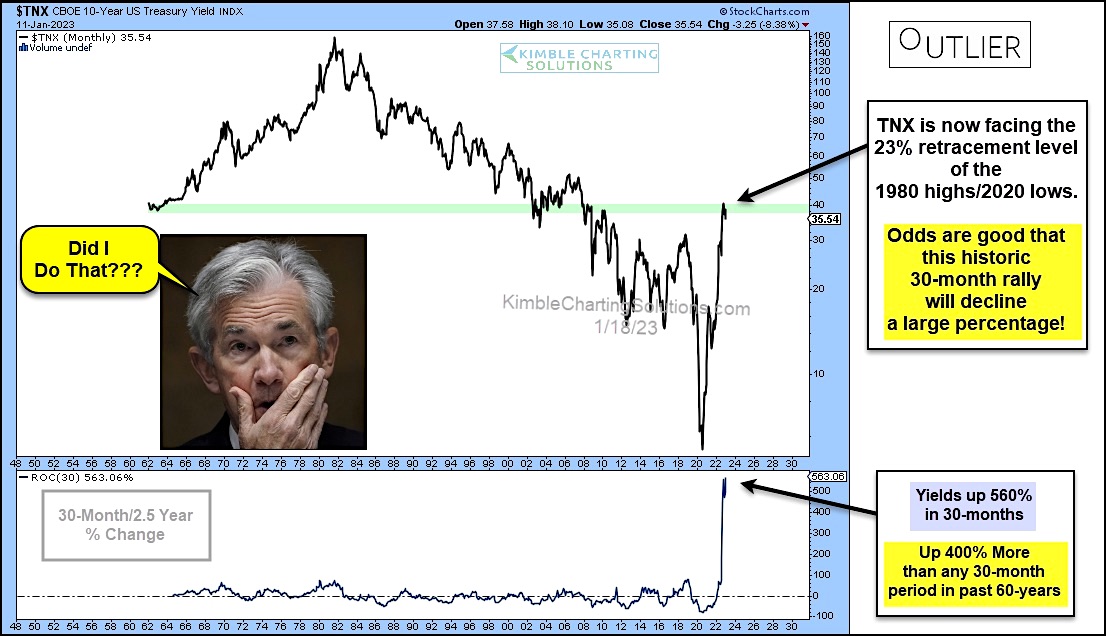

- Federal Reserve coverage: The Fed’s gradual tightening of financial coverage, together with will increase within the federal funds price, has additionally contributed to increased 10-year yields. The chart would exhibit a relationship between Fed price hikes and subsequent will increase within the 10-year yield, although not at all times speedy or immediately proportional.

- Geopolitical occasions: World uncertainty, together with geopolitical tensions and worldwide conflicts, can impression investor sentiment and affect yields. The chart could present momentary spikes or dips reflecting such occasions.

Decoding the Chart: Key Indicators and Relationships

Analyzing the 10-year Treasury yield chart requires understanding its relationship with different financial indicators. A number of key relationships are essential:

- Inflation Expectations: A rising 10-year yield usually displays expectations of upper inflation. Buyers demand increased returns to compensate for the erosion of buying energy brought on by inflation. The chart must be considered alongside inflation information (e.g., CPI) to evaluate the correlation.

- Financial Progress: Robust financial development usually results in increased yields as elevated demand for credit score pushes rates of interest upward. Conversely, financial slowdowns or recessions can result in decrease yields as buyers search the protection of presidency bonds.

- Federal Reserve Coverage: The Federal Reserve’s actions considerably affect the 10-year yield. Elevating rates of interest tends to push yields increased, whereas reducing charges has the other impact. Analyzing the chart at the side of Fed bulletins and coverage statements is important.

- Provide and Demand: The provision of Treasury bonds and the demand from buyers additionally play a task. Elevated provide can push yields increased, whereas robust demand can push them decrease.

- World Market Sentiment: World occasions and market sentiment can impression investor demand for U.S. Treasuries, influencing the 10-year yield. Durations of uncertainty usually result in elevated demand and decrease yields, whereas durations of optimism can result in increased yields.

The Yield Curve and its Implications

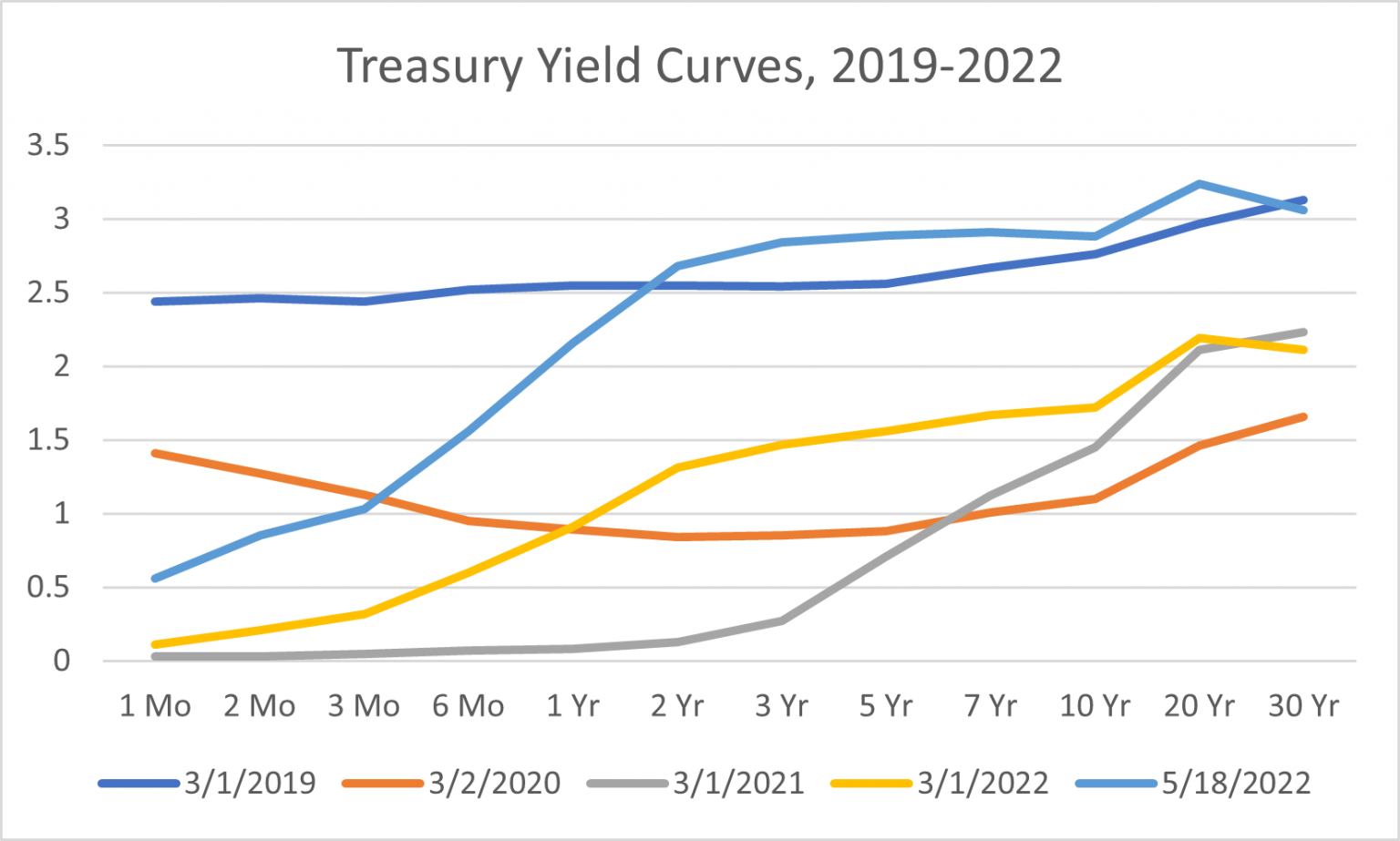

The ten-year Treasury yield can be a vital part of the yield curve, which plots the yields of Treasury bonds with totally different maturities. The form of the yield curve can present insights into future financial development. A steep yield curve (the place long-term yields are considerably increased than short-term yields) usually suggests expectations of robust future financial development. Conversely, a flat or inverted yield curve (the place short-term yields are increased than long-term yields) is usually a warning signal of an impending recession. Understanding the yield curve in relation to the 10-year yield gives a extra complete view of the financial outlook.

Affect on Buyers and Policymakers

The ten-year Treasury yield has profound implications for numerous stakeholders:

- Buyers: The yield influences funding choices throughout asset lessons. Greater yields make bonds extra enticing, whereas decrease yields could encourage buyers to hunt increased returns in equities or different riskier property. Pension funds, insurance coverage corporations, and different institutional buyers rely closely on the 10-year yield for portfolio administration.

- Debtors: The ten-year yield serves as a benchmark for company and mortgage rates of interest. Greater yields improve borrowing prices for companies and shoppers, probably slowing financial development.

- Policymakers: The Federal Reserve intently displays the 10-year yield to gauge the effectiveness of its financial coverage. The yield gives worthwhile insights into inflation expectations and general market sentiment, informing coverage choices.

Conclusion: A Dynamic Indicator in a Advanced World

The ten-year Treasury bond yield chart is way over only a assortment of knowledge factors. It’s a dynamic reflection of financial circumstances, investor sentiment, and coverage choices. Understanding its historic fluctuations, the components driving its actions, and its relationships with different financial indicators is essential for navigating the complexities of the monetary markets. By rigorously analyzing the chart and its context, buyers, policymakers, and financial analysts can acquire worthwhile insights into the present financial local weather and anticipate future developments. Nevertheless, it is important to do not forget that the 10-year yield is only one piece of the puzzle, and a complete evaluation requires contemplating a broader vary of financial information and market circumstances. The chart gives a worthwhile lens, however not the entire image. Steady monitoring and a nuanced understanding of its interaction with different components are key to efficient decision-making within the ever-evolving world of finance.

![]()

![]()

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the 10-12 months Treasury Bond Yield Chart: A Decade of Volatility and Perception. We hope you discover this text informative and useful. See you in our subsequent article!