Decoding the 30-12 months Mortgage Fee Chart: A Historic Perspective and Future Outlook

Associated Articles: Decoding the 30-12 months Mortgage Fee Chart: A Historic Perspective and Future Outlook

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the 30-12 months Mortgage Fee Chart: A Historic Perspective and Future Outlook. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the 30-12 months Mortgage Fee Chart: A Historic Perspective and Future Outlook

The 30-year fixed-rate mortgage is the cornerstone of the American dream of homeownership. Its stability, predictability, and affordability (or lack thereof, relying on the prevailing rate of interest) have formed generations of house owners. Understanding the historic trajectory of those charges, as depicted in a 30-year mortgage fee chart, is essential for anybody contemplating shopping for a house, refinancing, or just navigating the complexities of the housing market. This text delves into the historic context of 30-year mortgage charges, analyzes key influencing components, and affords a cautious glimpse into potential future developments.

A Journey By Time: A long time of Mortgage Fee Fluctuations

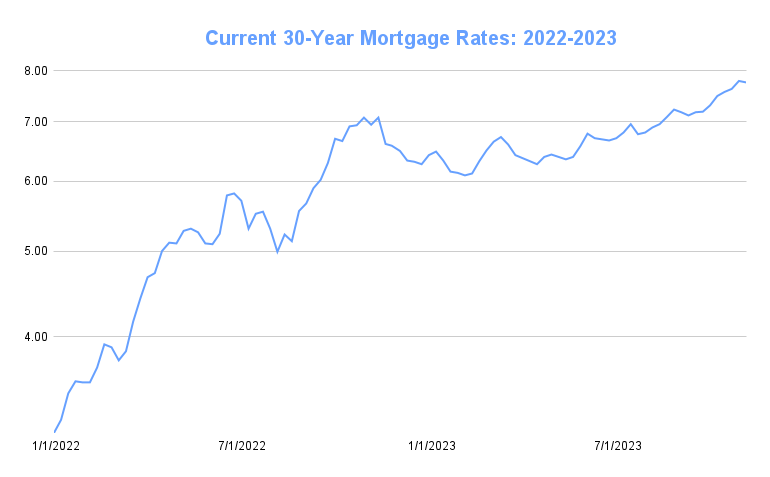

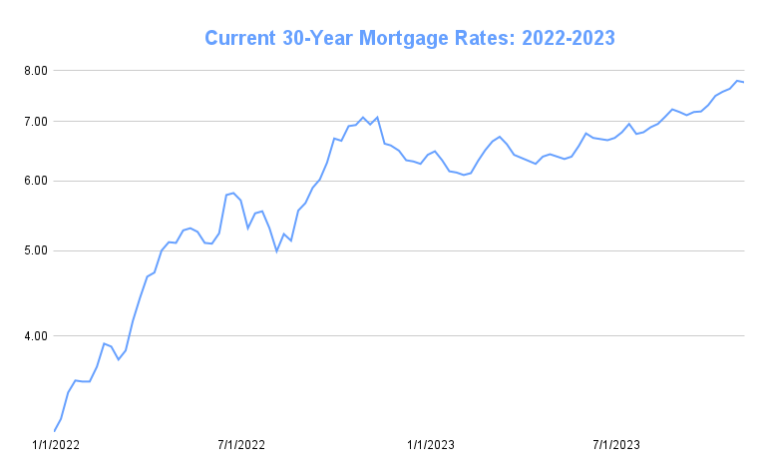

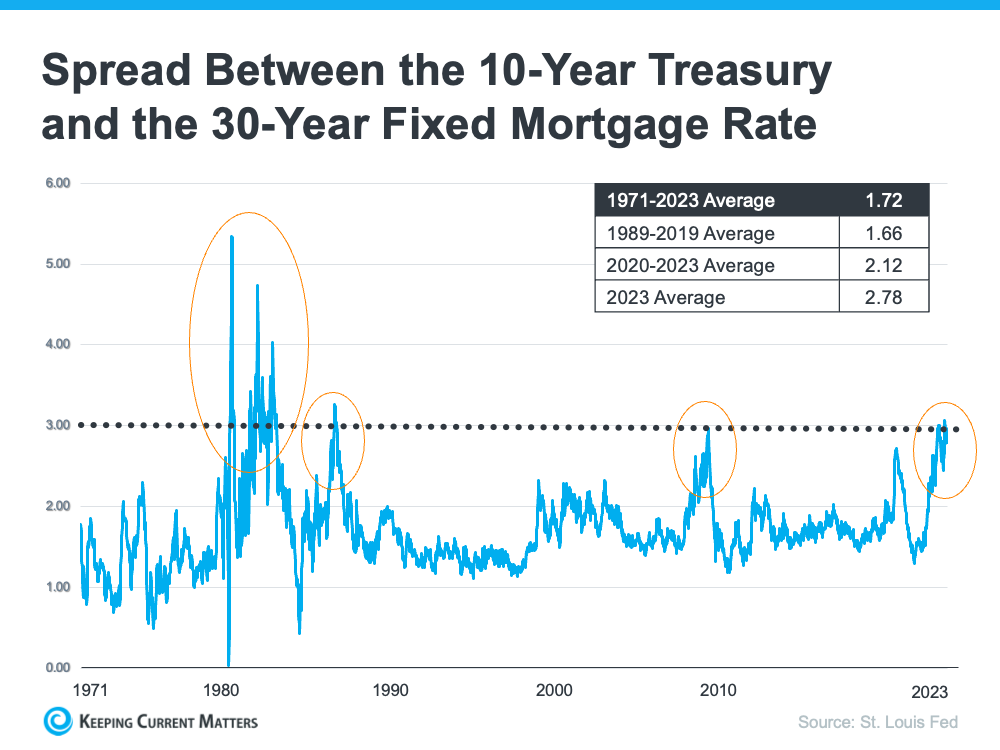

A visible illustration of 30-year mortgage charges over the previous a number of a long time reveals a captivating story of financial booms and busts, coverage adjustments, and world occasions. Whereas exact information varies barely relying on the supply (Freddie Mac, for instance, is a generally used benchmark), the general pattern stays constant. The chart reveals intervals of remarkably low charges, interspersed with dramatic spikes that may considerably affect affordability.

The early 2000s witnessed a interval of comparatively low charges, hovering round 6-7%, a pattern largely attributed to the Federal Reserve’s response to the dot-com bubble burst and the September eleventh assaults. These actions aimed to stimulate financial progress by making borrowing cheaper. Nevertheless, this period additionally foreshadowed the housing disaster of 2008.

The mid-2000s noticed a gentle improve in mortgage charges, culminating in a peak above 6% earlier than the disaster hit. The following collapse of the housing market, triggered by subprime lending practices and the bursting of the housing bubble, led to a dramatic intervention by the Federal Reserve. Charges plummeted to historic lows, reaching under 4% and even dipping under 3% within the aftermath of the disaster. This era of exceptionally low charges fueled a resurgence in homebuying exercise, but additionally raised considerations concerning the potential for future inflation.

The years following the 2008 disaster noticed a gradual however regular improve in mortgage charges, reflecting the gradual restoration of the economic system and the Federal Reserve’s efforts to normalize financial coverage. This upward pattern continued, albeit with some fluctuations, till the COVID-19 pandemic struck.

The pandemic’s arrival in early 2020 triggered one other unprecedented drop in mortgage charges, reaching report lows under 3%. This was a direct results of the Federal Reserve’s aggressive actions to mitigate the financial fallout, together with slashing rates of interest to close zero and implementing quantitative easing applications. The low charges, mixed with pent-up demand and a shift in the direction of suburban residing, led to a surge in house costs and intense competitors within the housing market.

Because the preliminary pandemic lows, charges have begun to climb once more, reflecting rising inflation and the Federal Reserve’s efforts to fight it via rate of interest hikes. This upward trajectory underscores the dynamic and sometimes unpredictable nature of mortgage charges.

Key Elements Influencing 30-12 months Mortgage Charges

A number of interconnected components contribute to the fluctuations depicted in a 30-year mortgage fee chart:

-

Federal Reserve Coverage: The Federal Reserve’s financial coverage choices, significantly its goal federal funds fee, have a profound affect on mortgage charges. Decrease federal funds charges usually translate to decrease mortgage charges, and vice versa. The Fed’s actions are guided by its evaluation of inflation, employment, and general financial progress.

-

Inflation: Excessive inflation erodes the buying energy of cash, prompting the Federal Reserve to boost rates of interest to chill down the economic system. This, in flip, results in increased mortgage charges. Conversely, low inflation permits for decrease rates of interest.

-

Financial Progress: A robust economic system usually results in increased rates of interest as traders search increased returns. Conversely, a weak economic system can result in decrease charges as traders search safer investments.

-

Authorities Laws: Authorities rules affecting the mortgage market, comparable to these associated to lending requirements and capital necessities for lenders, can affect mortgage charges. Stricter rules could make it dearer for lenders to supply mortgages, doubtlessly resulting in increased charges.

-

International Financial Situations: International financial occasions, comparable to worldwide crises or adjustments in world funding flows, may affect mortgage charges in the USA.

-

Provide and Demand within the Housing Market: The steadiness between the provision of accessible properties and the demand from consumers performs a major function in shaping mortgage charges. Excessive demand and low provide can push costs up, doubtlessly resulting in increased charges as lenders alter their threat assessments.

Decoding the Chart and Its Implications

Analyzing a 30-year mortgage fee chart requires understanding the context surrounding every interval of fluctuation. Merely trying on the numbers with out contemplating the broader financial panorama may be deceptive. For instance, a excessive fee in a interval of robust financial progress could be much less regarding than a excessive fee throughout an financial downturn.

The chart is usually a precious instrument for potential homebuyers, permitting them to gauge the present fee relative to historic developments. It gives a way of perspective, serving to them perceive whether or not present charges are unusually excessive or low. This info is essential for making knowledgeable choices about timing their house buy or refinancing their current mortgage.

For traders, the chart can provide insights into the cyclical nature of the housing market and the potential dangers and rewards related to investing in actual property. Understanding the historic relationship between mortgage charges and residential costs can inform funding methods and threat administration.

Trying Forward: A Cautious Forecast

Predicting future mortgage charges is inherently difficult, given the multitude of interacting components at play. Nevertheless, a number of components recommend potential developments:

-

Inflationary Pressures: Persistent inflationary pressures may proceed to place upward strain on mortgage charges because the Federal Reserve seeks to manage inflation.

-

Financial Uncertainty: International financial uncertainty and potential recessions may result in volatility in mortgage charges, with potential for each will increase and reduces relying on the evolving financial panorama.

-

Technological Developments: Technological developments within the mortgage trade, such because the elevated use of fintech and automation, may doubtlessly result in larger effectivity and decrease prices, doubtlessly impacting charges sooner or later.

-

Authorities Insurance policies: Future authorities insurance policies associated to housing and the mortgage market may considerably affect the course of mortgage charges.

In conclusion, the 30-year mortgage fee chart gives a wealthy historic narrative of the American housing market. By understanding the important thing components driving fee fluctuations and inserting present charges inside their historic context, people could make extra knowledgeable choices about homeownership and funding. Whereas predicting the longer term is not possible, a cautious evaluation of previous developments and present financial indicators affords precious insights into potential future trajectories of 30-year mortgage charges. The chart serves not simply as a report of the previous, however as a vital instrument for navigating the complexities of the current and anticipating the uncertainties of the longer term.

Closure

Thus, we hope this text has offered precious insights into Decoding the 30-12 months Mortgage Fee Chart: A Historic Perspective and Future Outlook. We recognize your consideration to our article. See you in our subsequent article!