Decoding the Aluminum Worth Chart: A Complete Evaluation

Associated Articles: Decoding the Aluminum Worth Chart: A Complete Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Aluminum Worth Chart: A Complete Evaluation. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Aluminum Worth Chart: A Complete Evaluation

Aluminum, a light-weight but sturdy steel, performs a vital function in varied industries, from transportation and development to packaging and shopper items. Understanding the dynamics of its worth, as mirrored in its chart, is subsequently important for companies, traders, and anybody within the world commodities market. This text delves into the complexities of the aluminum worth chart, exploring its historic tendencies, influencing components, and future outlook.

Historic Perspective: A Rollercoaster Journey

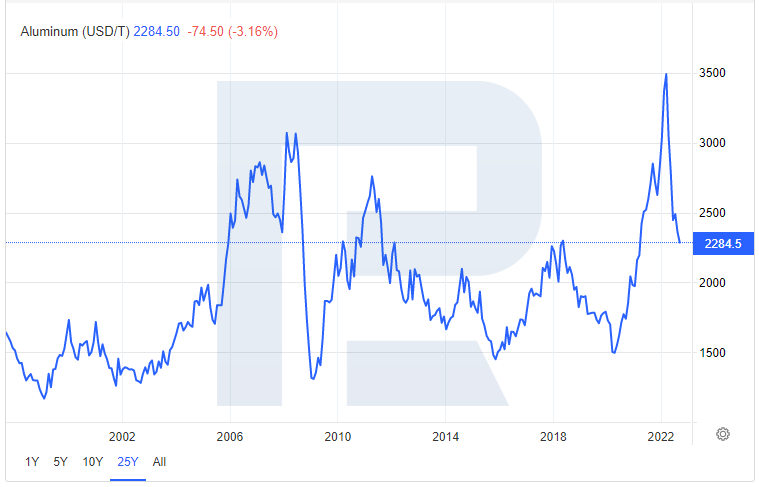

The aluminum worth chart, when considered over a number of a long time, reveals a captivating historical past of booms and busts. Initially, aluminum was a uncommon and costly steel, however developments in manufacturing methods, significantly the Corridor-Héroult course of, drastically lowered its price, making it extensively accessible. The twentieth century noticed durations of regular progress punctuated by sharp worth fluctuations pushed by world financial cycles, geopolitical occasions, and technological improvements.

The post-World Conflict II period witnessed a gradual enhance in aluminum demand, fueled by post-war reconstruction and the burgeoning automotive and aerospace industries. Nonetheless, the value remained comparatively secure till the late Nineteen Seventies and early Eighties, when inflationary pressures and provide disruptions led to a big worth surge. Subsequent years noticed a extra unstable market, with costs influenced by components such because the vitality disaster, recessionary durations, and adjustments in world supply-demand dynamics.

The early 2000s witnessed a interval of comparatively secure progress, adopted by a dramatic worth spike in 2008, largely attributed to the worldwide monetary disaster. The disaster triggered a pointy decline in demand, resulting in a big worth drop. Nonetheless, the following restoration noticed a gradual worth enhance, influenced by components like rising demand from rising economies, significantly China.

The previous decade has been characterised by a extra advanced interaction of things. Whereas demand remained sturdy, significantly from the development and automotive sectors, provide disruptions, environmental rules, and geopolitical uncertainties have contributed to vital worth volatility. The COVID-19 pandemic, for instance, initially led to a worth decline on account of lowered industrial exercise, however subsequent provide chain disruptions and a rebound in demand resulted in a considerable worth enhance. The continued battle in Ukraine has additional exacerbated the state of affairs, impacting vitality costs and aluminum manufacturing in Europe.

Key Elements Influencing Aluminum Costs:

A number of interconnected components affect the value of aluminum, as mirrored in its chart. Understanding these components is essential for deciphering worth actions and making knowledgeable predictions.

-

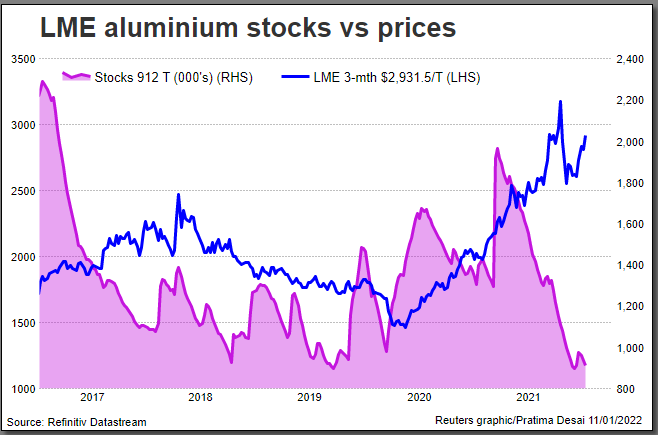

Provide and Demand: The basic precept of provide and demand stays probably the most vital driver of aluminum costs. Elevated demand, pushed by financial progress and industrial growth, sometimes pushes costs upward. Conversely, a surplus in provide, on account of elevated manufacturing capability or lowered demand, tends to depress costs.

-

Vitality Costs: Aluminum manufacturing is an energy-intensive course of. Fluctuations in vitality costs, significantly electrical energy prices, straight influence manufacturing prices and, consequently, aluminum costs. Greater vitality costs enhance manufacturing prices, resulting in larger aluminum costs, whereas decrease vitality costs have the alternative impact.

-

Uncooked Materials Prices: Bauxite, the first uncooked materials for aluminum manufacturing, additionally performs a big function in figuring out aluminum costs. Adjustments in bauxite costs, pushed by components like manufacturing prices, geopolitical occasions, and climate patterns, straight influence aluminum manufacturing prices and costs.

-

Geopolitical Elements: Political instability, commerce wars, sanctions, and different geopolitical occasions can considerably disrupt aluminum provide chains and affect costs. For instance, sanctions towards particular nations or areas can limit aluminum exports, main to cost will increase.

-

Environmental Laws: Rising considerations about environmental sustainability are resulting in stricter rules on aluminum manufacturing. These rules, geared toward decreasing carbon emissions and managing waste, can enhance manufacturing prices and contribute to larger aluminum costs.

-

Forex Fluctuations: The aluminum market is globally built-in, with costs sometimes quoted in US {dollars}. Fluctuations in change charges can influence aluminum costs, significantly for producers and shoppers in nations with completely different currencies. A weaker greenback, for example, could make aluminum dearer for worldwide consumers.

-

Technological Developments: Technological developments in aluminum manufacturing can influence costs. Improvements that enhance effectivity and scale back manufacturing prices can result in decrease aluminum costs, whereas technological disruptions can have the alternative impact.

-

Hypothesis and Funding: The aluminum market can also be influenced by speculative buying and selling and funding actions. Buyers’ perceptions of future demand and provide can drive worth actions, even within the absence of serious adjustments in basic components.

Analyzing the Aluminum Worth Chart: Strategies and Instruments

Analyzing the aluminum worth chart requires a mixture of technical and basic evaluation methods.

-

Technical Evaluation: This entails finding out worth patterns, tendencies, and indicators to foretell future worth actions. Strategies reminiscent of transferring averages, relative energy index (RSI), and assist and resistance ranges can be utilized to establish potential shopping for and promoting alternatives.

-

Basic Evaluation: This focuses on evaluating the underlying financial and market components influencing aluminum costs. Analyzing provide and demand dynamics, vitality costs, geopolitical occasions, and different related components can present insights into long-term worth tendencies.

-

Chart Patterns: Recognizing recurring chart patterns, reminiscent of head and shoulders, double tops, and triangles, can provide clues about potential worth reversals or continuations.

-

Indicators: Technical indicators, reminiscent of transferring averages and RSI, might help to verify worth tendencies and establish potential overbought or oversold situations.

-

Knowledge Sources: Dependable knowledge sources, such because the London Metallic Alternate (LME), are essential for correct evaluation. The LME supplies historic and real-time aluminum worth knowledge, together with different market info.

Future Outlook: Challenges and Alternatives

The longer term outlook for aluminum costs is advanced and unsure, influenced by a mess of things. Continued progress in rising economies, significantly in Asia, is anticipated to drive demand. Nonetheless, this demand will must be balanced towards potential provide constraints, rising vitality prices, and environmental rules.

The transition to electrical autos (EVs) is anticipated to considerably increase aluminum demand, as aluminum is a key part in EV batteries and light-weight car our bodies. Nonetheless, this progress may also rely upon the tempo of EV adoption and the event of other battery applied sciences.

The rising give attention to sustainability may also play a big function. The aluminum trade is striving to scale back its carbon footprint by way of initiatives reminiscent of utilizing renewable vitality sources and creating extra environment friendly manufacturing processes. These efforts will affect each the associated fee and competitiveness of aluminum sooner or later.

Geopolitical uncertainties and potential provide chain disruptions stay vital dangers. The continued battle in Ukraine, for instance, continues to create uncertainty within the aluminum market. Moreover, potential commerce disputes and sanctions may additional disrupt world aluminum provide chains and influence costs.

In conclusion, the aluminum worth chart displays a dynamic and complicated market influenced by a mess of interconnected components. Analyzing the chart requires a complete understanding of those components, using each technical and basic evaluation methods. Whereas the long run outlook is unsure, the long-term progress prospects for aluminum stay constructive, pushed by rising demand from varied sectors and ongoing technological developments. Nonetheless, navigating the inherent volatility of the market requires cautious consideration of the assorted dangers and alternatives introduced by this important steel.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Aluminum Worth Chart: A Complete Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!