Decoding the Bitcoin Stay Worth Chart: A Deep Dive into At this time’s USD Worth

Associated Articles: Decoding the Bitcoin Stay Worth Chart: A Deep Dive into At this time’s USD Worth

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Bitcoin Stay Worth Chart: A Deep Dive into At this time’s USD Worth. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Bitcoin Stay Worth Chart: A Deep Dive into At this time’s USD Worth

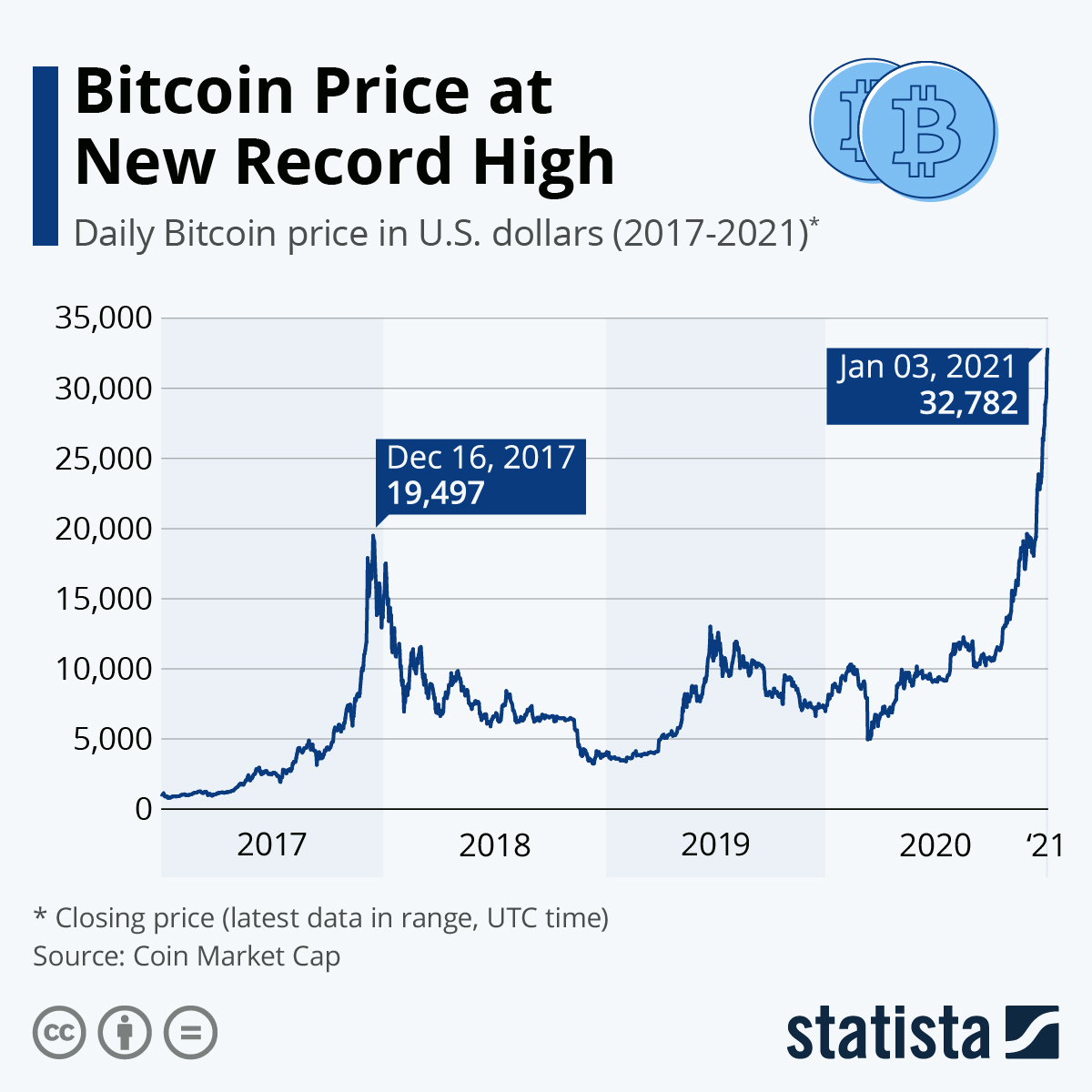

Bitcoin, the pioneering cryptocurrency, continues to captivate the world with its risky but influential presence within the world monetary panorama. Understanding its stay worth chart, expressed in US {dollars} (USD), is essential for each seasoned buyers and people simply starting to discover the world of digital belongings. This text delves deep into decoding the Bitcoin stay worth chart, inspecting its historic traits, influencing elements, and the implications for merchants and buyers.

The Bitcoin Stay Worth Chart: A Visible Illustration of Market Sentiment

A Bitcoin stay worth chart, available on quite a few cryptocurrency exchanges and monetary web sites, offers a real-time visible illustration of the cryptocurrency’s worth in USD. It usually shows the worth over various timeframes, starting from minutes to years, permitting customers to investigate short-term fluctuations and long-term traits. Key elements of a typical chart embody:

- Worth Axis (Y-axis): Represents the worth of Bitcoin in USD.

- Time Axis (X-axis): Exhibits the time interval, starting from minutes to years.

- Candlesticks or Line Graphs: Candlesticks visually symbolize worth actions over a selected time interval (e.g., one hour, someday), displaying the opening, closing, excessive, and low costs. Line graphs merely join the closing costs over time.

- Quantity Indicators: Usually displayed alongside the worth chart, quantity indicators present the buying and selling exercise (variety of Bitcoins purchased and offered) throughout every time interval. Excessive quantity typically accompanies vital worth actions.

- Technical Indicators: Many charts incorporate technical indicators (e.g., transferring averages, Relative Power Index (RSI), MACD) to assist merchants determine potential traits and buying and selling alerts.

Decoding the Chart: Figuring out Tendencies and Patterns

Analyzing a Bitcoin stay worth chart requires understanding a number of key ideas:

- Uptrends: A sustained improve in worth over time, characterised by increased highs and better lows. This means bullish sentiment and rising demand for Bitcoin.

- Downtrends: A sustained lower in worth over time, characterised by decrease highs and decrease lows. This means bearish sentiment and doubtlessly weakening demand.

- Sideways or Consolidation: Intervals of comparatively steady worth motion, typically characterised by a range-bound worth inside a selected excessive and low. This could precede vital worth actions in both route.

- Assist and Resistance Ranges: Worth ranges the place the worth has traditionally struggled to interrupt via. Assist ranges symbolize costs the place shopping for strain tends to outweigh promoting strain, stopping additional worth declines. Resistance ranges symbolize costs the place promoting strain tends to outweigh shopping for strain, stopping additional worth will increase. Breaks above resistance or beneath help typically sign vital worth actions.

- Worth Volatility: Bitcoin is understood for its volatility, that means its worth can fluctuate considerably in brief durations. This volatility presents each alternatives and dangers for buyers.

Components Influencing Bitcoin’s Worth

Quite a few elements contribute to the fluctuating worth of Bitcoin, making correct worth prediction extraordinarily difficult. These embody:

- Provide and Demand: Like every asset, Bitcoin’s worth is basically pushed by the interaction of provide and demand. Elevated demand (extra patrons) pushes the worth up, whereas elevated provide (extra sellers) pushes the worth down. The restricted provide of Bitcoin (21 million cash) is an important issue influencing its long-term potential.

- Regulatory Panorama: Authorities rules and insurance policies regarding cryptocurrencies considerably influence Bitcoin’s worth. Favorable rules have a tendency to spice up costs, whereas stricter rules can result in worth declines.

- Adoption and Utilization: Widespread adoption by companies and people as a cost methodology or retailer of worth can drive up demand and worth. Conversely, diminished adoption can result in worth declines.

- Technological Developments: Upgrades and enhancements to the Bitcoin community, such because the Lightning Community, can affect investor sentiment and worth.

- Market Sentiment: Total investor confidence and market sentiment play a major position. Constructive information and occasions have a tendency to spice up costs, whereas adverse information can set off worth drops. Concern, uncertainty, and doubt (FUD) can considerably influence worth.

- Macroeconomic Components: International financial situations, inflation charges, and rates of interest may affect Bitcoin’s worth, as buyers typically view it as a hedge in opposition to inflation or a protected haven throughout financial uncertainty.

- Main Investor Actions: Massive institutional buyers and whales (people holding vital quantities of Bitcoin) can affect worth via their shopping for and promoting actions.

- Media Protection: Constructive or adverse media protection can influence public notion and subsequently affect worth.

Utilizing the Chart for Buying and selling and Funding Choices

The Bitcoin stay worth chart is an important device for merchants and buyers, but it surely’s essential to grasp its limitations. Whereas the chart offers useful insights into worth traits and patterns, it does not assure future worth actions. Profitable buying and selling and funding require a mixture of chart evaluation, elementary evaluation (understanding the underlying elements influencing worth), danger administration, and self-discipline.

Technical Evaluation: Merchants typically use technical evaluation to determine potential buying and selling alternatives based mostly on chart patterns and indicators. This includes learning worth charts to determine traits, help and resistance ranges, and different patterns to foretell future worth actions.

Elementary Evaluation: Buyers typically use elementary evaluation to evaluate the long-term worth of Bitcoin based mostly on its underlying expertise, adoption price, and regulatory setting. This includes inspecting elements past simply the worth chart to find out the intrinsic worth of the asset.

Threat Administration: On account of Bitcoin’s volatility, danger administration is essential. Buyers ought to solely make investments what they will afford to lose and diversify their portfolio to mitigate danger.

Disclaimer: Investing in Bitcoin and different cryptocurrencies includes vital danger. The worth can fluctuate dramatically, and there is a risk of dropping your complete funding. It is essential to conduct thorough analysis and search skilled monetary recommendation earlier than making any funding selections.

Conclusion:

The Bitcoin stay worth chart in USD offers a dynamic snapshot of this risky but influential cryptocurrency. Understanding methods to interpret the chart, together with the varied elements influencing its worth, is important for navigating the complexities of the cryptocurrency market. Nevertheless, relying solely on the chart is inadequate. A mixture of technical and elementary evaluation, coupled with sound danger administration methods, is essential for making knowledgeable buying and selling and funding selections within the ever-evolving world of Bitcoin. Bear in mind, the cryptocurrency market is inherently dangerous, and it is important to proceed with warning and a well-defined funding plan.

Closure

Thus, we hope this text has offered useful insights into Decoding the Bitcoin Stay Worth Chart: A Deep Dive into At this time’s USD Worth. We admire your consideration to our article. See you in our subsequent article!