Decoding the Bull Flag: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Bull Flag: A Complete Information to This Highly effective Chart Sample

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Bull Flag: A Complete Information to This Highly effective Chart Sample. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Bull Flag: A Complete Information to This Highly effective Chart Sample

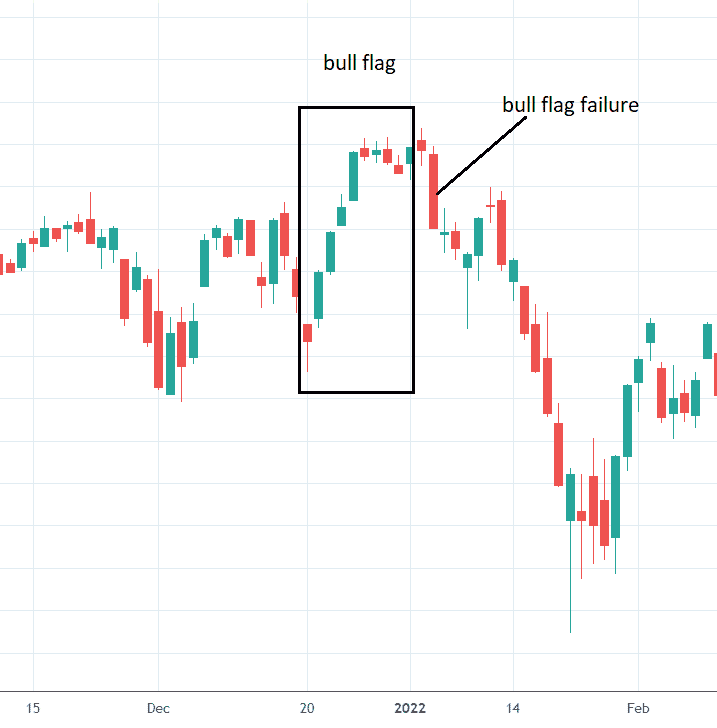

The world of technical evaluation is brimming with chart patterns, every providing distinctive insights into potential worth actions. Amongst these, the bull flag sample stands out as a dependable indicator of continued upward momentum. This sample, characterised by a interval of consolidation following a pointy worth improve, alerts a possible resumption of the bullish development. Understanding its formation, identification, and buying and selling implications is essential for any severe dealer. This text delves deep into the bull flag sample, equipping you with the data to confidently establish and commerce this highly effective setup.

Understanding the Anatomy of a Bull Flag

The bull flag sample is a continuation sample, that means it suggests a continuation of the present development, on this case, an uptrend. It is comprised of two distinct phases:

-

The Pole: That is the preliminary sturdy upward transfer, representing a major worth improve. The pole is characterised by a pointy, virtually vertical ascent, signifying sturdy shopping for strain and a speedy worth appreciation. This section builds the momentum that the flag sample will later capitalize on. The steeper the pole, the extra highly effective the anticipated breakout is commonly thought of to be.

-

The Flag: That is the next consolidation section. After the sharp rise of the pole, the value enters a interval of sideways buying and selling, forming a pennant-like or rectangular form. This consolidation is usually characterised by decrease quantity than the pole, indicating a brief pause within the shopping for strain. The flag itself can vary from a couple of days to a number of weeks, relying on the underlying asset and market circumstances. The flag’s orientation is essential; it ought to have a slight downward slope (bearish flag) or be comparatively horizontal (impartial flag). A sharply angled upward sloping flag is much less frequent and would possibly point out a weakening of the bullish development.

Figuring out Key Traits of a Bull Flag

Figuring out a real bull flag requires cautious remark and understanding of a number of key traits:

-

Uptrend Previous the Flag: Essentially the most basic requirement is a transparent and established uptrend earlier than the flag formation begins. With out this previous uptrend, the sample loses its significance. This uptrend needs to be identifiable via greater highs and better lows on the value chart.

-

Outlined Pole: The pole needs to be a major worth transfer, simply distinguishable from the next consolidation section. The size of the pole is a crucial issue, because it typically correlates with the potential worth goal after the breakout.

-

Consolidation Part (Flag): The flag needs to be comparatively tight and well-defined, with parallel or barely converging trendlines forming the boundaries of the consolidation. The consolidation section ought to ideally exhibit decrease buying and selling quantity than the pole, suggesting a brief pause within the shopping for strain.

-

Flag’s Slope: Whereas a barely downward sloping flag is most typical, a horizontal flag can be legitimate. Nevertheless, an upward sloping flag weakens the bullish sign, suggesting a possible lack of momentum.

-

Quantity Affirmation: The discount in quantity in the course of the flag section in comparison with the pole is a vital affirmation issue. This decrease quantity signifies a interval of consolidation and relaxation earlier than the anticipated breakout. A rise in quantity accompanying the breakout confirms the validity of the sample.

-

Breakout Affirmation: The affirmation of the bull flag sample comes with the breakout from the higher trendline of the flag. This breakout ought to ideally be accompanied by a surge in quantity, additional reinforcing the bullish sign.

Measuring Potential Worth Targets

One of the priceless points of figuring out a bull flag is the power to venture potential worth targets. A typical technique for projecting the value goal is to measure the peak of the pole and add that distance to the breakout level of the flag. For instance, if the pole measures a $10 improve, and the breakout happens at $50, the projected worth goal can be $60 ($50 + $10).

This technique, nevertheless, just isn’t foolproof. Different elements, equivalent to total market circumstances and the particular asset’s traits, can affect the precise worth motion. Due to this fact, it is essential to make use of this projection as a suggestion somewhat than a assured final result.

Buying and selling Methods for Bull Flags

The bull flag sample presents a number of buying and selling alternatives:

-

Lengthy Entry: The most typical technique is to enter an extended place after a decisive breakout from the higher trendline of the flag, confirmed by elevated quantity. A stop-loss order needs to be positioned beneath the decrease trendline of the flag to restrict potential losses if the breakout fails.

-

Trailing Cease-Loss: As the value strikes upward after the breakout, a trailing stop-loss order might be applied to guard income and restrict potential losses. This technique permits you to lock in income as the value strikes in your favor.

-

Threat Administration: Correct danger administration is essential when buying and selling bull flags. Figuring out the suitable stop-loss degree and place sizing are important to mitigate potential losses. By no means danger greater than a small share of your buying and selling capital on any single commerce.

Frequent Errors to Keep away from

A number of frequent errors can result in inaccurate identification or ineffective buying and selling of bull flags:

-

Misidentification of the Sample: Improper identification of the pole and flag, or mistaking different chart patterns for a bull flag, can result in incorrect buying and selling selections.

-

Ignoring Quantity Affirmation: Failing to contemplate quantity adjustments in the course of the pole and flag phases can lead to false alerts.

-

Neglecting Threat Administration: Ignoring correct danger administration methods can result in vital losses, even with correct sample identification.

-

Chasing Breakouts: Coming into a commerce too late after the breakout can lead to missed alternatives or getting into at unfavorable worth ranges.

Bull Flags vs. Different Chart Patterns

It is vital to distinguish the bull flag from related chart patterns, equivalent to pennants and rectangles. Whereas they share some visible similarities, there are key distinctions:

-

Pennants: Pennants are usually characterised by a converging triangle form, whereas bull flags are sometimes extra rectangular. The pole previous a pennant is often shorter than that of a bull flag.

-

Rectangles: Rectangles are characterised by horizontal worth consolidation inside parallel trendlines. Whereas a bull flag can resemble a rectangle, the previous sturdy uptrend is a key differentiator.

Conclusion

The bull flag sample is a strong device for figuring out potential continuation strikes in an uptrend. By understanding its anatomy, figuring out its key traits, and using sound danger administration methods, merchants can leverage this sample to reinforce their buying and selling efficiency. Nevertheless, it is essential to keep in mind that no chart sample ensures success. Thorough evaluation, mixed with a disciplined buying and selling plan and danger administration, are important for maximizing income and minimizing losses when buying and selling bull flags. Constantly refining your understanding of market dynamics and chart patterns will considerably enhance your buying and selling outcomes. Bear in mind to at all times apply accountable buying and selling and by no means make investments greater than you possibly can afford to lose.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Bull Flag: A Complete Information to This Highly effective Chart Sample. We hope you discover this text informative and helpful. See you in our subsequent article!