Decoding the Candlestick: A Complete Information to Charting the Inventory Market

Associated Articles: Decoding the Candlestick: A Complete Information to Charting the Inventory Market

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Candlestick: A Complete Information to Charting the Inventory Market. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Candlestick: A Complete Information to Charting the Inventory Market

The inventory market, a fancy tapestry woven with threads of danger and reward, can appear formidable to the uninitiated. Nevertheless, navigating its intricacies turns into considerably simpler with the appropriate instruments and understanding. One such invaluable software is the candlestick chart, a visible illustration of worth actions that gives a wealth of data at a look. This text delves deep into the world of candlestick charts, explaining their building, interpretation, and software in inventory market evaluation.

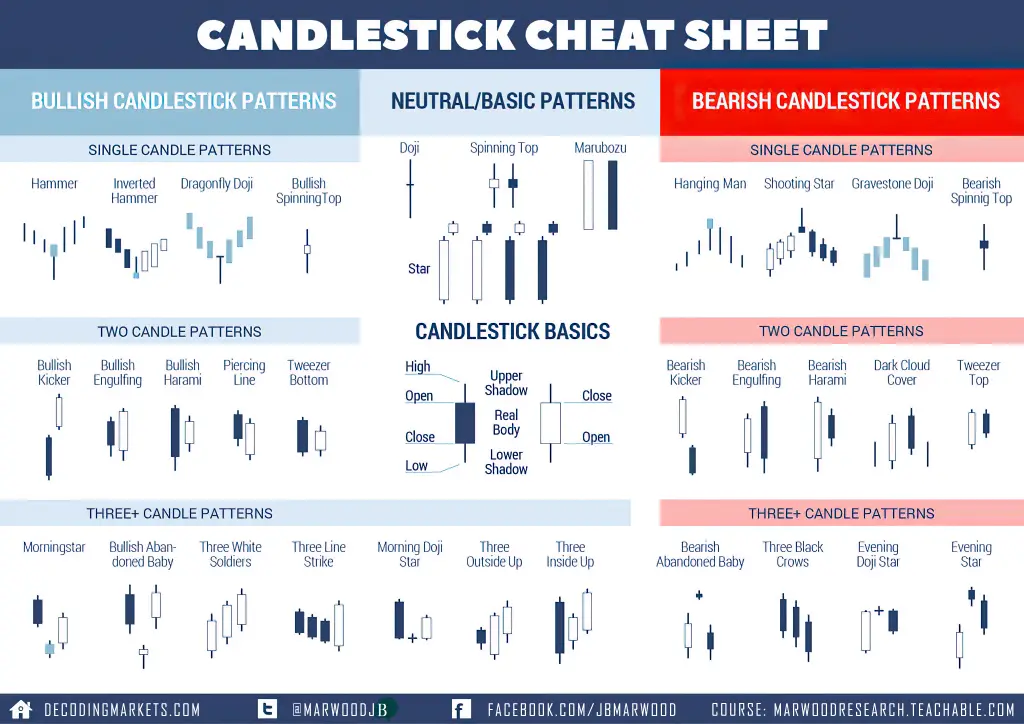

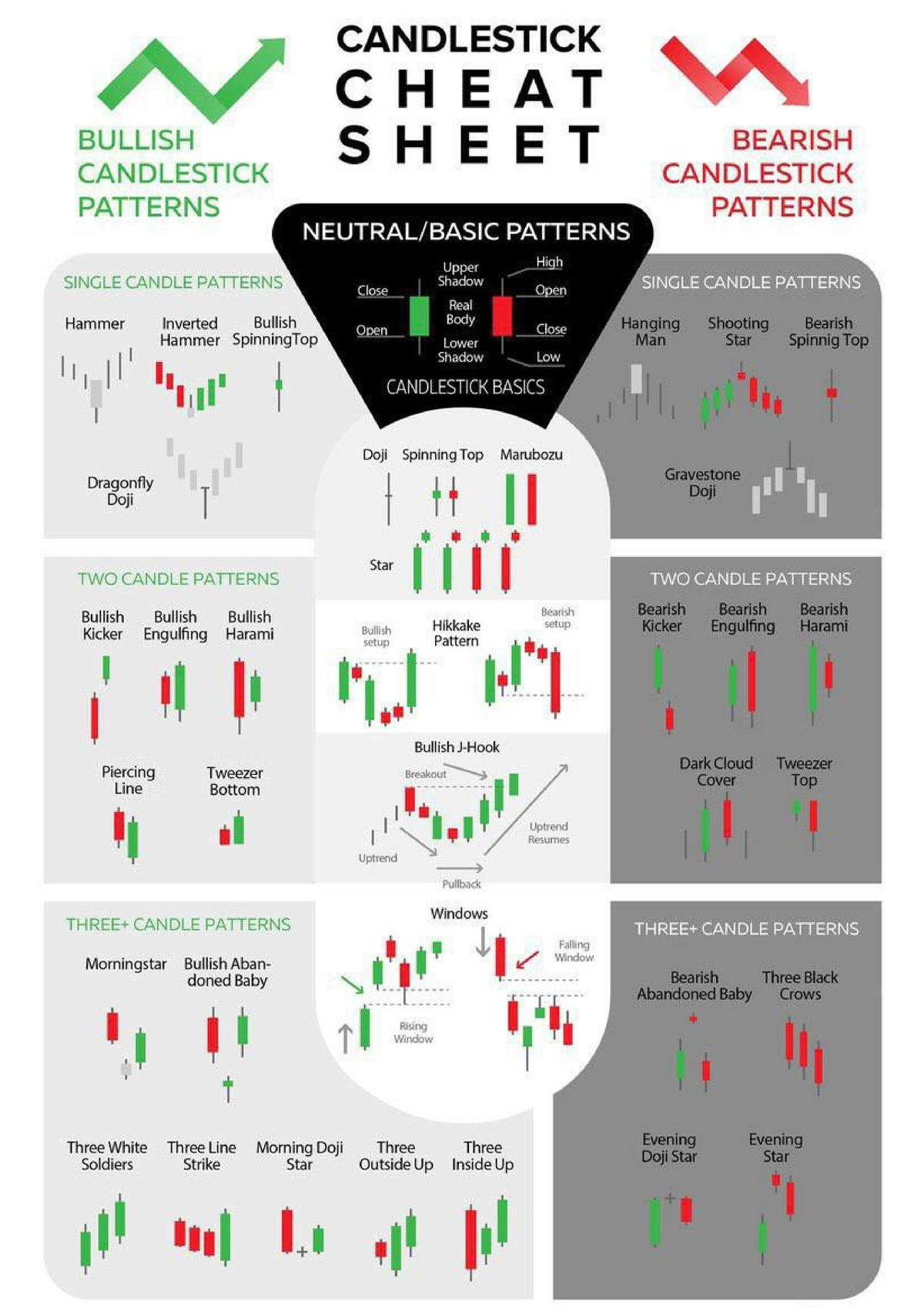

Understanding the Anatomy of a Candlestick:

A single candlestick represents the value motion of a safety (inventory, index, commodity, and so on.) over a selected interval, sometimes a day, week, or month. Every candlestick includes 4 key components:

-

Open: The worth at which the safety opened buying and selling throughout the interval. That is represented by the underside of the candlestick’s "physique" if the candlestick is inexperienced (or white), and the highest of the physique if it is pink (or black).

-

Shut: The worth at which the safety closed buying and selling throughout the interval. That is the highest of the physique for a inexperienced candlestick and the underside of the physique for a pink one.

-

Excessive: The very best worth reached by the safety throughout the interval. That is represented by the higher wick (or shadow) extending from the physique.

-

Low: The bottom worth reached by the safety throughout the interval. That is represented by the decrease wick extending from the physique.

A inexperienced (or white) candlestick signifies that the closing worth was increased than the opening worth (a bullish sign), whereas a pink (or black) candlestick signifies that the closing worth was decrease than the opening worth (a bearish sign). The size of the physique represents the magnitude of the value change, whereas the size of the wicks signifies the volatility of the value throughout the interval. A protracted physique suggests a powerful directional transfer, whereas a brief physique suggests indecision or consolidation. Lengthy wicks recommend important worth rejection at both the excessive or low.

Decoding Candlestick Patterns:

The true energy of candlestick charts lies in figuring out patterns fashioned by the mix of particular person candlesticks. These patterns can present insights into potential future worth actions, although it is essential to keep in mind that they don’t seem to be foolproof predictors. They’re greatest used at the side of different types of technical evaluation.

Listed below are among the commonest and important candlestick patterns:

Bullish Patterns:

-

Hammer: A small physique with an extended decrease wick, suggesting shopping for strain overcame promoting strain close to the low. It indicators a possible bullish reversal.

-

Inverted Hammer: A small physique with an extended higher wick, suggesting promoting strain was overcome by shopping for strain close to the excessive. Additionally indicators a possible bullish reversal.

-

Morning Star: A 3-candlestick sample consisting of a bearish candlestick, a small physique (often indecisive), and a bullish candlestick. Signifies a possible bullish reversal on the backside of a downtrend.

-

Bullish Engulfing Sample: A two-candlestick sample the place a big bullish candlestick fully engulfs the earlier bearish candlestick. Suggests a possible bullish reversal.

Bearish Patterns:

-

Hanging Man: Much like a hammer however showing on the high of an uptrend, suggesting a possible bearish reversal.

-

Capturing Star: Much like an inverted hammer however showing on the high of an uptrend, suggesting a possible bearish reversal.

-

Night Star: A 3-candlestick sample, the other of a morning star, signaling a possible bearish reversal on the high of an uptrend.

-

Bearish Engulfing Sample: A two-candlestick sample the place a big bearish candlestick fully engulfs the earlier bullish candlestick. Suggests a possible bearish reversal.

Impartial Patterns:

-

Doji: A candlestick with a gap worth and shutting worth which might be nearly equivalent, indicating indecision out there. Various kinds of Doji exist, every with delicate nuances in interpretation.

-

Spinning Prime: A small-bodied candlestick with comparatively lengthy higher and decrease wicks, suggesting indecision and a possible interval of consolidation.

Past Particular person Patterns: Combining Candlestick Evaluation with Different Methods:

Whereas candlestick patterns can present invaluable insights, it is essential to keep away from relying solely on them for buying and selling selections. Efficient technical evaluation entails integrating candlestick patterns with different indicators and instruments, reminiscent of:

-

Transferring Averages: These present a smoothing impact on worth information, serving to to determine traits and potential help and resistance ranges. Combining shifting averages with candlestick patterns can improve the accuracy of buying and selling indicators.

-

Relative Energy Index (RSI): This momentum indicator helps to determine overbought and oversold circumstances, offering context for candlestick patterns. For instance, a bullish engulfing sample accompanied by an RSI studying under 30 may strengthen the bullish sign.

-

Quantity: Analyzing quantity alongside candlestick patterns can affirm the power of worth actions. A robust bullish candlestick with excessive quantity signifies robust shopping for strain, whereas an identical candlestick with low quantity could be much less important.

-

Help and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt by. Figuring out these ranges and observing how candlestick patterns work together with them can present invaluable buying and selling alternatives.

Limitations and Issues:

It’s important to grasp the restrictions of candlestick evaluation. Patterns will be subjective, and their interpretation can differ amongst merchants. False indicators are attainable, and relying solely on candlestick patterns with out contemplating broader market context can result in losses.

Moreover, the time-frame chosen considerably impacts the interpretation. A sample that seems important on a day by day chart could be insignificant on a weekly or month-to-month chart. Due to this fact, it is important to investigate candlestick patterns throughout a number of timeframes to realize a complete perspective.

Conclusion:

Candlestick charts are a robust software for understanding and analyzing worth actions within the inventory market. Their visible nature permits merchants to rapidly determine potential buying and selling alternatives and acquire insights into market sentiment. Nevertheless, mastering candlestick evaluation requires observe, persistence, and a complete understanding of their limitations. By combining candlestick patterns with different technical indicators and basic evaluation, merchants can improve their decision-making course of and enhance their possibilities of success within the dynamic world of inventory buying and selling. Do not forget that profitable buying and selling entails steady studying, adaptation, and danger administration. By no means make investments greater than you possibly can afford to lose, and at all times diversify your portfolio. The candlestick chart is a software, not a assure. Use it properly.

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-7114a9af472f4a2cb5cbe4878c1767da.png)

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Candlestick: A Complete Information to Charting the Inventory Market. We hope you discover this text informative and helpful. See you in our subsequent article!