Decoding the Candlestick Chart: A Complete Information for Merchants

Associated Articles: Decoding the Candlestick Chart: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Candlestick Chart: A Complete Information for Merchants. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Candlestick Chart: A Complete Information for Merchants

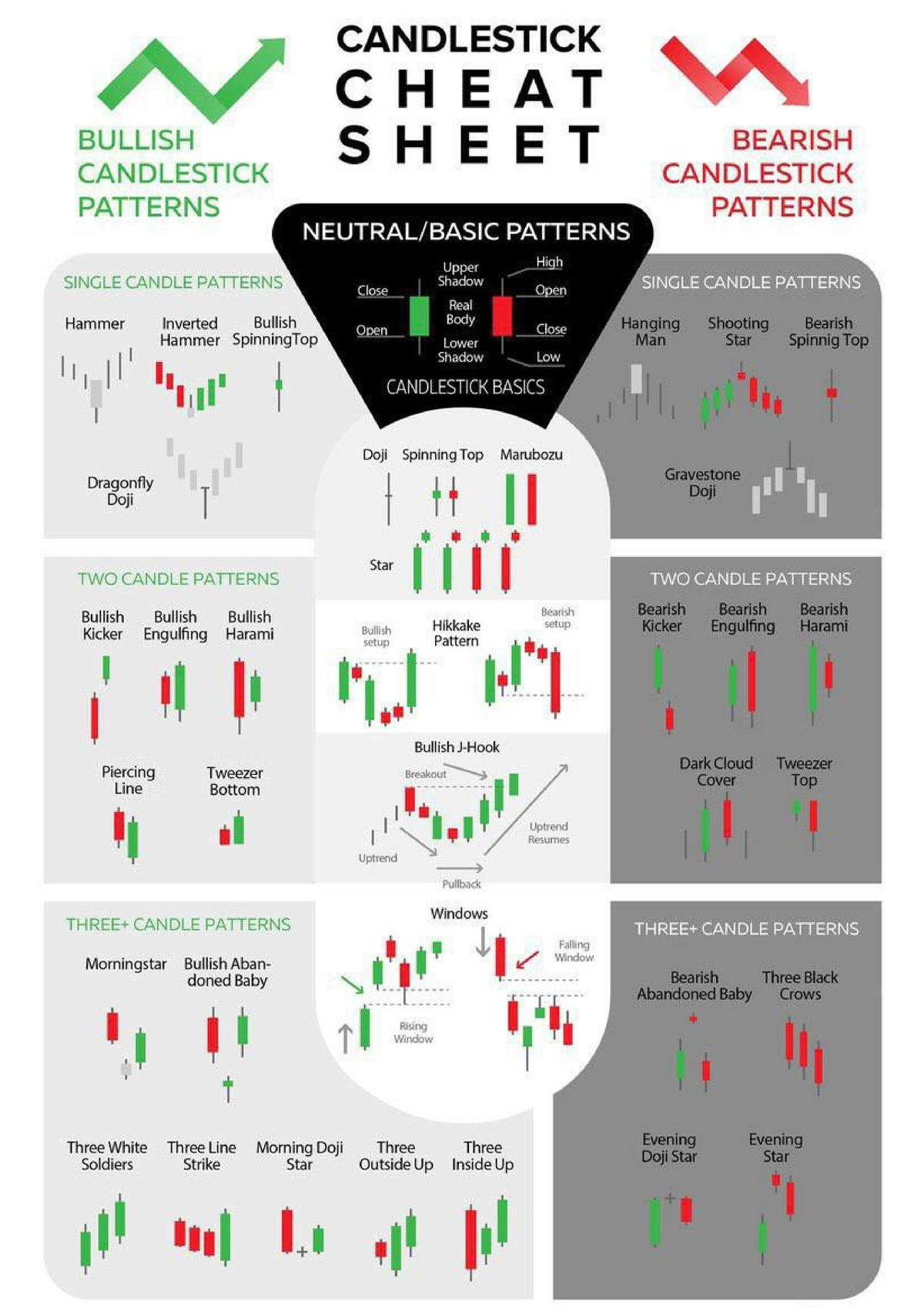

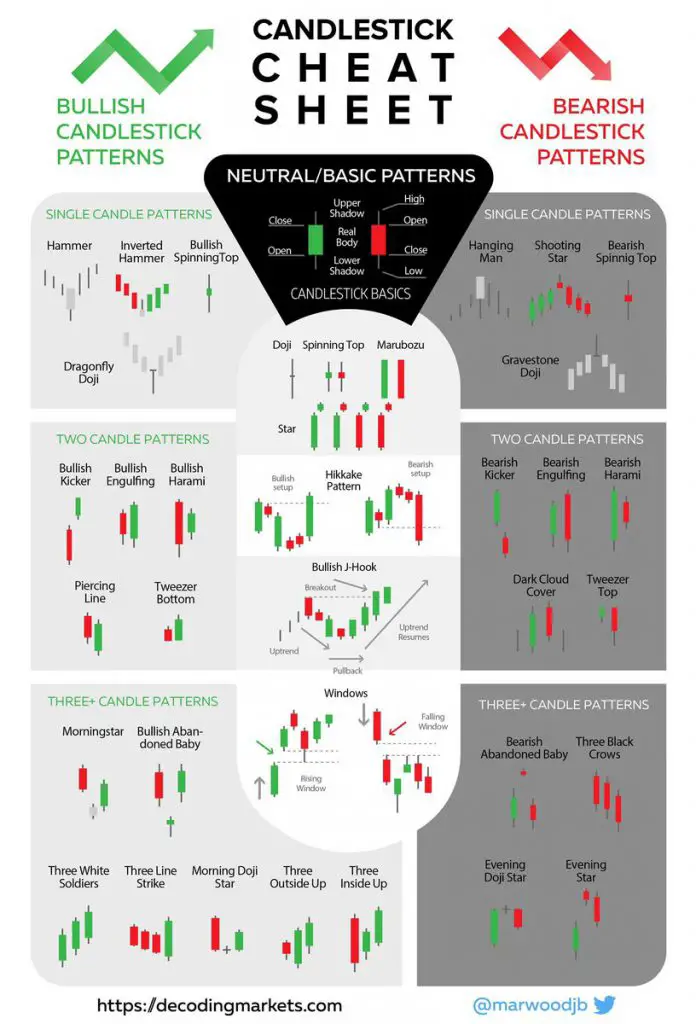

Candlestick charts, a staple in technical evaluation, supply a visually wealthy illustration of value motion over time, revealing insights typically missed by easier line or bar charts. Understanding the right way to learn these charts is essential for any severe dealer, whatever the asset class – shares, foreign exchange, cryptocurrencies, or commodities. This complete information will equip you with the information to successfully interpret candlestick patterns, determine traits, and make knowledgeable buying and selling selections.

Understanding the Anatomy of a Candlestick

Every candlestick represents the value motion of an asset over a particular time interval (e.g., at some point, one hour, one minute). It is comprised of 4 key components:

-

Open (O): The value at which the asset opened throughout the interval. That is represented by the underside of the candlestick’s "physique" if the candlestick is inexperienced (or white, relying on the charting software program) and the highest of the physique if the candlestick is purple (or black).

-

Excessive (H): The very best value the asset reached throughout the interval. That is the topmost level of the candlestick’s "wick" or "shadow" (the skinny vertical line extending above the physique).

-

Low (L): The bottom value the asset reached throughout the interval. That is the bottommost level of the candlestick’s wick or shadow (the skinny vertical line extending beneath the physique).

-

Shut (C): The value at which the asset closed throughout the interval. That is represented by the highest of the candlestick’s physique if the candlestick is inexperienced (or white) and the underside of the physique if the candlestick is purple (or black).

Deciphering Candlestick Colours

The colour of the candlestick offers speedy details about the value route:

-

Inexperienced/White Candlestick (Bullish): Signifies that the closing value was larger than the opening value, suggesting bullish sentiment (upward value motion). The longer the physique, the stronger the bullish strain.

-

Purple/Black Candlestick (Bearish): Signifies that the closing value was decrease than the opening value, suggesting bearish sentiment (downward value motion). The longer the physique, the stronger the bearish strain.

Key Candlestick Patterns: Unveiling Market Sentiment

Whereas particular person candlesticks present fundamental value data, the actual energy of candlestick evaluation lies in figuring out recurring patterns that usually predict future value actions. Listed here are a number of the most typical and vital patterns:

1. Doji: A Doji candlestick has a gap value and shutting value which might be just about an identical, making a small, and even nonexistent, physique. It indicators indecision or a battle between consumers and sellers. Several types of Doji exist (e.g., Headstone Doji, Dragonfly Doji, Lengthy-Legged Doji), every with barely totally different implications. A Doji typically precedes a big value reversal.

2. Hammer: A hammer candlestick has a small physique on the high of the candlestick with an extended decrease wick, suggesting that consumers stepped in to push the value up after a big drop. It is a bullish reversal sample, indicating a possible upward pattern. The inverted hammer is its bearish counterpart.

3. Hanging Man: Just like a hammer, nevertheless it seems on the high of an uptrend. It is a bearish reversal sample, suggesting a possible downward pattern. The lengthy decrease wick exhibits that consumers tried to push the value larger, however promoting strain prevailed.

4. Capturing Star: That is the other of a hammer, with a small physique on the backside of the candlestick and an extended higher wick. It seems on the high of an uptrend and indicators a possible bearish reversal.

5. Engulfing Sample: This sample consists of two candlesticks. A bullish engulfing sample entails a small bearish candlestick adopted by a bigger bullish candlestick that utterly "engulfs" the earlier one. This means a possible bullish reversal. The bearish engulfing sample is the other.

6. Piercing Sample: Just like the bullish engulfing sample, however the second candlestick (bullish) does not totally engulf the primary (bearish). It is a bullish reversal sample typically discovered on the backside of a downtrend.

7. Darkish Cloud Cowl: A bearish reversal sample that happens on the high of an uptrend. It consists of a big bullish candlestick adopted by a bearish candlestick that opens above the earlier candlestick’s shut and closes beneath its midpoint.

8. Night Star: A bearish reversal sample composed of three candlesticks. It begins with a big bullish candlestick, adopted by a small candlestick with a comparatively small vary, and ends with a bearish candlestick that gaps decrease and closes considerably beneath the primary candlestick’s physique.

9. Morning Star: The bullish counterpart of the Night Star. It is a bullish reversal sample shaped by three candlesticks: a bearish candlestick, adopted by a small candlestick with a comparatively small vary, after which a bullish candlestick that gaps larger and closes considerably above the primary candlestick’s physique.

Combining Candlestick Patterns with Different Indicators

Candlestick patterns are highly effective instruments, however their effectiveness is amplified when mixed with different technical indicators, comparable to:

- Transferring Averages: Determine traits and potential assist and resistance ranges.

- Relative Energy Index (RSI): Measures the momentum of value actions and helps determine overbought and oversold situations.

- MACD (Transferring Common Convergence Divergence): Identifies adjustments in momentum and potential pattern reversals.

- Quantity: Confirms value actions. Excessive quantity throughout a value transfer reinforces the sign, whereas low quantity suggests weak momentum.

Essential Concerns:

-

Timeframe Issues: The interpretation of candlestick patterns can fluctuate relying on the timeframe used (e.g., 1-minute chart vs. day by day chart). Patterns recognized on shorter timeframes are sometimes much less dependable than these on longer timeframes.

-

Affirmation is Key: Relying solely on candlestick patterns is dangerous. At all times search for affirmation from different indicators and value motion earlier than making buying and selling selections.

-

Context is Essential: The importance of a candlestick sample relies upon closely on the general market context. A sample which may sign a reversal in a sideways market may be insignificant in a robust trending market.

-

Observe Makes Excellent: Mastering candlestick evaluation requires apply and expertise. Begin by analyzing historic charts and step by step develop your skill to determine and interpret patterns. Think about using a demo buying and selling account to apply earlier than risking actual capital.

Conclusion:

Candlestick charts present a wealth of details about market sentiment and potential value actions. By understanding the anatomy of a candlestick, decoding coloration codes, recognizing widespread patterns, and mixing this data with different technical indicators, merchants can considerably enhance their skill to determine buying and selling alternatives and handle threat. Keep in mind that constant studying, apply, and disciplined threat administration are important for achievement in utilizing candlestick evaluation. Whereas this information offers a strong basis, steady studying and adaptation are key to staying forward within the dynamic world of buying and selling.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Candlestick Chart: A Complete Information for Merchants. We admire your consideration to our article. See you in our subsequent article!