Decoding the Charts: A Complete Information to Inventory Chart Evaluation

Associated Articles: Decoding the Charts: A Complete Information to Inventory Chart Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Charts: A Complete Information to Inventory Chart Evaluation. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Charts: A Complete Information to Inventory Chart Evaluation

Chart evaluation, a cornerstone of technical evaluation, entails learning historic value and quantity knowledge to foretell future value actions. It is a highly effective instrument for buyers of all ranges, permitting them to establish potential entry and exit factors, handle threat, and in the end, enhance their funding selections. Whereas not a foolproof system, mastering chart evaluation can considerably improve your buying and selling technique. This text supplies a complete overview of the important thing ideas and strategies concerned.

I. Understanding the Fundamentals:

Earlier than diving into particular chart patterns, it is essential to know the essential parts of a inventory chart:

-

Value Axis (Y-axis): Represents the value of the inventory at totally different cut-off dates. That is sometimes displayed in {dollars} and cents.

-

Time Axis (X-axis): Represents the timeframe of the value knowledge, which might vary from intraday (minutes, hours) to weekly, month-to-month, and even yearly intervals. The selection of timeframe considerably impacts the evaluation.

-

Candlesticks/Bars: These are the visible representations of value actions inside a selected timeframe.

- Candlesticks: Present the open, excessive, low, and shutting costs for a given interval. A inexperienced (or white) candlestick signifies a closing value greater than the opening value (upward motion), whereas a pink (or black) candlestick signifies a closing value decrease than the opening value (downward motion). The physique of the candlestick represents the vary between the open and shut, whereas the wicks (or shadows) prolong to the excessive and low costs.

- Bar Charts: Much like candlesticks, however they use a vertical line to symbolize the value vary (excessive to low) and horizontal strains to mark the open and shut costs.

-

Quantity: This can be a essential indicator that displays the variety of shares traded throughout a selected interval. Excessive quantity typically accompanies important value actions, indicating robust conviction out there. Low quantity can recommend an absence of curiosity or a interval of consolidation.

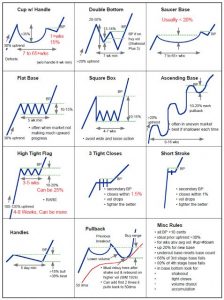

II. Key Chart Patterns:

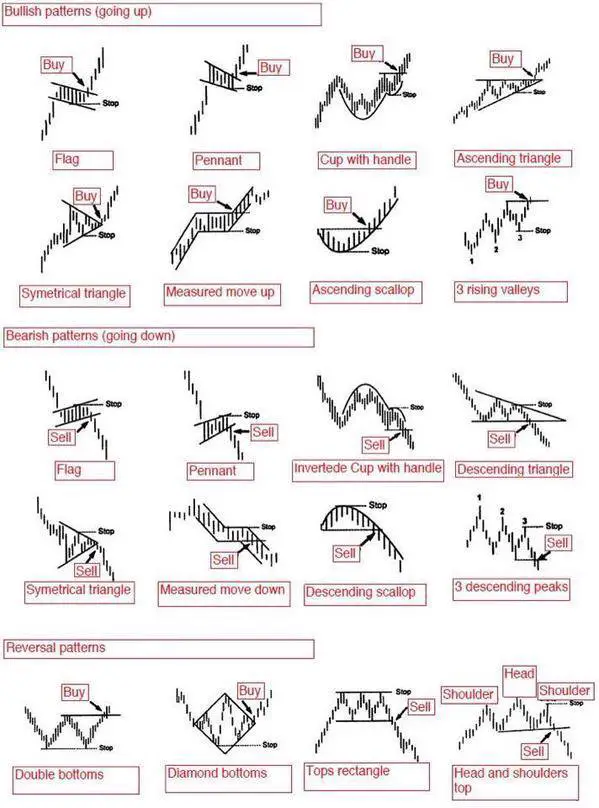

Chart evaluation depends closely on figuring out recurring patterns that usually precede particular value actions. Listed below are a few of the most typical and extensively used patterns:

A. Trendlines:

Trendlines join a collection of upper highs and better lows (uptrend) or decrease highs and decrease lows (downtrend). These strains symbolize the general course of the value motion. Breakouts above or beneath trendlines can sign important adjustments in momentum.

B. Help and Resistance Ranges:

Help ranges are value factors the place the value has traditionally discovered shopping for strain, stopping additional declines. Resistance ranges are value factors the place promoting strain has prevented additional advances. These ranges act as magnets, typically inflicting value reversals or non permanent pauses.

C. Head and Shoulders:

This can be a traditional reversal sample. It consists of three peaks, with the center peak (the "head") being the very best. A neckline connects the troughs between the peaks. A breakout beneath the neckline confirms the bearish reversal. The alternative, an "Inverse Head and Shoulders," indicators a bullish reversal.

D. Double Tops and Double Bottoms:

These are easier reversal patterns. A double high varieties when the value reaches the same excessive twice, adopted by a decline. A double backside varieties when the value reaches the same low twice, adopted by an increase. Breakouts above (double backside) or beneath (double high) the neckline verify the reversal.

E. Triangles:

Triangles are continuation patterns that symbolize a interval of consolidation earlier than a breakout. There are a number of sorts, together with symmetrical, ascending, and descending triangles. Breakouts from triangles sometimes happen within the course of the prevailing development.

F. Flags and Pennants:

These are continuation patterns that sometimes observe a pointy value transfer. Flags are characterised by parallel trendlines, whereas pennants resemble triangles. Breakouts from flags and pennants often happen within the course of the previous sharp transfer.

G. Gaps:

Gaps symbolize a value soar with none buying and selling occurring inside that value vary. They are often important indicators of market sentiment and sometimes result in additional value actions within the course of the hole. Nevertheless, gaps can be stuffed later.

III. Technical Indicators:

Whereas chart patterns present a visible illustration of value motion, technical indicators quantify market momentum and sentiment. Some well-liked indicators embody:

-

Transferring Averages (MA): These easy out value fluctuations and spotlight the general development. Generally used MAs embody the 50-day and 200-day transferring averages. Crossovers between MAs can sign purchase or promote indicators.

-

Relative Power Index (RSI): This measures the magnitude of latest value adjustments to judge overbought or oversold situations. RSI values above 70 are usually thought of overbought, whereas values beneath 30 are thought of oversold.

-

MACD (Transferring Common Convergence Divergence): This indicator compares two transferring averages to establish momentum adjustments. Crossovers of the MACD line above the sign line can point out bullish indicators, whereas crossovers beneath can point out bearish indicators.

-

Bollinger Bands: These bands plot commonplace deviations round a transferring common, indicating volatility. Value actions outdoors the bands can sign potential reversals.

IV. Timeframes and Technique:

The timeframe chosen for chart evaluation considerably impacts the outcomes. Completely different timeframes present totally different views:

-

Brief-Time period (Intraday, Hourly): Excellent for day buying and selling and short-term swing buying and selling. Focus is on fast value actions and momentum.

-

Medium-Time period (Day by day, Weekly): Appropriate for swing buying and selling and intermediate-term investing. Focus is on figuring out tendencies and potential reversals.

-

Lengthy-Time period (Month-to-month, Yearly): Finest for long-term investing. Focus is on the general market course and main tendencies.

Choosing the proper timeframe is dependent upon your funding horizon and threat tolerance. A complete technique typically entails analyzing a number of timeframes to substantiate indicators and scale back threat.

V. Danger Administration:

Chart evaluation is a strong instrument, however it’s not a assure of success. Danger administration is essential:

-

Cease-Loss Orders: These robotically promote your place if the value drops to a predetermined degree, limiting potential losses.

-

Place Sizing: By no means threat greater than a small share of your capital on any single commerce.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different shares and sectors.

VI. Conclusion:

Chart evaluation is a invaluable talent for any investor searching for to enhance their buying and selling and funding selections. By mastering the basics, understanding key chart patterns and technical indicators, and using sound threat administration practices, you’ll be able to considerably improve your means to establish potential alternatives and mitigate dangers within the inventory market. Keep in mind that chart evaluation is only one piece of the puzzle; basic evaluation and thorough analysis also needs to be integrated right into a well-rounded funding technique. Steady studying and follow are key to mastering this complicated but rewarding talent. It is also necessary to keep in mind that previous efficiency isn’t indicative of future outcomes, and no methodology ensures success within the inventory market. All the time strategy investing with warning and a long-term perspective.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Charts: A Complete Information to Inventory Chart Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!