Decoding the Dhan Chart View: A Complete Information to Understanding and Using this Highly effective Technical Evaluation Software

Associated Articles: Decoding the Dhan Chart View: A Complete Information to Understanding and Using this Highly effective Technical Evaluation Software

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Dhan Chart View: A Complete Information to Understanding and Using this Highly effective Technical Evaluation Software. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Dhan Chart View: A Complete Information to Understanding and Using this Highly effective Technical Evaluation Software

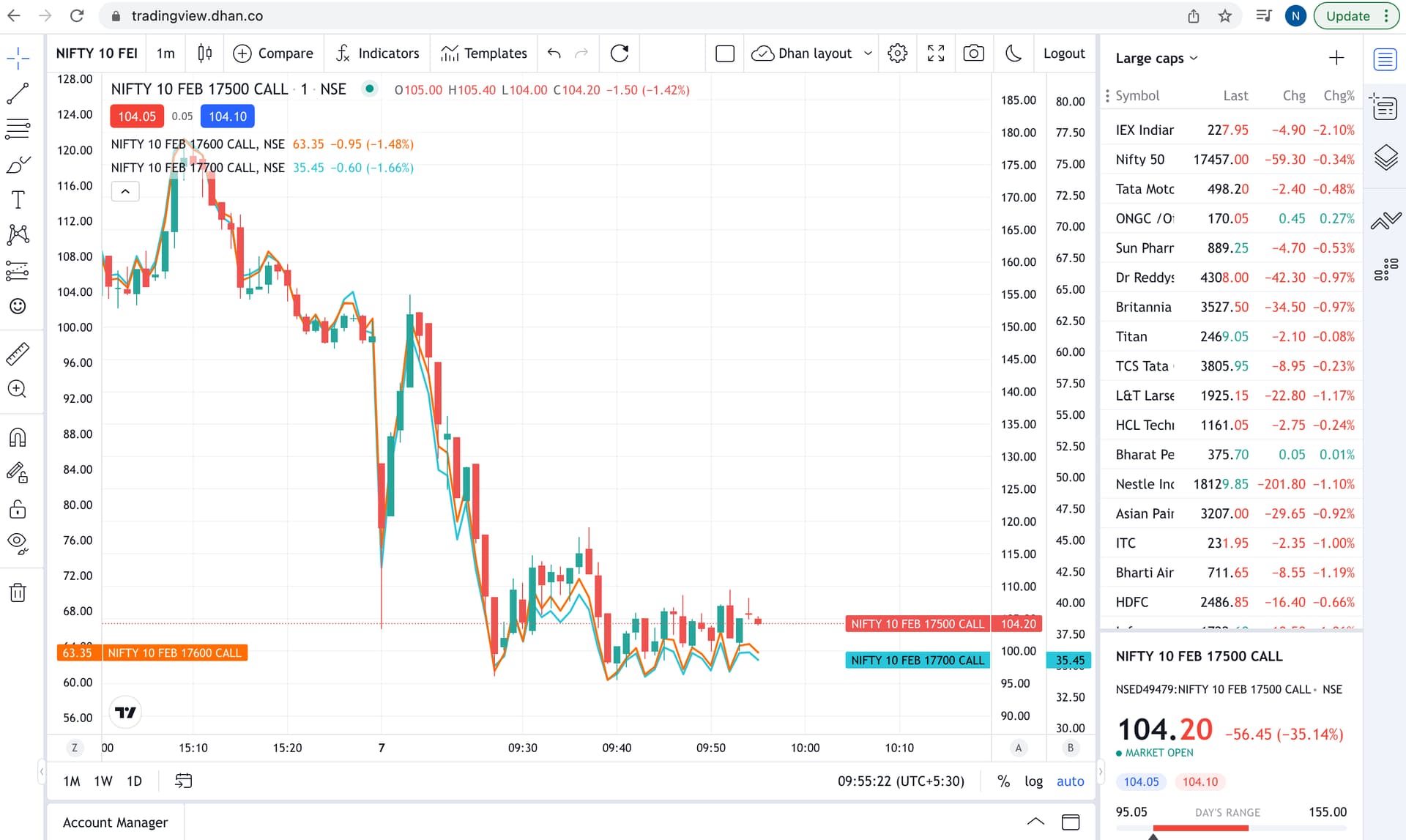

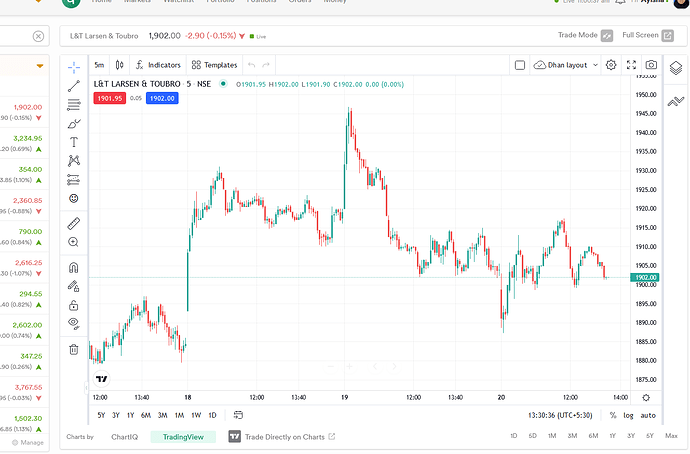

The Dhan chart, a much less extensively recognized however more and more in style technical evaluation instrument, provides a novel perspective on market tendencies. Not like conventional candlestick or bar charts, the Dhan chart visualizes value actions by way of a sequence of interconnected factors, making a dynamic illustration of momentum and pattern power. This text delves deep into the Dhan chart view, exploring its building, interpretation, and sensible functions for merchants and traders.

Understanding the Basis: How Dhan Charts are Constructed

The core precept behind the Dhan chart lies in its illustration of value motion relative to a transferring common, sometimes a easy transferring common (SMA). Every level on a Dhan chart signifies the connection between the closing value and the chosen SMA. The precise calculation figuring out the chart’s visible illustration varies barely relying on the software program or platform used, however the elementary idea stays constant.

Usually, the method entails:

-

Deciding on a Transferring Common: The dealer first selects an acceptable SMA interval, generally starting from 20 to 200 durations, relying on the timeframe and buying and selling technique. A shorter interval SMA might be extra aware of latest value modifications, whereas an extended interval SMA will present a smoother, longer-term pattern indication.

-

Calculating the Distance: For every interval, the distinction between the closing value and the SMA worth is calculated. This distinction represents the space of the closing value from the transferring common.

-

Plotting the Factors: These calculated distances are then plotted on the chart. A constructive distance (closing value above the SMA) is usually represented by a degree above a horizontal zero line, whereas a destructive distance (closing value beneath the SMA) is represented by a degree beneath the zero line.

-

Connecting the Factors: The factors are linked to type a steady line, creating the attribute visible illustration of the Dhan chart. The slope and course of this line present essential insights into the market’s momentum and pattern power.

Deciphering Dhan Chart Patterns: Key Alerts and Indicators

The Dhan chart’s simplicity belies its energy in revealing market dynamics. A number of key patterns and indicators could be derived from its distinctive visible illustration:

-

Pattern Identification: A constantly upward-sloping line signifies a robust uptrend, whereas a constantly downward-sloping line suggests a downtrend. A flat or fluctuating line signifies a sideways or ranging market. The steeper the slope, the stronger the momentum in that course.

-

Momentum Shifts: Adjustments within the slope of the road sign potential momentum shifts. A flattening slope after a steep incline suggests weakening bullish momentum, probably foreshadowing a reversal or consolidation. Conversely, a steepening slope after a interval of sideways motion signifies rising momentum.

-

Help and Resistance Ranges: Whereas indirectly depicted like conventional charts, assist and resistance ranges could be inferred from the Dhan chart. Repeated bounces off the zero line (indicating value constantly returning to the transferring common) can recommend a big assist or resistance stage.

-

Divergence: Much like different chart varieties, divergence between the Dhan chart and the value motion generally is a highly effective indicator of potential pattern reversals. Bullish divergence happens when the value makes decrease lows, however the Dhan chart varieties greater lows, suggesting underlying bullish stress. Bearish divergence is the alternative.

-

Breakouts: Breakouts above or beneath important highs or lows on the Dhan chart can sign a robust transfer within the respective course. These breakouts could be mixed with quantity evaluation for affirmation.

Evaluating Dhan Charts to Conventional Chart Sorts:

Whereas Dhan charts supply a novel perspective, it is important to check them to conventional chart varieties like candlestick and bar charts to realize a holistic understanding of the market. Candlestick charts present detailed info on open, excessive, low, and shutting costs, providing a richer image of intraday value fluctuations. Bar charts current comparable info however in an easier, much less visually detailed format.

Dhan charts, nonetheless, excel in visualizing the connection between value and a transferring common, offering a transparent illustration of pattern power and momentum. Utilizing Dhan charts at the side of conventional chart varieties can supply a extra complete and nuanced view of the market, decreasing reliance on any single indicator.

Sensible Purposes of Dhan Charts in Buying and selling Methods:

Dhan charts could be included into numerous buying and selling methods, enhancing decision-making and threat administration:

-

Pattern Following: Merchants can make the most of the slope and course of the Dhan chart to determine and capitalize on established tendencies. Getting into lengthy positions throughout robust uptrends and brief positions throughout robust downtrends is a standard utility.

-

Momentum Buying and selling: The modifications within the slope of the Dhan chart can be utilized to determine momentum shifts, permitting merchants to enter positions originally of a robust transfer and exit earlier than momentum fades.

-

Imply Reversion Methods: Repeated bounces off the zero line can be utilized to determine potential imply reversion alternatives. Merchants can enter brief positions when the value strikes considerably above the transferring common and lengthy positions when it strikes considerably beneath.

-

Affirmation of Alerts: Dhan charts can be utilized to substantiate indicators generated by different technical indicators or elementary evaluation. For example, a bullish divergence on the Dhan chart can affirm a bullish sign from a transferring common crossover.

Limitations and Issues:

Whereas Dhan charts supply useful insights, it is essential to acknowledge their limitations:

-

Lagging Indicator: Using a transferring common inherently introduces lag, that means the chart could not seize probably the most quick value modifications.

-

Parameter Sensitivity: The selection of SMA interval considerably impacts the chart’s look and interpretation. Experimentation and optimization are essential to discovering probably the most appropriate parameters for a given market and timeframe.

-

Subjectivity in Interpretation: Like all technical evaluation instrument, the interpretation of Dhan chart patterns could be subjective. Combining it with different indicators and threat administration strategies is important.

-

Not a Standalone Software: Dhan charts shouldn’t be utilized in isolation. They’re simplest when built-in right into a broader buying and selling technique that includes elementary evaluation, threat administration, and different technical indicators.

Conclusion:

The Dhan chart view provides a novel and highly effective instrument for technical evaluation, offering a transparent visible illustration of market momentum and pattern power. By understanding its building, interpretation, and limitations, merchants and traders can leverage its insights to boost their decision-making course of. Nevertheless, it is vital to keep in mind that no single indicator supplies a foolproof prediction of market actions. Combining Dhan chart evaluation with different technical and elementary indicators, together with sturdy threat administration, is essential for profitable buying and selling and investing. The Dhan chart, when used strategically and responsibly, generally is a useful addition to any dealer’s arsenal. Additional exploration and experimentation with completely different parameters and mixtures with different indicators will improve understanding and refine its utility inside particular person buying and selling methods.

Closure

Thus, we hope this text has offered useful insights into Decoding the Dhan Chart View: A Complete Information to Understanding and Using this Highly effective Technical Evaluation Software. We hope you discover this text informative and helpful. See you in our subsequent article!