Decoding the Dividend Yield Chart: A Complete Information for Buyers

Associated Articles: Decoding the Dividend Yield Chart: A Complete Information for Buyers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Dividend Yield Chart: A Complete Information for Buyers. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Dividend Yield Chart: A Complete Information for Buyers

The inventory market gives a mess of the way to generate returns, however dividend revenue represents a very engaging technique for a lot of buyers. A dividend yield chart, a visible illustration of a inventory’s or index’s dividend yield over time, supplies invaluable insights into the historic and present profitability of dividend-paying investments. Understanding how one can interpret these charts and leveraging the knowledge they supply can considerably improve your funding selections. This text delves into the intricacies of dividend yield charts, exploring their building, interpretation, and sensible purposes.

Understanding Dividend Yield: The Basis

Earlier than diving into the complexities of charts, let’s solidify our understanding of dividend yield itself. Dividend yield is a monetary ratio that expresses the annual dividend per share relative to the market worth per share. It is calculated as follows:

Dividend Yield = (Annual Dividend per Share / Market Value per Share) x 100%

For instance, if an organization pays an annual dividend of $2 per share and its present market worth is $50 per share, its dividend yield is (2/50) x 100% = 4%. Which means for each $50 invested, the investor receives $2 in dividends yearly. The yield is expressed as a proportion, making it straightforward to check throughout completely different shares.

The Anatomy of a Dividend Yield Chart

A typical dividend yield chart plots the dividend yield (vertical axis) towards time (horizontal axis), often represented in years or months. This creates a visible illustration of the yield’s fluctuations over the chosen interval. A number of key components contribute to a complete chart:

-

Time Axis (X-axis): This shows the time interval lined by the chart, starting from a number of months to a number of a long time. The granularity (every day, weekly, month-to-month, yearly) depends upon the particular chart and the info accessible.

-

Yield Axis (Y-axis): This axis exhibits the dividend yield as a proportion. The dimensions is usually adjusted to accommodate the vary of yields noticed throughout the chosen interval.

-

Knowledge Factors: Every level on the chart represents the dividend yield at a selected cut-off date. Connecting these factors creates a line graph illustrating the pattern of the yield over time.

-

Knowledge Supply: Respected sources for dividend yield knowledge embrace monetary information web sites (Yahoo Finance, Google Finance), brokerage platforms, and devoted monetary knowledge suppliers. The reliability of the info supply is essential for correct interpretation.

-

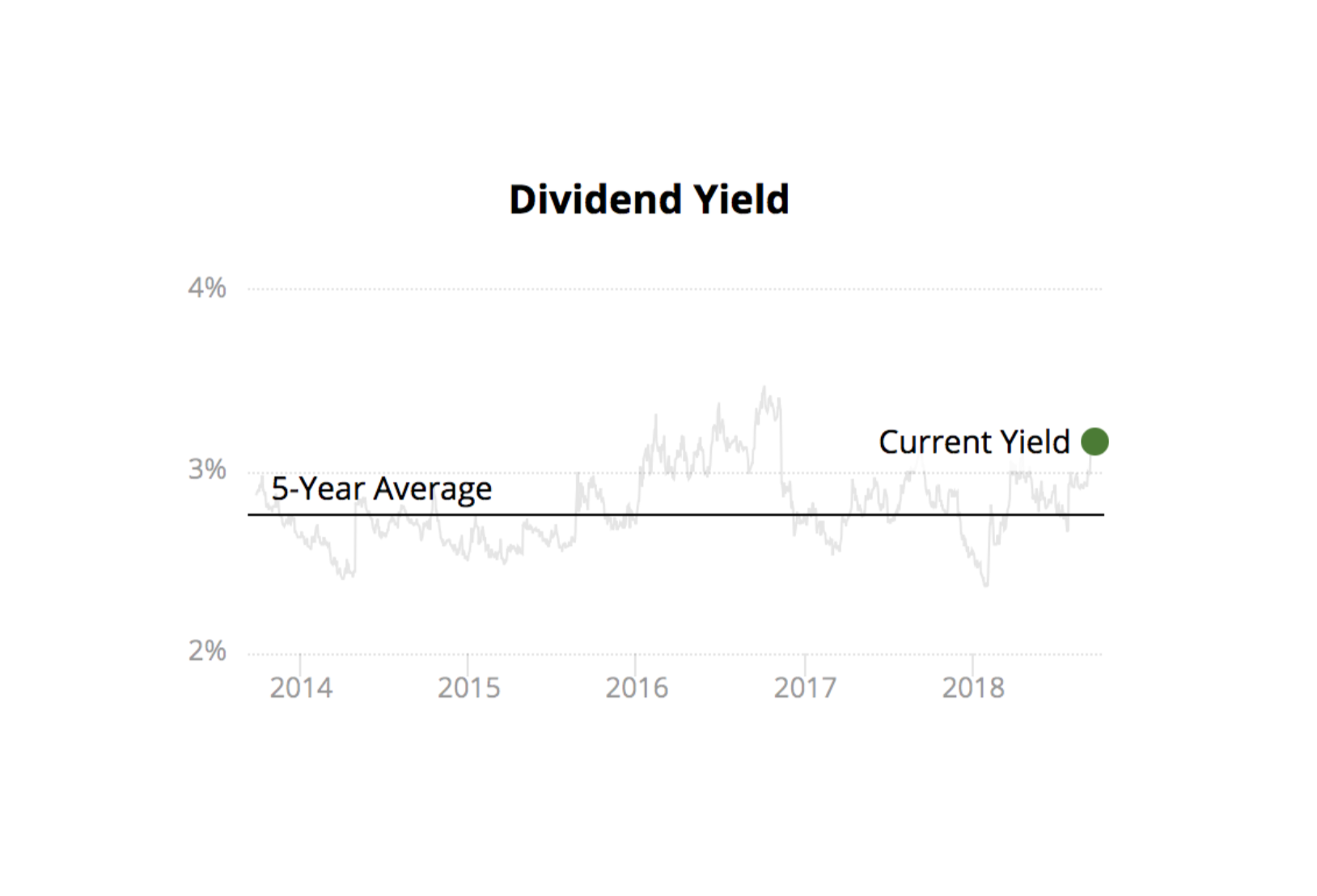

Shifting Averages (Non-compulsory): Some charts embrace shifting averages (e.g., 50-day, 200-day) to easy out short-term fluctuations and spotlight longer-term tendencies.

-

Reference Traces (Non-compulsory): Horizontal strains could also be added to focus on vital yield ranges, corresponding to historic highs or lows, or common yields over a specific interval.

Deciphering Dividend Yield Charts: Uncovering Significant Insights

The first function of a dividend yield chart is to visualise the historic efficiency of a inventory or index’s dividend yield. By analyzing the chart, buyers can glean a number of essential insights:

-

Pattern Evaluation: A rising pattern suggests growing dividend payouts or lowering inventory costs (or a mix of each). A falling pattern signifies the other. Figuring out the dominant pattern helps assess the long-term sustainability of dividend funds.

-

Volatility: The extent of fluctuations within the yield reveals the volatility of the dividend funds and the inventory worth. Excessive volatility signifies larger danger, whereas decrease volatility suggests extra stability.

-

Comparability with Friends: Evaluating the dividend yield chart of a selected inventory with these of its opponents in the identical business helps assess its relative attractiveness. The next yield may point out a doubtlessly undervalued inventory, however additional due diligence is essential.

-

Figuring out Potential Purchase/Promote Indicators: Whereas not a foolproof technique, vital deviations from historic tendencies or the crossing of shifting averages can be utilized as potential purchase or promote indicators, particularly when mixed with different basic and technical evaluation indicators.

-

Sustainability Evaluation: A persistently excessive dividend yield may elevate considerations in regards to the firm’s capacity to take care of such payouts in the long term. Buyers ought to scrutinize the corporate’s monetary well being and dividend payout ratio to evaluate the sustainability of the dividend.

Sensible Purposes of Dividend Yield Charts

Dividend yield charts are worthwhile instruments for numerous funding methods:

-

Dividend Progress Investing: Buyers targeted on dividend progress search for firms with a historical past of accelerating dividend yields over time. The chart helps visualize this progress trajectory and establish potential candidates.

-

Worth Investing: Worth buyers usually search out shares with excessive dividend yields, believing that these is perhaps undervalued by the market. The chart helps establish shares with yields considerably above their historic averages.

-

Revenue Era: Buyers in search of common revenue streams depend on dividend yields to generate money move. The chart helps examine the yield of various shares and select these providing the specified degree of revenue.

-

Portfolio Diversification: Utilizing dividend yield charts for various sectors or asset courses allows buyers to diversify their portfolios and cut back total danger.

-

Threat Administration: Analyzing the volatility of dividend yields helps assess the chance related to particular investments. Buyers can select shares with decrease yield volatility if they like a extra conservative method.

Limitations and Issues

Whereas dividend yield charts provide worthwhile insights, they’ve limitations:

-

Previous Efficiency is Not Indicative of Future Outcomes: Previous dividend yield tendencies don’t assure future efficiency. Firms can cut back or eradicate dividends on account of monetary difficulties or strategic adjustments.

-

Ignoring Different Elements: Dividend yield is only one issue to think about. Buyers must also analyze different monetary metrics, corresponding to earnings per share, price-to-earnings ratio, debt ranges, and future progress prospects.

-

Knowledge Accuracy: The accuracy of the chart depends upon the reliability of the info supply. It is important to make use of respected and well-established sources.

-

One-Dimensional View: The chart solely exhibits the dividend yield. It does not present details about the general return, which incorporates capital appreciation or depreciation.

Conclusion

Dividend yield charts present a robust visible software for analyzing the historic efficiency and present standing of dividend-paying investments. By understanding how one can interpret these charts and mixing this data with different basic and technical evaluation, buyers could make extra knowledgeable selections, optimize their portfolios, and obtain their monetary objectives. Nonetheless, it is essential to do not forget that dividend yield is only one piece of the puzzle, and a complete funding technique requires a holistic method encompassing numerous elements and danger issues. Bear in mind to all the time conduct thorough due diligence earlier than making any funding selections.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Dividend Yield Chart: A Complete Information for Buyers. We admire your consideration to our article. See you in our subsequent article!